gopixa

Ford Buyer Beware-Sell Thesis

Ford Motor Company (NYSE:F) is already down significantly for the year.

Ford Motor Company stock is down 37% year-to-date. What’s more, the stock is trading at an even bigger discount to its 52-week high.

The stock is trading 53% below its 52 week high at present. Nevertheless, its current technical status is that of a “falling knife.”

Ford’s stock currently a falling knife

Hopefully, everyone has heard the axiom never catch a falling knife in investing.

Well, Ford’s stock currently epitomizes the falling knife scenario. The stock was summarily rejected at the top of the current downtrend channel and now is squarely in what I refer to as “no man’s land.” This is where there is no substantial support immediately below. The next level of support is at the $11 level – over 10% from the current price. Now, the fact of the matter is this is the next level of major support, but there is no guarantee that it is going to hold. Furthermore, once a stock has performed in an erratic manner as Ford has as of late, I move to my next level of risk management and need to see at least some inkling of a trend reversal prior to buying back in.

The issue at hand is I am not so sure this is going to happen anytime soon based on the current negative catalysts that lie ahead for the stock and the markets. In the following sections, I will detail the headwinds I see for Ford Motor Company stock going forward.

The dividend may be cut

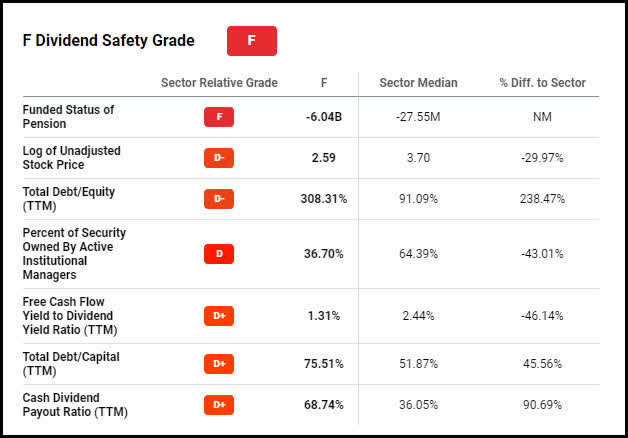

The dividend being reinstated was a big reason I got back into the stock in the first place. Now, according to Seeking Alpha’s quantitative metrics, Ford is in the danger zone as far as the dividend is concerned.

Seeking Alpha

According to Seeking Alpha:

“Ford Motor Company (NYSE:F) has displayed warning signs that have historically led to dividend cuts. The company has a Dividend Safety Score of F. Over the past 11 years 64.4% of stocks with an F rating did cut their dividend. Does this mean you should sell the stock? No, not necessarily. It just means that you should be careful about relying on this dividend for your income.”

I have no idea as to whether or not they are going to cut the dividend, but the update with the data-driven stats regarding the dividend from Seeking Alpha doesn’t give me a warm and fuzzy feeling. Now, let’s move on to a few of the other major issues I see.

The price of used cars is falling

The Fed has been on a rampage to bring down inflation. One area where they have done a great job is used car prices. The increased interest rates have done a number on used car prices, which directly effects the ability of new car sellers like Ford to move vehicles. I used to audit Ford in one of my former lives as a public auditor for Ernst & Young, and one of my clients was Ford. Almost all customers trade in their used cars when buying a new one. With a significant drop-off in used car values and increased payments due to the rise in rates, many prospective new car buyers have been effectively priced out of the market in my opinion. The next issue is the ICE dilemma.

ICE to EV transition drag on earnings

Another potential issue I see with the stock that I was blind to due to my love for Ford the first time around is the fact they are actually in the midst of a major transition from ICE, internal combustion engine, vehicles, to EVs, electric vehicles. This isn’t going to be easy, and Ford is most likely going to have to take some big hits to the bottom line as it begins to discontinue ICE operations as we go forward in time. This will no doubt have an impact on future earnings, there is no two ways about it. EV companies like Tesla (TSLA) don’t have this issue.

Ford just recently reported that slowing ICE SUV sales have offset the gains made in EVs sales. According to Seeking Alpha news:

“Overall Ford auto sales slipped against tough 2021 comparisons as strong EV sales were counterbalanced by declining SUV and truck sales. The Michigan-based auto manufacturer reported sales of 146,364 vehicles for the month of November, led by 81,210 trucks sold. Still, those figures represented a 7.8% drop in overall sales and 1.2% decline in truck sales specifically from the prior year. SUV sales decelerated the most significantly, falling 15% from 2021 despite noted popularity for Bronco, Expedition, and Lincoln models. Those declines offset rapid acceleration in EV sales, which grew 102.6% from November 2021 to 6,255 in the month.”

So even though the company is doing quite well regarding sales of EVs, it is somewhat essentially “spinning its wheels” (pun intended) in regarding to profitability. The other major issue confronting the company is the fact the odds are we are heading into a recession of some magnitude in the first half of 2023.

Recession Looms

So the Fed just came out and said they are staying on the war path and going to keep rates elevated for longer until they see “pain” across the board. This almost 100% guarantees we are going to have a recession of some sort. The problem is, even if the Fed somehow manages to engineer a soft landing, which I highly doubt, with inflation at 7% and their target rate at 2%, it’s still going to be hard on the general public, which are the ones who buy cars. Now let wrap this up.

The Wrap Up

Buying a falling knife stock like Ford’s when heading into a recession with slowing sales and lower margins is a recipe for losing money. It is as simple as that. Add the fact the company may have to cut the dividend and you have a disastrous situation on your hands.

Now is not the time to start a new position in Ford Motor Company stock, as I see major technical weakness at present. I would need to see the initial signs of a trend reversal at this point to start a new position.

For those who currently own the stock, I can’t make a blanket sell call. Everyone has their own particular situation and risk tolerance. It would be interesting to hear from Ford current longs as to your present thoughts and any option strategies you may be employing to reduce risk, Selling covered calls, etc. I wish the longs well! Don’t get me wrong, just putting my thoughts out there to see what people have to say. Those are my thoughts on the matter, I look forward to reading yours!

Be the first to comment