Andres Victorero

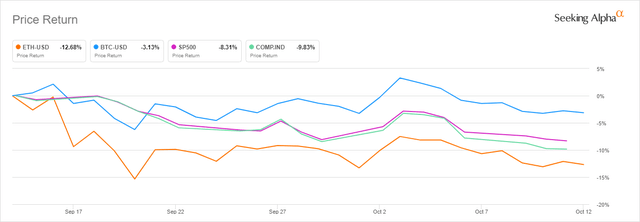

It has been almost exactly a month since the Ethereum (ETH-USD) network was successfully changed from a proof-of-work network to a proof-of-stake network. Since the time of “The Merge,” what was widely believed to be a bullish investment catalyst has largely served as a buy the rumor, sell the news event.

Ethereum is now down about 13% since Beacon became the main chain for transaction validation. While the decline following the completed merge came fairly quickly, Ethereum has yet to really threaten the mid-June lows as it has largely bounced around between $1,250 and $1,350. With all risk markets seemingly waiting for the Fed’s next move, Ethereum may have just made its case for higher prices regardless of what the central bank does; ETH just became a deflationary asset.

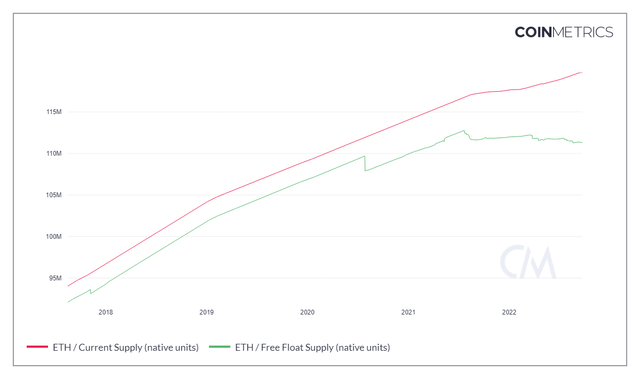

ETH Supply

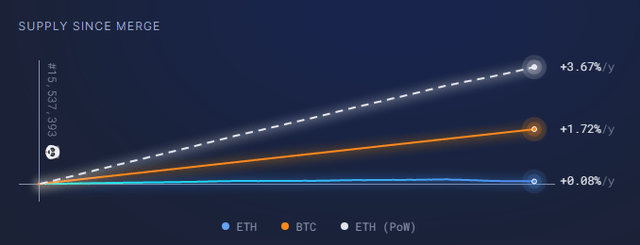

In addition to reducing the amount of energy required for bringing new coins into existence, the Ethereum Merge has also drastically slowed the issuance of ETH. Since the merge, a little over 7,000 ETH have been issued. This is a massive difference from where ETH’s issuance would have been had it remained proof-of-work:

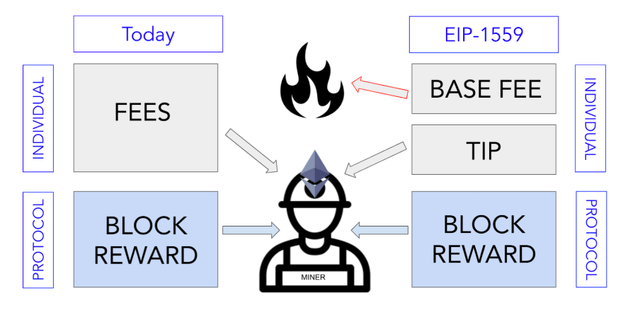

According to Ultrasound money’s PoW simulation, the network would have issued over 344k ETH over the last month had it not merged to proof of stake. This gives us a massive shortfall of ETH issuance since the merge provided there is network demand for the asset. By itself, this doesn’t make Ethereum deflationary. However, the merge issuance change coupled with EIP-1559 does theoretically make ETH deflationary:

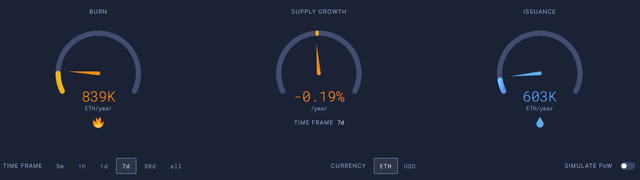

Because of an Ethereum improvement proposal that was previously passed before the merge, the Ethereum network burns ETH tokens when it validates transactions. This means as long as the network is being utilized by market participants, Ethereum can actually burn more tokens than are being issued because of the massively deflated coin issuance since the merge. Over the last week, that is exactly what happened:

Over the last 7 days, the Ethereum network issued new ETH at a pace of 603k coins per year in issuance but burned at a pace of 839k coins per year. For the first time since the network merge, Ethereum is deflationary. The potential for a price squeeze gets even more interesting because of burn/issuance dynamic coupled with the staking mechanism of the network:

Because so much of the ETH supply has been staked to validate and earn rewards, the free float of the coin has actually been trending down for some time. Even if the ETH reward that is granted to stakers for network security is sold off, as long as the issuance continues to lag the burn, Ethereum will be deflationary going forward.

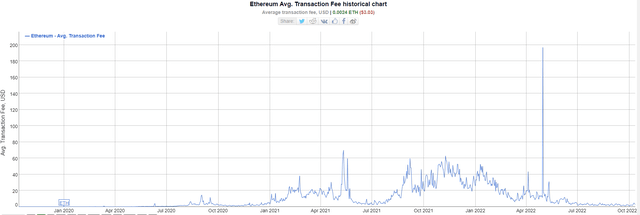

Network Usage & Gas Fees

What expedites that burn figure is the level of network activity. As activity picks up, the gas (transaction fee) gets more expensive. So far, the transaction fees on Ethereum have been low for several months:

This is largely a symptom of less network activity. During the crypto bull market when people were doing silly things like buying monkey jpegs, the Ethereum network would often become very expensive to use. At times, those fees were as high as $50 per transaction. This is why it’s so important to utilize layer two scaling solutions like Polygon (MATIC-USD) in my opinion. But since the crypto market sold off hard in June, the average fee per transaction has generally been in the area of $2. The reason the burn has exceeded the issuance over the last week is because the average transaction fees have moved up over the last few days.

| Date | Average Transaction |

|---|---|

| 10/7/22 | $1.69 |

| 10/8/22 | $2.58 |

| 10/9/22 | $4.15 |

| 10/10/22 | $4.75 |

| 10/11/22 | $3.59 |

| 10/12/22 | $2.89 |

Source: BitInfoCharts

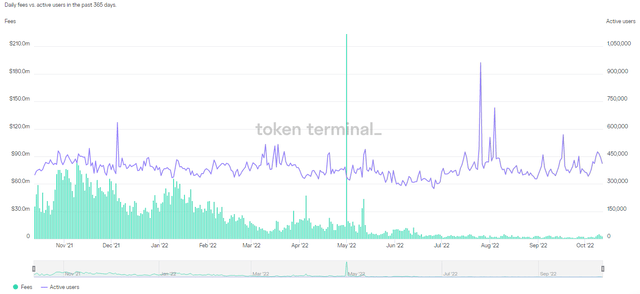

This bump in average transaction fees coincides with a small bump in active users over the last few days as well, according to Token Terminal:

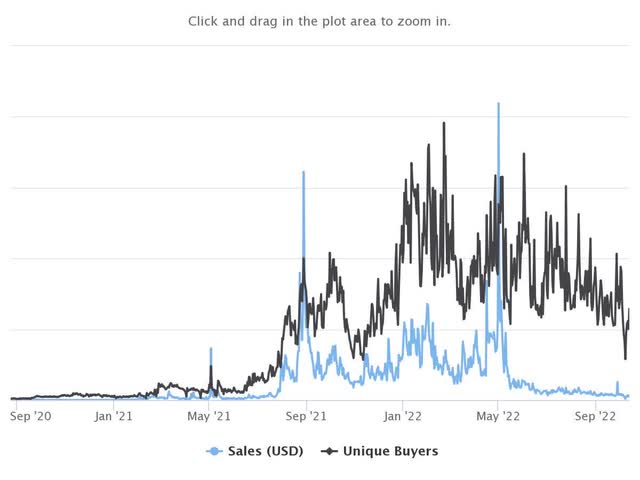

However, unlike previous fee spikes, these don’t seem to be coming from a frenzy in NFT transactions:

The NFT market on Ethereum has been very quiet for several months and is currently on pace for its third straight month of transaction declines. The point is, we haven’t even seen a drastic move up in the kind of network activity that has historically driven fees sky-high, and we’re already seeing the network become deflationary. That’s because Ethereum is being used for a variety of different activities. As more users come online, the deflationary story figures to continue.

Risks

There is no rule that says the NFT market ever has to come back on Ethereum. I personally think it will, but digital collectibles certainly don’t have to be a driver of increased transaction fees in the next crypto bull run. I expect us to see more of these projects and applications get built on secondary layers like Polygon, Arbitrum, and Optimism (OP-USD). Those chains should lessen the strain on Ethereum’s main layer. If infrastructure of ‘Web3’ is built orderly and efficiently, we may not see issuance lag burn very often. In which case, ETH won’t be a deflationary asset.

Summary

I think the best we can do as speculators is try to predict what we believe the most likely outcome is. I personally think Ethereum will be the dominant layer 1 blockchain network for smart contracts and Web3 base layer security. It has an early adopter advantage and a very talented development team. It doesn’t have the scaling on the base layer of other competing layer 1 chains, but it doesn’t necessarily need to as layer 2 chains can alleviate that problem. Since the passage of EIP-1559, we’ve seen Ethereum become deflationary before. This is the first time it has happened since the merge. What makes it so significant this time around is the new coin issuance is now so low that it didn’t take a large boost to network activity to turn the coin into a deflationary asset.

The way I view this is pretty simple; even if more people adopt layer 2 chains that scale Ethereum, it means Ethereum’s base chain will have demand for its base layer security. With that demand will come more transactions and higher fees. If fees increase, there is a greater chance for deflation. This creates a feedback loop where more activity creates more demand for a token that is diminishing in supply. Because of this, I think Ethereum will probably be among the best-performing crypto assets in the next bull cycle. Does that cycle start today? Probably not. But if you take a dollar-cost average approach to your alternative asset investments, I think you could do a lot worse than buying ETH at $1,250.

Be the first to comment