DNY59

Earnings of Customers Bancorp, Inc. (NYSE:CUBI) will most probably dip this year due to higher provisioning for expected loan losses and lower paycheck protection program fees relative to last year. Further, non-interest expenses will surge this year due to high inflation as well as team growth. On the other hand, subdued loan growth will likely support earnings. Overall, I’m expecting Customers Bancorp to report earnings of $7.45 per share for 2022, down 16% year-over-year. Compared to my last report on the company, I’ve decreased my earnings estimate mostly because I’ve reduced my margin estimate and increased my non-interest expense estimate. For 2023, I’m expecting earnings to dip by 5% to $7.10 per share. I don’t believe that this is a good time to buy Customers Bancorp. Therefore, I’m downgrading the stock to a hold rating.

Internal Factors to Drive Loan Growth

After declining significantly for three quarters, the loan portfolio grew by 11% in the second quarter of 2022, or 45% annualized. The management is targeting double-digit loan growth across all verticals, as mentioned in the latest earnings presentation. I believe the management’s target is achievable because the portfolio has already increased by 7.9% in the first half of 2022.

Moreover, the management is prioritizing geographical expansion, which should boost the loan portfolio. Customers Bancorp has recruited regional commercial and industrial teams and specialty lending teams in this regard, as mentioned in the presentation. Additionally, the management mentioned in the latest conference call that the number of clients in the pipeline was greater at the start of the third quarter compared to the beginning of the second quarter.

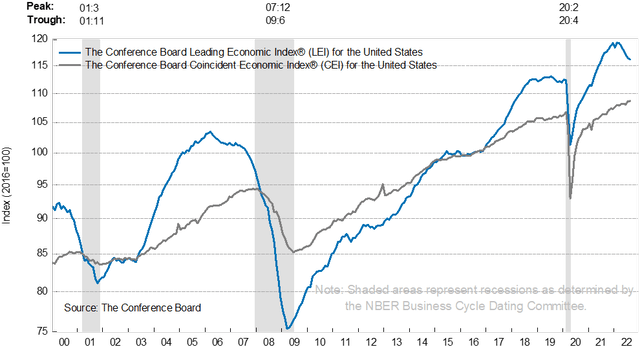

Considering these factors, I’m expecting loan growth to remain at a decent level in the second half of 2022. Beyond 2022, I’m expecting loan growth to slow down further as high rates will temper credit demand. Further, several indicators point towards an economic slowdown or recession, including the leading economic index. Customers Bancorp operates across several states, including California, Texas, and New York. As a result, the national leading economic index is a good gauge of credit demand. As shown below, the index has declined throughout this year.

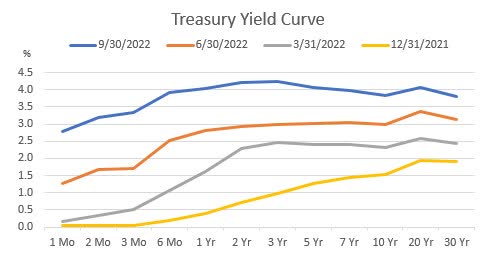

Further, the inverted treasury yield curve is an indicator of an upcoming recession. The yield curve started inverting back in the first quarter of 2022.

U.S. Treasury Department

Considering these factors, I’m expecting the loan portfolio to grow by 2% in the last two quarters of 2022, and 1% in every quarter of 2023. For the full-year 2022, I’m expecting loan growth of 11.9%. Compared to my last report on the company, I’ve increased my loan growth estimate because of the second quarter’s surprising performance.

Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Financial Position | ||||||||

| Net Loans | 8,504 | 9,508 | 15,609 | 14,415 | 16,127 | 16,782 | ||

| Growth of Net Loans | (0.2)% | 11.8% | 64.2% | (7.7)% | 11.9% | 4.1% | ||

| Other Earning Assets | 711 | 1,262 | 1,905 | 4,316 | 3,883 | 3,961 | ||

| Deposits | 7,142 | 8,649 | 11,310 | 16,778 | 17,629 | 18,345 | ||

| Borrowings and Sub-Debt | 1,668 | 1,693 | 5,820 | 1,180 | 1,727 | 1,762 | ||

| Common equity | 739 | 835 | 900 | 1,228 | 1,334 | 1,573 | ||

| Book Value Per Share ($) | 22.9 | 26.4 | 28.4 | 36.5 | 39.7 | 46.8 | ||

| Tangible BVPS ($) | 22.4 | 25.9 | 27.9 | 36.3 | 39.6 | 46.7 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

Margin to Remain Unchanged

Customers Bancorp’s margin declined by 21 basis points during the second quarter of 2022, partly because of lower paycheck protection program (“PPP”) fees compared to the first quarter. Customers Bancorp’s margin is barely rate-sensitive due to the combination of loan and deposit mixes. Around 65% of interest-earning assets are market sensitive, as mentioned in the earnings presentation. These rate-sensitive assets include floating loans, floating securities, and cash. The deposit book is also heavy on rate-sensitive deposits. Interest-bearing demand, savings, and money market accounts altogether made up 68% of total deposits at the end of June 2022.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis point hike in interest rates could boost the net interest income by 5% over twelve months. This analysis assumes a rate shock. As the rate upcycle has been gradual this year, the impact will be lower than 5%.

Considering these factors, I’m expecting the margin to remain mostly unchanged through the end of 2023. Compared to my last report on the company, I’ve reduced my margin estimate due to the second quarter’s results.

Recent Elevated Provisioning to Ease Pressure for the Second Half of the Year

Customers Bancorp’s provisioning was above average during the last four quarters. As a result, the allowances surged to 558% of non-performing loans by the end of June 2022 from 270% at the end of June 2021, as mentioned in the earnings release. Due to the high provisioning during the first half of 2022, I’m expecting provisioning to decline in the second half of the year despite the high inflation environment, which should trigger financial stress for borrowers. Overall, I’m expecting the net provision expense to average 0.25% of total loans in the last two quarters of 2022 and 0.24% of total loans in 2023. In comparison, the net provision expense averaged 0.20% of total loans in the last five years.

Expecting Earnings to Fall by 16%

Earnings will likely dip this year due to higher provision expenses as well as lower paycheck protection program income. Further, non-interest expenses will likely surge this year as high inflation and a tight labor market will boost salary expenses. Moreover, the ongoing recruitment and management’s expansion efforts will drive non-interest expenses.

On the other hand, the anticipated loan growth will likely support earnings. Further, Customers Bancorp is on track to launch the banking-as-a-service (“BaaS”) business, which the management expects to boost non-interest income in 2023, as mentioned in the conference call.

Overall, I’m expecting Customers Bancorp to report earnings of $7.45 per share for 2022, down 16% year-over-year. For 2023, I’m expecting earnings to slip by a further 5% to $7.10 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 258 | 277 | 404 | 685 | 674 | 713 | ||

| Provision for loan losses | 6 | 24 | 63 | 27 | 60 | 40 | ||

| Non-interest income | 59 | 81 | 102 | 78 | 70 | 73 | ||

| Non-interest expense | 220 | 232 | 267 | 294 | 350 | 425 | ||

| Net income – Common Sh. | 57 | 65 | 119 | 300 | 250 | 238 | ||

| EPS – Diluted ($) | 1.78 | 2.05 | 3.74 | 8.91 | 7.45 | 7.10 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on Customers Bancorp, I estimated earnings of $7.71 per share for 2022. I’ve reduced my earnings estimate mostly because I’ve revised downwards my margin estimate and increased my non-interest expense estimate following the second quarter’s results.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Downgrading to a Hold Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Customers Bancorp. The stock has traded at an average P/TB ratio of 0.90 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 22.4 | 25.9 | 27.7 | 36.3 | ||

| Average Market Price ($) | 26.5 | 20.9 | 14.5 | 39.1 | ||

| Historical P/TB | 1.18x | 0.81x | 0.52x | 1.08x | 0.90x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $39.6 gives a target price of $35.5 for the end of 2022. This price target implies an 11.0% upside from the October 6 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.70x | 0.80x | 0.90x | 1.00x | 1.10x |

| TBVPS – Dec 2022 ($) | 39.6 | 39.6 | 39.6 | 39.6 | 39.6 |

| Target Price ($) | 27.6 | 31.6 | 35.5 | 39.5 | 43.5 |

| Market Price ($) | 32.0 | 32.0 | 32.0 | 32.0 | 32.0 |

| Upside/(Downside) | (13.7)% | (1.3)% | 11.0% | 23.4% | 35.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 8.3x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.78 | 2.05 | 3.74 | 8.91 | ||

| Average Market Price ($) | 26.5 | 20.9 | 14.5 | 39.1 | ||

| Historical P/E | 14.9x | 10.2x | 3.9x | 4.4x | 8.3x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $7.45 gives a target price of $62.2 for the end of 2022. This price target implies a 94.3% upside from the October 6 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.3x | 7.3x | 8.3x | 9.3x | 10.3x |

| EPS – 2022 ($) | 7.45 | 7.45 | 7.45 | 7.45 | 7.45 |

| Target Price ($) | 47.3 | 54.7 | 62.2 | 69.6 | 77.1 |

| Market Price ($) | 32.0 | 32.0 | 32.0 | 32.0 | 32.0 |

| Upside/(Downside) | 47.7% | 71.0% | 94.3% | 117.5% | 140.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $48.8, which implies a 52.7% upside from the current market price. Despite the high upside, I’m downgrading Customers Bancorp to a hold rating as I believe this is not the right time to purchase a bank that won’t benefit much from the rising rate environment. I will revisit this stock further into the rate cycle, later this year or next year.

In the meantime, I will continue to favor companies that have asset-sensitive balance sheets, including Northrim BanCorp (NRIM) and S&T Bancorp (STBA). My latest report on Northrim BanCorp can be found here and the report on S&T Bancorp can be found here.

Be the first to comment