Brian Koellish/iStock via Getty Images

When Qorvo (NASDAQ:QRVO) reported its September quarterly report, and the guidance more than offered investors a moment at the scariest of scary spook alleys. It was scary in the very best light. The company has a past record of resilient steady growth, state-of-the-art technology, and pristine performance. Investors ought to be asking with deep interest, what happened? Fortunately, management remained focused, honest, and forthright with its investors during the call. In time, this approach will pay huge dividends for the company with investors.

The Quarterly Report

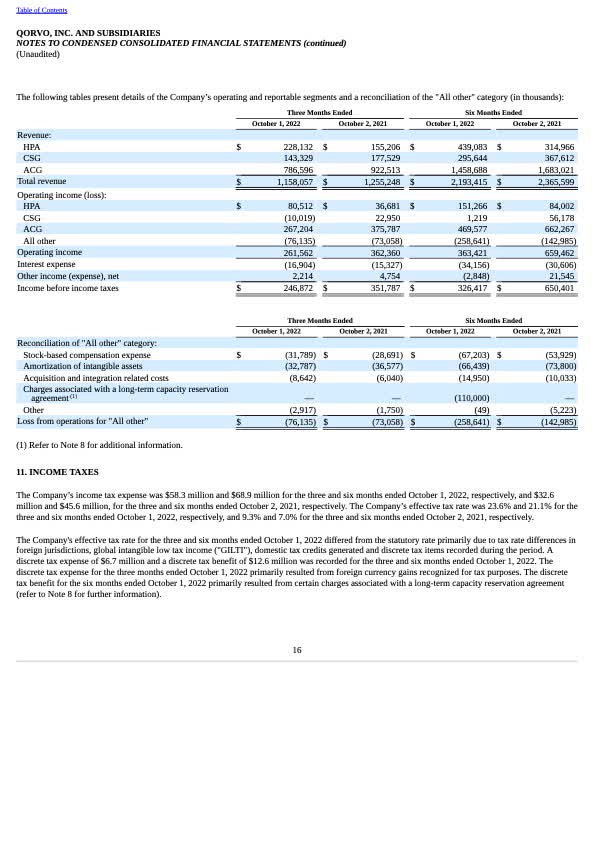

Last quarter, the company announced a new reporting system for its businesses, dividing itself into three major pieces. The first, high performance analog, consisting of defense and higher power applications, performed with strength. This segment signed a new agreement with SK Silting for a long-term supply of silicon carbide waters. The second business unit, Connectivity and Sensors, faced headwinds in consumer markets and inventory drawdowns, but achieved significant new design wins going forward. The weakness resided primarily within WiFi-enabled products. The last segment, Advanced Cellular, remained strong with a large customer ramp, Apple (AAPL) accompanied by weakness in the Android base. Long-term, Qorvo expects double digit growth with Sensing and Connectivity and High Performance Analog. It also expects high single digit growth with Advanced Cellar. The next slide found in the 10-Q for September summarizes the results by business. We encourage readers to review its contents.

Qorvo 10-Q

Of note about the quarter, Apple provides Qorvo with approximately 35% of its total business. Continuing, profitability for the individual businesses were HPA at 35%, AC at 34% and C&S at -7%. The non-GAAP earnings equaled $2.66 – slightly above the mid-point of guidance. Management also mentioned a tax rate increase to 15% due to tax law changes requiring 5 year write-off instead of full write-off for R&D capitalization. This tax law issue fixes itself either by legislation or neutralizes within a 5-year time frame. Finally, management announced a $2 billion stock repurchase program with a caveat, “The rate and pace in which we repurchased shares is based on our long-term outlook, low leverage, alternative uses of cash and other factors.” Management cancelled other buybacks. The September quarter was actually decent under the circumstances. But . . .

Guidance, the Scary Number

Guidance was given at $700 million to $750 million significantly below estimates; significantly below last year’s result of $1.15 billion. Non-GAAP earnings were guided at $0.50 to $0.75 – moving closer to zero. In conjunction with guidance, the company offered this statement,

“We expect sales to China-based Android smartphone OEMs to represent approximately 10% of total revenue during the December quarter. We expect this will mark the low point in our Android-based customer revenue and in the March quarter, we continue to project Android base revenue will grow sequentially.”

Management honestly addressed the China collapse. For investors, honest management is important. Several statements during the Q&A gave investors much color. Referring to China, the quarter-on-quarter change was -20% and -45% year-on-year. The company’s China revenue, when at its peak, represented 50% most of which was Android based. Looking back at past revenue generation, China revenue once represented approximately $600 million per quarter. Management also refused to confirm that guidance for March would be higher than December. In their answers, they made clear that Apple revenue seasonally declines in March, while Android through China and Samsung increases.

Future Growth

In spite of the lack of guidance, management highlighted the value of its coming design wins, ones telegraphed in prior conferences. Among the highlights, our short list includes:

- Room to grow content with Apple.

- Bulk Acoustic Wave (BAW) filter growth across a broad range of applications.

- Connectivity and Sensing being its highest growth market in the long-term lead by ultra-wideband, Matter and Wi-Fi.

- WiFi 7 is new exciting opportunity that will grow. (“There’s been a lot of cases in WiFi 6, where the PA that’s integrated in the SoC is sometimes good enough performance and they don’t need an external fab. That can’t occur with WiFi 7 which requires separate chips.)

- Low-band sockets in a flagship phone believed to be with Samsung.

Management summarized its feelings,

“So we’re pretty excited about that starting early next year. . . . I will say there’s one area that I think is another exciting opportunity for us as we move into WiFi 7. . So we’ve got great WiFi FEM socket win on a major Asia-based chipset platform provider on their reference design with our fans.”

Clearly, Qorvo’s significant wins with Samsung and others are blossoming into full bloom by the March quarter, a few months from now. Yes, the wins are meaningful, but management refused, probably wisely for now, to guide March revenue up.

The Stock Reaction That Didn’t

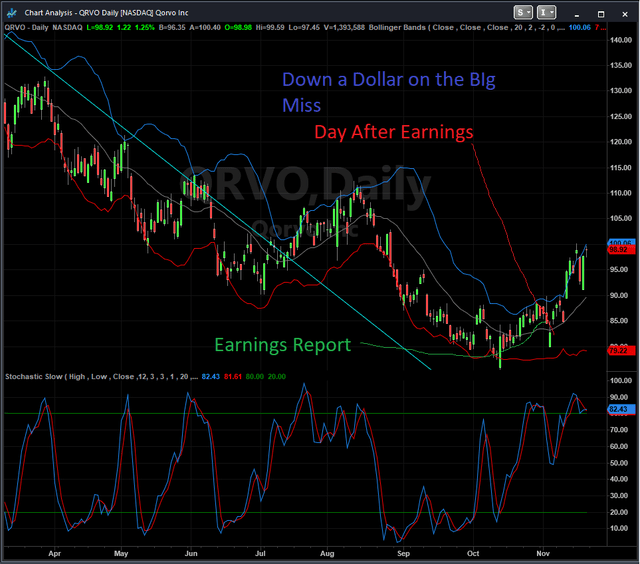

After the report, we expected a significant price correction that didn’t occur. The following chart made using TradeStation Securities illustrates the strange reaction.

TradeStation Qorvo

Qorvo’s price action was muted (down a dollar on the next day close) after the report and has continued to climb since. Often times, this represents a bottom has been in place. Also, of note, the price broke the major cyan down trend line several weeks ago.

Risk & Investment

We begin with a caution for Qorvo. In the guidance for December, the non-GAAP earnings guidance approached zero. Non-GAAP generally represents true cash flow, meaning that once negative, the company burns cash. It appears to us that another drop in revenue of $100 million places cash negative. This could come even with Apple performing admirably, something in this economic environment, not guaranteed. What happens if Apple starts a downward spiral? We, also, note that the world in general hasn’t started its recessionary downward spiral for consumer spending. Epoch Times headlined this, “Household Debt Sees Biggest Jump in 15 Years As Americans Rely More on Credit Amid Soaring inflation.” This forecasts consumer spending declines, which likely hits discretionary spending first.

On the other side of the coin, China demand is much stronger than the current sells rate being hindered by stuffed inventories for at least this quarter, plus Qorvo is winning a significant share of new business. The market also believes at least for now that a bottom is in place. In our view, owning right now is a coin flip at least until the March guidance becomes public. The above day bar chart also reminds investors that a price drop below $80 likely signals a sell from a break of the strong support. Qorvo is a great company caught in a once in a lifetime trap. At some point, it becomes a strong buy. For now, the scary guidance indicates a buy on weakness at beat, a sell if the underneath support is broken. Although this isn’t Halloween season, Qorvo did produce spook alley type guidance that at some-point becomes a screaming buy. We just don’t know for sure when the screams start.

Be the first to comment