bymuratdeniz

After the market closes on October 24th, the management team at Range Resources Corporation (NYSE:RRC) is expected to report financial results covering the third quarter of the company’s 2022 fiscal year. Leading up to that time, investors should be paying attention to what kind of guidance the company will offer, as well as what cash flow data the company ultimately reports. At the end of the day, given current projections, shares of the enterprise do look attractively priced. On top of that, overall risk for shareholders is limited so long as energy prices don’t fall materially from here. Given these facts, combined with the fact that management continues to find ways to reward shareholders directly, I would say that the firm makes for an appealing ‘buy’ prospect for anyone who is bullish for the oil and gas space moving forward.

Range Resources – A solid play in the E&P space

The past several years have been very volatile for companies and the investors of those companies in the oil and gas exploration and production space. After dealing with historically low prices for multiple years, the companies then experienced significant upside because of surging demand and supply that was hobbled by the pandemic and years of underinvestment. Many of the players in the space ended up going bankrupt. But those that survived came out of the downturn stronger and some players seem to understand that playing the speculative game that they did several years ago is not the best for the long-term picture.

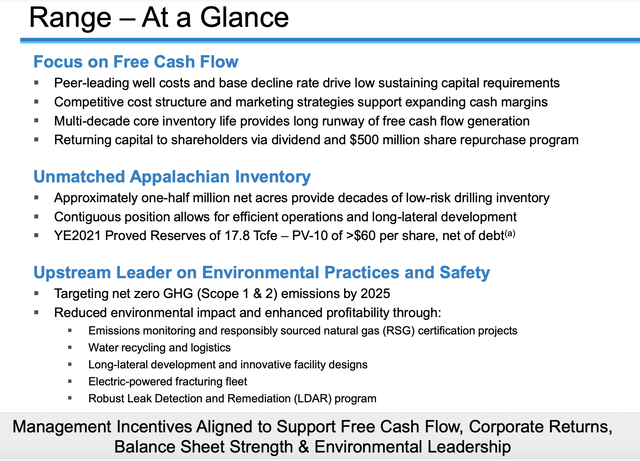

An example of this change in mindset can be seen by looking at the most recent investor presentation provided by Range Resources. On the 4th page of its presentation, management expressed that their primary focus moving forward is on generating free cash flow. Although this may seem like common sense, most oil and gas exploration and production companies over the past several years focused initially on maximizing production at all costs. But cash is king in that it creates additional value for the companies to be under-leveraged and to be able to deal with lower prices should economic circumstances turn against them.

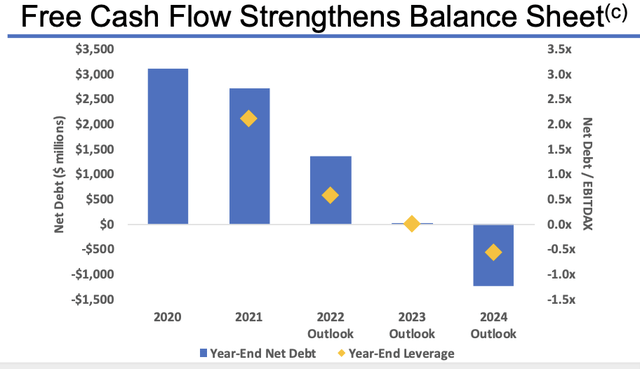

So dedicated has Range Resources become to generating free cash flow that management claims that the 2022 fiscal year should be the 5th consecutive year in which the company will be able to drive debt reduction as a result of its excess cash flow. Naturally, this strong cash flow picture has been aided significantly by the high prices the company generates from natural gas. Based on my own projections, about 70% of the company’s output comes from natural gas. Another 27.7% can be attributed to natural gas liquids, while the remaining 2.3% should be in the form of oil.

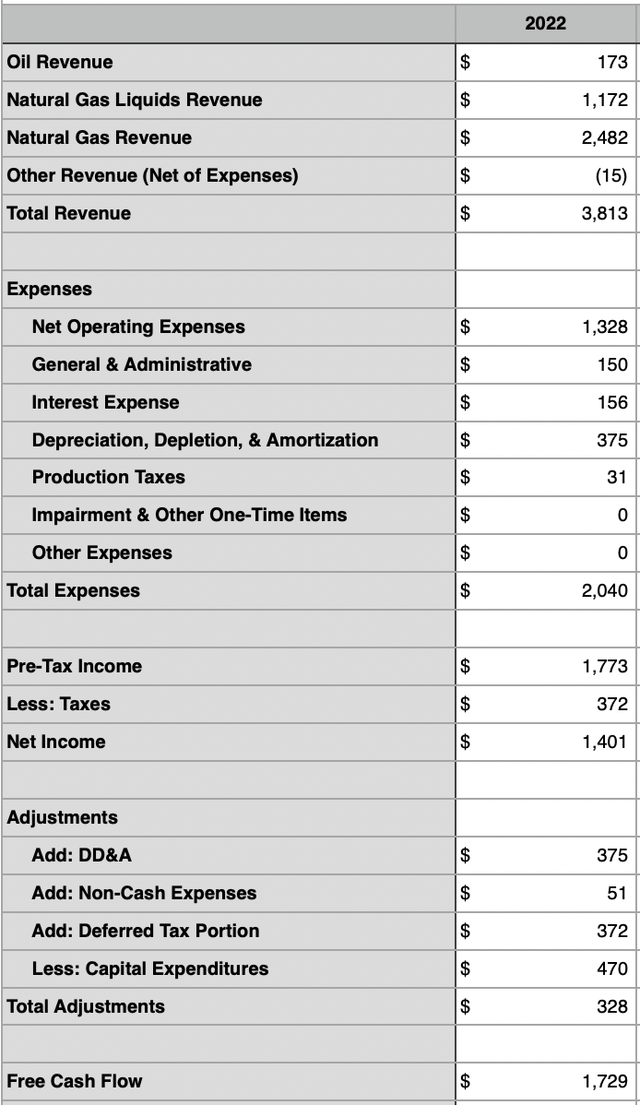

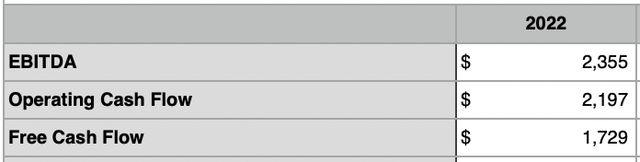

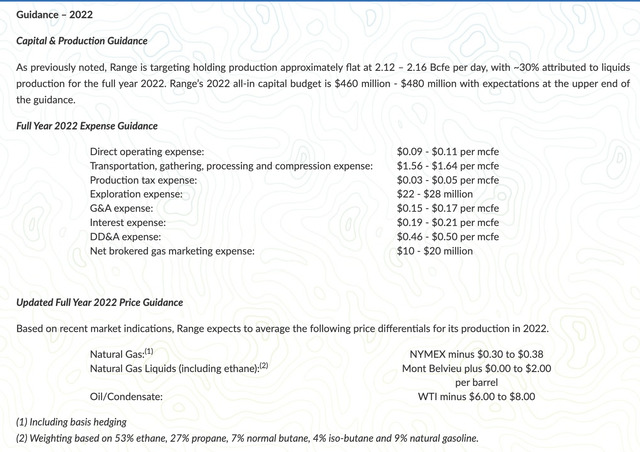

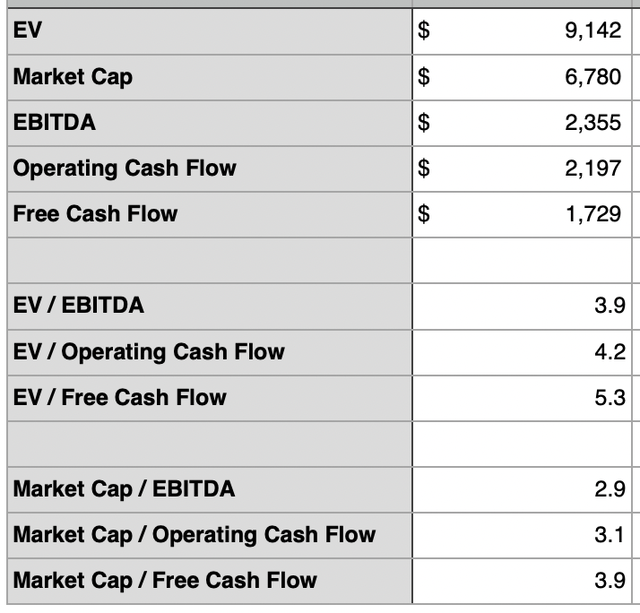

When it comes to the third quarter, the headline news will involve the company’s revenue and earnings per share. Revenue for the quarter is expected to come in at around $1.06 billion. Meanwhile, earnings per share should be around $1.37. From my experience though, revenue and earnings per share are not necessarily the best metrics to pay attention to in this market. How companies report derivatives, the significant role that depreciation plays, and many other factors, all make operating cash flow and EBITDA far more significant by comparison. Using the most recent guidance provided by management, which can be seen in the image above, and factoring in oil prices of $85 per barrel with natural gas prices of $5 per Mcf, I calculated that the company should generate EBITDA this year of $2.36 billion and operating cash flow of just under $2.20 billion. Using midpoint figures provided by management, capital expenditures should be around $470 million. That would imply free cash flow of $1.73 billion. This actually matches up nicely with management’s own guidance for the year. In their investor presentation from July, they said that free cash flow for 2022 should exceed $1.50 billion.

Author – SEC EDGAR Data Author – SEC EDGAR Data

To see if this kind of performance is in any way realistic, it would be helpful to see how the company performed during the first half of the 2022 fiscal year. During that time, operating cash flow, adjusted for changes in working capital, came out to $978.87 million. Although this is slightly less than half the operating cash flow figure I calculated above, it is close enough that changes in hedging and realized energy pricing could account for the difference. Using this strong cash flow generation, management has already been working on rewarding shareholders. For instance, in the second quarter of this year alone, the company repurchased 4.5 million shares for a combined $129.83 million. This leaves about $354 million of the $500 million the company has on its share buyback plan in place. And also, during the third quarter of this year, the company initiated a dividend for shareholders totaling $0.32 per year. Though this may not sound like much, it should translate to around $79.6 million in payouts annually.

One thing that investors should always pay attention to in this space is leverage. High leverage can significantly reduce the upside of any prospect or even go so far as to kill that prospect entirely. Generally speaking, the market prefers a net leverage ratio in the oil and gas exploration and production space of 2 or lower, with a number exceeding 3 considered to be dangerous territory. Back at the end of the 2020 fiscal year, that’s around where Range Resources stood. But between higher energy prices and positive cash flows, the company has reduced its leverage substantially. Based on my estimates for 2022, the net leverage ratio is around 1 today. And by the end of the 2024 fiscal year, management is targeting to have cash in excess of debt totaling $1 billion or more.

From a pricing perspective, shares of the company also look quite cheap. Assuming my 2022 estimates come to fruition, the company is trading at a forward price to operating cash flow multiple of 3.1. The price to free cash flow multiple is only slightly higher at 3.9. Meanwhile, the EV to EBITDA multiple of the company should come in at around 3.9 as well. From what I have seen in the oil and gas space from the companies I write about in my Marketplace, these numbers seem to be more or less similar to what many other players trade at. But on an absolute basis, shares do look cheap to me. Given the uncertainties in the space in recent years, it seems as though the market heavily discounts oil and gas exploration and production firms. I understand why this is. But at the same time, buying a company for just a few times cash flow only requires a couple of years before significant value creation is undeniable.

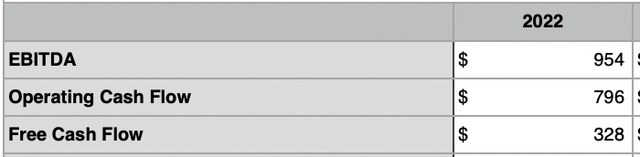

Of course, some investors might be worried about what happens if energy prices fall from here. This is a perfectly realistic concern given the volatility of the space and the prospect of a global recession. As part of my analysis, I asked myself what would happen if I removed all of the hedges on the company’s books and reduced the price of oil to $60 per barrel while the price of natural gas would be $3 per Mcf. In this case, the company would still generate EBITDA of $954 million annually, operating cash flow of $796 million, and free cash flow of $328 million. And this assumes that the company would not experience any increase in production from current investments. It’s also worth noting that the net leverage ratio here, again without any further debt reduction from what we have today, would be at 2.48. That is certainly elevated but not to a degree that would denote serious concern about the company’s prospects.

Takeaway

What data we have today suggests to me that, leading up to its earnings release on October 24th, Range Resources makes for an appealing prospect for investors who like the oil and gas space. Of course, investors do need to be on the watch for what kind of cash flow is ultimately reported and what guidance is provided. Any meaningful change in guidance could be really good or really bad for the company. And with energy prices having fallen a bit recently, it wouldn’t be unrealistic if management decided to scale back its targets in order to prioritize remaining free cash flow positive. But so long as nothing significantly unexpected comes out of the woodwork, I do think the company makes for a solid ‘buy’ prospect at this time.

Be the first to comment