Dennis Diatel Photography/iStock Editorial via Getty Images

Investment Thesis

Since January 2021, retail traders have taken an interest in GameStop (NYSE:GME) and AMC (NYSE:AMC). Their theory is something between justified rage and tinfoil hat conspiracy, depending on who you ask, and they claim the two stocks are headed for a short squeeze of epic proportions.

Without respect to fundamentals, traders piled into both of the stocks in an attempt to drive down the supply of shares available to borrow. Without shares available to cover their positions, short-sellers would be forced to offer higher and higher prices.

This attempt to drive up the stock price through a short squeeze might work, and it might not. In this report, I aim to demonstrate that AMC stock has more downside and less upside than GME in almost any market situation or operational outcome. Because GameStop and AMC stock became highly correlated, a high-alpha pair trade with low potential volatility has emerged.

In my opinion, AMC has ballooned its share count, overleveraged its balance sheet, and made some nonsensical capital allocation decisions. Meanwhile, GameStop has prudently raised capital while keeping the balance sheet and share count under control, with continued insider buying from the Chairman of the board, Ryan Cohen, adding fuel to the long thesis.

A pair trade of long GME and short AMC could have significant upside and limited downside regardless of market conditions. Comparatively, high borrow rates of GME shares have also created trade with positive carry, further limiting the downside and paying traders to make the bet.

Correlation

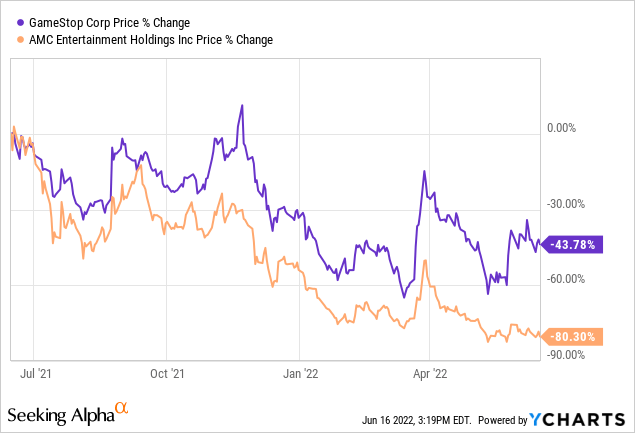

Overlapping investor demographics, with retail & some institutions on the long side and hedge funds on the short side, led to correlated stock prices between the pair of companies. Looking at the last 12 months of trading, GME has outperformed AMC in the long run, but the stocks are directionally coordinated on a near-daily basis.

The correlation is likely caused by insensitive buyers on the long side of the trade. Retail traders and passive index funds usually don’t care if the fundamentals of one stock are superior to another. They just buy, hold, and hope for the best.

On the short side, however, fundamentals eventually matter. Short sellers are generally attracted to situations where a company has a broken balance sheet or business model and has no further access to capital.

The resulting dilution or bankruptcy allows them to exit their positions with a gain. A situation like this could easily arise for AMC, while GameStop’s risk of bankruptcy or toxic dilution is minimal in the coming years.

Fundamental Comparison

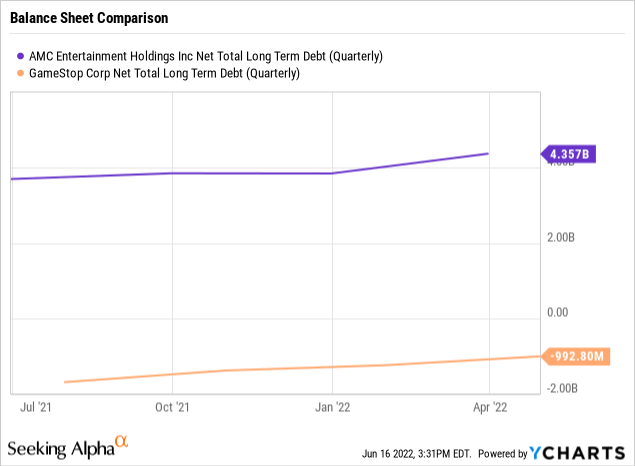

Both companies are facing identity issues thanks to the crisis of 2020, and are burning cash and raising capital to fund the turnaround. Because they are not generating cash internally to fund operations, the cost and availability of capital are important to the thesis.

Based on the balance sheets and cost of borrowing for the pair, GME has plenty of financial flexibility while AMC is overextended.

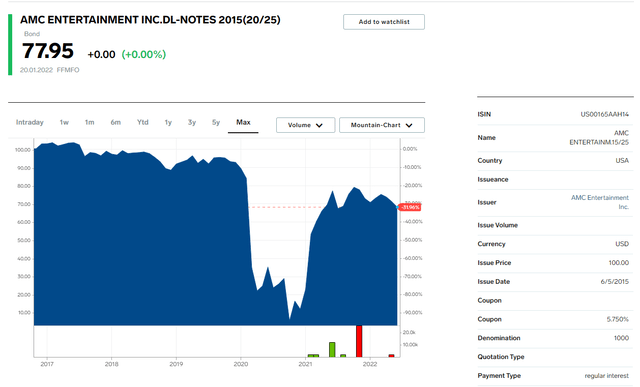

While the equity market appears hopeful for AMC’s future, the bond market is pricing a bankruptcy. Based on net debt levels and AMC’s high borrowing costs, bankruptcy or restructuring is likely on the table for AMC. The notes due in 2025 are trading at around 79c on the dollar for a yield to maturity of over 20%.

A yield north of 20% on corporate bonds is a bright red flag – the SPDR High Yield Bond ETF (JNK) is currently yielding less than 7%, meaning that compared to the average junk-rated company, the bond market is pricing a likely bankruptcy or restructuring for AMC.

Meanwhile, GameStop has a net cash balance that could fund multiple years of operational runway. GME has much more limited downside in the short and medium-term, as bankruptcy isn’t yet on the table and there is still capacity to raise capital.

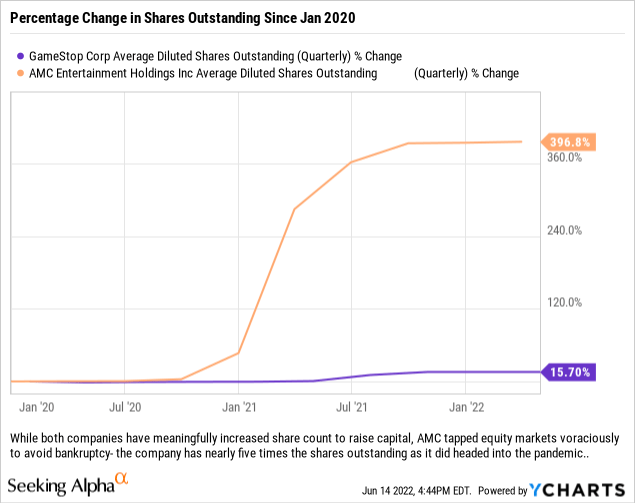

Past dilution will also dampen forward returns for both companies, which tapped equity markets to raise capital. While AMC’s share count increased by a factor of 5, GameStop issued a relatively small number of shares.

An increasing share count is not generally supportive of the equity price of a company, as the market has a new supply of stock to bring down prices. This could explain the relative outperformance of GME to date. I suspect this will continue, but a bankruptcy, restructuring, or massive dilution could serve as a catalyst.

Borrowing Costs Favor GME & Create Positive Carry

One thing to be aware of as a short-seller is the cost to borrow a stock. When there is a shortage of shares to borrow, sellers must pay exorbitant interest rates to borrow stock.

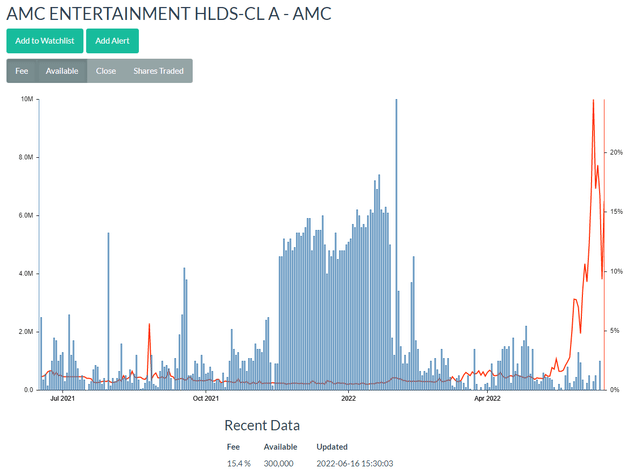

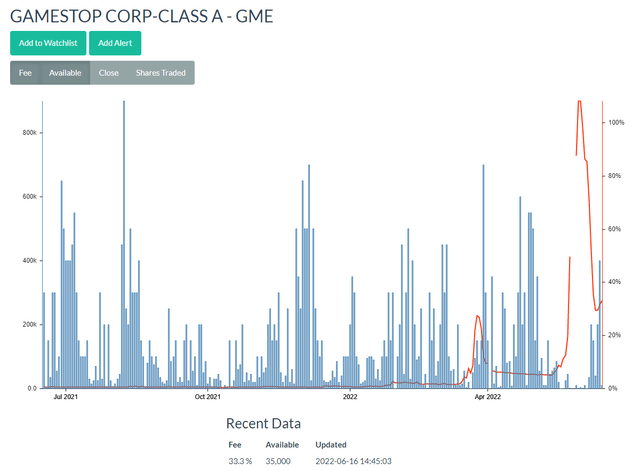

Thanks to the abundance of AMC shares and relative shortage of GME shares, costs to borrow AMC stock are about half of GME:

Thanks to the difference in shares outstanding, there is a greater supply of AMC shares available to borrow. The interest rate to borrow AMC stock is around 15% while GME is above 33%.

With brokers like Interactive Brokers offering to share half of the short interest earned from lending positions, a long position in GME could yield over 16% in net interest, more than enough to offset the borrowing cost on AMC shares. The trade would have a slightly positive carry at current borrow rates.

Management & Insider Activity

While operational hurdles exist in both companies, management teams are taking drastically different measures to navigate the environment. Even assuming the companies both fail over the long term, the capital allocation decisions tip the odds in favor of GameStop

While GameStop is spending its capital on fulfillment capabilities, inventory, and talent, AMC is making questionable moves.

Earlier this year, AMC acquired a minority interest in a junior silver miner with a shaky history, Hycroft Mining (HYMC). This move is optically suspect – mining and theaters have nothing in common operationally, and no synergies could be extracted from the move. Even more curious is the fact that Hycroft stock traded higher ahead of the announcement on March 15th, suggesting that some market participants could have traded on the news.

The $28 million price tag is not eye-raising by itself, though one could argue that money would be better spent on buying back discounted bonds to lower net debt, repairing the balance sheet, and reducing interest costs & solvency risks. Or, if the theater business is truly ripe for a comeback, AMC could have invested in its own business.

Even more suspect is the fact that insiders are not using the lull in AMC stock to purchase more shares. In fact, the CEO and other executives have dumped headline-generating amounts of stock.

Meanwhile, GameStop insiders were net buyers of the stock over the last year, led by a headline-generating purchase of 100,000 shares from Ryan Cohen. Capital allocation has been geared largely toward new hires, new products, and investments in online fulfillment. While these investments are costly and returns are uncertain, it’s better to see a business investing in future growth over interest expenses, management compensation, and sketchy acquisitions.

Valuation

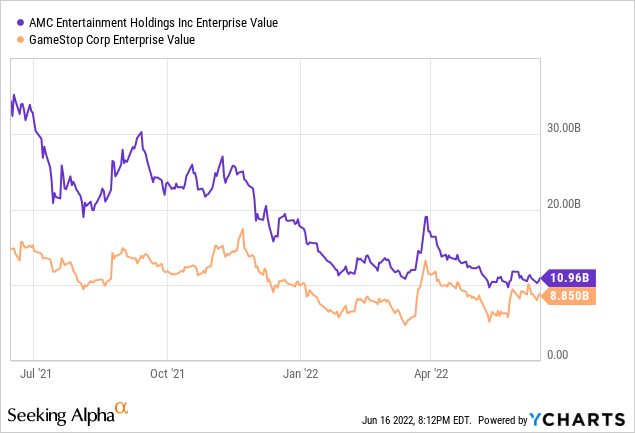

As turnaround cases, GameStop and AMC are difficult to value. The companies are both burning substantial amounts of cash.

Thanks to AMC’s debt load and bloated share count, GME actually boasts a slightly lower enterprise value. But the businesses are close enough in value.

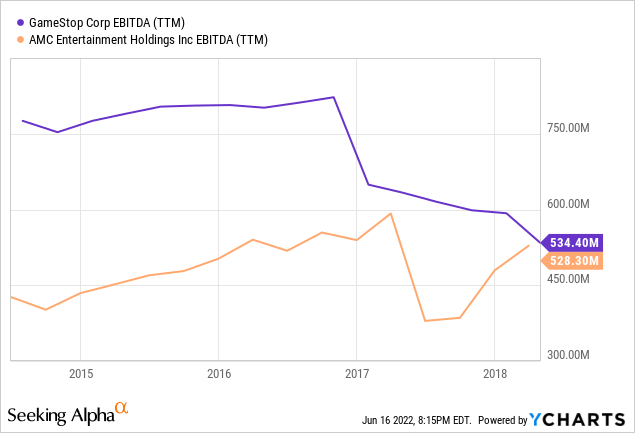

Looking at pre-pandemic EBITDA, the companies earned roughly the same amount. If we assume the turnarounds can earn similar EBITDA levels as when the businesses are healthy, they have roughly equal earnings power.

Given the differences in the balance sheets, the market is pricing a much rosier picture for AMC. While GME could survive for a while without earning a dollar, AMC will have trouble refinancing its debt without a real turnaround in earnings.

Conclusion

I believe the GME/AMC long-short pair trade represents a high-alpha opportunity with positive carry. The glut of AMC shares and the shortage of GME shares to borrow has created a rare opportunity to generate yield while betting against distressed equity.

The long side of the trade has no bankruptcy risk and aligned insiders, while the short side has plenty of catalysts to drive the stock lower. AMC’s broken balance sheet, bloated share count, and questionable management practices make it an obvious short against GameStop’s cash war chest, disciplined capital allocation, and aligned management.

Be the first to comment