tupungato

BAC: Fell Nearly 15% Since We Downgraded

Bank of America Corporation or BofA (NYSE:BAC) stock has collapsed nearly 15% since we downgraded it to a Hold in our previous article, citing concerns over its valuation and slowing net interest income (NII) growth headwinds.

As such, BAC has significantly underperformed the S&P 500 (SPX) (SP500), as the index posted a loss of 1.5%.

With the steep selloff, we believe BAC is looking attractive again as the market assesses the impact on the bank’s growth drivers in 2023. Moreover, with the Fed likely slowing down its rate hikes to 25 bps from the next meeting, we believe the market has justifiably turned its focus to a recessionary scenario.

The revised Fed’s summary of economic projections (SEP) suggests that the US economy could potentially skirt a recessionary outcome (not our base case), even though the path has narrowed markedly.

Based on the latest SEP, the Fed projects a median GDP growth rate of 0.5% in 2023, down from its previous estimates of 1.2%. Moreover, it also ratcheted up its median unemployment projections to 4.6%, up from its previous forecasts of 4.4%.

Even though Fed Chair Jerome Powell remains optimistic, he didn’t rule out a recession, as he believes it’s “not knowable.“

Economists have already penned in their consensus base case of a recession, with Bloomberg’s estimates suggesting a 100% probability of a recession over the next 12 months.

BofA’s Estimates Likely Not Configured For Severe Recession

Therefore, with the Fed’s path narrowing, as it raised its terminal rate guidance to 5.1% through 2023, BAC investors need to ask what’s an appropriate valuation level for BAC to tide through a recession.

But, before we can even answer that question, investors need to assess whether the bank has adequately prepared for a recession. We think it likely has modeled for one, even though it maintained that consumer spending patterns have remained robust. CEO Brian Moynihan articulated:

So it was really, I guess, a mild recession. So that’s the base case assumption. And right now, [consumers have] stayed employed and that’s very good news for the American consumer. And then borrowing and credit quality and everything we’ve talked more about is all in good shape. So the US consumer is in good shape. And our base is sort of 60% base case, 40% adverse case. [Based on the adverse case], that shakes out to an unemployment rate predicted for all this year, year-end and all next year between 5% and 5.5%. (Goldman Sachs 2022 US Financial Services Conference)

So, it’s pretty clear that the bank has modeled for a mild-to-moderate recession and has likely allocated appropriate reserves for its assumptions. Moreover, we mentioned in our previous article that the data suggests that US banks have probably not assumed a severe recession over the horizon.

Goldman Sachs (GS) CEO David Solomon also articulated in a recent WSJ summit that he feels pretty confident about the state of the US economy. Accordingly, Solomon sees a “35% chance of a soft landing” and didn’t rule out “a recession of some kind.”

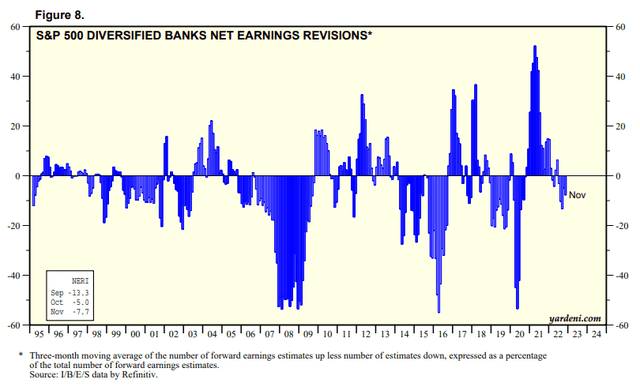

S&P 500 Diversified Banks net earnings revisions % (Yardeni Research, Refinitiv)

Analysts’ industry earnings estimates also suggest that they have not modeled for a significant recession through their November revisions, likely predicated on a strong NII growth outlook.

BofA: NII Growth Tailwinds Likely Not Sustainable

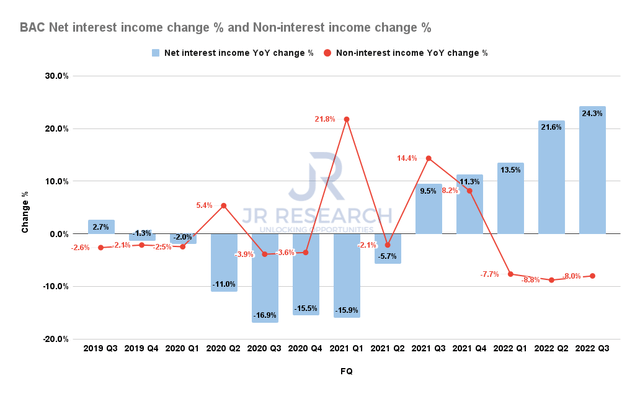

BofA Net interest income change % and non-interest income change % (Company filings)

However, we urge investors to be wary about expecting BofA to repeat its NII growth performance in 2022 as the Fed slows down its rate hikes. With a slower NII growth accretion, BofA needs to lift its non-interest income to mitigate the earnings growth deceleration due to the NII headwinds in 2023.

If a potential recession causes further headwinds in investment banking and wealth management while driving up higher credit risks, further writedowns of its earnings projections could be necessary to de-risk its execution through a recession.

While consumer spending remains healthy, with credit card delinquency rates still below pre-pandemic levels, negative surprises could unravel rapidly if the economy weakens significantly and if such an outlook has not been priced into BAC.

BAC: Valuation Already Pummeled

Hence, the critical question is whether the market has reflected significant pessimism in BAC at its current levels after the recent hammering?

We think the answer is likely yes.

We gleaned that BAC last traded at an NTM earnings multiple of 9x, well below its 10Y average of 12x. However, we noted that the market has continued to reject advances above the 10x P/E level since August.

So, we believe it’s vital for investors to demand a significant margin of safety from those levels, as BofA’s earnings estimates could be downgraded further, impacting its valuation.

Takeaway

BAC price chart (weekly) (TradingView)

With the recent pummeling as BAC underperformed the SPX, we believe its price action has reflected worsening macro risks due to the Fed’s hawkish stance through 2023.

That said, we have yet to glean a bullish reversal, and therefore further downside volatility causing a re-test of its October lows cannot be ruled out.

Hence, it’s critical that investors looking to add more exposure consider layering in accordingly, even though we assess the pullback as constructive.

Maintain Buy.

Be the first to comment