onurdongel/E+ via Getty Images

Investment Thesis: While PVH Corp. has seen a significant decline this year – a strong cash position, attractive valuation, and the easing of COVID restrictions in China could see the stock rebound to the upside.

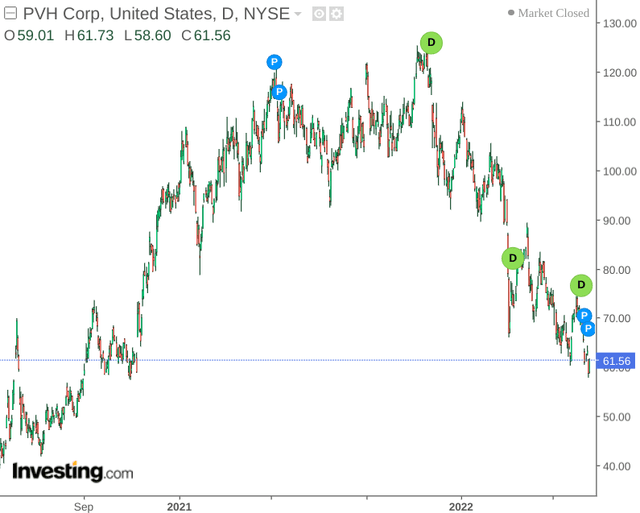

In a previous article last March, I made the argument that PVH Corp. (NYSE:PVH) has potential for a rebound following the decline we had seen so far in 2022.

However, the stock has continued to decline to a level of just over $61 at the time of writing:

With inflation and supply chain concerns having placed pressure on the stock with potentially further declines possible, the purpose of this article is to assess how financially resilient PVH Corp. can remain in the face of current macroeconomic pressures – and whether the stock has potential to rebound once these pressures start to abate.

Cash Analysis and Recent Performance

During 2020, many companies in the luxury clothing industry conserved significant amounts of cash in light of the fact that in-store sales had sharply fallen and boosting cash levels was necessary in order to compensate for the drop in revenue.

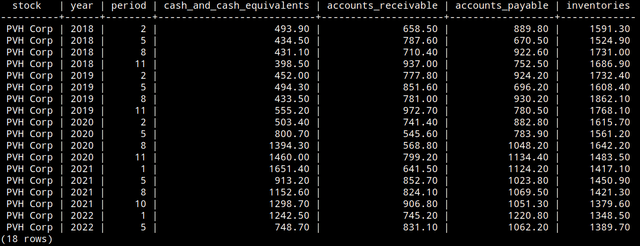

To analyze the cash situation of PVH Corp, I decided to collate quarterly data on cash and cash equivalents, accounts receivable, accounts payable, and inventories.

Figures sourced from historical quarterly reports. SQL table created by author.

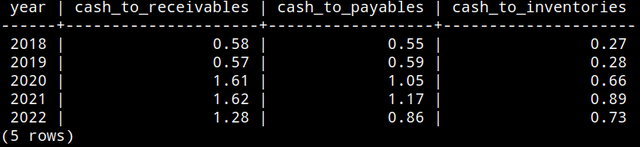

Using SQL, I calculated ratios for cash to receivables, cash to payables, and cash to inventories, with the ratios averaged for each year. Note that the first two quarters of 2022 are included under the relevant entry.

Financial ratios calculated by author using SQL.

For 2021 and the first two quarters of 2022, we can see that the ratio of cash relative to receivables, payables, and inventories is higher than in 2019. This indicates that even with higher costs both as a result of inflation and an increase in cost of goods sold, PVH Corp. is still holding on to relatively more cash than it was doing before the pandemic.

In this regard, while it is probable that the company will face further pressure as rising costs and a potential drop in demand result from inflationary pressures – the company still seems to be in a good cash position to handle a short-term decline in sales growth.

Moreover, as well as having sufficient cash reserves – PVH Corp. has also managed to significantly decrease its long-term debt from just over $3.5 billion in January 2021 to just over $2.2 billion in May 2022.

With that being said, we do see that while PVH Corp. showed sales growth as compared to the same quarter last year, the pace of growth has slowed from that of the previous year.

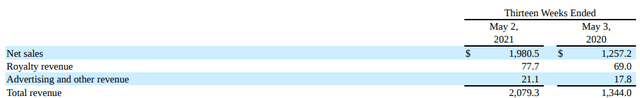

Net sales growth – May 2020 to May 2021

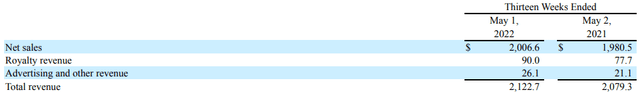

Net sales growth – May 2021 to May 2022

From this standpoint, it remains to be seen whether sales growth can continue into 2023 – or whether inflationary pressures will prove too great.

Looking Forward

In addition to the broader inflation concerns, two reasons why PVH Corp. specifically could see lower sales manifest later this year is due to both lockdowns in China earlier this year impacting demand in Asia as a whole, as well as the closure of the company’s manufacturing base in Ethiopia, as part of an effort to relocate supply chains closer to home. While this could be a good move over the longer-term, this is likely to impact production capacity for PVH Corp. in the near-term. Even if demand remains robust, there is a risk that the company will be unable to meet that demand.

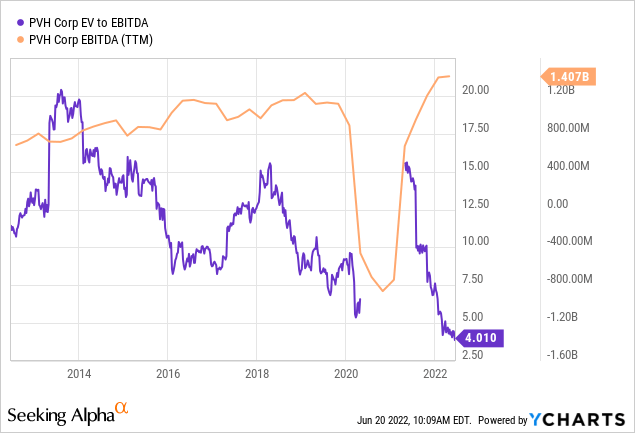

From a valuation standpoint, we can see that the company’s EV/EBITDA is trading at a 10-year low, while EBITDA has rebounded strongly to a 10-year high.

ycharts.com

In this regard, there could be a case for significant upside if sales and earnings growth manages to remain resilient in the remaining quarters for 2022.

In spite of the risks with respect to supply chains and inflation, a potential rebound in demand from China could provide a significant boost to sales, and the company seems to be in a strong cash position to withstand potential short-term pressures.

Conclusion

To conclude, PVH Corp. has come under pressure due to a broader market downturn as well as the impact of supply chain concerns and the recent lockdowns in China.

However, should PVH Corp. prove able to withstand short-term pressures, then there could be a case for a rebound to prior highs of near $130.

Be the first to comment