Bim/E+ via Getty Images

Shares of Rayheon Technologies (NYSE:RTX) are trading 4% lower following the release of second quarter results. The company posted non-GAAP EPS of $1.16, beating the consensus by $0.05, but its revenues of $16.31 billion missed expectations by $300 million. In this earnings analysis I will analyze the results to see where Raytheon Technologies missed expectations and where it possibly saw appreciable performance.

Raytheon Technologies Faces Significant Pressures

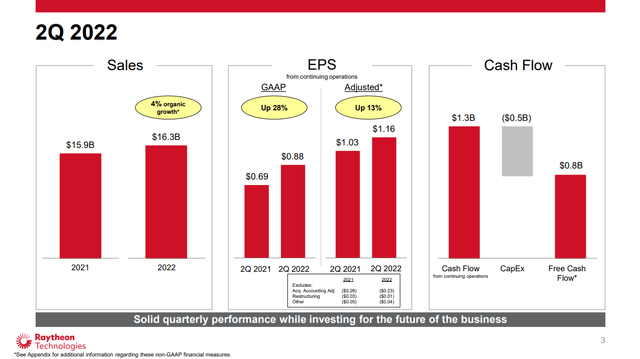

Raytheon Technologies earnings overview (Raytheon Technologies)

Raytheon global Q2 2022 overview does not look bad at all. Sales grew 4% and earnings per share grew 28% or 13% on adjusted basis. On global level, what could be seen as somewhat disappointing is the free cash flow of $807 million while it was $966 million in the same period last year. Having higher revenues but lower free cash flow is not really what you’re looking for as an investor, but Raytheon Technologies expected around $0.8 billion in cash flow.

So, for the disappointing items we really have to look elsewhere and keep in mind what investors on any normal day find favorable about Raytheon Technologies. If I held shares of Raytheon Technologies what I would like is the relative stability of the defense business and the growth prospects that commercial aerospace offers and that is where it went wrong for Raytheon Technologies really.

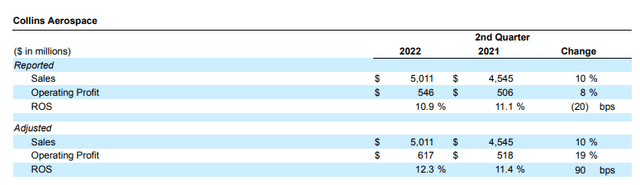

Collins Aerospace results (Raytheon Technologies)

Collins Aerospace saw sales increase by 10% driven by 25% higher after commercial aftermarket sales and 14% higher original equipment manufacturer sales for commercial aerospace. This was offset by a 6% decline in military sales driven by lower material receipts and expected lower F-35 sales. Results for Collins Aerospace in no way were bad but already show the pain point. At present, the Defense business is not providing the stability we would normally be looking for.

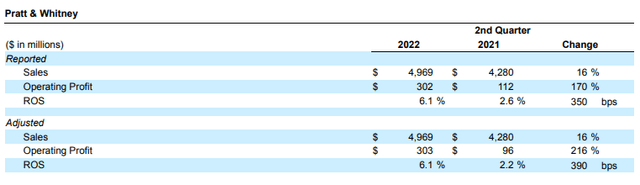

PW Results (Raytheon Technologies)

Results at Pratt & Whitney were strong. On an adjusted basis, revenues grew 16% while operating profit grew 216% That earnings recovery was driven by a 26% increase in commercial aftermarket sales and a 22% increase in original equipment manufacturer sales for commercial aerospace. Defense sales had a 5% boost during the quarter driven by contract award timing. Data that we use for the TAF Defense Contracts Monitor shows that Raytheon Technologies received a $4.4 billion contract to add scope for the production and delivery of Lot 15 and 16 F-35 Lighting II Joint Strike Fighter propulsion systems.

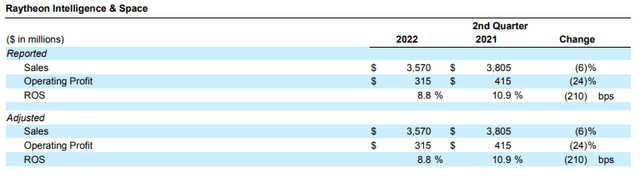

RIS results (Raytheon Technologies)

The disappointing performance of defense seemingly is visible in RIS (Raytheon Intelligence & Space) results. Sales declined by 6% but was largely driven by the divestiture of the Global Services and Training business. Organic growth was negative 1% during the quarter due to lower 3C and sensing sales partially offset by classified cyber programs. Profits were down due to the absence of a land sale last year, lower efficiencies and the absence of the divested business profits.

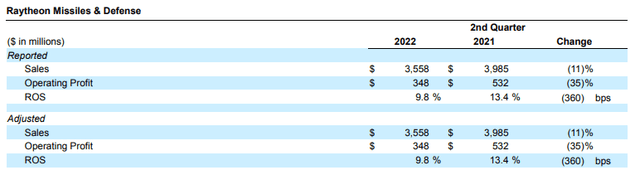

RMD results (Raytheon Technologies)

The results of Raytheon Missiles & Defense showed a 11% decline in sales. This was driven by expected declines and supply chain challenges offset by radar sales as well as the Next Generation Interceptor program. Profits declined by 35% due to unfavorable mix, unfavorable margin and lower volume.

A Challenging Environment

If you look at the segment results there’s nothing that really truly stands out for being extremely unexpected. What we see is that as air travel recovers, Raytheon Technologies is seeing better volumes across its services and OEM business while the defense business is largely coping with expected declines and lower volumes due to lower material receipts and supply chain issues. I believe what was truly disappointing is that Raytheon indicated that issues caught them off guard. Material receipts recovery has been slower than expected and the same holds for labor issues and supply chain challenges. Raytheon indicates that the issues mostly arise at the lower tier suppliers, but its statement that usually 75% to 80% of the laid off people return when positions open up and that now is just 25% really puts a sobering prospect on improvement in volume and efficiency.

Another reality is that titanium supply chain remapping is going to hurt. In the days prior to the invasion of Ukraine by Russia I pointed out the pain point that titanium could become as strategic asset for the aerospace industry and national security. In the days and weeks after, what was mostly echoed is that suppliers and OEMs had stockpiled and were able to remap. We’re now seeing Raytheon saying that the sanctions are preventing them to live up to their delivery promises:

But I would tell you right now, there is no other surprises on GTF beyond those structural castings. And there is always little things, David, but nothing huge. On the Pratt Canada side, you’re exactly right on titanium. And again, this is primarily around the sanctions and our inability to continue to buy nor our desire to buy anything from Russia. So we have been working to identify second sources, qualify them. I will tell you we will impact production lines at a number of our customers. I’m sure you’re going to hear that from them as well on the biz jet side. We’re just not going to be able to make all the deliveries.

Raytheon pointed out the biz jet side where pain would be felt, and it seemed to have sent shares of Bombardier (OTCQX:BDRAF) 10% lower.

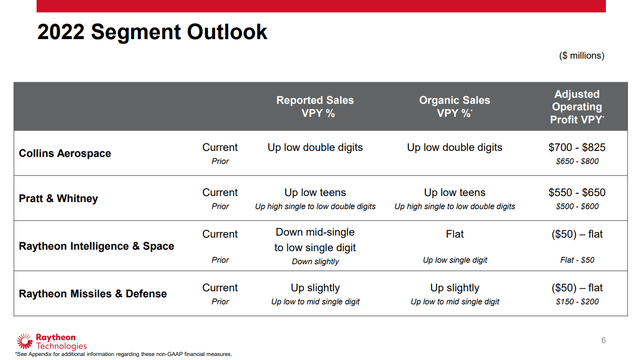

Raytheon Technologies sector outlook 2022 (Raytheon Technologies)

The plus and minuses come together in the new outlook for Raytheon Technologies. Guidance for Collins Aerospace are maintained, but driven by commercial aerospace strength the expected profit increases are lifted by $25 million to $50 million. Pratt & Whitney sales are expected to be showing sales increases of low teens in stead of high single digit to low double digits with a $50 million adjusted profit lift, also driven by the commercial aerospace sales.

RIS was expected to show low single digit organic growth, which has now been altered to flat and stable to $50 million lower profits. For RMD, sales are expected to be up slightly and its RMD profit had a relatively big disappointing adjustment with the profit increase being reverted to $50 million or flat from a $150 million to $200 million increase expected projected last quarter. Overall, Raytheon Technologies maintained its guidance for revenues, EPS and free cash flow.

Conclusion

The Raytheon Technologies report was not one that would make me pull my hairs. In fact, over the longer term I continue to believe in the strength of the combined business featuring defense involvement and exposure to commercial aerospace.

However, what was disappointing is the fact that Defense segments are not providing the stability that investors are looking for even though it was just three months ago that Raytheon Technologies had provided for 2022 and the company is now already forced to dial down expectations as material receipts have not improved as much as hoped and labor issues continue to be a problem throughout the supply chain. Raytheon Technologies really did fail there with its assessment on the realities in the aerospace industry and its supply chain.

Does it mean that I’m changing my rating on Raytheon? No. Raytheon Technologies has already shown why I like it as an investment. Last year I pointed out that shares of Raytheon were underperforming due to commercial as well as defense headwinds. Since then, shares of Raytheon Technologies gained 12.1% versus a 14% decline for the broader market and that appreciation was driven by a reversal in the commercial and defense headwinds and shows why Raytheon can be a nice company to have in your portfolio even when not all parts of its business are performing as desired.

Be the first to comment