Wpadington/iStock via Getty Images

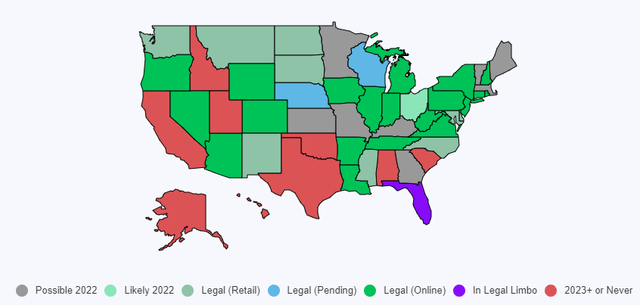

The United States sports betting market is one of the country’s largest growing industries. To date, 30 states have legalized sports betting and 18 states have legalized online gambling. According to intelligence firm Morning Consult, the amount legally wagered in 2021 doubled to more than $52 billion. Sportradar Group AG (NASDAQ:SRAD) and Genius Sports Limited (NYSE:GENI) are two companies that will significantly benefit from industry tailwinds over the next decade. While not pure-play casino and gaming companies, these two SaaS data companies are going head-to-head as direct competitors.

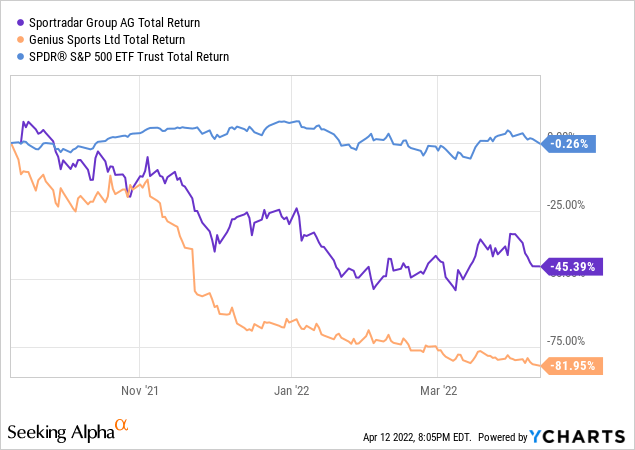

After IPO’ing at optimistic valuations, bearish sentiment has rained over both Sportradar and Genius since then. As characterized in the chart below, Genius and Sportradar have significantly underperformed the broader markets (SPY) over the past year down 81.95% and 45.39%, respectively.

Sportradar vs Genius

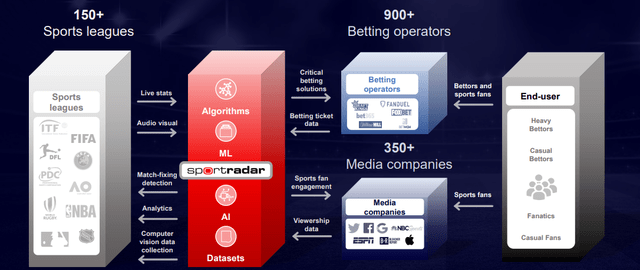

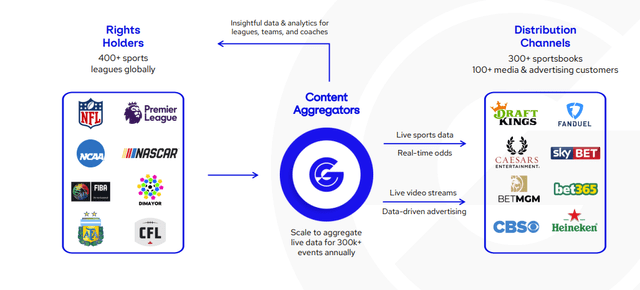

Sportradar and Genius are both B2B technology companies that provide the multi-billion dollar sports market with technology and software-focused solutions with in-depth data & analytics. Both SRAD and GENI serve three core segments of customers: betting operators/sportsbooks, sports leagues/federations, and sports media companies.

The demand side of the business involves sportsbooks and media companies, in which SRAD and GENI receive revenue from providing different services. The supply side of the business involves data rights obtained from different leagues and federations.

The image below characterizes Sportradar’s business model with respect to its relationship with key customers.

Sportradar Business Model (Sportradar Q3 Earnings Presentation)

While not as descriptive and visually appeasing as Sportradar, the image below shows Genius Sports’ key relationships with its core customers and new developments as of Q4’21.

Genius Sports Business Model (Genius Investor Presentation)

Sportsbooks/Betting Operators

Sportradar

Founded in 2001 by CEO Carsten Koel, Sportradar is the number one provider of data to sportsbooks in the United States. SRAD claims in many cases it is the sole provider of data and analytics to different sportsbooks, and controls over 70% of the total in-play betting market in the United States.

Genius

Genius Sports was founded in 2001 by current CEO Mark Locke. While Genius does not describe itself as the “number one” provider of sportsbook data, it offers a range of services to sportsbooks similar to Sportradar including live data, oddsmaking, risk management, and player marketing.

Both Genius and Sportradar provide sportsbooks with in-depth data and share common customers including bet365, DraftKings (DKNG), Fanduel, and Entain.

| Company | Sportradar | Genius Sports |

| Number of customers | 900+ | 500+ |

| Annual Events | 790,000 | 285,000 |

| Sportsbook Customers |

|

|

As shown above, we can see Sportradar has a longer list of high-profile betting customers relative to Genius, as well as more events covered.

Sports Media Companies

Sportradar and Genius also serve sports media companies as a key operating segment. Sportradar and Genius both provide their media customers with fan engagement tools, including audiovisual content, analytics & insights, ad solutions, and digital services.

Sports Leagues/Federations

Both companies provide technology infrastructure, data collection tools, and integrity services (match-fixing, bet monitoring technology, etc…) to sports leagues and federations. Sports leagues/federations also supply SRAD and GENI with rights to its proprietary data, which we will discuss in more depth shortly.

| Company Name: | Sportradar | Genius |

| Number of leagues and federation customers | 250+ | 400+ |

Growth Drivers

Betting Data Rights

Both Sportradar and Genius are competing for data rights between themselves and different sports leagues in order to serve as an intermediary between sports leagues and betting operators. Acquiring data rights is highly lucrative for both businesses as they can then monetize the data collected, strengthening their business models and partnerships with sportsbooks who can use the data to create pre-match and live odds, among other uses.

As sports betting legalization grows across the world, sportsbooks will require valuable data and analytics. Further, the United States is expected to see significant growth in live sports betting, increasing sportsbook demand for high-quality and reliable data. So far, both Sportradar and Genius Sports are continuing to pursue betting data rights with various sports leagues and federations across the world.

Sportradar Betting Rights Data

In 2021, Sportradar announced multi-year partnerships with both the NHL and NBA.

On July 22, 2021, we entered into a 10-year global partnership with the NHL. Under the terms of the NHL agreement, we were named as the official betting data rights, official betting streaming rights and official media data rights partner of the NHL, as well as an official integrity partner of the NHL

On November 16, 2021, we entered into an expansive multiyear partnership (the “NBA Partnership Agreement”) with the National Basketball Association (the “NBA”) that maintains Sportradar as the exclusive provider of NBA data worldwide and will help fans across the globe to engage with the NBA, WNBA and NBA G League content.

| League | Global | United States |

| NBA |

Exclusive (ex. China) |

Non-Exclusive |

| MLB | Exclusive | Non-Exclusive |

| NHL | Exclusive | Exclusive |

| UEFA | Exclusive | Exclusive |

| ITF | Exclusive | Exclusive |

| ICC | Exclusive | Exclusive |

| Formula 1 | Exclusive | Exclusive |

| DFL | Non-Exclusive | Non-Exclusive |

Genius Betting Rights Data

Genius’s portfolio of brands includes the NFL, EPL, NBA, NCAA, and FIBA. Genius does not specifically state the type of relationship with each league, however, on April 1, 2021, it entered into an exclusive deal with the NFL.

As mentioned in the annual report, the company entered into a 6-year deal with the NFL for worldwide exclusive rights to its data.

entered into a new multi-year strategic partnership with the NFL (the “License Agreement”). Under the terms of the License Agreement, the Company obtains the right to serve as the worldwide exclusive distributor of NFL official data to the global regulated sports betting market, the worldwide exclusive distributor of NFL official data to the global media market, the NFL’s exclusive international distributor of live digital video to the regulated sports betting market (outside of the United States where permitted), and the NFL’s exclusive sports betting and i-gaming advertising partner. The License Agreement contemplates a six-year period (the “Term”), with an initial four-year period commencing April 1, 2021 and years five and six renewable by NFL in one year increments.

In exchange for NFL data rights, Genius issued the NFL 18.5 million warrants and 2 million additional warrants for each annual extension. As reported by Sportica on April 6, 2022, as the NFL vested 4.25 million warrants, the league is now GENI’s largest American shareholder, obtaining a 7.7% controlling interest in the company. Genius also stated in its 10-K that the majority of its third-party data rights fees are attributed to the newly found partnership, indicating a high level of commitment from GENI.

The Bottom Line

Based on the data above, Sportradar appears to have a broader portfolio of data rights agreements in its arsenal. However, of the billions wagered every year on sports, approximately 70% of bets are placed on soccer. Therefore, Genius’ EPL data rights can provide significant growth in the future. Further, the highest wagered sports in the United States are NCAA and NFL, a clear advantage Genius has over Sportradar. Over half of all US sports bets are placed on NFL events, indicating a lucrative opportunity for Genius.

Further, access to high-quality data via acquiring rights from sports leagues is essential to provide sportsbooks with real-time data necessary to create pre-match and live odds.

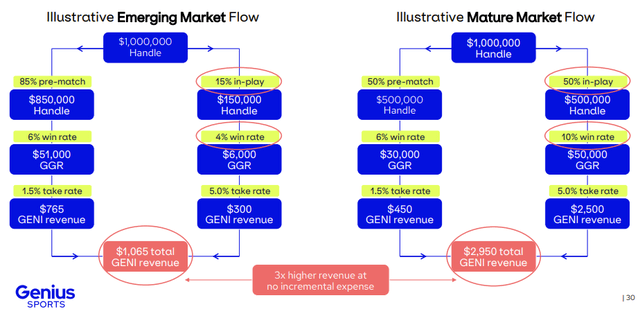

According to Sportradar CEO Carsten Coel, the US market is exhibiting similarities to the European market a decade ago. According to Barron’s, he said:

The U.S. betting market—it’s like Europe was 10 years ago…. In the U.S., 70% to 80% of all betting is prematch, over all sports. In all other world markets, it’s the opposite.

As live betting increases in popularity, sportsbooks will require exceptional data with low latency. Hence, it is crucial for both Genius and Sportradar to lock in key partnerships with leagues in order to drive future growth.

Acquisitions

2021 was an eventful year for Genius and Sportradar, as the two focused on strategic acquisitions to expand the scope of their business and improve their product offering.

Sportradar

Since 2013, Sportradar has made 13 acquisitions to complement its product offering. Less than a week from this writing, Sportradar acquired Vaix Limited, an AI company aimed at allowing betting and gaming operators to provide a more personalized view of their customers. In simpler terms, Vaix’s data and analytics give sportsbooks the opportunity to deeply understand each customer, allowing for better overall user insights. Some of Vaix’s many use cases include personalized promotions and a better live chat experience.

On March 4, 2021, Sportradar acquired the personalized messaging platform Fresh Eight. Carsten Koel’s rationale behind the acquisition involved strengthening Sportradar’s digital marketing services and offerings in order to enhance its product suite.

We have developed ads into a substantial business for Sportradar with its platform offering and a significant portfolio of sports-book clients. But the market doesn’t stand still, and we must continually innovate and grow. The acquisition of Fresh Eight will accelerate that growth, as we add this personalization technology to our marketing services offering.

Just a few weeks later on March 22, the company acquired Synergy Sports, a market leader in data & analytics in US College and Professional Sports. Similar to the previous acquisition, Koel said Synergy is a great complementary product to Sportradar:

Adding Synergy Sports to the Sportradar family will expand our product offering into U.S. college sports data and video analytics and further cements our relationships with the major sports organizations in the U.S. and around the world.

Sportradar also made moves to expand its presence into cricket. As the second most popular sport with over 2 billion followers, SRAD acquired Interact Sport, a data company with cricket partnerships.

we see this as a growth opportunity for the company, especially given the significance of the sport in the Asian region.

Genius

On the other hand, Genius acquired Second Spectrum for $115 million in cash and $83.3 million in equity. Second Spectrum is an AI company offering tracking and data visualization services – simply put, its AI and computer vision technologies can capture precise ball location and player movements. Second Spectrum uses data to provide clients with real-time data visualization services (player tracking), enhancing decision making and engagement. Second Spectrum also unlocks a new client base with Genius due to the company’s existing client base.

As mentioned in the press release following the acquisition:

Second Spectrum will also bring a highly complementary client base, building on Genius Sports’ official data partnerships with over 400 sports organizations, including the NFL, MLB, EPL and NCAA. Second Spectrum is the official tracking provider of the EPL, NBA, and MLS, using advanced AI capabilities and computer vision technology to capture precise ball and player location-based data. In addition to these relationships, Second Spectrum has partnerships with ESPN, BT Sport, and Bally Sports to offer augmented reality features for select soccer and basketball games. The business has also formed partnerships with leading sports franchises, including The Los Angeles Clippers, to provide new content and revolutionize the fan viewing experience.

Three days prior to acquiring Second Spectrum, Genius acquired a digital provider of free-to-play games, Fanhub. CEO Marck Locke mentioned that the acquisition will complement their data and video solutions business segment.

As part of the transaction, Genius Sports will also acquire FanHub’s suite of F2P games, including fantasy sports, trivia, bracket challenges, pick ’em, and polling games. These will complement Genius Sports’ established offering to sports leagues and federations, sportsbooks, media companies and broadcasters worldwide. FanHub works in partnership with some of the largest companies across Genius Sports’ ecosystem, including the NFL, MLB, MLS, Betway and PointsBet.

Most recently, Genius acquired creative marketing company Spirable, a company aimed at enabling advertisers to deliver content through different digital media channels. As outlined in GENI’s press release, Spirable can assist with the following channels:

- Betting: live odds display ads on social and in-venue screens powered by official data

- Brands and sponsors: capture fans interest at key moments with contextually relevant in game creative

- Rights holders: personalized fan videos, automated social posting and dynamic ticketing ads

- Broadcast and OTT: live data video overlays and sponsor activation

The Bottom Line

Both Genius and Sportradar have had their fair share of acquisitions over the last year. Analyzing the acquisitions, it boils down to expanding their product depth & breadth, driving growth in emerging markets, and enhancing the customer experience. However, it is prudent to note that none of the acquisitions will have or have had a material impact on the business so far.

Utilizing acquisitions to fuel growth can have significant benefits, however, both companies must ensure that the acquisitions provide tangible long-term value and are focused on achieving their strategic initiatives. SRAD and GENI must ensure they are able to unlock the synergies of their acquisitions rather than throwing good money after bad.

Global Market Penetration

The United States is a key global growth market for both companies. According to Sportradar’s annual report, the US market at maturity represents a $23 billion opportunity, larger than the total TAM ((total addressable market)) in Europe. As mentioned previously, both companies are competing in the US by securing long-term deals with key sports leagues and media companies. Further, the rise in live betting can significantly increase both companies’ take rates, driving high-margin revenue.

Pre-Match vs. In-Play Betting (Genius Investor Presentation 2022)

For the fiscal year 2021, the revenue from the United States represented 13% and 20% of Genius and Sportradar’s total revenue, respectively. As depicted on the vector map below, the shaded grey areas show additional states that can see legalization in the latter half of 2022.

Sports Betting Laws Per State (Action Network)

Challenges

A key challenge both these companies face is their reliance on sports leagues for data rights. Leagues such as the NFL and NBA have some of the widest moats of any business on planet earth, attracting world-class talent combined with significant ad revenue and high viewership. Hence, pricing power is extremely high for sports leagues and it is clear they hold most or all of the cards when negotiating data rights contracts. In essence, SRAD and GENI are at the mercy of leagues/federations to keep their business models and product offering intact. It seems as if both companies are essentially in “make-or-break” scenarios – in that if a few key contracts are broken, it can turn the business completely upside down and erode any competitive advantage.

Further, it is unclear how strong the economic moat is for Sportradar and Genius. However, gathering high-quality, reliable data and providing a valuable service to sports betting operators can be a moat in itself. By building an ecosystem of reputable customers and a strong portfolio of licensing deals, Sportradar and Genius can further their competitive advantage through scale and scope. Currently, it is unclear how strong the two company’s moats are, posing a challenge for investors.

Financials

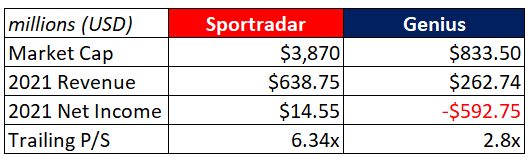

Based on market capitalization, Sportradar is over four times the size of genius. The figure below depicts basic financial metrics comparing the two businesses.

Key Financial Data (Tikr)

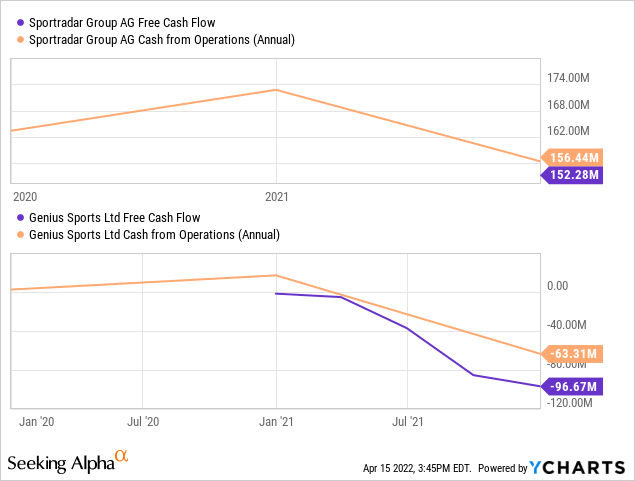

As shown in the line chart below Sportradar is CFO ((cash from operations)) and FCF ((free cash flow)) positive, with a healthy 22.5% FCF margin. On the other hand, Genius is CFO and FCF negative, primarily due to a significant net loss driven by a higher cost of revenue. A key expense dictating a path to profitability for both companies is data rights costs. Costs from licensing and services agreements accounts for 21% of Sportradars revenue and 16% of Genius revenue.

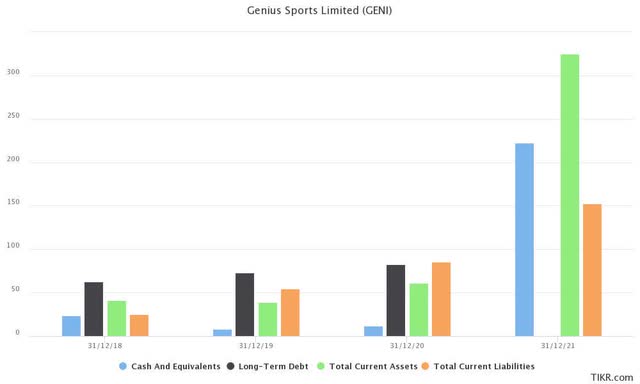

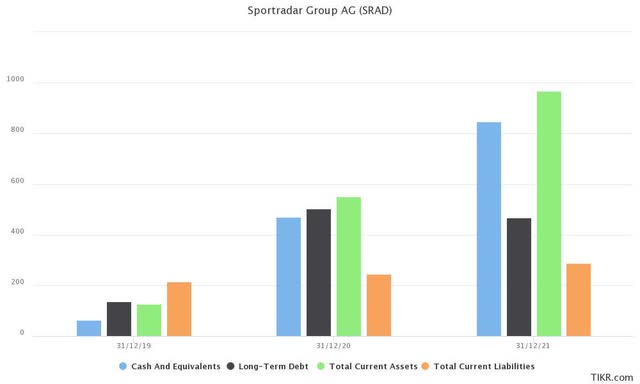

As depicted by the figures below, both companies have relatively strong balance sheets with healthy cash balances and working capital.

Genius Balance Sheet Data (TIKR)

Sportradar Balance Sheet Data (TIKR)

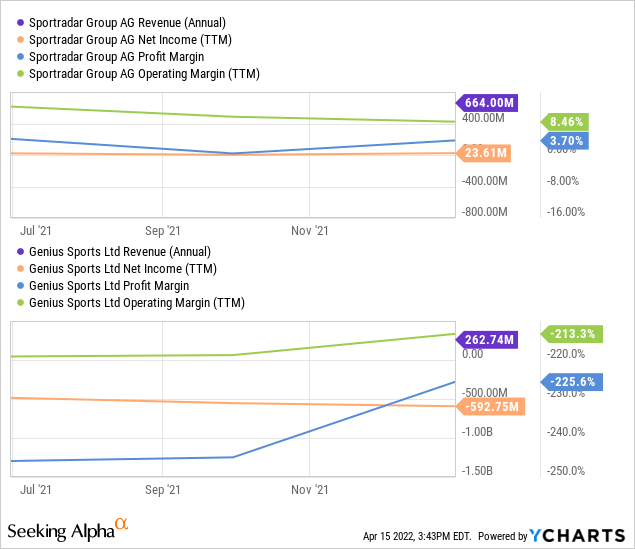

We can see that based on the income statement metrics below, Sportradar has much stronger financials than its competitor. GENI’s net loss is almost double their revenue with negative operating margins.

Final Thoughts

Now to answer the million-dollar question: which one is the better bet? The bears have had a lot of fun with both companies – as of this writing, both stocks are trading near their all-time lows and significantly underperforming the market.

To recap, the three core growth drivers identified above include:

- Betting Data Rights

- Strategic Acquisitions

- Growth in Global Markets

Both companies are heavily focused on acquiring top betting data rights from leagues and federations, and it is no doubt that this will be a short and long-term revenue driver for both these companies. Specifically in the United States, both Sportradar and Genius have a broad portfolio of data rights and additional capabilities to penetrate the market. However, Genius appears to be tackling the bigger markets with its NFL and NCAA licensing deals.

Regarding strategic acquisitions and global growth, Genius and Sportradar have had their fair share of acquisitions over the last year, establishing a stronger product suite to better serve their customers. And, if it isn’t clear already, the United States is a huge growth market benefiting from heavy regulatory tailwinds as legalization continues to rise.

Lastly, Sportradar’s financials are significantly stronger than Genius’s. SRAD is GAAP profitable and free cash flow positive, compared to Genius which posted a net loss of $592 million in F21.

As a younger investor with higher risk tolerance, I would invest in Genius rather than Sportradar despite the latter’s stronger financials. Based on their sports betting portfolio, the NFL and NCAA licenses will drive significant revenue growth as sports betting becomes more widespread in America. While SRAD has secured NBA and NHL licensing deals, Genius is tackling the bigger markets (NFL and NCAA). However, I do not believe this industry is a zero-sum game, in that both companies can be successful in the long term. Both Sportradar and Genius can thrive within their respective niches and portfolios by cross-selling existing customers and enhancing their product offerings.

With that being said, I am implementing a hold recommendation at this time as both companies will have their fair share of challenges ahead. As an investor, I am willing to pay a higher price in the future and wait for the investment thesis to play out. As a believer that the US sports betting industry will continue to grow and become more innovative, I am comfortable paying a slightly higher price in the future for a clearer story.

Be the first to comment