JHVEPhoto

No matter who you are, bedding should be important. After all, it impacts how we sleep which, in turn, can have short-term and long-term effects on our well-being. One company that’s dedicated to providing the best bedding products available to its customers is Tempur Sealy International (NYSE:TPX). The good news for investors is that this high-quality company is trading at levels that generally should be considered appealing. But on the downside, we have seen some deterioration of its business model as of late. Long term, I have no doubt that the company will fare well for its investors. But for those worried about a bumpy ride, it might make sense to recalibrate expectations for now. In light of this, I have ultimately decided to decrease my rating on the company from a ‘strong buy’ to a ‘buy’.

Not as comfortable

Back in February of this year, I wrote an article that took a very favorable stance on Tempur Sealy International. In that article, I talked about how the company’s share price leading up to that point had fallen materially in response to management missing expectations when it came to both revenue and earnings for the fourth quarter of the company’s 2021 fiscal year. Despite missing expectations, I felt as though the overall picture for the company was positive and that shares were trading at incredibly low levels. This led me to increase my rating on the company from a ‘buy’ to a ‘strong buy’, reflecting my new opinion that the stock should drastically outperform the broader market for the foreseeable future. Since then, the company has definitely outperformed. While the S&P 500 is down 6.9%, shares of Tempur Sealy International have generated a profit of 5.4%. To be fair, I wouldn’t exactly call this kind of performance strong enough for the company to have earned the ‘strong buy’ rating. But the fact that the overall direction of my call proved to be accurate by a meaningful margin is a net positive.

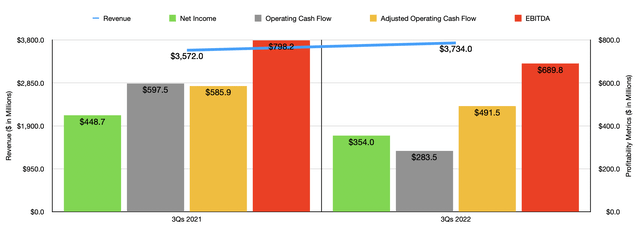

Although the company has done really well from a share price perspective, we have seen some weakness as of late. Consider how the company performed during the first nine months of its 2022 fiscal year. During this window of time, sales came in at $3.73 billion. That’s 4.5% higher than the $3.57 billion the company generated at the same time of its 2021 fiscal year. On a constant currency basis, the sales growth would have been even more impressive at 6.3%. Most of the sales increase for the company came from its international operations, with revenue jumping from $554.1 million to $780 million. More than 100% of this increase came from the company’s direct business channels. According to management, this was driven largely by the company’s acquisition of Dreams back in August of 2021. In really all other aspects of the enterprise, sales actually decreased. For instance, revenue in North America declined by 2.1%, while the wholesale channel of international operations reported a decline of 5.4%.

Despite sales rising, profitability has been a problem. Net income for the company fell from $448.7 million in the first nine months of its 2021 fiscal year to $354 million the same time this year. This was driven in large part by a drop in the company’s gross profit margin from 43.5% to 41.8%. In North America, operational investments aimed at better servicing the company’s customers, as well as higher costs and some other miscellaneous factors, played a negative role in the firm’s margin. Internationally, gross profit margins plunged because of unfavorable product mix, price increases to customers without a benefit to margin, and the aforementioned acquisition the company made last year. Unfortunately, other profitability metrics followed suit. Operating cash flow went from $597.5 million to $283.5 million. If we adjust for changes in working capital, it would have fallen more modestly from $585.9 million to $491.5 million. Meanwhile, EBITDA also took a step back, dropping from $798.2 million to $689.8 million.

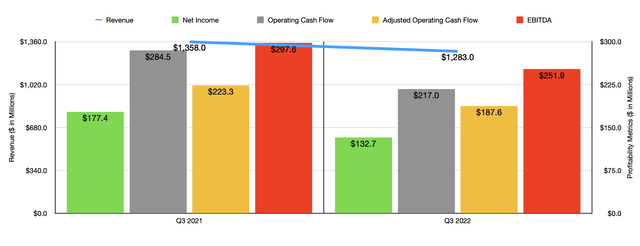

Unfortunately, the picture seems to be worsening as time goes on. Consider financial performance covering the third quarter of the company’s 2022 fiscal year. During this time, sales came in at $1.28 billion. That’s 5.5% lower than the $1.36 billion reported the same time last year. According to management, macroeconomic pressures impacting US consumer behavior materially affected the company’s wholesale channel here at home, while the direct channel did increase sales by 8.4% thanks to growth in the company’s e-commerce operations and company-owned stores. Internationally, sales also fell, driven by the same weaknesses that hit the firm’s wholesale operations. Though thanks to the aforementioned acquisition that the company made last year, sales and the direct channel for the firm grew by 21.3% on a constant currency basis.

The same cost issues there have been affecting the company all year were also present in the third quarter alone. Net income fell from $177.4 million to $132.7 million. Operating cash flow dropped from $284.5 million to $217 million. Even if we adjust for changes in working capital, we would have seen a drop, with the figure falling from $223.3 million to $187.6 million. And finally, EBITDA also took a hit, dropping from $297.6 million to $251.9 million. Despite these troubles, management has been very active in buying back stock. Over the past 12 months ending in the third quarter, the company repurchased 24.1 million shares of stock for a combined $887.7 million. That leaves $809.5 million under the company’s current share buyback program still in place. In the latest quarter alone, share repurchases did slow, totaling only one million units for roughly $25.2 million in all.

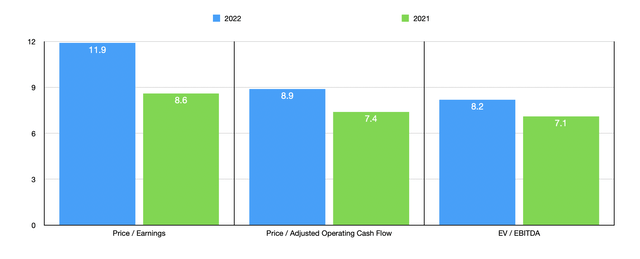

When it comes to the 2022 fiscal year and its entirety, management is forecasting earnings per share of between $2.50 and $2.60. That’s down from prior guidance of between $2.60 and $2.80. Sales are also now expected to be flat for the year, indicating a rather weak fourth quarter. Using the midpoint of guidance, the company should generate net income of $451.4 million. If we annualize other profitability metrics, we should get adjusted operating cash flow of $606.6 million and EBITDA of roughly $981.7 million. Given these figures, we can see that the company is trading at a forward price-to-earnings multiple of 11.9. It’s trading at a forward price to adjusted operating cash flow multiple of 8.9. And it is trading at a forward EV to EBITDA multiple of 8.2. As you can see in the chart above, this pricing is a bit higher than what we would get if we used data from the 2021 fiscal year. As part of my analysis, I also compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.5 to a high of 39.9. Using the EV to EBITDA approach, we would get a range of between 2.7 and 9.1. In both of these cases, three of the five companies would be cheaper than Tempur Sealy International. Finally, using the price to operating cash flow approach, the range is between 8.1 and 23. In this scenario, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tempur Sealy International | 11.9 | 8.9 | 8.2 |

| Leggett & Platt (LEG) | 13.5 | 12.7 | 9.1 |

| Mohawk Industries (MHK) | 39.9 | 10.5 | 8.5 |

| La-Z-Boy (LZB) | 7.1 | 10.9 | 2.7 |

| Ethan Allen Interiors (ETD) | 6.5 | 8.1 | 3.5 |

| The Lovesac Company (LOVE) | 9.4 | 23.0 | 7.6 |

Takeaway

What data we have available to us today tells me that, fundamentally speaking, Tempur Sealy International is still a robust firm that is trading on the cheap. At the same time, however, we have seen some weakness because of economic conditions. Long term, I have no doubt the company would do well for itself and its shareholders. But it’s not unreasonable to think that this weakness could extend well into next year. After all, when times are tough, one of the things easiest to kick off into the future is the purchase of a new mattress. I am still generally optimistic about the company, but I also feel as though it’s appropriate to decrease my rating on it from the ‘strong buy’ I had it at previously to a ‘buy’ to reflect these changes.

Be the first to comment