gguy44

(This article was co-produced with Hoya Capital Real Estate)

Introduction

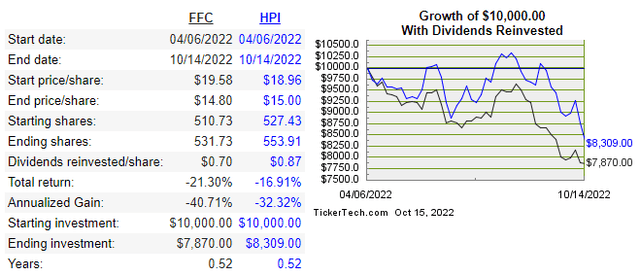

Last April, I wrote an article that compared Flaherty & Crumrine Preferred and Income Securities Fund (NYSE:FFC) to the John Hancock Preferred Income Fund (HPI). Not only was my Buy rating on FFC poor (to say the least), I recommended it over HPI too, which also turned out wrong.

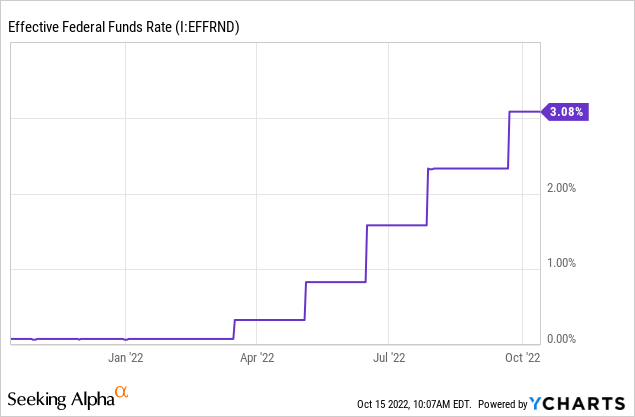

I think the main reason things went so bad was underestimating how high (and long) inflation would hang on, and then how fast the FOMC would raise the Fed Funds Rate to combat it.

Understanding the manager: Flaherty & Crumrine

This is how they describe themselves:

Flaherty & Crumrine Incorporated specializes in the management of preferred, contingent capital and related income securities. We have focused on preferred securities portfolios for institutional clients and investment funds since our inception in 1983.

We are an independent and employee-controlled investment adviser with a dedicated credit research team that performs comprehensive analysis of the risks faced by preferred and contingent capital security holders. With only a relatively small number of institutional portfolios and eight public funds (including two in Canada), we are able to offer customized portfolio strategies to best meet each client’s investment objectives, risk tolerances, tax position and time horizon.

Investment approach and philosophy

We believe the best way to achieve consistently superior investment results in the preferred and contingent capital securities market is to manage credit risk and reinvestment risk, the two main pitfalls that come with focusing solely on high current income. In each case, potential problems can be averted at relatively little cost when they are recognized early.

Proper portfolio maintenance requires serious analytical efforts. To do this, we utilize a combination of intensive credit research and quantitative analysis, along with some very pragmatic trading strategies. However, we do not believe in strategies which require heroic bets on individual credits or on predicting the direction of interest rates. Rather, we see ourselves as assessors of risk and our goal is to build and maintain preferred portfolios that sufficiently compensate our clients for taking on those risks.

Source: flaherty-crumrine.com/our-firm

Flaherty & Crumrine Preferred Securities Income Fund review

Seeking Alpha describes this CEF as:

Flaherty & Crumrine Preferred Securities Income Fund that invests in the public equity and fixed income markets of the United States. It seeks to invest in securities of companies operating across diversified sectors. The fund primarily invests in investment grade preferred securities consisting of hybrid or taxable preferreds. It employs quantitative analysis to create its portfolio. The fund benchmarks the performance of its portfolio against the Merrill Lynch 8% Capped DRD Preferred Stock Index, Merrill Lynch Hybrid Preferred Securities Index, and Merrill Lynch Adjustable Preferred Stock 7% Constrained Index. FFC started in 2002.

Source: seekingalpha.com FFC

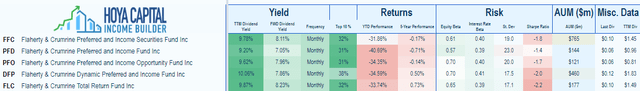

FFC has $766m in AUM and comes with a 166bps fee; a year ago the fee was under 130bps. Rising rates not only hurts the prices of held assets but the cost of using leverage too (currently about 40%). There is just over $500m in leveraged assets outstanding, providing an asset coverage ratio close to 250%. The current yield on FFC is 8%, though as will be shown later, three cuts have occurred in 2022.

Holdings review

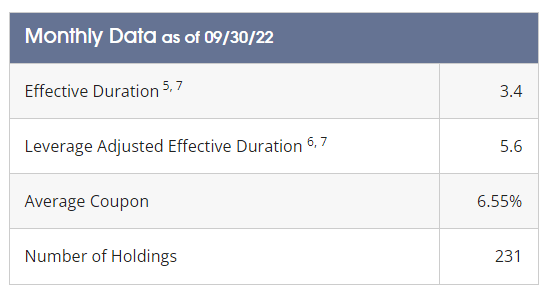

The F&C managers provides these basic portfolio statistics:

preferredincome.com

Maybe as reflection of the low (11%) turnover, the average coupon is 21bps lower now than it was at the end of 2021. BBB-rated debt is up 400bps over the past year, 225bps from when the prior article was published; which translates into an expected price drop for FFC of 12%, assuming the LAE duration hasn’t moved: in reality it is down 24%.

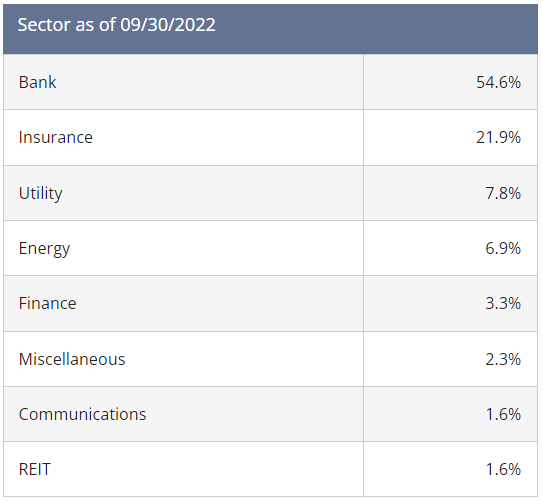

preferredincome.com sectors

Not unexpectedly, financial companies represent 80% of the portfolio, as Preferred stock counts toward their regulatory capital requirements. The one negative there is those issues must be non-cumulative, meaning a missed payment does not need to be paid. The allocations have not moved much since the February data used in my prior analysis.

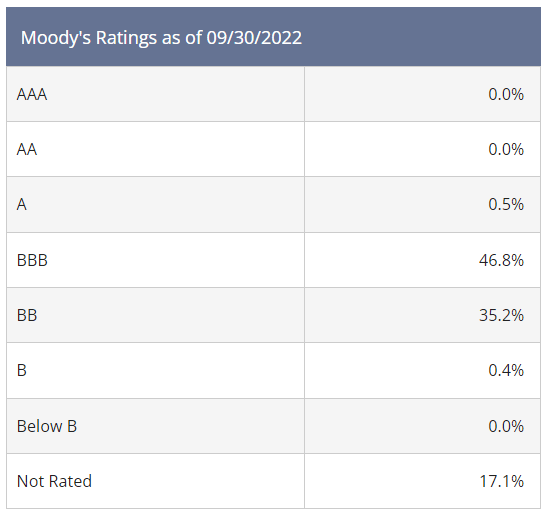

preferredincome.com ratings

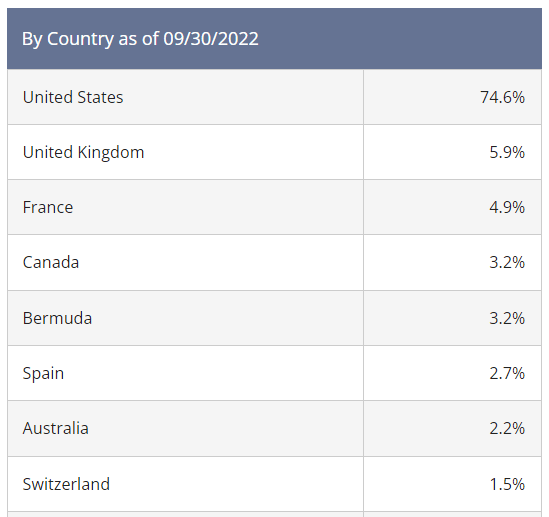

Most holdings are either at the bottom of the investment-grade ratings or top of the non-investment-grade ratings. Having 17% non-rated is fairly usual too. The top 8 country allocations, also little changed, are:

preferredincome.com countries

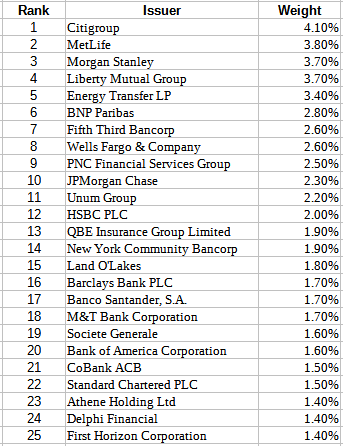

The top issuers of the assets owned are:

preferredincome.com issuers

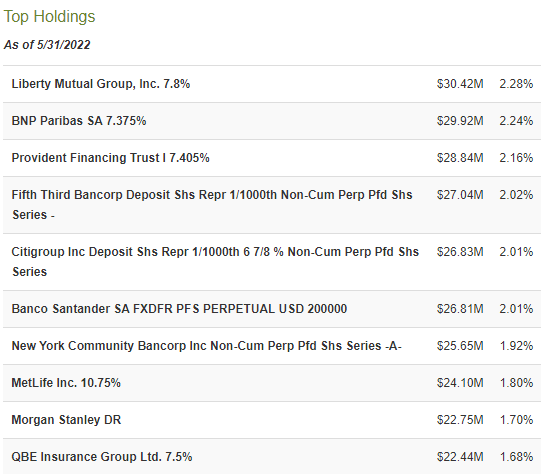

FFC is well diversified for default risk as this list only covers 56% of the portfolio. I had to go to a site other the F&C for holdings data, and even then the data is months old.

CEFConnect.com FFC

From the May semi-annual report, it shows the type of securities held:

- Preferred stocks: 78%

- Contingent Capital Securities: 17%

- Corporate debt: 3%

- Cash/other: 2%

A Contingent Capital Security is a hybrid security with contractual loss-absorption characteristics.

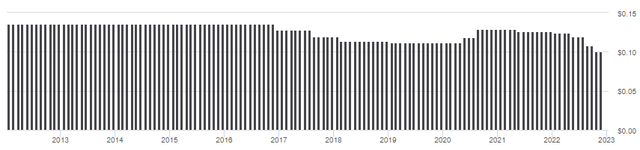

Distribution review

Holdings generating Qualified Dividend Income (QDI) for Individuals is 66.2%. Holdings generating Income Eligible for the Corporate Dividends Received Deduction is 45%. The Fixed-to-Float exposure of 83% could help income going forward, or reverse recent cuts.

There have been five cuts since restoring the payout post-COVID. In 2021, all the payouts were from ordinary income, with 2022 payouts currently listed the same.

Depending on market conditions and operations, a portion of the cash held by the Fund, including any proceeds raised from the offering, may be used to pay distributions in accordance with the Fund’s distribution policy and may be a return of capital.

Source: preferredincome.com Prospectus

I could not locate what the actual distribution policy is for FFC.

Price and NAV review

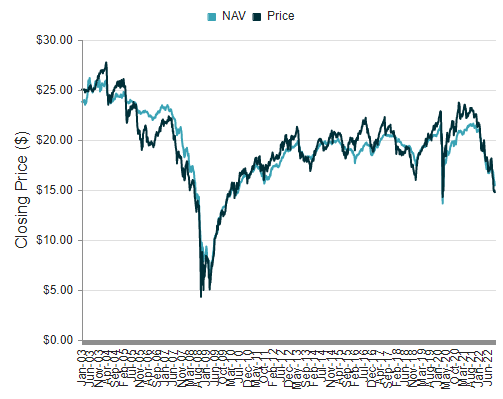

cefconnect.com FFC

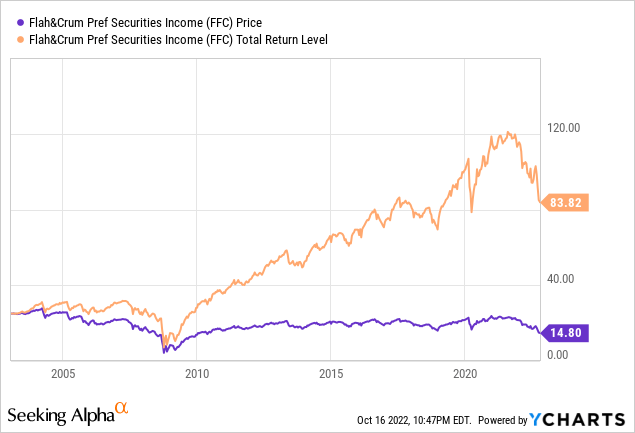

Keep in mind an important part of FFC is the payouts, which the above price-only chart doesn’t reflect. That said, today’s price is close to what FFC sold for after the 2008-09 GFC. The next charts show how the investor’s decision to reinvest or take payouts effected their CAGR.

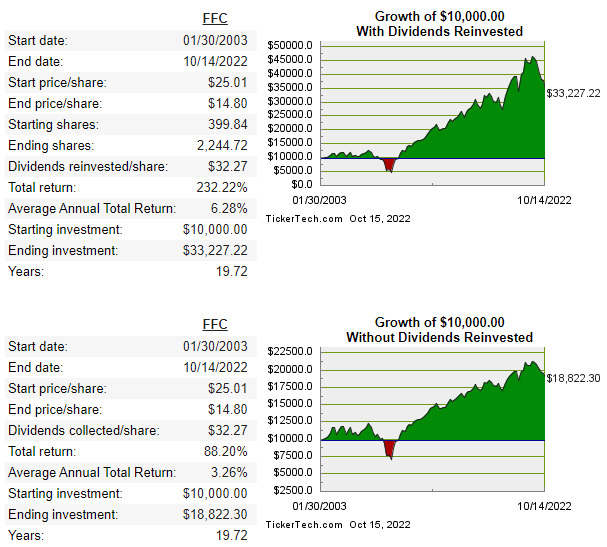

dividendchannel.com/drip-returns-calculator

Takers earn just over 50% of the CAGR that other investors earned since FFC started. Since the site doesn’t mention if taken payouts earned interest, I have to assume they did not.

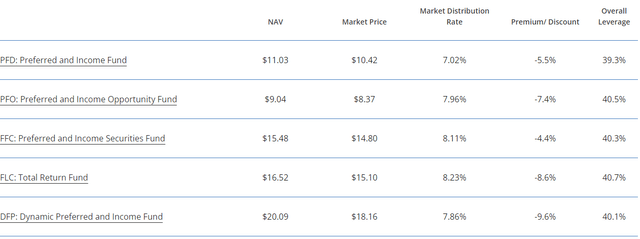

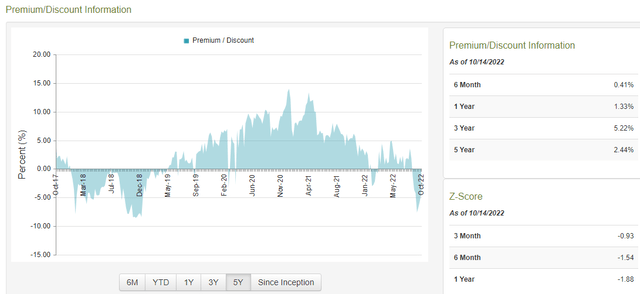

The current 4.4% discount, shrinking from a recent low of 7.66% in late September. The current depth is more than what FFC hit during COVID. While that is a positive for FFC, other F&C CEFs are even deeper.

Portfolio strategy

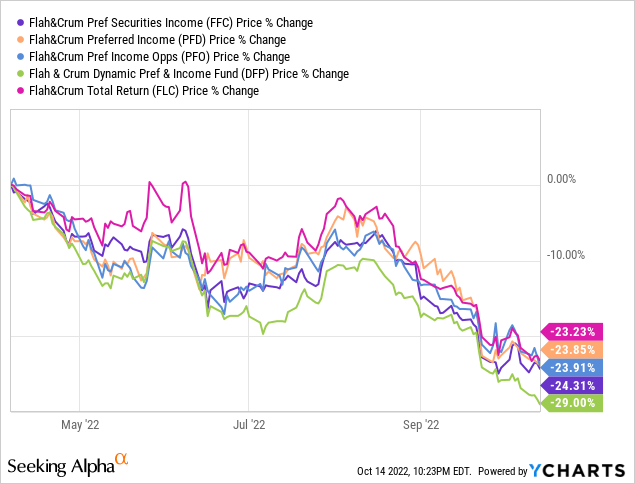

With FFC down over 30% in 2022, it is a prime candidate for a tax-loss sale and possible swap into another of the other Flaherty & Crumrine CEFs offered.

preferredincome.com Funds

From the date of the prior FFC article, only the Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) is down in price more, though none vary by much. Of the F&C CEFs, FFC is showing the smallest discount from its NAV, another reason to consider a swap out. Other data on the five CEFs include:

Final thought

With the FOMC almost promising another 125bps (or more) increase in the FFR, selling FFC now to establish the loss and then waiting until 2023 to repurchase either FFC (past 30-day wash sale period) or a similar CEF, F&C or other, is another option. The risk is the CEFs could rally before buying the replacement.

Be the first to comment