Michael M. Santiago/Getty Images News

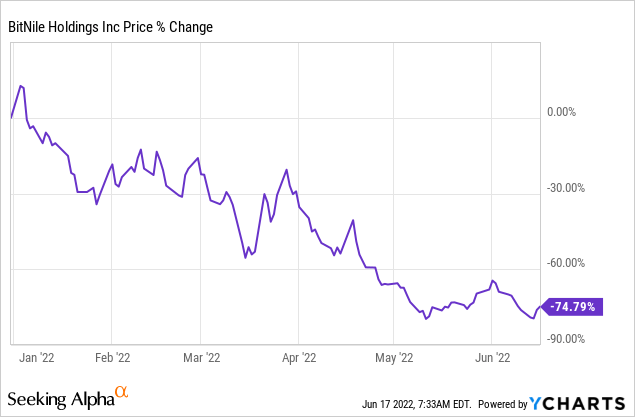

BitNile Holdings (NYSE:NILE) has turned into a penny stock that can easily go up 5 times and, arguably, still be undervalued. The main reason why the stock is severely depressed, trading below $0.3 per share at the time of writing this article, is the common stock ATM (at-the-market) offering. Eventually, the ATM program will come to end, the selling pressure will ease, and, when this happens, NILE is poised to explode.

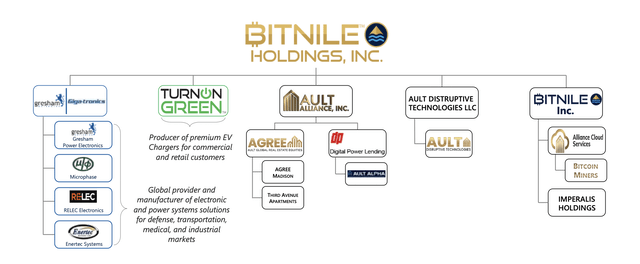

NILE is a diversified holding company with several operating segments within multiple verticals. Specifically, the segments include:

- commercial real estate

- Bitcoin mining and data center operations

- commercial lending and activist investing

- aerospace and defense

- EV charging and technology

NILE also sponsors a SPAC, Ault Disruptive Technologies (ADRT) that intends to focus on opportunities to acquire assets with innovative, emerging, and disruptive technologies.

The organisational structure is depicted below:

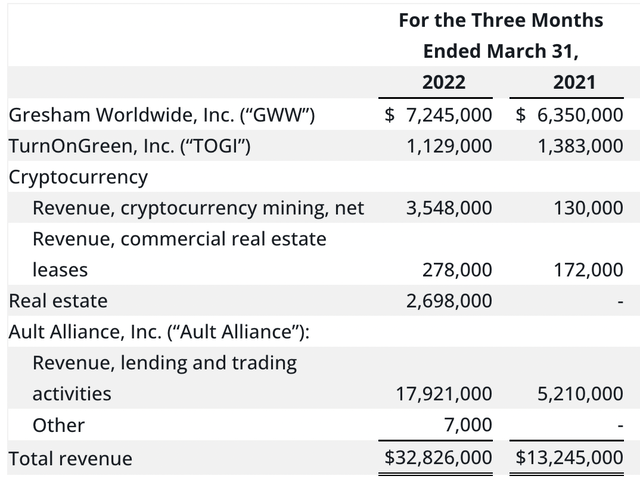

There is no doubt that BitNile is a very firm believer in the crypto space. Even its name contains the word “Bit”, which alludes to Bitcoin. BitNile owns and operates a 617,000 sqft data center in western Michigan (housing Bitcoin miners and hyperscale data center solutions) and also holds a stake in a Decentralized Finance community and trading startup called Earnity. It is fair to say that BitNile’s investments in the crypto space will increase substantially over time. As such, most investors perceive BitNile as a crypto play. However, this is incorrect. Cryptocurrency reflected less than 12% of total Q1 2022 revenue, an amount similar to the newly formed real estate segment.

Just like the crypto segment, real estate is expected to generate substantial cash flows going forward. In fact, the real estate segment was non-existent in 2021, generated almost $2.7 million in revenue in Q1 2022 (more than $10 million annualized), and is poised to increase exponentially through additional acquisitions and once various developments reach income generation mode.

BitNile’s real estate segment includes a portfolio of four midmarket select service hotels across the Midwest (526 rooms in total) operating under world-class brands, namely Hilton Garden Inn, Residence Inn (Marriott) and Courtyard (Marriott). Also, one of its hotels, the 135 room Hilton Garden Inn, Rockford, IL, has a vacant 1.6-acre parcel adjacent, primed for development of a possible restaurant, additional hotel, or mixed-use retail facility. In addition, BitNile has interests in a newly developed ultra-luxury hotel in New York City and a multi-family residential condominium development property (high-rise multifamily project; 23-story 285 unit mixed use development – see proposed rendering below) located in the Central Business District of St. Petersburg, Florida (with walking access to downtown and the Tampa Bay). The development is anticipated to break ground in the Fall of 2022.

BitNile Holdings

All in all, it is anticipated that the real estate segment will act as an anchor of stability that will allow BitNile to reinvest its stable operating cash flows (rent cheques derived from real estate) into more volatile sectors with greater upside potential. Also, the real estate assets will provide substantial collateral value, as property value increase in the future, to raise additional funds through low interest rate, non-recourse, mortgages. This is a nice business model to have.

Putting real estate and crypto aside, the biggest segments at BitNile are defense (via Gresham Worldwide), which generated more than 20% of Q1 2022 revenue, and investments (lending and trading activities; essentially BitNile acts like a hedge fund, activist investor and mini Berkshire Hathaway (BRK.B)), which generated more than 50% of Q1 2022 revenue.

Taking into account all of the above information, it seems that, at least on paper, BitNile looks like a very exciting company to invest in. Yet its share price is in severely depressed territory. In fact, the share price is down 75% YTD and the market cap has fallen below $100 million.

There is a very simple explanation for this terrible share price performance. Even though one could blame the general stock market turmoil and the collapse of Bitcoin, it predominantly has to do with the ongoing common stock ATM (at-the-market) offering, which has created severe selling pressure. On a more positive note, BitNile has raised a substantial amount of capital, with total assets surpassing $500 million as of March 31, 2022. On an even more positive note, the common stock ATM offering is coming to an end. Reading between the lines, this was hinted by Milton Todd Ault, BitNile’s CEO, in a recent Tweet dated 15 June 2022 whereby he stated:

$NILE has filed a pro supp to sell up to an additional $46.4 million of non-dilutive Series D Preferred Stock. It will allow us to potentially raise long-term capital and continue building our company. Please read the pro supp for more information

Emphasis on “non-dilutive”. This is important since, at the same time, it was revealed that the CEO purchased 1 million shares in the open market. This is a strong vote of confidence.

With a $500M+ diversified asset base, which includes an ever-increasing focus on high-quality real estate, with company-wide operating cash flow poised to go into attractive positive territory, with the common stock ATM coming to an end, with the CEO purchasing a substantial amount of NILE stock, with the balance sheet being in strong shape (paying off $66 million in senior secured notes and ending Q1 2022 with $56 million in positive working capital), and with the stock trading at a fraction of NAV, BitNile is well positioned to outperform. Lastly, some of the passive investments BitNile has made into other companies, many of which are listed, have a bright future. For instance, Mullen (MULN) has a large number of positive catalysts, most expected in the coming days within June, namely the Fortune 500 order, impressive solid-state polymer battery test results and licensing agreements with OEMs, and joining the Russell 2000 and 3000 Indexes. It goes without saying that if Mullen (or any other investee company) shines, BitNile stands to benefit tremendously.

In closing, even though BitNile has substantial upside potential, one needs to be very mindful of various company-specific risks that, if materialised, could cause further pain to shareholders. Because NILES’s market cap is below $100 million, it doesn’t mean that it cannot fall much further, despite the stock trading well below NAV and the company’s assets being highly diversified. In my view, this has to do with the company’s common stock ATM offering. If, for whatever reason, it continues at a similar pace, then the share price will most likely continue its downward trajectory. Also, if the share price remains below the $1 mark, the company might be forced to carry out a reverse split, in order to meet listing requirements, which could attract renewed interest from short sellers. Again, in my view, it all has to do with financial engineering and the common stock ATM offering. The good news is that, during the past month, the share price has largely stabilized in the 0.25-0.30 range. This is an important milestone in the turnaround story as the share price has stabilized literally for the first time since the beginning of the year, after many months of severe pain. And this coincides with the CEO purchasing 1 million shares and concurrently announcing that the company is now raising capital via non-dilutive Series D Preferred Stock. Things are arguably looking brighter on this front. That said, it is reasonable for investors to be traumatized and afraid about another common stock ATM offering. After all, until May, the share price was in constant decline, largely in line with the common stock ATM offering. I am not against raising capital if it can be done in an accretive manner i.e. done in a smart way when the share price is increasing, just like AMC (AMC). For instance, in its last ATM round, AMC sold 11.55 million common shares at an average price of approximately $50.85 per share (this was during the era when AMC’s share price was booming, fuelled by retail investors). In any event, it is important to note that NILE’s ATM offering took place in order to raise capital for growth initiatives, across different industries, as discussed above, and not for survival purposes. As such, any future potential dilution will depend on the investment pipeline and whether management wants to grow at any cost. It will not be done to pay the bills. This is important to emphasize. So far, growth has been funded predominantly by common shareholders and the cost has been detrimental; massive dilution at unfavorable prices leading to a 75% drop in the share price YTD.

Regarding cash burn and sustainability concerns, in the first quarter of 2022, cash provided by operating activities was $25 million, a very positive outcome especially after taking into account that operating cash flow was negative $14 million in the first quarter of 2021. However, this figure is largely affected by volatile metrics such as marketable securities. If the company can manage to sustain positive operating cash flow metrics in the coming quarters, the turnaround will be much faster. Importantly, operating cash flow is anticipated to be more stable going forward, with support offered by more stable segments such as real estate, as outlined in this article. The balance sheet is solid. Cash and cash equivalents, including restricted cash and marketable securities held in trust account, outweigh total liabilities by a wide margin. Interestingly, total assets (more than $500 million as of Q1 2022) outweigh total liabilities by more than 5 times. This suggests that there is ample collateral value to raise debt capital, if the company wishes to do so. As such, funding any future operating cash burn at NILE seems to be manageable (it is more a problem of the past), given its flexible balance sheet and clearer path to generate positive operating cash flows. But this risk must not be disregarded until the company manages to consistently generate sizable operating cash flows that will provide less incentive for management to raise additional capital, especially via highly dilutive common stock ATM offerings. Despite a growing asset base and revenue expected to surpass the $150M mark by year end, we still have a long way to go until the company reaches the point whereby it can rely on internally generated cash flow to fund substantial growth initiatives as well as reward shareholders.

In this article I wanted to shed some light that the key risks relate mostly to the mechanism of how the company will raise additional capital going forward. Will it be accretive share offerings (at higher share prices) or will it be more of the same (destructive dilution at lower share prices)? This depends on the management team. BitNile is so highly diversified right now that focusing on any one segment (e.g. cryptos) in order to justify the underperformance or speculate on the turnaround is of little value, in my view, especially when taking into account that the share price trades at such a big discount to NAV, and even to liquid assets such as cash and marketable securities. This is not an investment for someone with a low risk appetite.

Be the first to comment