vitranc/E+ via Getty Images

Broadmark Realty Capital (NYSE:BRMK) is a hard-money lender REIT with a loan book of $1 billion. In line with the market, BRMK stock has gone down for most of the past year. In addition to market risks, many writers predict a lower dividend.

Indeed, in the current economic context, a reduction of BRMK’s dividend seems natural, but I argue that even with a reduced dividend, the company will still be yielding 8% at current prices.

In addition, because of its low leverage, I think the company is relatively more insulated from market risks than its competitors.

Unleveraged lender

BRMK has a loan book of about $1 billion deployed ($1.5 billion committed).

The company’s business is to make quick lending decisions to real estate developers based on parameters that are different from those used by banks. According to BRMK’s webpage and the company’s latest 10-K, they concentrate on a developer’s experience, the property’s qualities and the developer’s net worth, while banks put more emphasis on the developer’s credit score and the property’s income generation capacity.

Hard-money loans are much shorter than regular mortgages. In general, they don’t last more than 1 year. In this respect, BRMK is no different with an average loan maturity of 13 months at origination in 2021. Hard-money lenders charge a higher rate than traditional lenders, which for BRMK stood at about 10% on average through 2021.

BRMK is nationally diversified, with loans in 19 states, although four of them, Texas, Colorado, Utah and Washington, concentrate 75% of the book.

Just like Manhattan Bridge Capital (LOAN), a hard-money lender in the New York Metropolitan Area, BRMK is mostly equity financed. The company only owes $100 million in secured notes maturing in 2026 and yielding 5% and has an open but undrawn credit facility for $135 million.

According to the company’s investor presentation, BRMK has only produced $12 million in losses from a total historical portfolio of $3.8 billion, which comes to around 0.3%. This is since 2019, because before the company was also in operations but was not public.

As of 2021, the company had $100 million in defaulted, non-accrual loans, and about $60 million in foreclosed property. This represents 18% of the loan book, quite different from the previous 0.3%. However, the company has an average LTV ratio of 60%, which means that even defaulted and foreclosed loans should not represent principal losses.

Storms ahead in the market

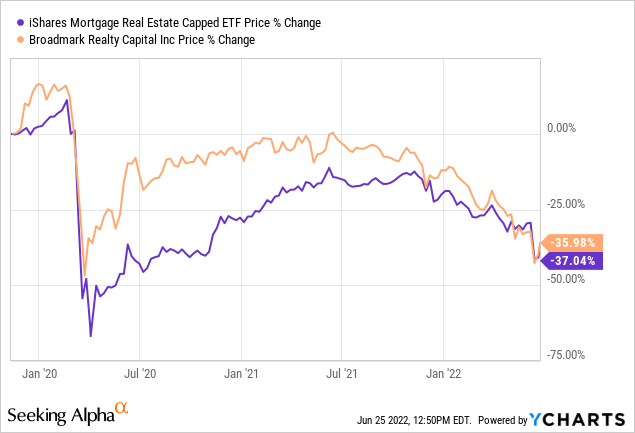

Of course, BRMK is getting hit, like most mortgage REITs, because the higher interest rate environment shades doubts over BRMK’s borrowers.

I believe this association misprices BRMK, because BRMK does not operate in the same market, nor with the same structure, as most other mortgage REITs.

The biggest difference is that BRMK’s interest rate risk is much smaller than that of its mortgage REIT peers because its loan maturities are much shorter. A mortgage REIT whose assets are 5-year, 10-year or even longer-maturity mortgages has to lower the price of its assets with each interest rate increase, BRMK does not suffer this kind of problem as much.

Another difference is that BRMK is unleveraged. This provides several protections. First, if the company’s revenues fall, it does not suffer from financial leverage, meaning that earnings are less affected than with more leveraged companies. Second, the company has the strategic flexibility to shrink or keep the size of its loan book, while other companies might be forced to shrink it because their short-term financing dries up. Third, and most importantly, even a higher default rate and loss level should not affect BRMK as much as it does a leveraged peer.

Dividend and profits under question

BRMK paid a yearly dividend of $0.84 per share in 2021. At the current price of $7 per share, that represents a mouthwatering 12% yield.

According to the company, last year it generated $94 million in distributable profits (net earnings minus non-cash expenses), a proxy for its dividend generation capacity. However, it distributed around $110 million in dividends, meaning it was already having a small gap.

Last quarter, according to the company’s 10-Q, distributable earnings fell to $0.17, but the company kept the monthly dividend at $0.07 per share up until April at least. That level represents $0.21 in dividends a quarter, with lower earnings.

The question is whether or not the company can sustain the drain. First, one must answer what will happen with earnings, and then, how long could BRMK drain on cash if earnings are lower than dividends.

Regarding the first question, I think that BRMK has more chances of keeping the current profitability, or even increasing it a little, than to decrease it. The reason is its privileged liquidity position and the extent to which supply dries faster than demand in the hard-money lending market. The company also has very little chance of growing its income and loan book substantially in this context.

It seems obvious that demand for loans should recede as developers face less demand in their own market. Households will face higher mortgage payments, therefore not buying as much. Housing represents 40% of BRMK’s book. Developers will face similar constraints on the 60% commercial portfolio remaining. So the question about demand is better answered on the negative.

But the market is also affected by supply. My thesis is that BRMK’s competitors will have to reduce their lending because their financing dries up, especially if it is short term or balance sheet-dependent financing, like credit facilities. Because BRMK is equity financed, it gets to decide when to shrink its balance sheet and may be able to absorb the demand that is not covered by competitors.

It is still very early to judge on this point, given that mortgage rates really started escalating in January. Up to Q1 2022, BRMK showed higher originations than one year ago.

Another factor helping BRMK keep its earnings is the increase in rates. While BRMK might suffer from lower origination, it compensates by higher rates. Every point in interest rates is approximately equal to a decrease of 10% in origination to generate the same interest income, starting from a 10% interest level. Say for example last quarter BRMK generated $175 million in loans, or a potential $17.5 million in interest income lending at 10% plus $5 million in fees at the current 3% level. For the company to generate the same income at 11% it only needs to lend $160 million, or $15 million less.

In terms of defaults, the company is exposed but actually defaulted non-accrual loans went down for the quarter from $100 million to $66 million, without transfers to real estate accounting for that reduction. However, for the losses to translate to non-provisioned losses, currently accounting for 1% of origination, property prices should fall substantially.

Because it now has to pay for the $100 million notes taken in December and amortize the credit facility expenses, the company still has to come up with $6 million more in operating income than it did last year to prevent net income from falling.

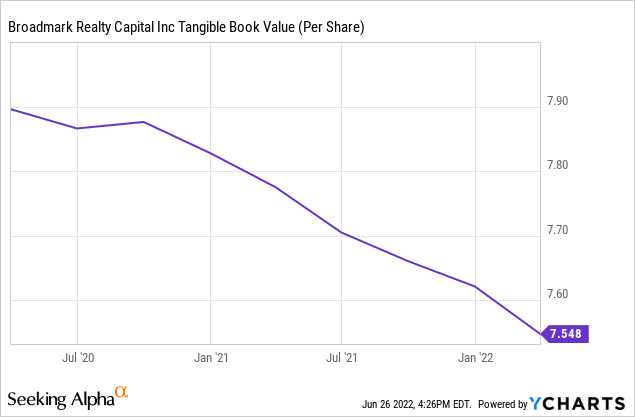

Additionally, it will be very difficult for the company to grow beyond the $1 billion book because debt financing will probably be more expensive and until markets recover the stock currently trades below tangible book value, making share issuance financing less desirable. This means that BRMK can only grow through interest rate increases.

Summarizing, the context shows that the company’s earnings are not extremely threatened by the current environment. In fact, the company might be able to increase its earnings with interest rates, albeit not a lot given that its loan book growth is restricted.

However, even if dividends are higher than earnings, that should not represent a terrible solvency risk for BRMK. For example, at the current deficit of $0.16 per share per year, the company is losing $21 million a year in cash. With cash holdings of $100 million, it does not seem as if it would cause the company to go bankrupt.

Also, even if the dividend fell, the yield is still interesting. Considering a 33% dividend decrease, from $0.21 to $0.14, coincident with net accrual earnings last quarter, the company would still be yielding 8.3% annually.

Conclusions

BRMK is being punished as if it belonged to the general mortgage REIT class when several characteristics make the company safer to the current risk environment than its class peers.

There are substantial doubts that the company can maintain last year’s dividend, but the company’s profitability and solvency are not threatened. Even if the dividend got cut by 33%, the stock would still yield 8% at current prices.

I think it is a good opportunity to invest in a conservatively managed REIT that can return to growth once the economy absorbs the current shocks.

Be the first to comment