elinedesignservices

Despite the uncertainty of today’s Consumer Price Index result for November and tomorrow’s updated monetary policy outlook from the Fed, stocks surged yesterday, with the Dow Jones Industrials rising more than 500 points. I think investors are starting to realize that the daily drumbeat of bad news is largely priced into this market. At the same time, there has been some good news of late for both the soft landing scenario and a less aggressive Fed in 2023.

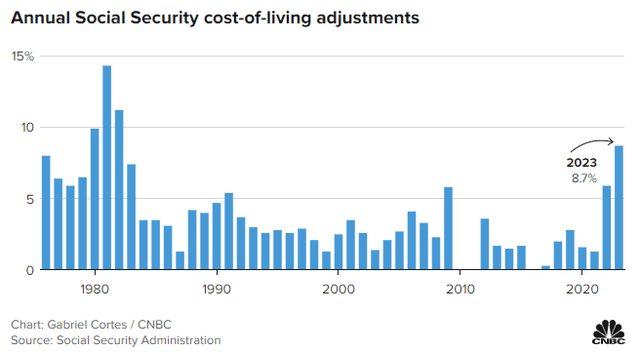

Social security beneficiaries are about to realize their largest pay increase in 40 years at 8.7% as of January, which comes just as the rate of inflation starts to fall more precipitously. That means a form of retirement income that will see real growth next year to help cope with high prices. The average retiree benefit will increase by $146 per month to $1,827. Additionally, the standard Medicare Part B premium will decline by 3% to $164.90 per month, which covers outpatient medical care. Some will see this as another inflationary factor to contend with in 2023, but I don’t see this pay raise driving more consumption as much as it helps this demographic boost savings and keep up with higher prices for food, shelter, and medical care.

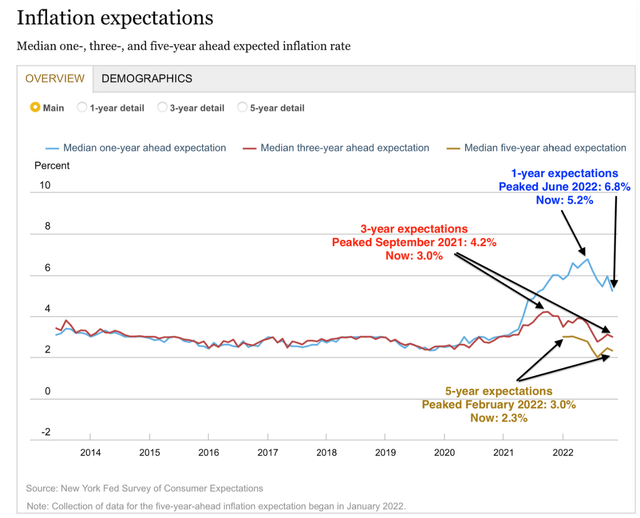

In fact, the non-stop forecasting for recession next year that inundates the airwaves probably has retirees leaning towards caution rather than a spending spree. At the same time, expectations for higher prices continue to abate.

The New York Fed’s November Survey of Consumer Expectations revealed a reduction in inflation expectations for all time frames and by all income groups. The median inflation expectation for the next year fell a sizeable 0.7% last month to 5.2%, while the three-year period declined 0.1% to 3%, and the five-year period also slipped 0.1% to 2.3%. The declines were also expected across a broad range of goods and services categories, including wage expectations. This is exactly what the Fed wants to see, and the current trajectory should give the Fed confidence that its rate-hike cycle can come to an end tomorrow with another 50-basis point rate increase.

The boost in retirement income pay could not come at a more opportune time, because it will serve as another buffer to slower growth while the impact of tighter monetary policy weighs on the economy next year. I think it increases the odds of a soft landing, especially when combined with the steady decrease in consumers’ inflation expectations.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment