Neilson Barnard/Getty Images Entertainment

Thesis

Stanley Druckenmiller’s 13F SEC filing for the June quarter revealed that his family office doubled down on Antero Resources (NYSE:AR), increasing its long position by more than 100% as compared to one quarter prior to $31.2 million. In my opinion, this bullish bet makes absolute sense. Investors should consider that AR is trading at a one-year forward PE of about x5 and EV/EBITDA below x4.

Antero Resources stock is up by approximately 130% YTD, versus a loss of about 11% for the S&P 500. While an outperformance of almost 150 percentage points is likely not sustainable long-term, I nevertheless believe AR will give investors a much better risk/reward than the broad market. Personally, I value AR based on a residual earnings model-anchored on analyst EPS estimates-and see more than 45% upside. My target price is $61.04/share. Buy.

About Antero Resources

Antero Resources Corporation is a US-based oil E&P company, focused on exploring, developing, and producing oil and liquids-rich natural gas properties. Most notably, the company operates more than 502,000 acres of natural gas, NGLs and oil properties, which are mainly located in the Appalachian Basin. And as of Q2 2022, the company’s daily production averaged about 166 MBbl per day.

Antero operates three key segments: exploration and production, income from equity method investments, and marketing. Activities from exploration and production are by far the most important and generate about 70% of Antero’s total sales. Equity method investments, mainly related to Antero Midstream Corporation (which operates Antero’s energy infrastructure), generate some 15% of sales. Finally, marketing also accounts for about 15% of sales and is, in other words, the company’s downstream business segment.

Valuation Lagging Fundamentals

On the backdrop of rising energy prices, paired with a special shortage of natural gas, Antero resources has enjoyed a nice profit-windfall. For the past 12 months (end of June reference), Antero generated revenues of more than $5.7 billion, which is about $1.5 billion more than in 2020. Respectively, net income also jumped by about $1.5 billion, from -$205 million in 2020 to $1.24 billion for the past 12 months.

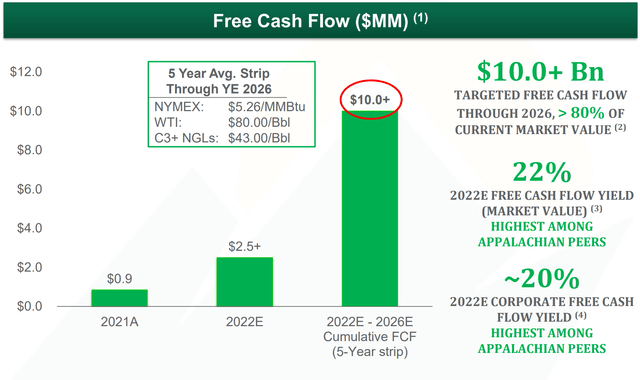

According to the company’s Q2 2022 presentation, Antero management estimates that from 2022 to 2026 the business could yield a cumulative free cash flow of more than $10 billion. If materialized, this would imply about 80% and 58% of Antero’s current market capitalization and enterprise value, respectively.

Antero Resources Q2 Presentation

Antero’s leverage is elevated, but still acceptable enough to not raise any red flags. Investors should consider that the $4.93 billion of total debt and $270 billion of preferred equity could be amortized by cash from operations within about two years. For reference, during the trailing 12 months, Antero generated cash from operations of $2.3 billion and free cash flow of $1.39 billion.

Residual Earnings Valuation

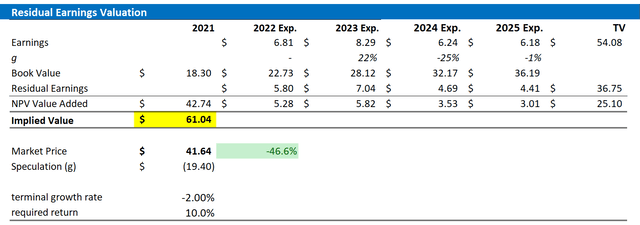

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchored on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS for 2022, 2023, and 2024 are estimated at $6.81, $8.29 and $6.24.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 05, 2022. My calculation indicates a fair required return of 9%.

- To derive AR’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply -0.5 percentage points to reflect a secular decline for oil and gas as an energy source.

Based on the above assumptions, my calculation returns a base-case target price for AR of $61.04/share, implying material downside of about 45%.

Analyst EPS Consensus; Author’s Calculation

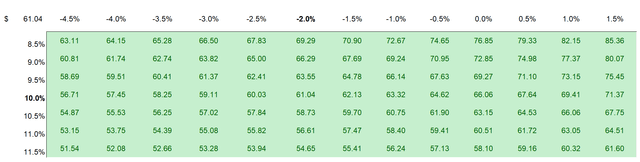

I understand that investors might have different assumptions with regard to AR’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst EPS Consensus; Author’s Calculation

Risks To My Thesis

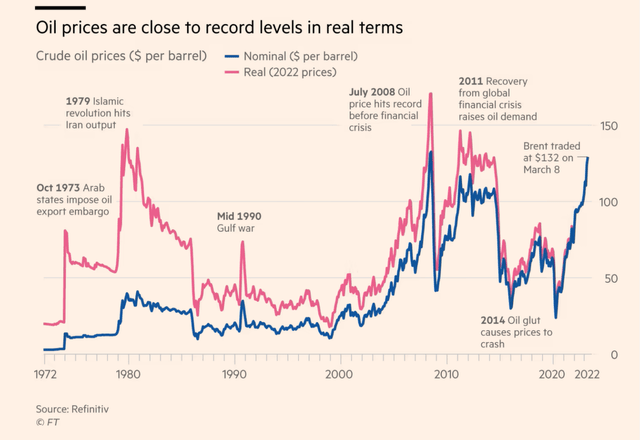

AR is an energy company whose business fundamentals are closely correlated to oil price. Accordingly, a slowing macro-environment might negatively impact AR’s financials. Investors should note that I assume a sustainable oil price of about $60/barrel. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. Notably, during the past recessions, oil and oil producing companies always depreciated in value.

Financial Times

As the 2020 COVID-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break considerably below $60/share and does not recover within a sensible time-period, the bull thesis for Antero Resources would break.

Conclusion

As compared to financials, Antero is arguably trading cheap. While I do understand the concerns that energy firms such as Antero are operating at peak energy cycle levels, I believe the market is discounting the impact of an oil price depreciation too aggressively. Most notably, analyst consensus estimates work with an average oil price between $60 – $70/barrel (Source Bloomberg Terminal as of August 15) and estimate Antero’s EPS for 2022, 2023 and 2024 at $6.81, $8.29 and $6.24. Accordingly, AR’s one-year forward P/E is below x5. Personally, I think AR stock should be fairly valued at $61.04/share. I initiate with a Buy recommendation.

Be the first to comment