Smoczyslaw/iStock via Getty Images

Shares of Prudential (NYSE:PRU) have been a mediocre performer over the past year down 12%, though they have rallied over 50% since I last recommended buying shares in the company. With the company set to report third quarter earnings on November 2, now is a good time to review operations. The company is performing relatively well, though I expect shareholder returns to moderate somewhat over the next year. I view the stock as a “hold.” Its shares should hold up better during market downturns, and it pays a very secure dividend, but the upside is likely no more than 10%.

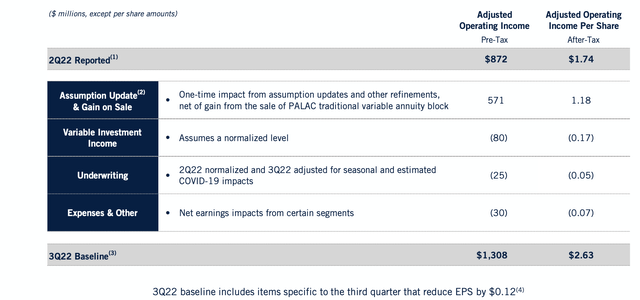

In the company’s second quarter, it earned $1.74 in adjusted operating income, down from last year’s $3.60. Its US insurance business had an operating income of $370 million vs $1.05 billion last year due to a one-time assumption change. Every year, insurers review how losses are materializing relative to assumptions underlying their policies and make an adjustment to rebase earnings for the realized outcome. Its overseas business similarly saw earnings fall, coming in at $555 million from $803 million due largely to one-time adjustments.

On net, Prudential essentially had over-earned in the past by about $105 billion, partially offset by a one-time gain from the sale of its VA business, which it rectified this quarter. When a company writes a life insurance policy, it cannot know when you will die, so it reports quarterly earnings based on an actuarially assumed date. As people die sooner or later than expected, it refines the estimated profitability, taking a charge or a gain to right-size its accounting. Essentially, this hit to Q3 earnings relates to the past policies performing a bit worse than hoped, rather than anything management’s decisions today are doing to the business. These can move either way. Last year, for instance, PRU enjoyed a $180 million benefit and in 2020 an $84 million loss.

This year’s adjustment was a bit larger than normal. Additionally, the company underearned on its alternative investments by about $80 million. While private assets are not revalued every day, they tend to be correlated to the stock market, so in periods like now when the market has performed poorly, these assets underearn. That was an $80 million drag. Unlike the assumptions update, I expect this headwind to be repeated in Q3 and Q4, given the ongoing weakness in the equity market. Adjusting for these items, earnings would have been about $2.63.

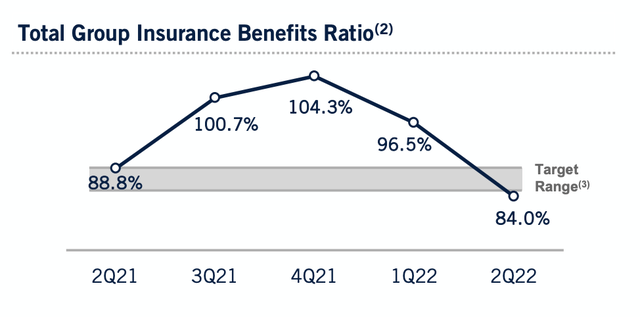

On the insurance business, I was encouraged to see that loss rates have improved from their poor 2020-2021 performance when excess mortality and disability from the COVID-19 pandemic weighed on results. With the impact of the pandemic (hopefully) largely behind us, its combined ratio has returned back to the target at 84% (100% represents breakeven). This should support underwriting profitability in the coming quarters.

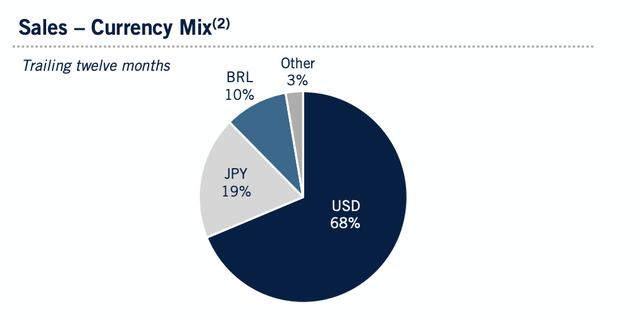

Prudential’s overseas operations account for 41% of its profits, led by a leading position in Japan, and small businesses across higher-growth emerging markets. Given the strength of the dollar, the translation effect may be a headwind for profits. Fortunately, though, the majority of policies written overseas are actually denominated in US dollars. While its yen exposure will be a headwind, this is unlikely to impact profitability by more than low-single digits in Q3.

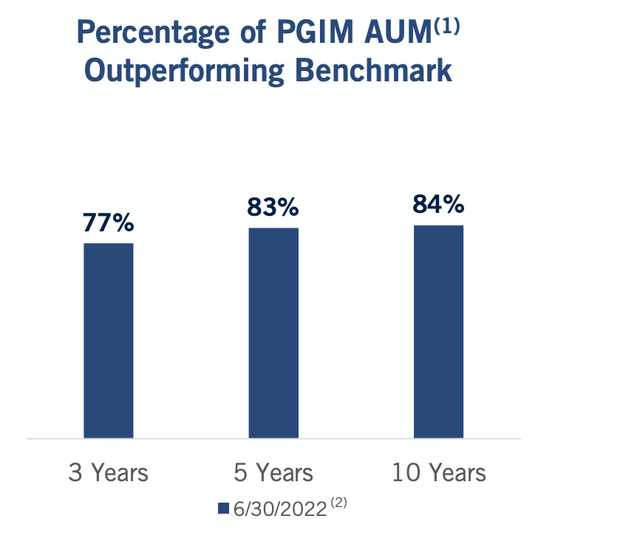

In addition to providing insurance, Prudential sells asset management services to other companies and individuals through PGIM, which generates about 15% of the company’s profits and is less capital-intensive. Assets under management (‘AUM’) have fallen to $1.41 trillion from $1.73 trillion over the past year and given the market performance I expect AUM to be down again this quarter. This has been a steady growth unit, driving positive inflows in 18 of the past 19 years. While flows are a -$4.5 billion so far this year, that is not a bad performance in a year many investors are moving to cash. It also highlights that the AUM decline is almost entirely driven by markets and not outflows, which should make them more recoverable. Indeed, PGIM funds are largely beating the market, which should help retain clients.

Moreover, PGIM’s fees are only down 6% this year, significantly outpacing AUM. This is because Prudential has been able to generate better flows in higher-fee products in particular alternatives. It has $269 billion in alternatives, $96 billion of which is private credit, a particularly in vogue asset class. While this unit is not immune to markets, it remains well-positioned.

Now, one thing that may be eye-catching is that Prudential’s book value was $74.72 vs $160.31 last year. This is because it went from an unrealized gain of $6 billion on its investment portfolio to a $15 billion loss. Insurers generally hold assets to maturity as they buy long-dated bonds to match the long-dated liabilities of life insurance policies. So long as there are no credit issues, the unrealized gains/losses should migrate toward $0 over time. We have seen other companies like MetLife (MET) and Lincoln Financial (LNC) report similar declines. Adjusted book value, which excludes these movements, was flat at $104.19 and is a better indicator of PRU’s financial position.

Of its $418 billion investment portfolio, 78% is in fixed income and another 13.4% is in commercial mortgages. The yield on fixed maturities fell from 3.68% to 3.6% over the past year, With interest rates substantially higher over the summer, we should start to see book yields rise, but this would be a slow process given the long-dated nature of its assets. Still, it is a modest tailwind to earnings power.

During Q2, the company returned $832 million to shareholders, including $457 million in dividends and $375 million in stock, about half of last year’s buyback. I would expect this slower pace of buybacks to continue. Prudential had a 456% risk-based capital ratio at year-end, but capital is down $1.3 billion year to date due to market movements while risk measures have risen. As a consequence, RBC is just a bit over 400%, which is still healthy and consistent with strong financial health. Given ongoing market volatility in Q3, it may have fallen slightly further. Accordingly, management is likely to pull less capital up from subsidiaries and into the holding company. That is already happening with dividends from subsidiaries of $144 million YTD from $865 million last year. By taking less in dividends, the insurance operating companies build more capital, but the holding company has less cash with which to buy stock.

Due to proceeds from its variable annuity sale, the holding company has $7 billion in liquid assets, above the $3-5 billion target. As a consequence, the company can return capital to shareholders without taking dividends for some time. With a $457 million per quarter dividend, I would look for share repurchases to be in the $250-$375 million range over the next few quarters, or about $750 million in total capital returns, as management slowly works down its excess liquidity position while taking less in dividends from subsidiaries.

Prudential has proven to be a long-term value creator. Over the past five years, it has grown adjusted book value per share by about 7% and dividends by 10%. It has about $10-11 in run-rate earnings power and significant parent company liquidity. I expect it to raise its dividend by mid-single digits in Q1 of next year, and it offers a 5.3% dividend yield. However, when it reports earnings in November, investors should expect a slower pace of buybacks and emphasis on balance sheet integrity from management in this period of uncertainty. As such, I expect book value of $104 to be a ceiling for where shares can rally to. PRU is a good option for income-oriented investors, but those seeking greater upside potential will be better off looking elsewhere, in my opinion.

Be the first to comment