sekarb/iStock via Getty Images

A Pass On Land Based Fish Farms

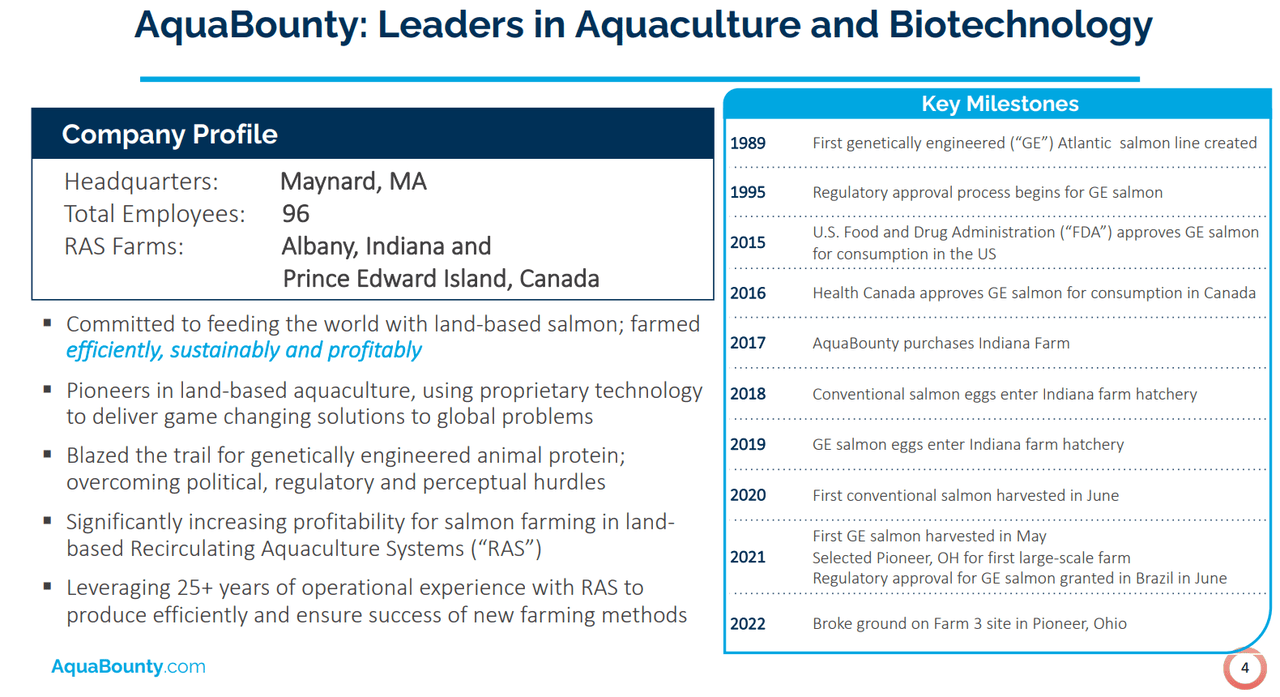

AquaBounty (NASDAQ:AQB) is a company developing dry land farms to raise and sell salmon to the market to take demand away from wild caught salmon. The hot words to consider is that these salmon are both genetically engineered and farm raised. Public image issues aside, other risks that have plagued the company are due to the lack of FDA approval (of farm sites) and harvest issues. This has prevented this aging company from seeing any significant development since the early 90s.

AquaBounty August Investor Presentation

Advantages of the AquaBounty platform, or the trademark AquAdvantage Salmon, are many-fold. Initially, the major benefits revolve around faster growth, reproduction cycles, and ease of harvest, all allowing for a reduction in salmon cost. This either allows AquaBounty to sell at market price for a significant profit, or attempt to steal major market share by offering the lowest prices. Residual effects revolve around the issues inherent in wild-caught fish: ecological impacts, transportation impact, catch risks, food-borne illness, or biomagnification.

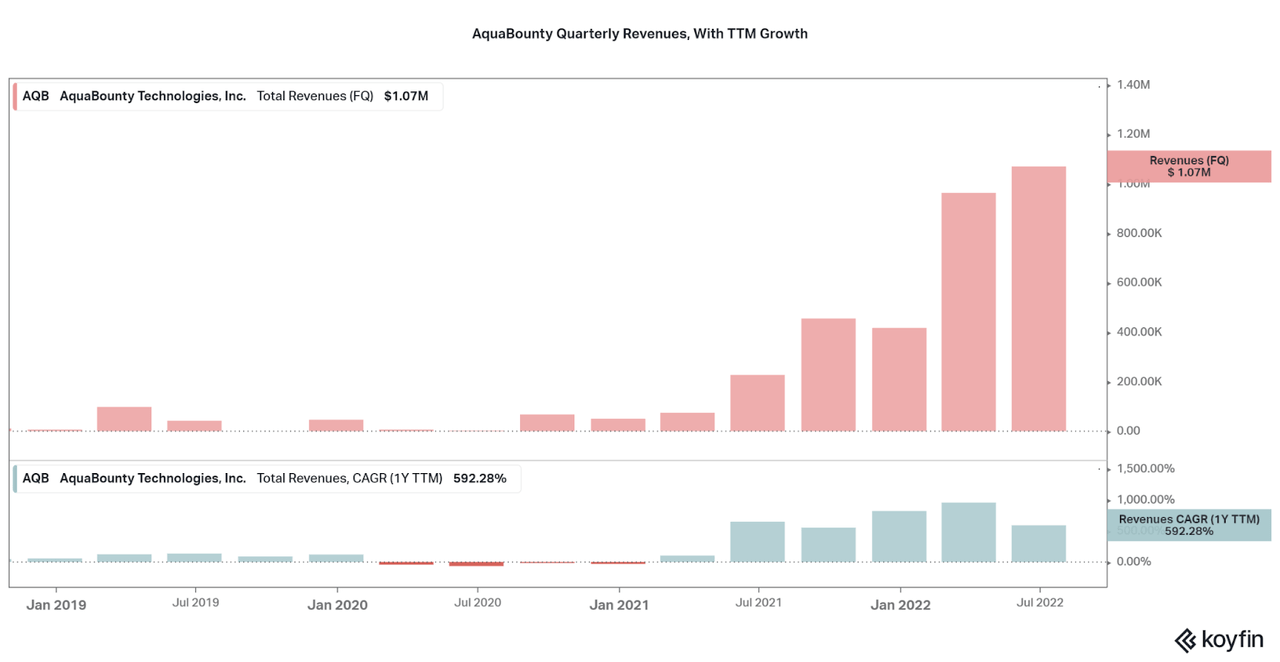

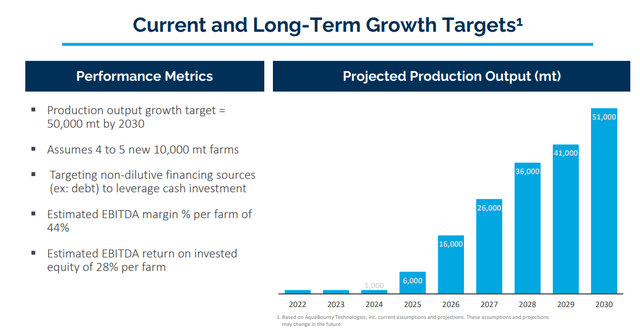

The current issue is that AquaBounty is still working out the kinks and is yet to produce a full-scale operational facility. However, the bet is that once equilibrium is found, the platform, or these farms and salmon, can be developed worldwide, and the market share looks to be significant. In particular, it seems that commercial usage looks quite favorably upon the genetically engineered salmon, and in time, retail consumers may swing around as well. Investors should feel quite confident in the ability to find customers, but uncertainty around the funding of aquaculture centers and the improvement of harvest yields will be an issue for the coming years. Just look at the small amount of revenues that have been found since initiating the process nearly 30 years ago.

Koyfin

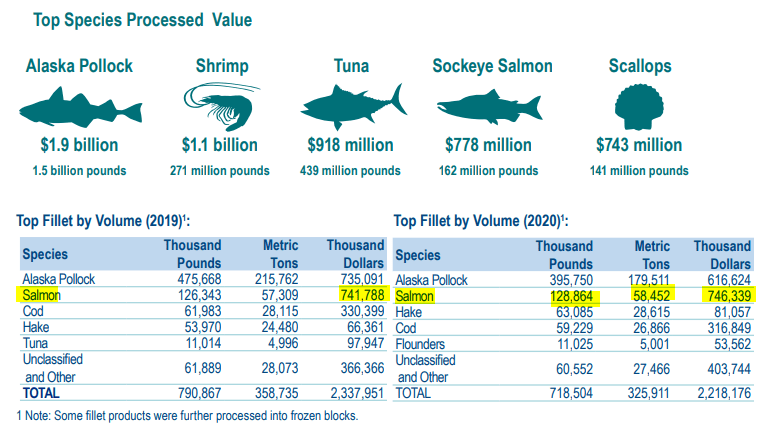

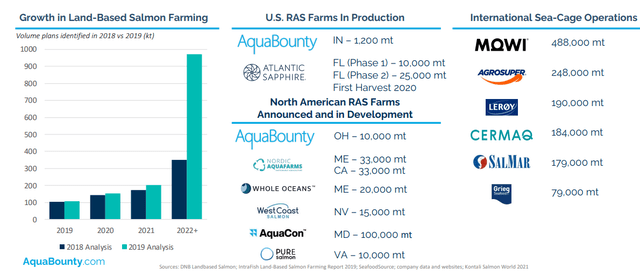

Revenues are derived from two initial farms in Indiana and Prince Edward Island, Canada. However, these sites will only have a maximum yield of approximately 1,000 metric tons per year. This contrasts significantly with the over 160 million tons of salmon processed per year, in the US. The table below is a great way to realize the sheer size of the fishery market, and to begin understanding the benefits of taking a dent out of the amount of fish we obtain from the oceans. Because of this, AquaBounty’s story will remain not one plagued by demand issues, but rather supply constraints. To combat the lack of supply from their two initial production experiment sites, the company has recently begun construction of a larger 10,000 metric ton facility that will easily provide over 5x current harvest yields.

NOAA Fisheries 2020 Report

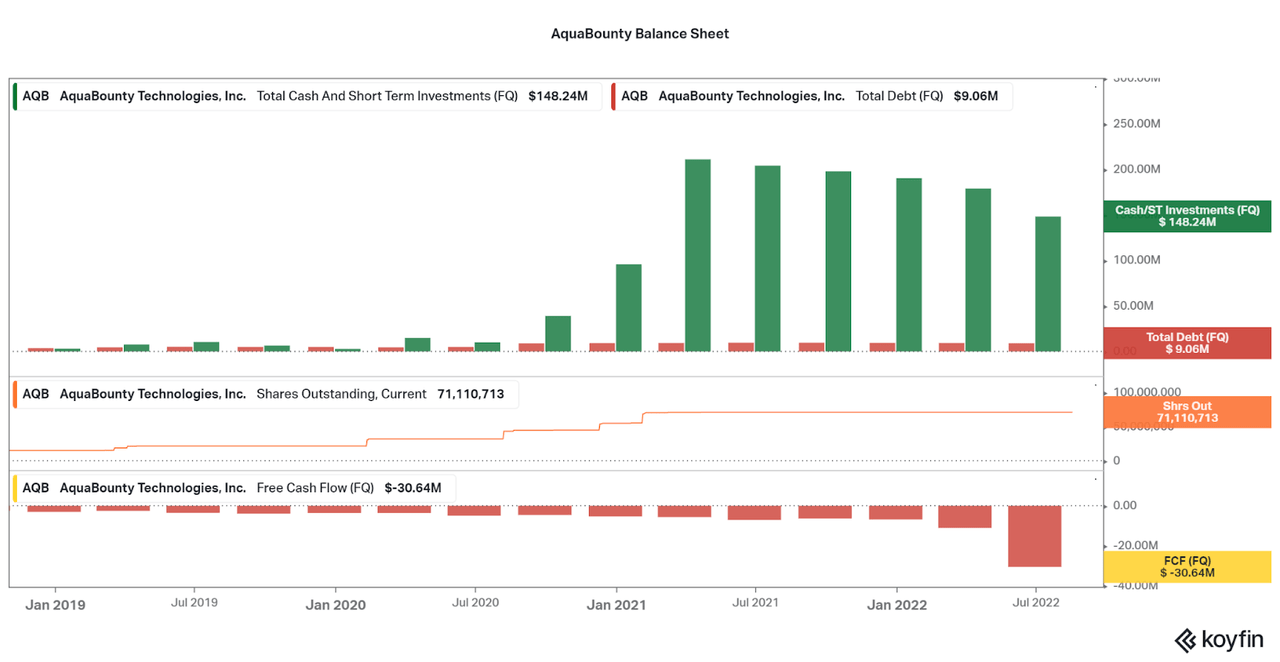

The main problem, as usual, is money. While the company has done well to raise millions at the peak of the recent bull market, current estimates for the price of the new facility will drain the coffer. Now the company is not looking to dilute but to issue bonds instead, partially tempering the hit to current shareholders. However, no funding has come for six quarters and the cash on hand is slowly falling away. As of the August earnings press release, management had the following comments:

On the bond financing front, we have decided to slow the process down temporarily in order to evaluate the current economic forces that are driving both inflation and interest rates higher. Since our estimate for construction of the farm currently exceeds our previous range of $290 – $320 million, we will review all options for reducing cost, including potentially phasing the construction of the 10,000 metric ton farm with an initial production output level that would demonstrate our competitive advantage and ability to operate at commercial scale.

The Future

As only uncertainty exists and current supply is only worth a few million per year, I will certainly be remaining on the sideline. However, I look to the success of their construction and will be following their developments. If you are interested in this story, I will offer some valuation points to consider. Based on prices provided by the 2020 NOAA Fisheries report (see above), the value per pound for Salmon is approximately $5/lb at commercial scale.

Now, we can estimate a fair value for the company upon the completion of the new facility. With a total of ~11,000 metric tons per year, or ~24 million lbs, AquaBounty would bring in $121 million in revenues per year. This is above the current market cap of $95 million, but not really fair in terms of a 10% discount rate over the next five years, or $75 million.

The company can be worth more if no issues arise, but with the uncertainty, I find the risk currently outweighs the reward. As an example, $121 million in revenues 5 years from now at a 5x price to sales ratio sounds nice, but the probability of this point being met remains low. For reference, far larger and well-established fish farmer Mowi (OTCPK:MHGVY) only trades between ~2-3x trailing P/S ratio, while Leroy Seafood (OTCPK:LYSFF) trades between ~1.75-2.25x historically.

Each catalyst moving forward: fundraising, production increases, new facilities, etc., change the risk reward profile, but also insert their own risks. In respect of the coming volatility, I would concede to trading around, especially after large drops on mildly negative news or press. This would include adding shares at this level, as the earnings a few days ago did little to raise the price. However, there are many fish in the sea, and competitors in land or marine aquaculture offer alternate exposure that I may elaborate on in the future. One such land-based competitor is Atlantic Sapphire (OTCQX:AASZF) who are further along in their development and lay out higher yield goals over the next few years. Most participants are in a downtrend, so take your time performing due diligence.

Thanks for reading.

Be the first to comment