simonkr

Orrön Energy formerly known as Lundin Energy is an interesting story to tell. Here at the Lab, we previously covered Lundin (OTCPK:LNDNF) with a buy rating target. Our buy case recap was based on 1) a low-cost asset base (at the time, Brent price was at $33 per barrel and Lundin’s cash neutrality was set at $17 per barrel, 2) shareholder support back by the Lundin family with a proven track record in the gas and oil sector, 3) ten years of oil reserve and a solid balance sheet. What has happened?

As a memo, non considering the dividend, since our May 2020 update, Lundin shareholders enjoyed an upside of more than 100%. How? Since our overweight rating, the company was acquired by Aker BP for a total consideration of approximately $14 billion in a cash and stock deal. Aker created a pure exploration and production player concentrated in the Norwegian Continental Shelf. The combined entity has one of the world’s best asset classes of oil and gas operations with extremely low operating costs and sustainable dividend expectations. Since the deal went through, Lundin shareholders received $2.22 billion in cash and 0.95098 Aker BP shares for each share previously held in Lundin Energy.

The shareholders will also maintain their shares in Lundin Energy’s renewable energy-focused business (now called Orrön).

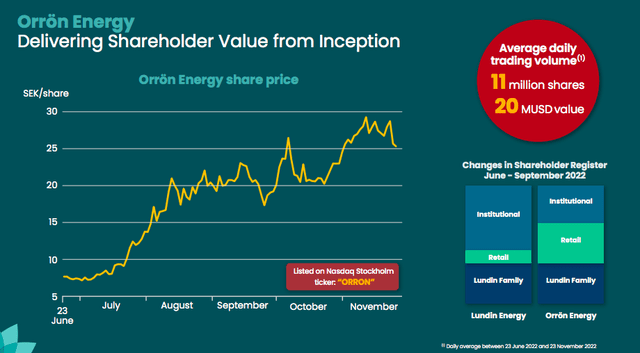

What is even more interesting is the fact that Orrön (after the E&P disposal) is up by almost 300%. We can clearly say that this was an extremely good call.

Orrön stock price evolution

Source: Orrön Energy November Investor Presentation

Starting with the CEO’s words: “the proposed name change marks the start of a new era for the Company, reflecting our renewable focus, our Nordic roots, and the entrepreneurial spirit of the Lundin Group of Companies“. The company’s future aim is simply “creating value through the Energy Transition“. Given the previous Lundin renewable energy portfolio, Orrön Energy is already positioned to create value for shareholders.

Our key main takeaways:

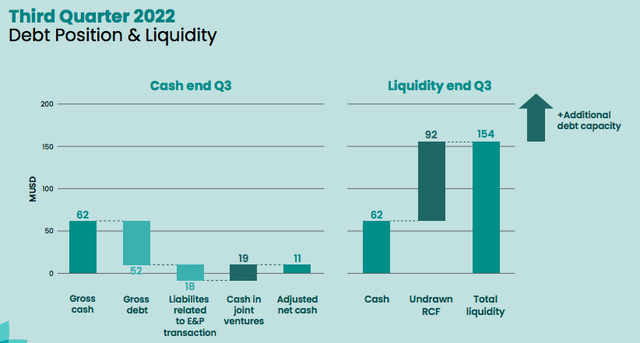

- The company started as a debt-free player and is very well-positioned for inorganic acquisitions (Fig 1);

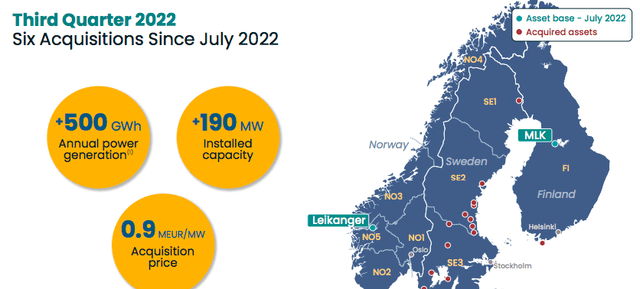

- Since July 2022, the company already completed six acquisitions for a total installed capacity of 190 Mw (Fig 2);

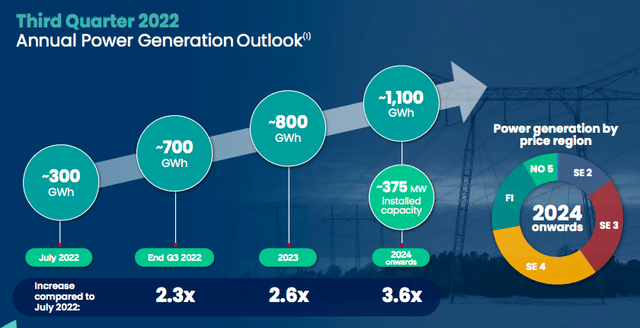

- Here at the Lab, we covered many EU-integrated energy players such as Enel and Iberdrola, and we can clearly say that there is a strong acceleration toward renewable energy assets. This is also confirmed by Orrön’s ambition to grow its asset-base by 3.6x in 2024 with an estimated annual power generation of 1.1 Gw (Fig 3);

- Still related to point 3), the EU is playing a crucial role in supporting and financing new projects (a key catalyst was the Russian invasion of Ukraine);

- Orrön Energy started its operation with Lundin Energy’s top management and board of directors. This team has a solid track record of delivering value (28% per year over the latest 20 years);

- Regarding the valuation, Orrön is trading at a 16x P/E on our 2023 numbers and is above our Iberdrola and Enel forecast (we recently commented about their respective capital market day). However, the two EU leading companies are integrated players, but even compared with a pure renewable player such as Orsted, we believe that Orrön is fairly priced in at this moment. Therefore, we decide to initiate the Nordic renewable player with a neutral rating and a twelve-month price target of SEK 23 per share.

Orrön debt position

Fig 1

Orrön M&A deals completed

Fig 2

Orrön 2024 guidance

Source: Orrön Energy Q3 results presentation (Fig 3)

Be the first to comment