Chesky_W/iStock via Getty Images

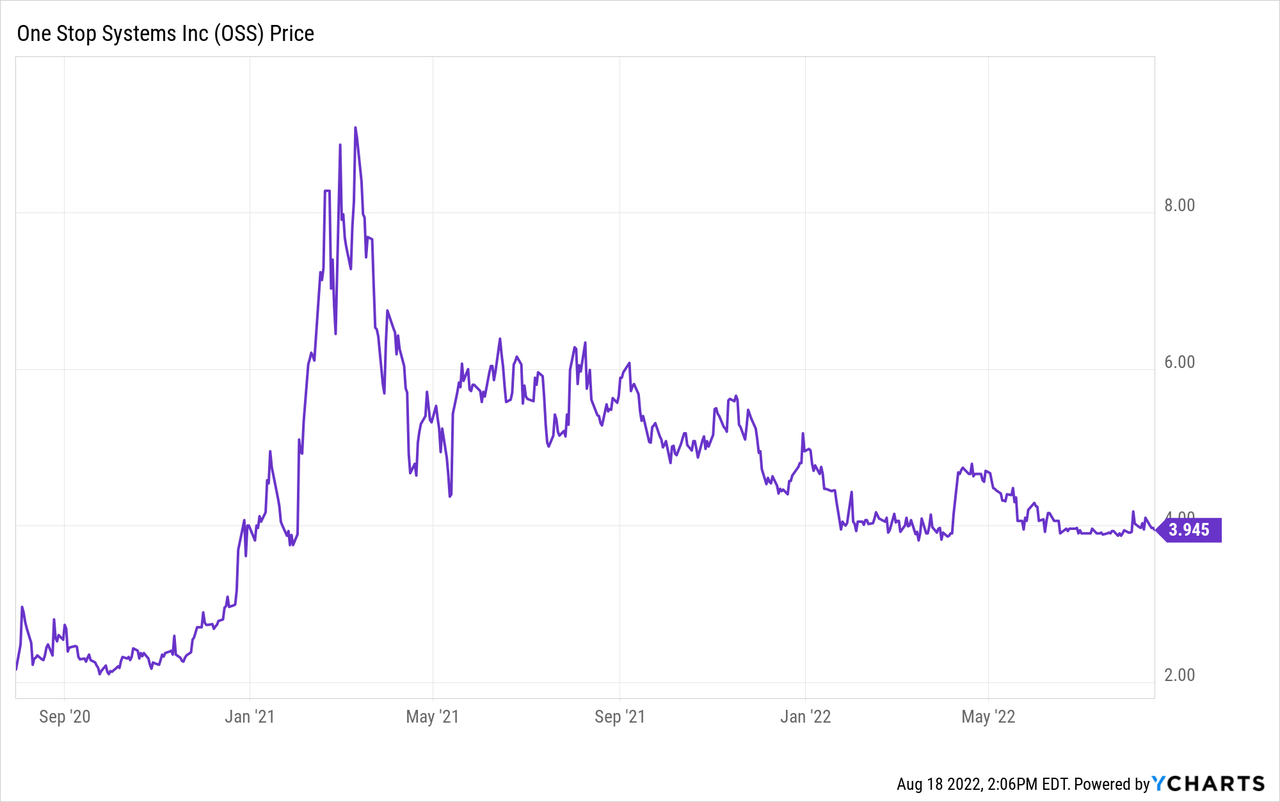

One Stop Systems (NASDAQ:OSS) specializes in “AI on the fly” hardware components for edge computing where A.I. can’t wait for the cloud. I first wrote about the turnaround in this company in an article published in August 2020 and wrote a series of articles on the company’s turnaround strategy and its progress. The stock price is higher by over 70% than at the time of my first article, having risen by as much as 300% at one time before settling at about the same price as my previous article, published about a year ago.

The stock price ran up when edge computing and other buzz sector stocks became crowd favorites. The crowd that quickly runs up a stock price isn’t known for sticking around for too long, and subsequently, the stock price retreated as the herd exited their positions.

Meanwhile, things are going well at OSS. Investors got a progress report and a peek into the future last week as OSS reported record revenues. The company is experiencing healthy growth and key developments point to a higher stock price:

- Management’s goal to identify an area where the company could excel and become the market leader is on track.

- We can now see the wisdom in two financial actions that initially resulted in diluting earnings, but have set up OSS for improved margins and EPS going forward.

- Continued positive results from its long-standing customer base

Focus On A.I. Transportables

Management identified autonomous trucking as a nascent multi-billion dollar market opportunity within the AI transportable umbrella where the company has the potential to become a dominant player. Autonomous trucking is further along than autonomous automobiles and happening now because there is a severe shortage of truck drivers. Autonomous trucks are also beneficial to a company’s bottom line as the autonomous trucks can operate round the clock, while human drivers have statutory limits on daily drive time. Currently, autonomous trucks are operating on our highways on pilot programs and are expected to be predominant in the next few years.

OSS started with just one customer and now conducts business with three of the top autonomous trucking companies and is pursuing developing business with others. OSS reported that of its 32 pending contracts, half are AI transportable related and three are autonomous trucking related. These pending deals are defined as worth at least $1 million in revenue and that the company stands a good chance of closing.

As autonomous trucking becomes mainstream, OSS could reap a financial windfall. CEO David Raun said during the 2020 Q2 earnings call:

We believe that all 3 of these customers (autonomous trucking) could end up being our top 10 customer list in 2022 and over time, could be some of our largest accounts.

…there could be an inflection point somewhere on time, whether it be later in ’23 or ’24, where they could become our largest accounts in the company.

OSS has already established its AI transportable in military airplanes. The company is seeking to expand into other military vehicle verticals such as drones, tanks, boats, etc. while it is also pursuing applications in autonomous farm and mining vehicles…anything that is mobile and requires A.I. CEO Raun at the Q2 earnings call:

We have commented in the past that we expect the opportunity for AI Transportables to be significant in the armed forces throughout the military theater. These applications will take significant time to close and even more time to generate revenue, but we are now engaged with multiple high-profile programs, which include drones, aircraft, ships and land vehicles.

Dilution

The share count has grown from 15 million in 2019 to about 20 million, diluting earnings. The additional shares came mostly from a 2020 financing and from a March 2021 capital raise.

In February 2020, the company was suffering from a lack of cash due to a past due AR from their media and entertainment client, Disguise. Disguise had to cancel most events due to the pandemic. Credit wasn’t readily available, and OSS took a convertible note in order to maintain operations. The note has been fully exercised.

The stock price tripled in early 2021 without supporting fundamentals to back the price hike. Management took the opportunity and raised $10 million by selling shares at $6.50. The cap raise put the company in a strong financial position. OSS has about $20 million in inventory in order to position itself against negative impacts from supply chain problems, and $14 million in cash and short-term securities.

The financial deals helped the company survive revenue shortfalls due to COVID-19 and to provide funding for maintaining sufficient inventory to support its growth. It is unlikely that we will see OSS do a capital raise in the near future, as it is well funded to pursue its stated goals. The company is already profitable and without dilution, we should see an escalation of EPS growth and gross margin expansion.

Building On The Long-Term Customer Base

Disguise is coming out of the COVID restrictions with a bang, as revenues grew 135% year over year for the same period, to a record $6.4 million. The European unit Bressner has a reported revenue increase of 31% to $7.6 million. Overall revenue for the first half of 2022 as compared to the first half of 2021 increased 25% to a record $35.4 million.

Key developments to watch going forward:

- Disguise didn’t experience reopening in the same way throughout the globe, and there were still events that were canceled or postponed. It’s possible that Disguise could continue setting new records as its business returns to normal and the additional revenue from virtual technology continues to be utilized.

- Bressner now has a dedicated staff that is focusing on marketing OSS products, including autonomous trucking, in Europe. Management sees additional opportunities in lower-end automated vehicles leveraging some of their other product lines (where the app does not need as much performance).

- Management cited on the Q2 call that some defense businesses had moved from 2022 to 2023 which will result in 2023 being a strong year.

- OSS is working on initial designs with defense contractors. CEO Raun said to me in an email conversation, “These will be primarily small quantities for initial designs but will not be insignificant.

- OSS is broadening its foothold on AI Transportables and particularly autonomous trucking.

Risks

OSS uses GPUs for its systems, which compete with other available technologies. OSS competes against much larger companies such as Dell (DELL), IBM (IBM), Hewlett Packard (HPE), and Microsoft (MSFT). The company has carved out a niche by concentrating on customized products with a long sales cycle. As these products become more mainstream, OSS will find it more difficult to differentiate itself. Supply chain issues could hamper production. Some parts currently have as much as a 52-week lead time.

Valuation

The market cap is about $80 million. I expect that OSS will exceed $80 million in revenue next year, resulting in a P/S ratio of better than 1X. This is a profitable company, selling at a cheap multiple. Why aren’t investors scooping it up? What I know about investors is that once they suffer losses from a particular stock, they tend to avoid reinvesting. Many investors took a loss after the stock run-up that I described earlier resulted in a selloff. It takes time for the company to rebuild confidence. I believe this is a well-managed company that is just starting to hit the sweet spot and that new investors will find it as EPS grows, as I anticipate it will. The stock should rerate to at least a double from here, and even 3x revenue seems reasonable.

Conclusion

In previous articles, I discussed how OSS management was intimating a turnaround and provided updates. Record revenue and profitability along with increasing penetration in the targeted A.I. transportable market sector of edge computing demonstrate that the turnaround has been successful, and I anticipate strong and steady revenue growth going forward.

Be the first to comment