Ben Gabbe

The Quarter:

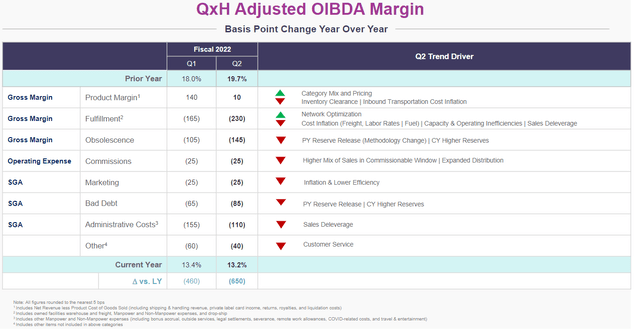

Qurate Retail (QRTEA) reported earnings that were down severely from the previous year and even the previous quarter but was better than feared by some. Customer count was down to 9.475 million leading to sales down 12% and adjusted OIBDA down 40% (38% in constant currency). Margins were impacted by a slew of challenges, mainly tied to negative operating leverage and inflation.

Margin Impacts on Qurate Q2. (Qurate Retail Q2 Company Presentation)

Free cash flow was weak at negative $137 million. The only positives were the company finished the quarter with still relatively low leverage of 2.3x, $561 million of cash and equivalents and $2.5 billion of liquidity at quarter-end, generated more liquidity provided by sale leasebacks after quarter-end, and remained well below all bank covenants and comfortably within all restricted payments capacity necessary to service parent level debt and preferreds.

Mea Culpa

Well, I definitely whiffed on these Qurate 8% Preferreds (NASDAQ:QRTEP). Obviously, operations fell off much harder than I anticipated and concerns surrounding the operating and parent level debt were much more pronounced than I first judged. Obviously, any time you’re dealing with a company with negative cash flow, you feel much less secure about any coupon payment, especially one that can be deferred and is reliant on restricted payment capacity like these preferreds.

Management has made several moves to address liquidity with the foremost being sale-leaseback transactions that raised $685 million, the bulk of which came after the quarter. Taken together, the company has over $3 billion of liquidity and more than enough to service parent level debt and these preferreds for quite a while. The big question is whether that will be enough time until the “5 Pillar” turnaround takes hold and this company can return to close to $2 billion of OIBDA and hundreds of millions of free cash flow generation. Gun to my head and knowing the guys behind the throne here (John Malone and Greg Maffei), I’d say everything will be ok with these preferred, but it is likely to be a bumpy road.

Risks

The main risk here is that the American consumer is tapped out thanks to rising costs of basics like food and energy and has little appetite or disposable income to shop with Qurate’s assets. There is also the risk that the “5 Pillar” turnaround plan does not work. Lastly, specific to the QRTEPs, there is the risk the company decides to preserve capital and halt the dividend, (which would accrue at a higher rate) and/or the company runs out of restricted payments capacity. Either situation would be ugly. The one, albeit flimsy, offset to that is the company has $1.5 billion of market cap behind these preferreds. That’s a decent amount of value to burn through before these securities get impaired.

Conclusion

I thought these preferreds were mispriced in December. In my partial defense, interest rates spiked and high yield credit spreads widened (both risks I called out in that piece). These securities have dramatically underperformed what those risks should have implied. I was wrong in judging the appropriate yield here. The company is supposed to announce the dividend some time over the next few days. I think a 17% strip yield might be worth a flyer for a small position but only for those with a bit of a risk appetite.

Be the first to comment