JuSun

Quotient Technology Inc. (NYSE:QUOT), which operates in the digital advertising business, has an impressive ability to locate active buyers for retail clients. QUOT has access to an impressive amount of data about consumers, which retailers demand. Under conservative conditions, I obtained a free cash flow stream, which would justify a valuation of close $4.28 per share. I also see risks from competitors offering less automatic tools. With that, I believe that Quotient is undervalued.

Quotient

The digital advertising business has had enormous growth since the insertion of mobile devices in the day-to-day business world and citizens not only because of the marketing campaigns themselves, which bring a significant number of customers to the companies that advertise their products, but also because of the collection of user data that later allows the advertising companies to develop segmentation plans and much more detailed objectives in relation to the product in question and to the region where it wants to be inserted.

Quotient Technology is undoubtedly one of the companies that has been able to get the most out of the returns in relation to the transformation of the advertising culture. Founded in 1998 by Steven Boal, under the name of Coupon.com, the company offered only discount coupons based on acting as an intermediary between customers and the companies that offered their discounts. The name of the company changed to its current name in 2015, and it developed a business model that was able to adapt to the needs of the current market.

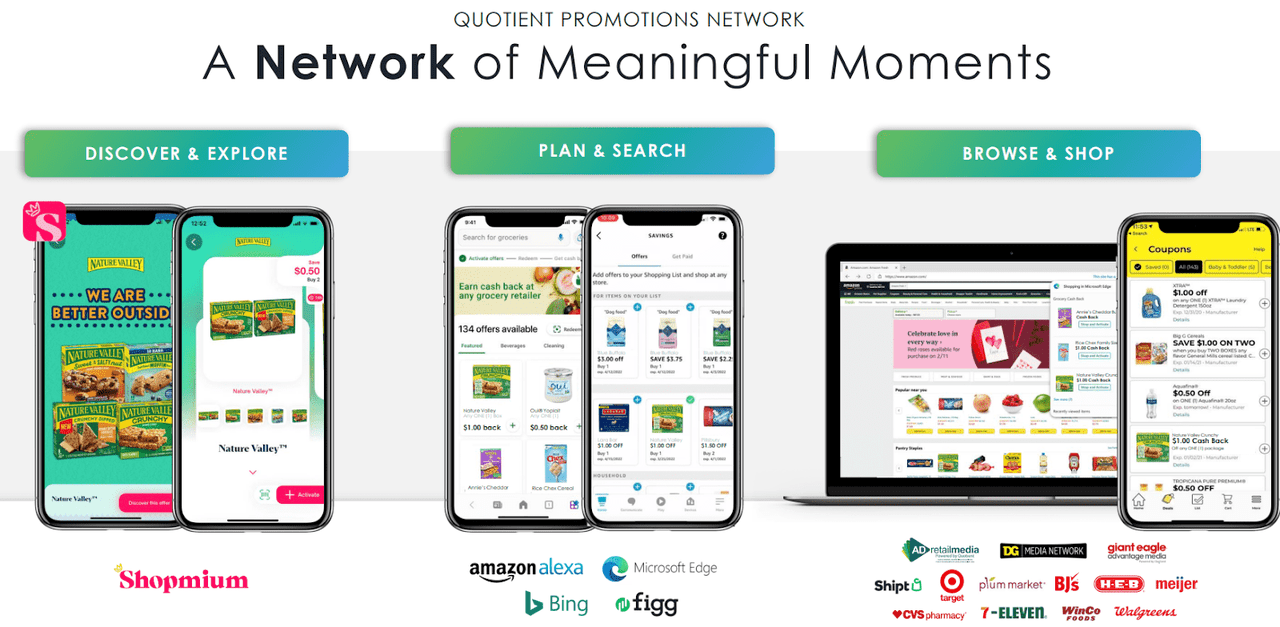

Source: Quarterly Presentation

Its business is divided into three large segments: for brands, for data collectors, and its data analysis service. In other words, Quotient offers its multimedia channel to companies interested in generating advertising content besides offering the data collected by its software to other companies. In addition, it has a data analysis service to generate better segmented targets.

According to its last 10-k, some of the company’s leading numbers include 127 million located and active buyers, more than $45 billion in coupons activated in 54,000 different points, and 108 daily mobile signals in the United States for its objectives of locating potential buyers. In my view, these figures demonstrate the magnitude of capital involved in the company’s operations and the success it has had in developing and growing since its founding.

Source: Quarterly Presentation

In relation to its human capital, which the company points out as one of the key factors in the development of its business model, the company currently has 1,162 employees, of which 943 work from the United States and the rest work remotely in other countries of the world. The development in the area of inclusion and diversity that this company presents over most of the companies in the field is worth noting, since 52% of its employees are women, and 42% of executive positions are held by women.

Expectations From Analysts Include 2024 Sales Growth of 5.7% And Double Digit EBITDA Margin

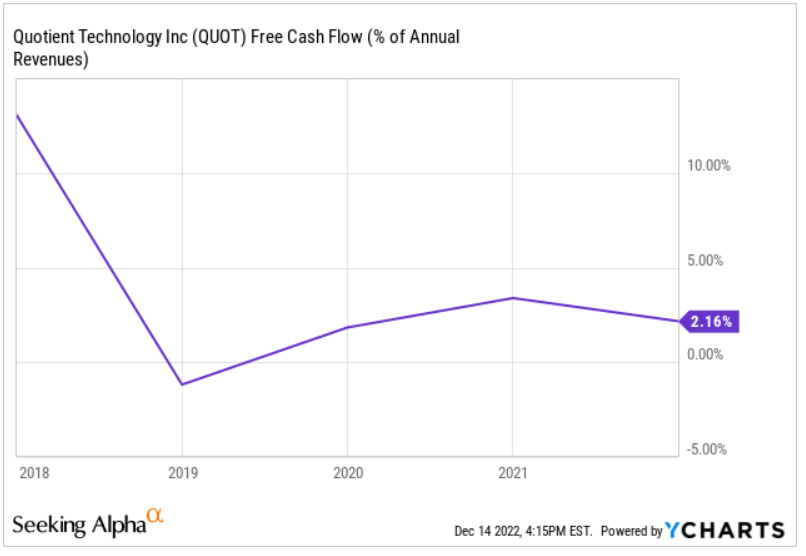

From 2018, the company’s FCF went from close to 5%-10% to around 2% in 2022. I used some of these figures in my financial models, so I believe that investors may want to have a look at them.

Source: Ycharts

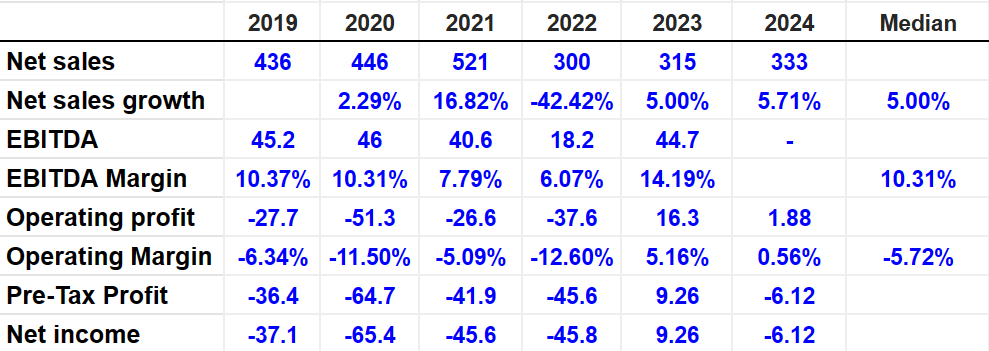

Market expectations include net sales of $333 million by 2024 with a net sales growth of 5.71%. 2023 EBITDA will likely stay close to $44.7 million with an EBITDA margin of 14.19%. 2023 operating profit would be $16.3 million together with an operating margin of 5.16%. Finally, pre-tax profit would be close to -$6.12 million with a net income of -$6.12 million.

Source: Ycharts

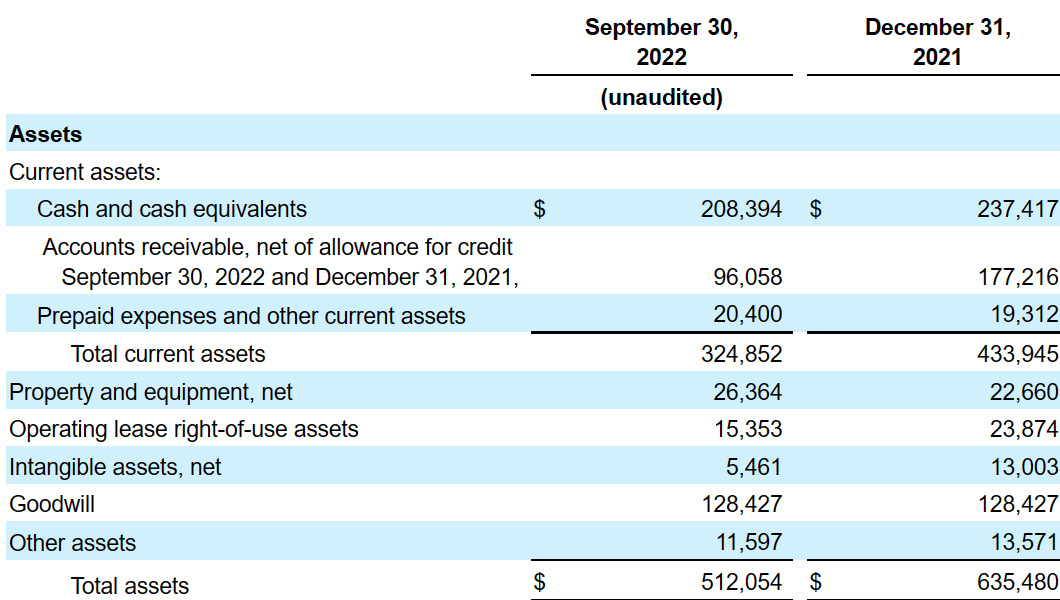

The Asset/Liability Ratio Is Larger Than 1x

As of September 30, 2022, Quotient reported cash worth $208.394 million in addition to accounts receivable of $96.058 million. Total current assets were equal to approximately $324.852 million, which implied a current assets/current liabilities ratio of 1x. Total of assets stand at $512.054 million with an asset/liability ratio larger than 1x. I believe that the company’s liquidity and the balance sheet are in good shape.

Source: 10-Q

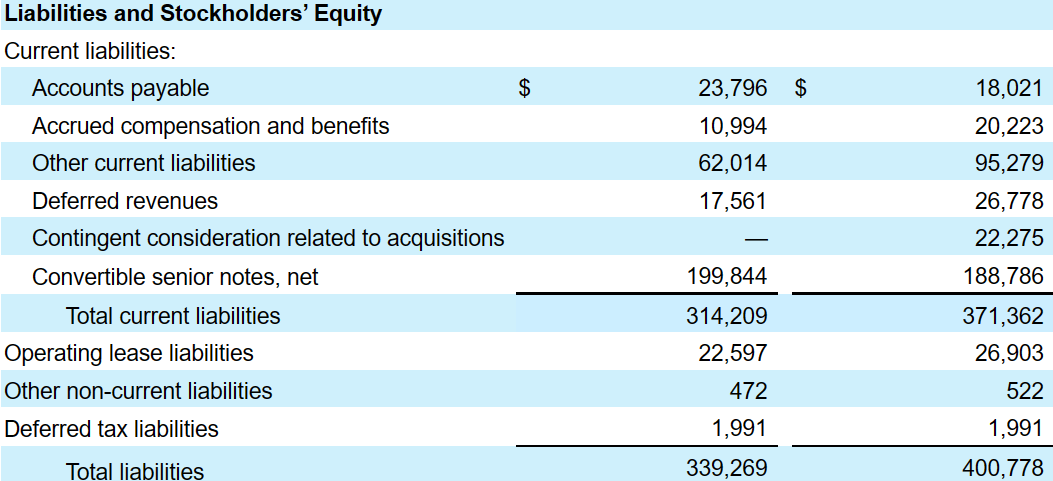

Accounts payable stood at $27.796 million with other current liabilities close to $62.014 million. Convertible senior notes were worth $199.844 million with total current liabilities of $314.209 million. Finally, with operating lease liabilities worth $22.597 million, total liabilities are equal to $339.269 million.

Source: 10-Q

My Conservative Case Scenario Indicated A Fair Valuation Of $4.28 Per Share

During 2019, a single client meant a sum of revenue greater than 10% of the total revenue. I believe that management is making a lot of efforts to increase its exposure to a small number of clients. In 2020 and 2021, no client represented more than 10% of the total amount of revenue. This speaks of the successful diversification in its client portfolio, avoiding the risk of being directly subject to the success in the development of the business model of a third company. Under this case scenario, I assumed that more clients would mean more revenue growth.

The company’s services are available for brands that want to place their products on the advertising network and for retailers who benefit from the company’s information and developments even without placing their products on the market.

In my view, the fact that Quotient targets very different types of clients and offers tailored solutions depending on the data required is promising. In my view, further information about what clients need will likely bring revenue growth and perhaps economies of scale.

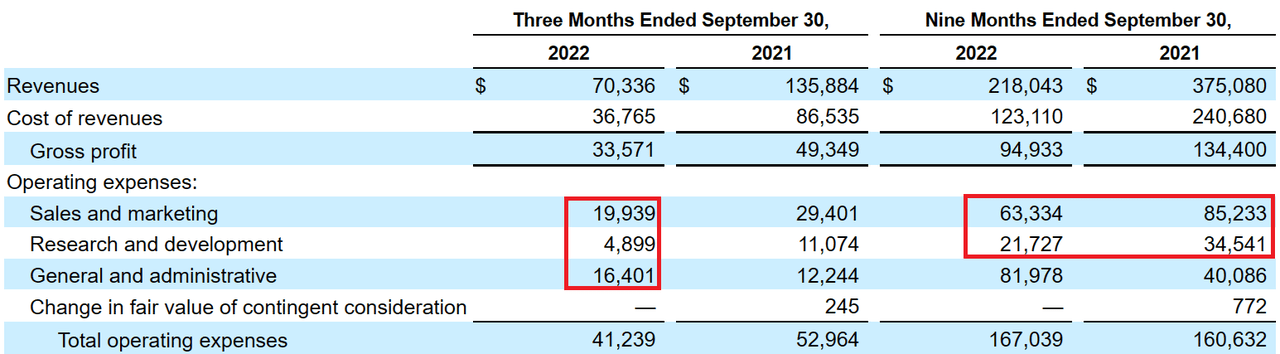

Finally, if Quotient continues to invest in sales and advertising, growth of its customer base and network, and R&D of new products, revenue growth will likely continue. In the nine months ended September 30, 2021, I saw that management reported as much as $63 million in sales and marketing and close to $21 million in R&D efforts.

Source: 10-Q

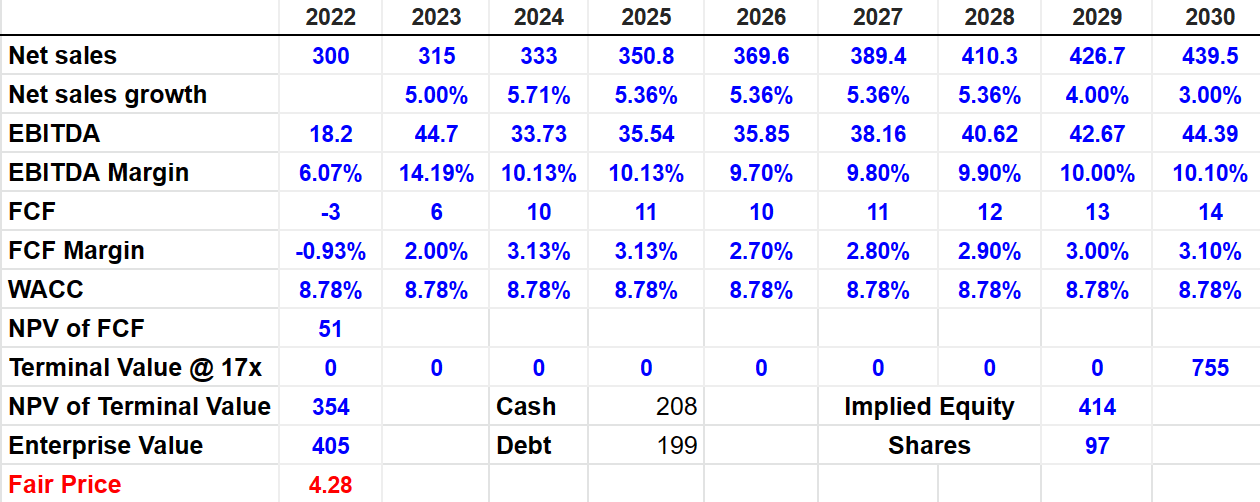

Under the previous conditions, my forecast for 2030 includes net sales close to $439.5 million and sales growth of 3%. In addition, I assumed an EBITDA of around $44.39 million together with an EBITDA margin of 10.10%. I also included an FCF of $14 million accompanied by an FCF margin of 3.10%.

By including a WACC of 8.78%, I obtained an NPV of FCF of $51 million. With an EV/EBITDA multiple of 17x, the terminal value would be close to $755 million, which also implied an NPV of terminal value of $354 million,

Finally, my model included an enterprise value of $405 million, equity of $414 million, and a fair price of $4.28 per share. Note that with cash of $208 million and debt of around $199 million, Quotient’s net debt is close to zero, so I wouldn’t be afraid of the company’s leverage.

Source: Bersit’s DCF Model

Risks From Competitors, Business Model Changes, And Less Support From Retailers

In the last 10-k, management seemed to be a bit concerned about the rapid development of competing companies, especially in the area of digital advertising. This undoubtedly shows a situation of high risk for the company although the sale of its products and its traditional operation currently has a large flow of capital.

In the last quarter, the company also noted that clients may not appreciate the company’s automated solutions, and some clients may decide to work with competitors. If many clients leave the company, we may see less revenue growth than expected.

Business model changes such as these carry operational risks, and our expectations regarding the execution, success, timing, and impact of these changes may not be met. For example, an operational risk relating to our shift to self-service and automated solutions is that these new offerings may not be preferred by advertisers and retailers to alternative offerings from our competitors. Source: 10-Q

Recently, some clients decided to bring retail media and shopper programs in house, which may lower the support Quotient receives from clients. As a result, some investors may foresee lower revenue expectations, which may bring lower free cash flow generation.

The success and scale of our platforms depend on our strategic relationships with retailers. The success and scale of our platforms also depends on the level of commitment and support for our platforms from retailers. For example, retailers are increasingly interested in bringing retail media and shopper programs in house. If we are unable to adapt to this evolution of retail media and maintain and grow retailer support for our platforms and solutions, such as our retail ad network, our business and revenue will be adversely impacted. Source: 10-Q

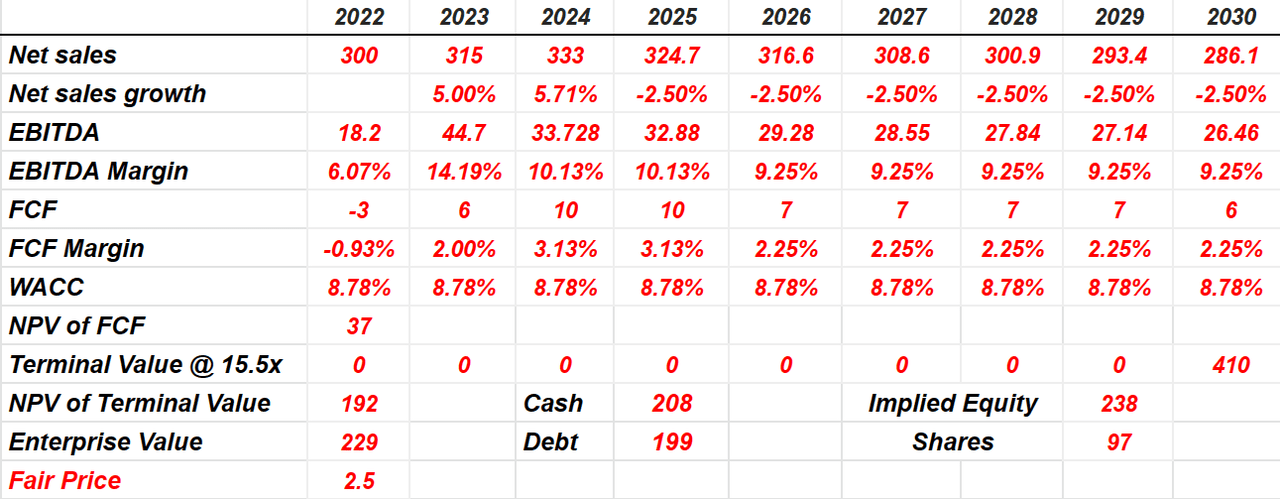

I expect 2030 net sales of $286.1 million with net sales growth of -2.50%, an EBITDA of $26.46 million, and an EBITDA margin of 9.25%. 2030 FCF will likely be close to $7 million with an FCF margin close to 2.25%.

My results also included an NPV of FCF of $37 million and NPV of terminal value of $192 million, which implied an enterprise value of $229 million. Finally, the implied equity will likely be $238 million with an fair price of $2.5 per share.

Source: Bersit’s DCF Model

Conclusion: The Stock Appears Undervalued

Quotient reports an impressive number of located and active buyers per day and a lot of know-how accumulated in coupon distribution. In my view, if Quotient continues to invest in sales and marketing, and automatic tools continue to be successful, free cash flow generation could be substantial. I summed future free cash flow, and obtained a valuation that is significantly larger than the current market price. Yes, there are risks from competitors, and clients may bring retail media and shopper programs in house. With that, in my view, the stock is undervalued.

Be the first to comment