Dzmitry Dzemidovich/iStock via Getty Images

Article Thesis

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) reported its most recent quarterly results on Tuesday afternoon. The company missed estimates on both lines, and profits actually were down year-over-year. Nevertheless, I do believe that the company is a compelling bargain at current prices, and overall, the recent quarterly results have reinforced my belief that GOOG is trading below fair value right now.

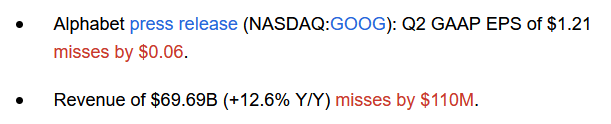

Headline Results Missed Estimates

The following screenshot captures the headline numbers from Alphabet’s most recent quarterly release:

Seeking Alpha

Alphabet missed both the analyst consensus estimate for its revenue as well as the consensus estimate for its earnings per share. That naturally isn’t great, especially since earnings per share also were down year-over-year, declining from $1.36 to $1.21. The headline numbers thus look pretty bad, but when we take a deeper look, things are way more nuanced.

A Deeper Look At The Good And Bad From The Quarter

Starting from the top of the earnings statement, let’s work our way through the factors that resulted in Alphabet’s earnings per share declining versus the previous year’s period.

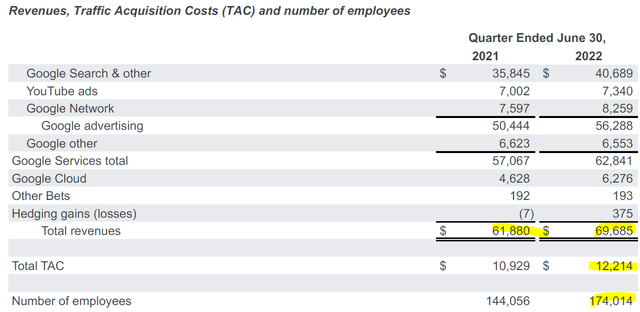

Revenue was up by 13%, mainly thanks to the strength of the company’s core Google Search business. Google Search is the largest and most established of the company’s business units, and yet it delivered the best growth. To me, this indicates that Alphabet has major advantages versus peers in the online advertising space. Others, such as Twitter (TWTR) and Snap (SNAP), disappointed in that regard with their recent earnings releases, but Alphabet’s business remains strong.

YouTube saw some revenue growth, but at a lowish rate of 5%. That is likely attributable to the behavior of consumers, however. With travel, dining out, etc. becoming easier in this year’s Q2 relative to last year’s Q2 when the pandemic impact was larger, consumers spent less time at home and in front of their phones, tablets, and TVs. YouTube thus faced tough comparisons, and the fact that the business unit nevertheless managed to grow its revenues is a major positive, I believe.

In the above screenshot, we also see that Traffic Acquisition Costs rose by 13% year over year — in line with revenues. There thus was no margin squeeze from that perspective, which is positive and points to margins likely remaining healthy in the long run.

Alphabet hired many more employees, however, which is why its headcount rose by 21%. It is not immediately clear why that is necessary for a company that is established and that is growing at a low-teens rate. Alphabet’s management likely came to the same conclusion, which is why the company recently announced that it would slow down hiring. The headcount data from the quarterly report is thus negative, as GOOG did not manage to grow its revenue and gross profit faster than its headcount.

Operating leverage thus wasn’t a positive factor in the quarter. But the fact that management has come to the conclusion that hiring was overdone in the recent past, and that this should change going forward, is a good sign. Investors can expect that headcount will grow less going forward, which should have a positive impact on Alphabet’s margins in the coming quarters, all else equal.

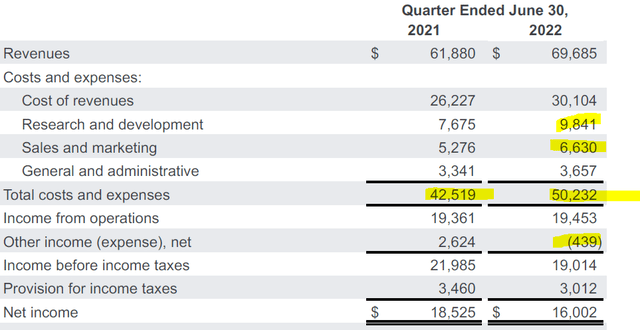

When we go through the income statement, we see that the big headcount increase we have seen earlier has made Alphabet’s operating expenses rise considerably. R&D costs were up by a whopping 27% year over year, while SG&A expenses rose by 20%. The R&D expense increase hurts profits now, but can be seen as an investment in the future. In the past, Alphabet’s investments have paid off, thus I’m okay with R&D expenses growing, as this will hopefully result in better future products that can expand GOOG’s addressable market and revenue potential.

SG&A expenses growing by 20% is far from great, however. When a company grows its top line by 13%, administrative expenses shouldn’t rise more. In fact, they should ideally rise less, so the company benefits from operating leverage. That was not the case here. But if the hiring pause has a meaningful impact on GOOG’s headcount growth, this trend could reverse in the coming quarters, and SG&A expenses might grow less going forward. This would have a positive impact on Alphabet’s margins.

Another big factor for Alphabet’s earnings decline was a big move in its other income/expenses. That line moved $3.1 billion against Alphabet compared to the previous year’s quarter. Since Q2 2021 was extraordinary positive, that move isn’t dramatic. And since this line isn’t really reflecting Alphabet’s underlying business performance, I don’t think that this should concern investors.

When we back out the move in GOOG’s other income and adjust its taxes, net income would actually have increased by $100 million year-over-year, or by 0.6%. That’s still significantly less than the revenue growth rate, which is far from ideal, but we can nevertheless say that the earnings decline can be attributed to the other income/expense performance during the period — the earnings decline is not the issue of Alphabet’s core business. Underlying business growth remains healthy, and as long as management follows through on its headcount alignment statements, margins should expand again. I thus believe that there is a high likelihood that underlying earnings growth will be better in the coming quarters and years.

Low Valuation, Great Balance Sheet, And Shareholder Return Potential

Alphabet has one of the best balance sheets in the world. At the end of the second quarter, cash and equivalents stood at $125 billion, not factoring in non-marketable securities. That is equal to 9% of the company’s current market value. When we account for Alphabet’s debt, net cash still stands at a hefty $110 billion, or 8% of the company’s market value — which is way better than Apple’s (AAPL) 3% net cash position, relative to its market value. Compared to Apple, which is widely seen as a company with a very strong balance sheet, Alphabet has thus three times the cash reserves, market-value adjusted. Even in absolute terms, Alphabet’s net cash position is 30% higher.

Alphabet’s large cash war chest can be used in several ways. The company could introduce a dividend, but that does not seem like a priority right now. Acquisitions are another option, although those should only be pursued when the price is right, and when there are no antitrust issues. I do believe that one of the best ways for Alphabet to spend its money is its stock buyback program, as those increase each share’s portion of the total company, and since there is no regulatory or execution risk there. Management seems to agree, as Alphabet has spent heavily on buybacks during the quarter. According to its earnings release, Alphabet spent $15.2 billion on buybacks during the period, or a little more than $60 billion annualized. At that pace, the company can buy back around 5% of its shares per year, which has a meaningful impact on its earnings and cash flow per share growth rate. In fact, that is a faster buyback pace than Apple’s historic buyback pace (around 3%-4%), and Apple’s buybacks are widely regarded as a key factor for its compelling total returns.

With Alphabet being able to repurchase shares even more aggressively, a lot of shareholder value could get created in the long run as long as GOOG keeps its buyback pace up. With GOOG generating free cash flows of $16.5 billion during the most recent quarter, those buybacks are easily financed. In fact, despite this compelling buyback pace, Alphabet actually added even more money to its net cash pile. The company could thus ramp up buybacks further, as there would be no problem if its net cash position declines over time.

Looking at Alphabet’s valuation, we see that shares are currently trading at 19x free cash flow (Q2 annualized) when we adjust for Alphabet’s net cash position. This is, I believe, appropriate. In other words, Alphabet is trading at a net cash adjusted free cash flow yield of a little more than 5%, which is a pretty attractive valuation for a company with a strong moat, growth tailwinds, high-potential business units such as Waymo, and when we account for Alphabet’s solid underlying business growth of 13% during the most recent period.

Takeaway

Not everything was great during the most recent quarter. Hiring seemingly was overdone, as the headcount has grown too much relative to the business growth rate. This hurt Alphabet’s margins during the period. But it looks like management wants to correct that mistake going forward.

GOOG’s earnings declined versus Q2 2021, and results missed estimates on both lines. That naturally isn’t great. But the earnings decline is attributable to other income/expense movements, and the earnings miss wasn’t too large.

I do believe that Alphabet is a very solid company with a positive long-term outlook, and the current valuation is attractive. I also believe that there is a good chance that investors will be happy when buying at current inexpensive prices, especially when management follows through with its headcount adjustments that should make margins improve again. In the meantime, buybacks should add meaningful shareholder value as long as they are done at current inexpensive prices.

Be the first to comment