fotocelia/iStock via Getty Images

I have been holding off on updating the Seeking Alpha community on Quipt Home Medical’s (NASDAQ:QIPT) recent progress until after they report earnings, likely sometime in August. However, QIPT has made multiple accretive acquisitions and announced two material business development wins with large players in the healthcare space recently. On top of that, we could be near a pivotal moment where the company is able to force the conversion of its outstanding convertible debentures into shares of common equity. I discussed the significance of this overhang in my last article on QIPT, but will reiterate below why I believe cleaning up these debentures will lead to near-term share price appreciation.

Given these developments, I decided to update my Seeking Alpha followers sooner than the next earnings report. While I expect that report to be solid, I believe it is more valuable for investors to be aware—and possibly take advantage of—the possible convertible debenture clearance, which could take effect as early as August 8. Once these debentures clear, not only will QIPT’s balance sheet be pristine (no debt; no derivatives), but the hedging activity that has taken place over the past year due to various derivatives should be relieved, and the shares should be free to move towards a more standard industry valuation (8-12x EV/EBITDA). With respect to QIPT, that type of valuation would lead to the share price increasing at least 70% within the next year, if not sooner.

National Contract With UnitedHealthcare

On April 26, QIPT announced its first-ever national insurance contract. While the linked press release simply notes the contract was with “a top 5” health insurer in the US, the company’s homepage (as of the date of this article) has a pop-up appear, noting “BREAKING: Quipt Now Accepting UHC Nationally!” Based on this, it is quite obvious that UnitedHealthcare (UNH), or UHC, is likely the company referenced in QIPT’s press release.

QIPT Homepage (quipthomemedical.com)

Although UHC is a household name, the average investor likely underestimates the importance of this national contract. Absent a national contract, QIPT (and other, similar companies) must establish contracts with insurance carriers on a state-by-state basis. Not only is this a laborious and time-intensive process, but there is absolutely no guarantee that an insurance company will ever decide to accept a company in a given state. Simply put, before this national contract, QIPT could have done business with UHC in, say, Kentucky and Tennessee, but be denied on its billings in Georgia or Florida. In fact, this is one of the reasons why QIPT, as well as much larger players like Viemed Healthcare (VMD) and AdaptHealth (AHCO), employ an acquisition strategy—they acquire not only a given company with its revenue and earnings, but that company’s important insurance contracts within the states where the acquiree operates. This is a quick and easy way to gain contracts that might otherwise take multiple years to materialize.

By signing this national contract with UHC, QIPT has ensured that wherever they expand, UHC will pay for QIPT’s equipment and services. Since UHC is the largest health insurer in the US, this national contract provides significant advantage to QIPT. Moreover, the contract allows QIPT to easily layer on additional equipment and services to the business of its acquired companies. For example, if QIPT acquires a company focused on sleep therapy, QIPT can now easily layer on its own respiratory or ventilation program since UHC will automatically cover these areas as well.

Finally, we should note that QIPT’s national deal with UHC provides validation that QIPT is quickly becoming a key player, on a national scale, in the home healthcare space. To that end, this new insurance contract is not the only recent deal signaling QIPT’s arrival on a larger scale.

Supply Contract With Cardinal Health

Less than two months following QIPT’s announcement of the UHC deal, the company released news of an agreement with Cardinal Health at-Home, a business unit of Cardinal Health (CAH). Before mentioning the specifics of the partnership, let me again reiterate that arguably the most important aspect of this deal is the validation of QIPT as a legit player in the home healthcare space. Companies such as UHC and CAH do not make these types of deals with just anyone!

Under the terms of QIPT’s agreement with CAH, QIPT will sell CAH’s disposable medical equipment nationwide. For its part, CAH is responsible to supply and distribute these products, meaning that CAH is the one bearing the cost of carrying the inventory. From what I can gather, this deal provides upside to QIPT with absolutely zero downside risk.

Cardinal Health Logo (cardinalhealth.com)

Speaking of this deal, in the press release, QIPT CEO Greg Crawford noted that the contract provides QIPT with the ability to expand its continuum of care and to produce meaningful cross-selling opportunities. He continued by noting the deal allows QIPT to further leverage the national insurance contract with UHC. In other words, one can see that as QIPT inks more and more of these types of deals, future opportunities will begin to present themselves. More succinctly, QIPT has reached a pivotal moment where the company will now have access to these types of deals that one year ago were impossible. This is also how QIPT can conceivably turn itself into a $300M+ company within the next three years. While accretive acquisitions will continue to be made to help the company reach that goal, QIPT should now have new tools to help with delivering stronger organic growth.

Organic Growth & Accretive Acquisitions

The most common criticism I hear about QIPT is that much of their growth has come via acquisitions. Acquisitions inherently come with risk, although QIPT has proved itself to be disciplined and successful. What most investors do not understand is that companies like QIPT cannot grow significantly without making accretive acquisitions. This is, in part, due to the scenario I outlined above regarding the importance of having a national health insurance contract: companies cannot just set up shop in a new state and start earning money—they must first gain the coveted insurance contracts. Regardless, investors love organic growth, and often value companies at higher multiples when they are growing organically.

While QIPT will continue to expand by accretive acquisitions—they added nearly $17M in the past two months by acquiring Hometown Medical, Access Respiratory Homecare, and NorCal Respiratory–the company has begun to guide for even stronger organic growth. CEO Greg Crawford spoke about this on the May 17 2Q22 earnings call.

NorCal Respiratory Logo (norcalrespiratory.com)

Historically, QIPT’s organic growth has been around 8% annually, higher than larger industry peers. But with the recent addition of the UHC and CAH deals, and with the pandemic phase of Covid seemingly over, the company believes this number can materially improve. I have already discussed how this organic growth is possible with respect to the UHC and CAH agreements. But additional organic growth is expected now that the company is able to physically meet with hospital and other healthcare representatives.

During the pandemic phase of Covid, most hospitals and healthcare organizations were not meeting face-to-face with representatives from companies like QIPT. Without this personal interaction, it was much more difficult for QIPT to cross-sell its products. For example, if QIPT acquired a respiratory-focused company with no sleep products, the inability to physically meet with healthcare providers/representatives made it more difficult for QIPT to convince them to start offering its sleep equipment and supplies. Remember, these local hospitals/providers would not have been familiar with QIPT prior to the company’s acquisition—they were only familiar with the acquired company and its rather limited offerings.

Now that QIPT has more access to hospitals and healthcare professionals, they are better able to establish relationships and begin cross-selling their products. I should note that people familiar with QIPT have told me consistently since mid-2020 that Covid had this negative, yet hidden, impact, and that they were enthused about the organic growth opportunities once the pandemic was over. Of course, the pandemic stage persisted much longer than we all hoped. But with it now (hopefully) in the rearview mirror, I believe we will soon see stronger than 8% organic growth rates from QIPT (although it should be noted again that even that 8% rate is strong for the industry).

Convertible Debenture Overhang Clearance

In my most recent prior article on QIPT (see link in intro), I covered in detail the convertible debenture overhang. I presented an argument that I believe leads to a logical conclusion that QIPT’s relatively low valuation, when compared to industry peers, likely resulted from related hedging/shorting activity. The “smoking gun” in my argument was the fact that QIPT’s 52-week low share price touched the exact price at which shares were valued on these convertible debentures, after which any hedging activity would lead to a mere breakeven (above that share price, hedging/shorting was an automatic profit). Hence, shares did not fall below that price, and have since risen, despite shorting activity continuing each time the share price rose near or above the forced conversion price mentioned below.

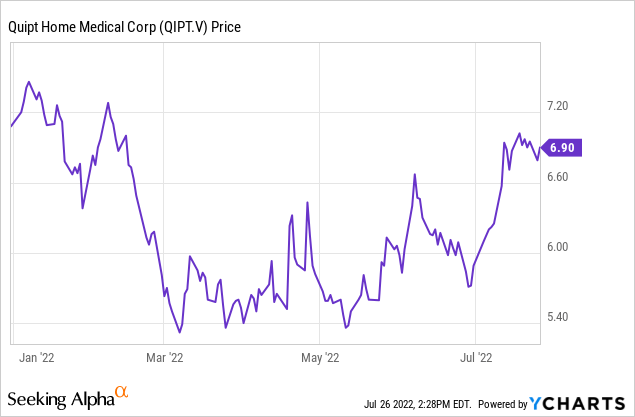

However, beginning on July 11, following the announcement of the Hometown Medical acquisition, and continuing through the submission of this article, QIPT shares have closed above the forced conversion price of CAD $6.48/share. In order for QIPT to forcibly convert the debentures, shares must trade for 20 consecutive trading days on a VWAP basis above this $6.48/share CAD price. It is important for investors to note that this share price is based on the Canadian exchange, and not on the Nasdaq shares. To follow the share price, investors should use the symbol QIPT.V instead of QIPT.

Based on July 11 being the first date of QIPT.V ending the day trading above $6.48/share on a VWAP basis, the 20-day trading period would end on Friday, August 5. I will be watching this situation closely as I believe the forced conversion of the debentures that could follow should lead to a re-rating of QIPT shares. The reason for this re-rating would be twofold.

- Following the conversion of the debentures, the only reason to short QIPT shares would be because an investor believes the company is overvalued. Currently, however, debenture holders may be able to profit from shorting shares, both because it will extend the interest payments, and because any shares they short now that will be converted later are guaranteed to profit them (i.e. you sell short the shares at, say, $6.48/share, but you are covering that short position with shares that had been valued at $5.20/share when the debentures were issued).

- In addition to the above, I believe shares will be re-rated because new investors will buy shares—investors who categorically avoid any company with convertible debentures, warrants, or any other derivative on their balance sheet will now consider QIPT as an investment opportunity.

I will discuss in more depth my valuation comps and assumptions below. Suffice it to say here that the clearance of these convertible debentures will be highly celebrated by me, several other investors in my network, and, I believe, likely, the company itself. The final thing I will mention here is what happens if hedging activities—or even just a slight downturn in the stock price for other reasons—lead to the stock dropping below $6.48/share CAD on or before August 5. In that case, there are likely two scenarios that can play out:

- The company continues to execute on its strong, fundamental business, and lets the stock price do whatever the market dictates. The hope/thought here is that eventually enough people will see how undervalued the business is and the buying pressure outweighs any hedging pressure, and the stock then stays above the magic $6.48/share CAD price for 20 consecutive days; OR

- The company institutes a $5-10M share buyback program that either scares or buys away all sellers/hedgers, and the company very quickly reaches the 20 consecutive day price that allows them to force conversion.

I believe that if the company does not reach the 20-day forced conversion by August 5, there is a good probability that management will institute such a buyback program. I believe management thinks the stock is significantly undervalued at this time for the same reasons I do—primarily because of this convertible debenture overhang—and that they would prefer to remedy this situation sooner than later. Arguably, it makes the most financial sense for the company to acquire its own stock at such a deep discount, even before they acquire other companies. Obviously, however, it has been more practical for the company to see if the debenture overhang would clear a little more organically (which has at least started, and is more than 50% complete now, at 11 of the 20 consecutive trading days having passed as of this article’s submission), and for the company to have then preserved its cash for future acquisitions.

In any case, once the convertible debentures convert, I believe QIPT shares will be re-rated by the market, and current QIPT shareholders stand to benefit significantly.

Risks

In my most recent prior article, I discussed extensively several of QIPT’s risk factors, including mitigating reasons why I believe the company is still a solid investment. To recap, those risks included:

- Reimbursement rates. QIPT is dependent on reimbursement rates set by the government and insurance companies. I highlighted how QIPT has actually seen an increase in reimbursement rates recently, and why I believe this trend is unlikely to reverse. Still, this risk is a factor investors should consider.

- Acquisition/merger issues. As mentioned previously, acquisitions bring with them inherent risk. I believe this is mitigated by both QIPT’s recent and historic track record. Historically, QIPT has integrated companies efficiently and effectively. More recently, according to people familiar with the situation, QIPT stepped away from a material acquisition they had announced was in the letter-of-intent (LOI) phase in 2021. QIPT announces any LOI when the closure of the acquisition would lead to an immediate 10% or more increase in revenue. According to my sources, one of these announced deals will not close because QIPT walked away, fearing they were not getting as much value as they initially expected. This is an extremely bullish sign, in my opinion, because it highlights QIPT’s discipline. Just because they announce a potential deal does not mean they will close on the deal. It has to fit their stringent criteria for the company to pull the trigger on an acquisition.

- Capital raise. It is possible, though currently improbable, that QIPT will come to the capital market for an equity raise. While QIPT’s operating cash flow is strong, they are constantly looking to acquire other companies. I believe with their current cash-on-hand and debt availability, the company will not likely need to raise additional capital in the near-term. I estimate they have at least $100M of cash plus inexpensive credit available to them. Further, I believe the company is now in strong financial position and will not be afraid to take on manageable and inexpensive debt. So, while a capital raise is always a possibility with an acquisitive company, in QIPT’s case, it seems highly improbable in the near future. Moreover, if a raise does become necessary, it will almost certainly be for a large, accretive acquisition (i.e. it will actually benefit current shareholders).

Valuation

As with the Risks section, I will simply provide an overview of my prior valuation of QIPT. My most recent prior article provided extensive details regarding the company’s valuation. Specifically, I highlighted the company’s adjusted EBITDA (AEBITDA) run-rate guidance for calendar EOY 2022. That outlook still sets at $38-43M in AEBITDA.

In addition to that, I provided a couple of comps based on recent acquisitions, which I argued justified an 8-12x EV/EBITDA valuation for QIPT. Since that time, the overall market has rebounded to some degree. Consequently, some of QIPT’s larger peers, such as VMD and AHCO, have seen their share prices recover (unlike QIPT, they had no convertible debenture overhang holding them back). Unsurprisingly, these companies now trade right at that 8-12x EV/EBITDA valuation I used for QIPT based on the acquisitions I cited.

With that in mind, I want to reiterate my valuation assumption that QIPT should trade at 8-12x EV/EBITDA. Personally, because QIPT is growing at a much more rapid pace than its larger peers, I tend to use the 10-12x EV/EBITDA. But for the sake of conservatism in this public article, I will also show an 8x EV/EBITDA here.

At the midpoint of QIPT’s guidance, the company would be at a $40.5M AEBITDA run rate by calendar EOY 2022. A multiple of 8x would give an EV of $324M. Taking into account the additional shares upon convertible debenture exercise, QIPT shares would be valued at about $9.15/share in this scenario. That represents about a 70% implied return from current share prices.

| One Year Revenue Run Rate | $185 |

| Forward EBITDA | $40.5 |

| Forward EBITDA Multiple (8x) | $324 |

| Share Price (“Fair Value”) | $9.14 |

| Current Share Price | $5.30 |

| Implied Return | 72.4% |

Using those same numbers, but a 12x multiple, QIPT’s EV would be $486M. That would lead to a share price of roughly $13.70/share, or an implied return of nearly 160%.

| One Year Revenue Run Rate | $185 |

| Forward EBITDA | $40.5 |

| Forward EBITDA Multiple (12x) | $486 |

| Share Price (“Fair Value”) | $13.71 |

| Current Share Price | $5.30 |

| Implied Return | 158.6% |

It should be noted that I believe QIPT’s fundamental business justifies these valuations within one year or less; and that the stock will be free to attain these levels when the debenture overhang clears—possibly as early as August 8 (the first trading day following the 20-day trading period that began on July 11). If these returns seem unimaginable, keep in mind that QIPT is up about 30% from YTD lows, while VMD is up around 115% and AHCO is up over 80% from YTD lows, respectively.

Conclusion

QIPT’s recent deals with UHC and CAH will help accelerate and expand the company’s rapid growth. Perhaps more importantly, these deals clearly validate that QIPT has arrived as a major player in the home healthcare space. Together with these deals and the pandemic phase of Covid in the rearview mirror, QIPT should see double digit organic growth rates soon. This organic growth should complement a robust, accretive acquisition pipeline that helped propel the company to this stage. Once the company is able to put the convertible debenture overhang in the rearview also—which could occur as early as August 8—I believe shares could rise by 70-160% within the next year. While such a rise may seem preposterous at first blush, a detailed analysis of QIPT’s fundamentals, combined with a comparison to larger industry peers, shows that these stellar returns could certainly be within reach.

Be the first to comment