Author’s Note: Those who have been following the Ranking Recession Readiness series will note I had already awarded a 3rd place to Google (GOOG) (GOOGL), however, due to an error discovered in my algorithm, Meta’s score had been unfairly penalized. This pushes Google to 4th. I apologize for this error, and the algorithm has been corrected. No other scores were affected.

With rapidly rising fed rates in response to equally rapidly rising inflation, the U.S. looks set to raise its rates right into a recession, slamming the brakes on an economy still recovering from COVID as war rages on in Ukraine, throwing the whole world into chaos.

With a recession inbound, or potentially already upon us, smart investors will already be thinking about where to park their capital, and no doubt be looking to exit firms they expect will suffer under heightened interest rates and poor economic conditions.

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 U.S. firms are positioned to strive through a downturn, and which firms will stumble.

This article seeks to explore the preparedness of Meta Platforms Inc. (NASDAQ:META), probably one of the most recognizable firms in the top 100 U.S. firms list, and needs almost no introduction.

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

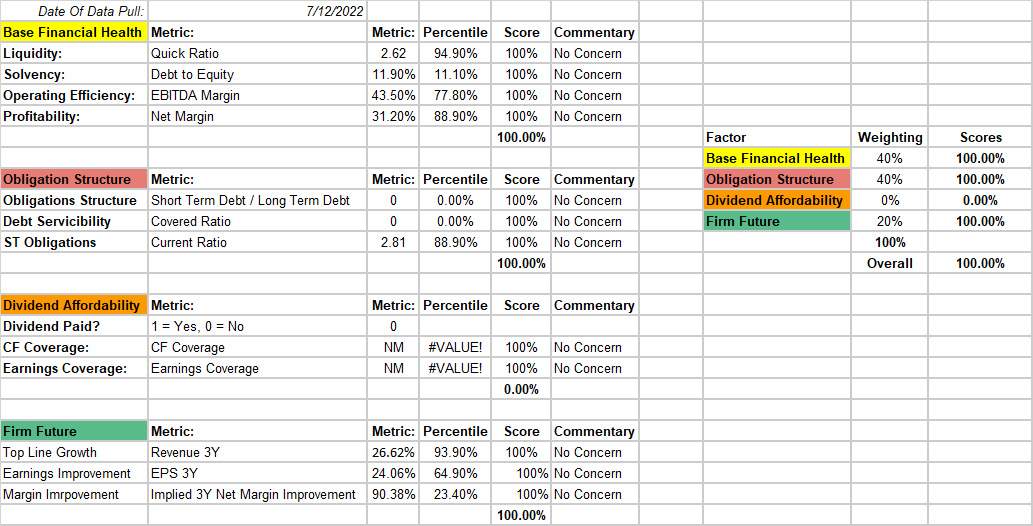

META’s Base Financial Health

Ordinarily in this series, I would break down a firm’s financial health analysis and dissect each line piece by piece. However, with Meta, the firm has one of the best-looking summaries I’ve looked at so far, and it deserves to be viewed in its full form below.

Ahhh… Just beautiful (Author)

(Don’t worry, we’ll still do a little dissecting!)

Meta’s base financial health is near-perfect, with the most minor of debts on its balance sheets relative to it’s equity, a phenomenal EBITDA showing excellent internal efficiency, and a hard-to-beat net margin of 31%. META has a license to print profit in its current operating environment.

Meta’s obligation structure is slightly odd however, if you look at Meta’s financials, they show Meta has no long-term or short-term debt (but has a debt-to-equity ratio). This is possibly because the firm has no debts, but has various liabilities (such as capital leases, accounts payable, income taxes payable, other current liabilities) that might be considered debt under a debt to equity ratio. We won’t question Seeking Alpha’s calculation on this, given it is such a minor figure.

This would then explain the covered ratio of 0 (no debt, no debt obligations to service), while we see an outperforming current ratio of 2.81.

Meta doesn’t pay a dividend yet, so we skip on to firm future outlooks, which again outperform its peers across the board. Margin improvement is low against the peer group, but I don’t think anyone in the comments will argue that a 90% improvement in margin is a risky metric.

Overall, perfect scores for Meta vs. its peers in the top 100 U.S. firms list. So with this very healthy picture in mind, we no look to see how Meta is prepared to face a recession.

Assessing META’s Recession Preparedness

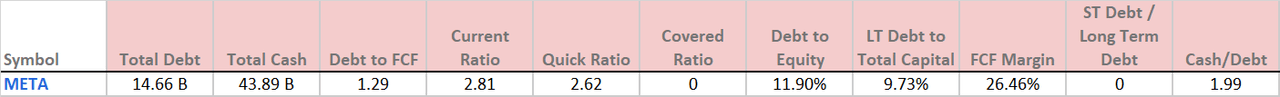

Starting with reviewing Meta’s balance sheet, we cast our mind back to the advice from business leaders during the 2008 Great Recession.

Author

Their advice centered on reducing debts before a recession hit, and building and maintaining a healthy cash stockpile, both of which Meta has done very well, knowing that Meta has no debt obligations to speak of, and that is a very significant cash stockpile.

The only other metric worth mentioning is the free cash flow (“FCF”) Margin, which is an extremely healthy 26%.

So now we rank these scores against the other 99 firms, score them and weight the scores.

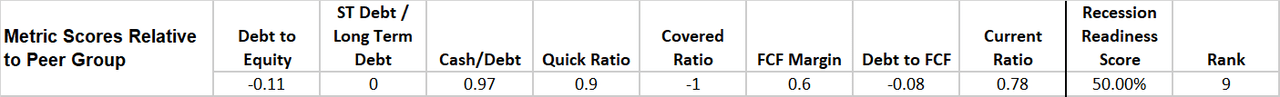

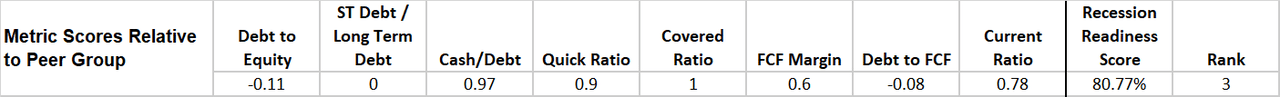

Author

One significant detail I notice here is that the Covered Ratio of 0 has confused my algorithm slightly. This has penalized Meta when it should have rewarded it. Adjusting this to a positive “1” shifts Meta’s score from 50% Recession Readiness Score and 9th ranked to 80.77% & 3rd ranked, which I will manually override and accept as its final score, pushing Google down to 4th ranked.

Oops – Sorry Google (Author)

But as we know, numbers don’t always tell the whole story, so let’s delve a little deeper into Meta…

A Deeper Dive Into META’s Recession Readiness

Our guides from the 2008 Great Recession shared some fantastic wisdom around how to survive a prolonged and deep recession.

The first great piece of advice they gave was about managing debt and maintaining cash stockpiles, which we’ve covered in the above.

Next was de-risking your business and minimizing your exposure to your customer’s financials, by working down your accounts receivables.

It’s an interesting one for Meta, with a very large Total Receivables balance relative to their total assets, but this is offset by having no inventory (as they don’t sell physical products, so there’s no costs associated with storage).

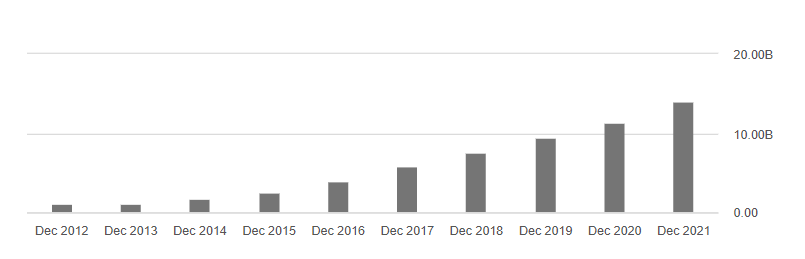

Meta Total Receivables (Author)

Total Receivables ~$11.4B, 19% of total current assets, 6.9% of total assets.

The next piece of wisdom was around costs reduction and staffing. While recession veterans strongly recommended aggressively cutting costs, the advice also included a note about avoiding layoffs due to the costs associated with hiring and training post-recession.

For Meta, the firm is extremely efficient in regards to revenue and profit per employee, so there appears at this point a low risk of mass-layoffs unless the business faced a catastrophic decline in revenues.

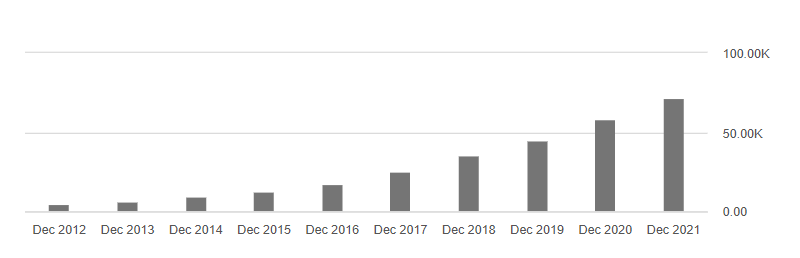

Meta Total Employees (Author)

77,805 total employees, $1,538,024 revenue per employee, $479,892 profit per employee

The final piece of advice was around taking the opportunity to invest during a recession in CAPEX, in order to take advantage of the lower opportunity costs of capital. The idea is that firms can use this time to roll out projects that would ordinarily compete for budget with more direct revenue driven projects.

Meta is perfectly primed to do this, with no debts to service and a huge war chest of funds to ride out a recession with ease. Though, many investors in the comments section will undoubtedly point out that Meta already has a very significant project underway that they hope will be the next major shift in digital trends: The Metaverse.

Perhaps a recession will give Meta an opportunity to accelerate this project or push consumer adoption – though I do not dare try to write the narrative of how that would play out.

Closing Remarks

I haven’t created a pricing mechanism for firms based on the Recession Readiness Rankings, however I am able to broadly get a sense of whether a firm is a buy, sell or hold heading into a recession. Meta’s fantastic general financial health, it’s Recession Readiness Ranking (3rd place – sorry Google) and score (80%), along with terrific qualitative elements make Meta a very easy Strong Buy recommendation for investors looking for safer mega-cap stocks to put their money into.

I really hope you’ve enjoyed the series so far, this is the third installment of Ranking Recession Readiness, and I’m really appreciating the feedback on the first pieces thus far.

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession readiness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

sefa ozel

Be the first to comment