Andrei Berezovskii/iStock via Getty Images

It was not the best day to release a Q3 earnings report on November 1, 2022, the evening preceding the Federal Reserve Interest rate announcement on November 2, 2022. Enovix Corporation (NASDAQ:ENVX) stock declined 41%, from $17.99 to $10.74, the day after the earnings release. A discounted cash flow (“DCF”) valuation, however, shows a share price of $36.39, implying a 167% upside from the 11/11/2022 close.

Is Enovix Corporation stock overvalued or undervalued given the potentially revolutionary battery technology it is developing?

Using a discounted cash flow analysis, the expected price of $36.39 implies that the stock currently is undervalued at $13.61.

Based on relative valuation, on the other hand, using calculable ratios, the Enovix Corporation is overvalued. The company is expected to have negative EPS for the next at least 2-3 years. The divergence between the results of the relative valuation, which shows overvaluation, and DCF, that shows undervaluation, is due to a perception gap, or since investors find emerging companies with negative earnings hard to value. Relative valuation multiples do point out that some investors are paying for the company’s future growth, making it look like it is overvalued.

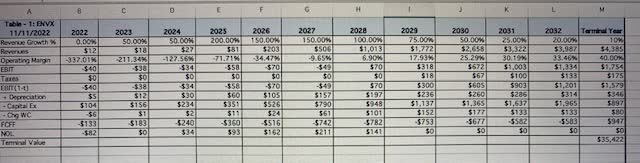

I first used a DCF analysis to value Enovix. The calculated share price is $36.39. And using the treasury method results in a price target of $34.27, using beta of 2.29, cost of equity of 17.75%, risk free rate of 4%, equity risk premium of 6%, and assuming 75% CAGR of revenues. The price closed at $13.61 on 11/12/2022. The Table -1 below shows the DCF calculation.

DCF for ENVX (Used Microsoft Excel)

|

The Valuation |

|||||||

|

PV of FCFF during high growth phase = |

$(2,137) |

||||||

|

PV of Terminal Value = |

$7,520 |

||||||

|

Value of Operating Assets of the firm = |

$5,384 |

||||||

|

Value of Cash & Non-operating assets= |

$349.01 |

||||||

|

Value of Firm = |

$5,733 |

||||||

|

– Value of Outstanding Debt = |

$24 |

Capitalized leases |

|||||

|

Value of Equity = |

$5,708 |

||||||

|

– Value of Equity Options = |

$113 |

Value of options and warrants |

|||||

|

Value of Equity in Common Stock = |

$5,596 |

Treasury Stock Approach |

|||||

|

Value of Equity per share = |

$36.39 |

$34.27 |

Data Source: Yahoo Finance, MarketWatch.com, stockanalysis.com, investors.com, ENVX SEC filings, ENVX conference calls, volatility, and news releases. 11/11/2022.

Enovix has only six quarters of financial information released publicly since becoming public. Quarterly Results | Enovix.

The company has enough cash to last for about one year from October 2022. Based on the anticipated spending, cash received from the Business Combination – SPAC – and net proceeds from the exercises of the Public Warrants, and timing of expenditures, management currently expects the cash will be sufficient to meet funding requirements over the next twelve months from the date the Quarterly Report on Form 10-Q was filed, which was 11/3/2022. Future cash requirements will be met through a combination of available cash, cash equivalents and future debt financings, and access to other public or private equity offerings as well as potential strategic arrangements. The company has $349 million in cash on hand as of November 2022.

The valuation also assumes the followings:

– Industry analyst Avicenne Energy’s 2019 estimate, the Li-ion battery cell market will grow from $45 billion in 2020 to $75 billion in 2025.

– Research and development expenses will continue to increase for the foreseeable future.

– The company leases headquarters, engineering, and manufacturing space.

– Revenue funnel was $1.4 billion at the end of third quarter of 2022, which was comprised of $1.0 billion of Engaged Opportunities and $423 million of Active Designs and Design Wins. Usually, conversion rate to revenues is 10-15%.

– R&D center in India to be created to focus on Machine Learning.

– Complete Gen2 Autoline that can produce both small and large cells will cost between $50 million and $70 million of capital expenditures and at 80% overall equipment effectiveness (“OEE”) will produce just over nine million cells annually once fully ramped by 2024.

– Expect selling, general and administrative expenses to increase significantly in the near term and for the foreseeable future.

– Expect equipment depreciation and idle costs to continue to increase from the second quarter going forward.

– Proceeding with one line right now that will land in the second half of 2023, plan is to add additional lines that would come in 2024 into that Fab-2 location.

– In fiscal year 2022 and over the next several years, expect research and development expenses and selling, general and administrative expenses will continue to increase.

– Expect to recognize between $6 million and $8 million for full-year 2022, with service revenue being a significant contributor. I used $12 million for 2022 revenue, high end of street analyst estimates.

Relative Valuation: In relative comparison, I looked at similar companies with similar metrics. Table – 2 below indicates that using comparable valuation shows that ENVX is overvalued. The reason for this is that investors see the growth potential in ENVX technology and paying for growth.

|

Table -2 |

Market Cap ($billions) |

% Float |

2023 EPS Est. |

Price-to-Sales |

Price-to-Book Value |

EV/EBITDA |

% of Shares Held by Insiders |

|

(AMPX) |

1.15 |

8% |

-0.44 |

186.49 |

76.6 |

-121.49 |

82.3% |

|

(BE) |

4.26 |

98% |

0.17 |

3.63 |

24.64 |

-26.11 |

9.2% |

|

(BLNK) |

0.75 |

83% |

-1.94 |

14.27 |

2.80 |

-10.2 |

18.6% |

|

(ENS) |

3.17 |

98% |

5.97 |

0.95 |

2.17 |

14.14 |

1.8% |

|

ENVX |

2.14 |

68% |

-0.70 |

400.01 |

5.97 |

-15.01 |

18.8% |

|

(EOSE) |

0.96 |

76% |

-1.72 |

3.98 |

NM |

-1.21 |

6.9% |

|

(FLNC) |

1.72 |

64% |

-0.69 |

1.82 |

3.74 |

-5.7 |

0.2% |

|

(FLUX) |

0.76 |

71% |

0.04 |

1.36 |

4.28 |

-4.53 |

28.6% |

|

(FREY) |

1.61 |

82% |

-1.71 |

NM |

2.82 |

-9.45 |

22.4% |

|

(GWH) |

0.63 |

66% |

-0.59 |

714.09 |

3.97 |

-0.9 |

46.0% |

|

(KOS) |

2.95 |

98% |

1.49 |

1.31 |

3.31 |

3.61 |

3.1% |

|

(MVST) |

0.74 |

63% |

-0.27 |

3.61 |

1.14 |

-2.59 |

42.7% |

|

(RUN) |

6.50 |

95% |

0.30 |

3.06 |

0.98 |

677.37 |

5.4% |

|

(SES) |

1.92 |

59% |

-0.39 |

NM |

4.87 |

-69.3 |

30.4% |

|

(SLDP) |

0.99 |

55% |

-0.45 |

152.29 |

1.79 |

15.37 |

29.0% |

|

(STEM) |

2.07 |

92% |

-0.48 |

7.97 |

3.6 |

-26.64 |

8.8% |

|

(ULBI) |

0.77 |

59% |

0.55 |

0.64 |

0.67 |

26.33 |

6.0% |

|

Mean |

1.95 |

73% |

-0.05 |

99.70 |

8.96 |

26.10 |

21.2% |

|

Median |

1.61 |

71% |

-0.44 |

3.63 |

3.455 |

-4.53 |

18.6% |

Data Source: Yahoo Finance, MarketWatch.com, stockanalysis.com, investors.com, 11/11/2022. Price-to-Sales: TTM from Yahoo Finance, Price-to-Book Value is most recent quarter from Yahoo Finance. Valuation ratios, Market Cap, Insider ownership also are from Yahoo Finance.

For example, ENVX insider ownership is about 19%. Table-3 shows there are four companies with insider ownership percentage of 18-28%, BLNK, ENVX, FREY and FLUX. Based on the Price-to-Book Value, ENVX is overvalued, trading at 5.97 times among the comparable firms with similar range of insider ownership.

|

Table – 3 |

Market Cap ($billions) |

% Float |

2023 EPS Est. |

Price-to-Sales |

Price-to-Book Value |

Enterprise Value /EBITDA |

% of Shares Held by Insiders |

|

BLNK |

0.75 |

83% |

-1.94 |

14.27 |

2.80 |

-10.2 |

18.6% |

|

ENVX |

2.14 |

68% |

-0.70 |

400.01 |

5.97 |

-15.01 |

18.8% |

|

FREY |

1.61 |

82% |

-1.71 |

NM |

2.82 |

-9.45 |

22.4% |

|

FLUX |

0.76 |

71% |

0.04 |

1.36 |

4.28 |

-4.53 |

28.6% |

Similarly, ENVX share float is about 70%. We look at a group of peers with similar float range of 55% to 76%. In this group, in Table-4, ENVX is the highest valued company based on price-to-book ratio, clearly showing again that investors are paying for ENVX potential future growth, and expectant operational improvements with the appointments of new executive chairman and COO.

|

Table -4 |

Market Cap ($billions) |

% Float |

2023 EPS Est. |

Price-to-Sales |

Price-to-Book Value |

Enterprise Value /EBITDA |

% of Shares Held by Insiders |

|

SLDP |

0.99 |

55% |

-0.45 |

152.29 |

1.79 |

15.37 |

29.0% |

|

SES |

1.92 |

59% |

-0.39 |

NM |

4.87 |

-69.3 |

30.4% |

|

ULBI |

0.77 |

59% |

0.55 |

0.64 |

0.67 |

26.33 |

6.0% |

|

MVST |

0.74 |

63% |

-0.27 |

3.61 |

1.14 |

-2.59 |

42.7% |

|

FLNC |

1.72 |

64% |

-0.69 |

1.82 |

3.74 |

-5.7 |

0.2% |

|

GWH |

0.63 |

66% |

-0.59 |

714.09 |

3.97 |

-0.9 |

46.0% |

|

ENVX |

2.14 |

68% |

-0.70 |

400.01 |

5.97 |

-15.01 |

18.8% |

|

FLUX |

0.76 |

71% |

0.04 |

1.36 |

4.28 |

-4.53 |

28.6% |

|

EOSE |

0.96 |

76% |

-1.72 |

3.98 |

NM |

-1.21 |

6.9% |

Summary of The Company’s business from company sources: I read the Company’s conference calls transcripts, SEC filings, and below is a summary of its business, how it makes money and factors that might give ENVX its competitive advantage, so the readers can make the connection between the quantitative valuation and the underlying investment profile.

ENVX is an emergent manufacturer in the lithium-ion battery market. The Company defines itself as leader in advanced silicon-anode lithium-ion battery development and production. The company’s proprietary 3D cell architecture increases energy density and maintains high cycle life. Enovix is building an advanced silicon-anode lithium-ion battery production facility in the U.S. for volume production. The company’s initial goal is to provide designers of category-leading mobile devices with a high-energy battery so they can create more innovative and effective portable products. Enovix is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable widespread utilization of renewable energy.”

The Company has a current strong “revenue funnel” in what they believe their addressable potential strong position in the portable electronic products and EVs market. Revenue funnel was $1.4 billion at the end of third quarter of 2022, which was comprised of $1.0 billion of “Engaged Opportunities and $423 million of Active Designs and Design Wins.” The company generates revenues from payments received from customers in connection with: (1) the sale of silicon-anode lithium-ion batteries and battery pack products (“Product Revenue”); and (2) executed engineering revenue contracts (“Service Revenue”) for the development of silicon-anode lithium-ion battery technology.

Enovix has two design wins from two mega-cap technology companies and has signed a non-binding memorandum of understanding with one of those mega-cap companies. Investors do not know what the mega-cap company is, but it has a broad product portfolio. These design wins are what make Enovix potentially a promising investment.

Energy density and safety of its batteries are also its other promising core competencies. Energy density is a focal concentration point in terms of what’s being developed, and the company thinks it is ahead of the competition in terms of battery density innovation, not just nominally but five years ahead where the industry is today with its EX-2 in 2024, and EX-5 in 2025, according to management.

International markets offer another potential growth area, extending the potential “revenue funnel” as well, coupled with eventual entry to the electric vehicle (“EV”) market.

Its customers in the addressable market are portable electronics manufacturer, smartphone OEMs and EV manufacturers – automakers. Its growth is going to depend on not only viability of its batteries, but also growth in the consumer electronics market and personal disposable income, since the company is putting significant focus on the “wearables” market. Another potentially accelerating revenue source will be licensing and joint ventures of the Gen2 autoline. Gen2 is a state-of-the-art manufacturing line, and the company has shifted significant capital expenditures to Gen2 from Gen1 in the second half of 2022, and will continue to do so in 2023, as well as shifting most of the staff to its Gen2 efforts.

For the automakers, fast charging is an advantage Enovix offers. The challenge remains with the capacity of the Gen2 autoline. The company expects to land its Gen2 line operational in the second half of 2023 and ramp up in 2024. To see more about this revolutionary technology go to Brakeflow – Enovix and here.

Management said on 11/1/2022:

“Subject to final technical design and Board approval scheduled for early 2023, we continue to target full delivery of our Gen2 equipment in the second half of 2023 followed by our Gen2-compatible pilot line (“Agility Line”) for accelerated product development and qualification.”

So, it is possible infer that products for sale from Gen2 line are not going to start until later in 2023 and into 2024.

The company is also manufacturing wearable size batteries, particularly smartphone size battery, and making technological leaps, anticipating sampling of this technology in 2023 to customers. An investor gets the feeling that all the products Enovix is working on are in their research and development, testing, and sampling stage. The management stated that 2022 sales will be about $6-8 million dollars, most of which coming from services.

In 2023, sales numbers are expected to be low as well. The products are still in sampling, R&D stages, then customers must test those samples to decide whether the samples match their specifications and other requirements. If that is approved, Enovix only then manufactures products specific to that customer’s requirements and possibly get a sale, after manufacturing qualification, which is another process that takes months. A more meaningful volume shipments can happen in 2023, but a significant volume launch will come in 2024, management said in the third quarter conference call on November 1, 2022. Our model’s sales projections are based on these assumptions, some ramp up coming in 2024, as most of the 2023 will also be a period of sample testing, qualification, customization, auditing, testing the quality systems and then possibly purchase orders.

The company signed a memorandum of understanding with a mega-cap company, what it calls “strategic account.” This company is collaborating with Enovix on batteries for multiple products different product lines, such as wearables, mobile phones, laptop, computers, and other mobile products. It is not hard to guess which customer – company – it might be. First, one risk is that since this mega-cap company is likely to be a significant customer, it will make up a higher percentage of Enovix’ sales, in 2-3-4 years down the road. Second, however, it will be like a steady revenue stream if Enovix continues to innovate, once the MOU is turned into a purchase order (contracts), with dozen of more steps and it could be years in between. Investors need to watch this carefully and keep it on their radar, because the day that announcement is made, ENVX stock will probably gap up significantly. This is, however, an 18-month process. Management referred to quite substantial volume of sales, once the commercial agreement is signed sometimes in the future, because the mega-cap company has huge volume of products that need batteries. The company is envisioning doing joint ventures, licensing, and creating dedicating capacity to meet the demands from this mega-cap strategic account.

One problem is that the management spent only three minutes discussing the financials after their opening statement on the conference call on November 1, 2022. I thought that was not enough. ENVX needs Investor Relations coaching. What signal is the management giving with so little emphasis on the financials on a conference call? The problem with the IR was also highlighted in the press release on November 07, 2022, when announcing the appointment of T.J. Rodgers as Executive Chairman. He said in his press release that:

“Problem 1: The lack of clear and transparent investor communications. I have worked with the Enovix team for ten years. It has always been honest. Yet, we must improve the clarity of our communications.”

Is the Company doing something different that no one else is doing or is the Company doing “things differently.” Answers to those questions determine competitive advantage.

The Company is targeting multiple device markets. This is not a competitive advantage, but a hedge, opportunity to gain stronger foothold, broaden investor base and revenue streams. Targeting multiple markets is not competitive advantage because the company must have competitive advantage in all the markets it targets. A company can’t be mediocre, or average, in one segment and dominant in another. The weaker segments will impact the financials negatively and take proportionally more management time and focus.

Investors need to keep this stock in their radar screen for possible news of certain milestones and catalysts because management is working hard building the team and focusing on operational challenges.

Enovix may also be takeover candidate after 2024. Once the technology is proven and actual sales ramp up, it should become a takeover target by another company to gain market share and eliminate the competition and/ or when the consolidation in the battery sector starts after 2025.

Is there a “first to market” advantage? That is also a “no.” One competitive advantage is going to be battery density innovation that management thinks the company is five years ahead of the competition.

ENVX should be a buy for an investor with at least an investment time horizon of two or more years. Enovix’ technology is promising, and it is an innovative company, and some investors are buying, paying for expected growth.

Be the first to comment