OLGA Zhukovskaya/iStock via Getty Images

What’s the best stock to buy for the unfolding high-inflation environment? In my opinion, a top pick has to satisfy the following criteria:

- As inflation rises, it is poised to produce more and more and sell at higher and higher prices, thus pulling in sales at an accelerating pace. Yet at the same time, its operating costs appreciate little, resulting in expanding margins.

- It is preferably a capital-light business such that growing revenue and expanding margins lead to fattening free cash flow.

- The business generates revenue from operations in politically-stable jurisdictions because high inflation tends to engender political volatility.

- The management has skin in the game and is inclined to use part of the free cash flow to reward shareholders.

- The stock is currently undervalued relative to its intrinsic value, and investors can still buy it at an adequate margin of safety.

The stock of Altius Minerals Corp. (ALS.TSX)(OTCPK:ATUSF) ticks all the boxes of the afore-described perfect setup. Allow me to explain below.

Altius stands to benefit in a high-inflation environment

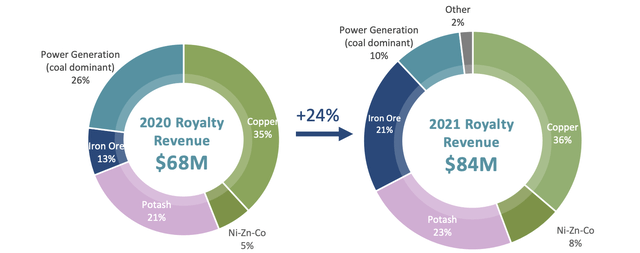

Altius Minerals is a mineral royalty company. It owns royalty interests in 12 producing assets in Canada, the U.S., and Brazil. These are long-life, high-margin operations that produce base metals (copper, nickel, zinc and cobalt), iron ore, potash, and coal-fired power generation (Fig. 1).

Fig. 1. Pie charts of the royalty revenue of Altius Minerals in 2020 and 2021. (Altius Minerals)

Growing royalty revenue

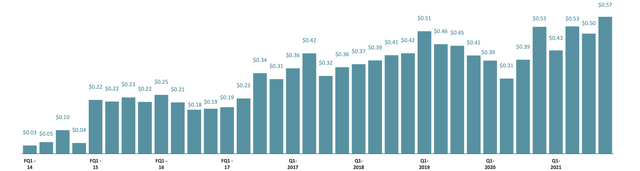

Altius has been growing royalty revenue at a CAGR of 37.4% since 2014 (Fig. 2). The growth has been driven by three forces: (1) the perpetual exploration optionality at no cost to Altius; (2) new additions to the portfolio of producing assets; and (3) commodity price strength of late.

Fig. 2. Royalty revenue per share of Altius Minerals from 1Q2014 to 4Q2021. (Altius Minerals)

Going forward, as the commodity super-cycle unfolds, royalty revenue is expected to continue to grow.

- Firstly, the mine operators are incentivized by high commodity prices to re-invest capital in producing mines so as to increase production and extend mine life, notably at the Eastern Deeps mine in Voisey’s Bay (first nickel-cobalt-copper production in 2022), Chapada (copper-gold mine expansion under technical studies), 777 (ongoing tailings reprocessing for copper study to extend the mine life), and Nutrien (NTR) raising potash production by ~50% to nameplate capacity, which will benefit Altius at zero cost.

- Secondly, a host of projects are being advanced toward production, including the Curipamba copper-gold deposit (2% NSR royalty, fully financed, permit pending, and first production anticipated in early 2024), the Kami iron ore project (3% GSR royalty, feasibility study update expected in 2H2022), and the 3.37 million ounce Silicon gold deposit (1.5% NSR royalty, delineation underway).

- Thirdly, the commodities that Altius is directly exposed to – copper, nickel, zinc, cobalt, iron ore, potash, and even thermal coal – are structurally under-supplied and poised to experience price strength in the foreseeable future. After all, we are in the early innings of a commodity super-cycle.

Project generation

Like numerous other royalty companies, Altius acquires royalty interests from operators; unlike them, Altius also generates mining projects and sells these projects to junior explorers in exchange for equity interests and retained royalties. Through projection generation, Altius organically grows its royalty pipeline at negative capital costs.

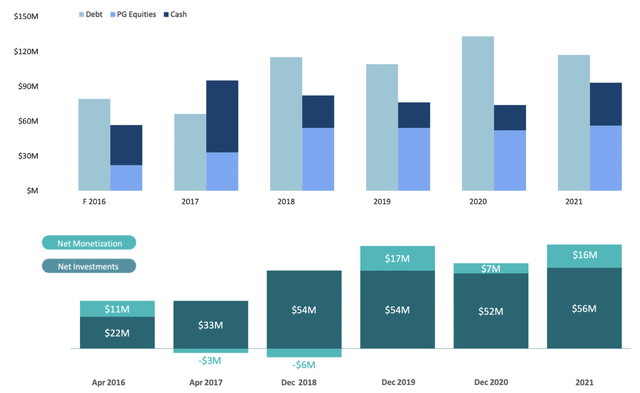

- As of end-2021, Altius had accumulated $56 million in junior exploration equity and monetized $16 million in net proceeds in the year (Fig. 3).

Fig. 3. Equity interest from project generation relative to cash and debt (upper), and project generation-driven growth of equity portfolio (lower). (Modified from Altius Minerals)

As the commodity cycle swings higher, I expect the junior equity portfolio to further expand and Altius to realize more proceeds.

Equity investment

Altius has two strategic equity investments, namely, Altius Renewable Royalties Corp. (OTCPK:ATRWF) and private Lithium Royalty Corporation. Both are supposed to benefit massively from the commodity upcycle.

- Altius Royalties owns a 59% equity interest in Altius Renewable Royalties, which holds gross revenue royalty interests in a portfolio of utility-scale wind and solar energy projects. Altius Renewable Royalties had a market cap of C$306.77 million as of April 14, 2022.

- Altius also has a 12.6% equity interest in Lithium Royalty Corporation, which has accumulated 18 royalties on lithium projects, including two in production and three in construction. Lithium Royalty Corporation may pursue a sale or public offering in 2022.

Valuation and risks

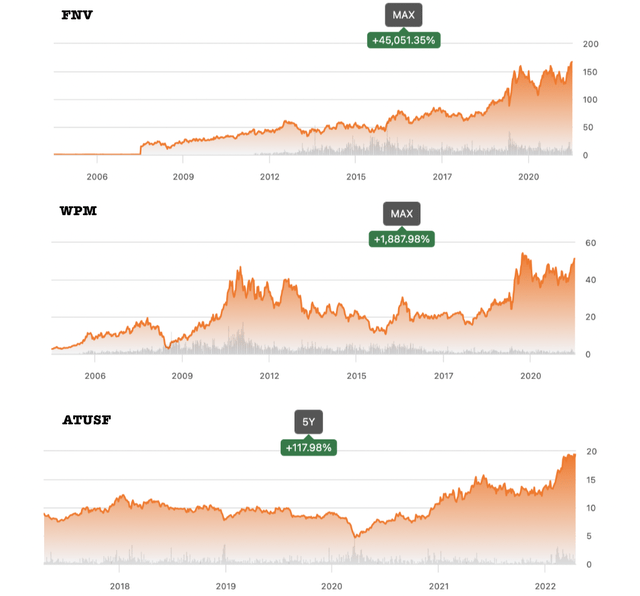

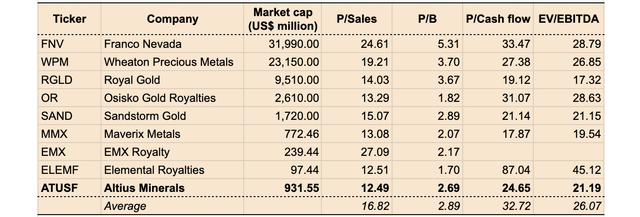

Thanks to their advantageous business model, well-run royalty stocks are known to be secular compounders across industry cycles, as exemplified by Franco-Nevada (FNV) and Wheaton Precious Metals (WPM). As the crown jewel of the mining industry, royalty stocks deserve premier valuation (Fig. 4). Altius Royalties first transformed into a royalty company in 2014 and has become consistently FCF-positive since 2018. As an emerging royalty play, Altius is substantially undervalued relative to large-cap peers at this time (Table 1).

Fig. 4. Stock charts of Franco-Nevada (FNV), Wheaton Precious Metals (WPM), and Altius Minerals (ATUSF). (Seeking Alpha, modified by Laurentian Research) Table 1. Valuation metrics of select royalty stocks, on a TTM basis. (Seeking Alpha, compiled by Laurentian Research)

- Supposing it maintains the current growth momentum for 10 years amidst the ongoing commodity super-cycle, conservatively assuming it then enters a 20-year terminal decline, and backing out net debt and adding its equity interests, I reckon Altius Royalties may be worth ~US$42 per share, which confirms the large margin of safety the stock gives investors.

Although mature royalty companies compound secularly, commodity cycles do make them relatively high-beta. Operations on the individual mine level are beyond the control of the royalty companies; therefore, if the royalty portfolio is inadequately diversified, investors are exposed to undesirable volatility when one or several mines suffer from resource nationalism, labor issues, natural disasters, or subsurface uncertainties. Franco-Nevada and Wheaton have 113 and 23 producing assets, respectively, while Altius currently has 12; it will take a long time for Altius to reach the extent of portfolio diversification attained by Wheaton and Franco Nevada.

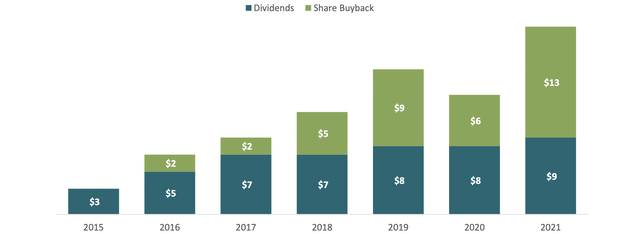

Royalty companies are essentially capital allocators specialized in unconventional financing of mining projects. As shown by its 25-year track record and success in graduating from project generation to reaping royalties, Altius management has excellent skills in capital allocation, uncommon discipline, and long-term perspectives. The insiders own 6.3% of the company, giving them substantial skin in the game. Since 2015, they have returned ~C$84 million to shareholders through ever-increasing dividends and opportunistic share buybacks (Fig. 5).

Fig. 5. Altius Minerals’ returns of capital, in C$ millions, through dividend payments and share repurchase. (Altius Minerals)

Investor takeaways

“Oil and copper are the best hedges against inflation, not gold. Gold’s a lousy inflation hedge,” said Jeff Currie at Goldman Sachs. “The best place to be right now, particularly given the Fed pivot, is commodities.“

Unique among royalty stocks, Altius Royalties gives investors exposure to copper as well as a host of commodities that are in the center of this inflation environment, yet without introducing operating cost expansion, capital intensity, and jurisdictional risk into the equation.

Altius thus fits the bill perfectly as an inflation hedge and, most probably, an inflation beater.

[This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.]

Be the first to comment