onurdongel/E+ via Getty Images

(Note: This article appeared in the newsletter on May 1, 2022, and is updated with current information as needed.)

Antero Midstream Corporation (NYSE:AM) reported another quarter with less than satisfactory dividend coverage. But there is more to maintaining the dividend than the latest coverage figure. This is one of the financially strongest midstream companies that I cover. It is also one of the most conservatively run. As a result, the dividend is not as sacred here as is balance sheet strength. Therefore, management makes a decision to maintain (or not) the dividend based upon future capital needs as well as key debt ratios. That may be discomforting to income investors who want a spendable “sure thing.”

But such a strategy will ensure a likely growing cash flow that should result in higher distributions in the future. Nonetheless, debt will remain lower at this “captive” midstream than is the case at such financial rocks as Enterprise Products Partners (EPD). For those investors that do not mind a little more short-term dividend uncertainty, this entity offers a combination of some long-term growth as well as a sound financial structure that will protect the capital of the investor.

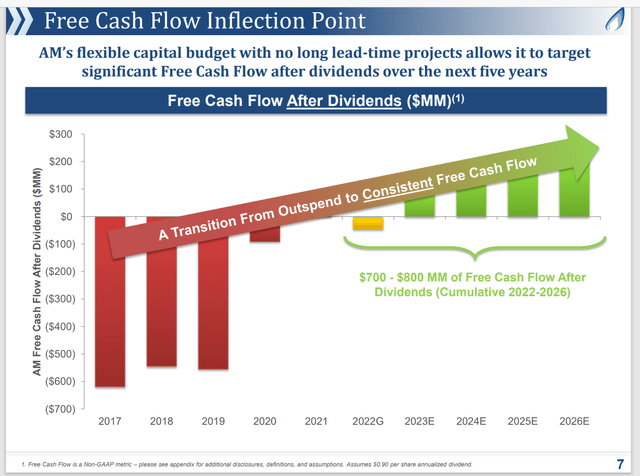

Antero Midstream Free Cash Flow Projection And History (Antero Midstream First Quarter 2022, Earnings Call Presentation)

This company went public after Antero Resources. The midstream was then acquired by the general partner, which then took both the company name and the symbol. I documented this in several articles in the past. Throughout all of this, the organization has built an impressive midstream structure to service Antero Resources.

The major construction is clearly coming to an end. The nice part about that is that it is easy to add excess capacity so that all the midstream needs to do is wait for the excess capacity to get use while collecting the money from rising volumes.

What could change that rosy free cash flow scenario would be a decision by Antero Resources to form another joint venture that would require major capital expenditures or a decision to grow significantly faster in the future. Right now, none of that appears likely because Antero organization management is well aware of transportation capacity constraints and labor shortages. There is also a need for Antero Resources to reduce the debt load.

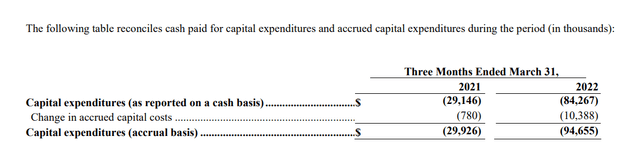

Antero Midstream Capital Expenditures Comparison (Antero Midstream First Quarter 2022, Earnings Press Release)

The choice by management to completely fund the capital budget from current cash flow to reduce some key debt ratios caused insufficient cash to be available to pay the dividend in the current quarter. The choice to not fund at least part of the capital budget with debt is an extremely conservative management decision rarely seen in the midstream industry.

One can change the priorities of official thinking by stating that they did indeed use the company bank line to fund some of the capital budget while paying the distribution. It is really the choice of the investor as to what that debt funded because the key is there is not enough cash to do both.

The other key is that the debt ratio remains well below 4. That is a rare and very conservative debt measure that I seldom see in the midstream industry. It is also fairly typical of midstream companies that have one main customer. This makes the financial structure very safe for income investors. But the dividend will be sacrificed from time to time to keep that balance sheet extremely conservative. The dividend here is not the same priority as it would be at an independent midstream like Enterprise Products Partners which has a diversified list of customers.

Management also stated that the pace of capital investments should decline considerably from the level posted above in the second half of the year. That should result in the projected very small negative cash flow for the fiscal year. After that, the lack of projected necessary capital projects will result in increasing free cash flow while the debt ratio declines towards management’s goal. That implies growth potential of earnings and cash flow throughout the projection period.

Antero Resources is a lot larger than it was during the heyday growth period. Therefore, the company is unlikely to grow as fast as it did back in those early days. But even single digit growth combined with the generous Antero Midstream dividend should make for a very bright future without that upstream risk.

The Future

Antero Midstream is a very profitable company because it can coordinate activities with Antero Resources. There are some risks mostly related to a potential acquisition one day of Antero Resources or a decline in the parent company financial strength that is very unlikely to happen in the future. But for right now, the outlook is more of the same. Some slow growth and a well-protected dividend.

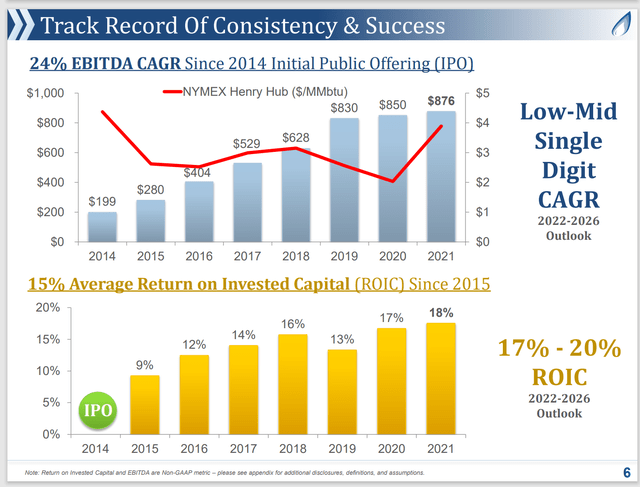

Antero Midstream Profitability Growth And ROC History (Antero Midstream First Quarter 2022, Earnings Conference Call Slides)

Growth has clearly slowed. But that growth is unlikely to cease because Antero Midstream does not service anything close to all of the operations of Antero Resources. That also means that Antero Midstream could grow at a rate different from the growth of Antero Resources until a sufficient amount of the Antero Resources business is properly serviced.

Income investors would like to see relatively high returns on capital. That means that cash flow generated for invested amounts will be on the generous side. It also implies decent dividend growth prospects as at least some cash flow will be reinvested in the business for the foreseeable future.

Reinvestment of some cash flow implies a compounding growth rate rather than a “simple” growth rate. That means that a 4% growth implies larger total growth each year because the invested capital base is larger thanks to reinvestment. The rate of dividend increases can therefore be maintained at the compound growth rate for the future. That is also favorable for income investors.

Some growth potential may include the eventual diversification to include other customers. The Marcellus and Utica Shale basins where this company operates currently has a lot of activity. Transportation and some associated midstream services are in short supply. Therefore, management could decide to enter some competitive markets during the current cycle.

But for the time being, the combination of some appreciation and the dividend appear to offer a total return in the low teens. That is an excellent return for an income and growth vehicle that does not have the upstream exposure. The operating risk and the financial strength make this a relatively low risk investment.

Be the first to comment