ImagineGolf/E+ via Getty Images

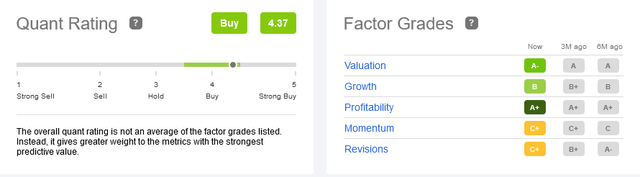

PotlatchDeltic Corporation (NASDAQ:PCH) offers investors an opportunity to invest in inflation-protected timberland with an attractive 3.85% forward dividend yield. The stock is down 24% in 2022 while the Seeking Alpha Quant Rating is a high “Buy” at 4.37. My eyebrows jump when I see B or better grades for both valuation AND growth, which PCH boasts.

But I’m not pulling the trigger on this one, yet. Macro data indicates that the industry is in cyclical decline, as confirmed by momentum, and it would be best to wait.

Cyclical Decline

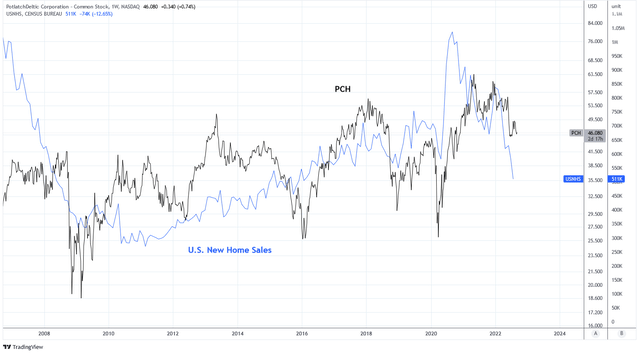

The primary driver for the timber industry is real estate construction, specifically residential. This is why the industry is subject to volatile market cyclicality. Therefore, share price tends to decline in response to falling new home sales in the United States, as shown in the chart below. The current pace of new home sales suggests that PCH should expect further share price declines.

Charts by TradingView (adapted by author)

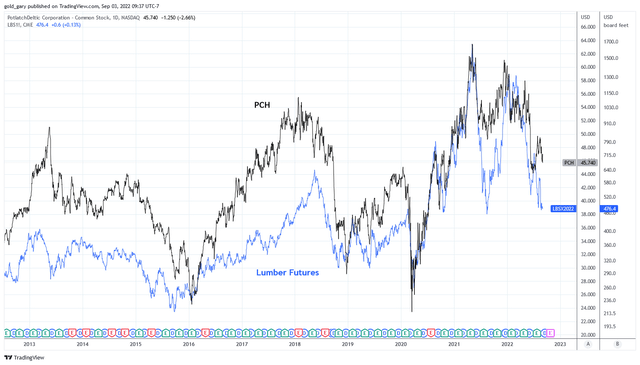

More specifically, share price is correlated to the price of lumber which can be represented by lumber futures in the next chart. PCH has been following lumber lower and current lumber prices implies further share price weakness is possible.

Charts by TradingView (adapted by author)

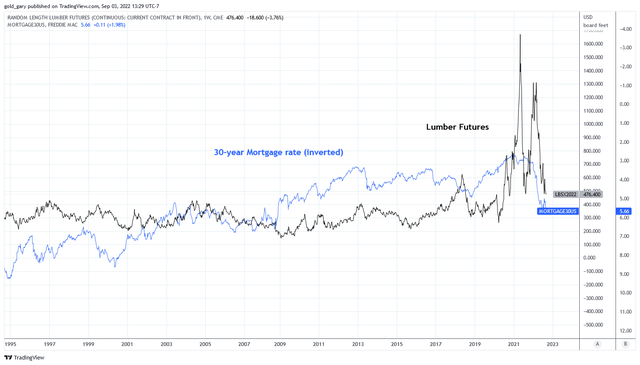

The price of lumber is contingent upon the demand for lumber. Lumber demand rises when demand for new home construction rises which often occurs following an improvement to housing affordability. Affordability tends to improve when mortgage rates decline, albeit only until prices rise. That is how I have concluded the recent spike in lumber is largely a result of the historically low mortgage rates that preceded it.

Charts by TradingView (adapted by author)

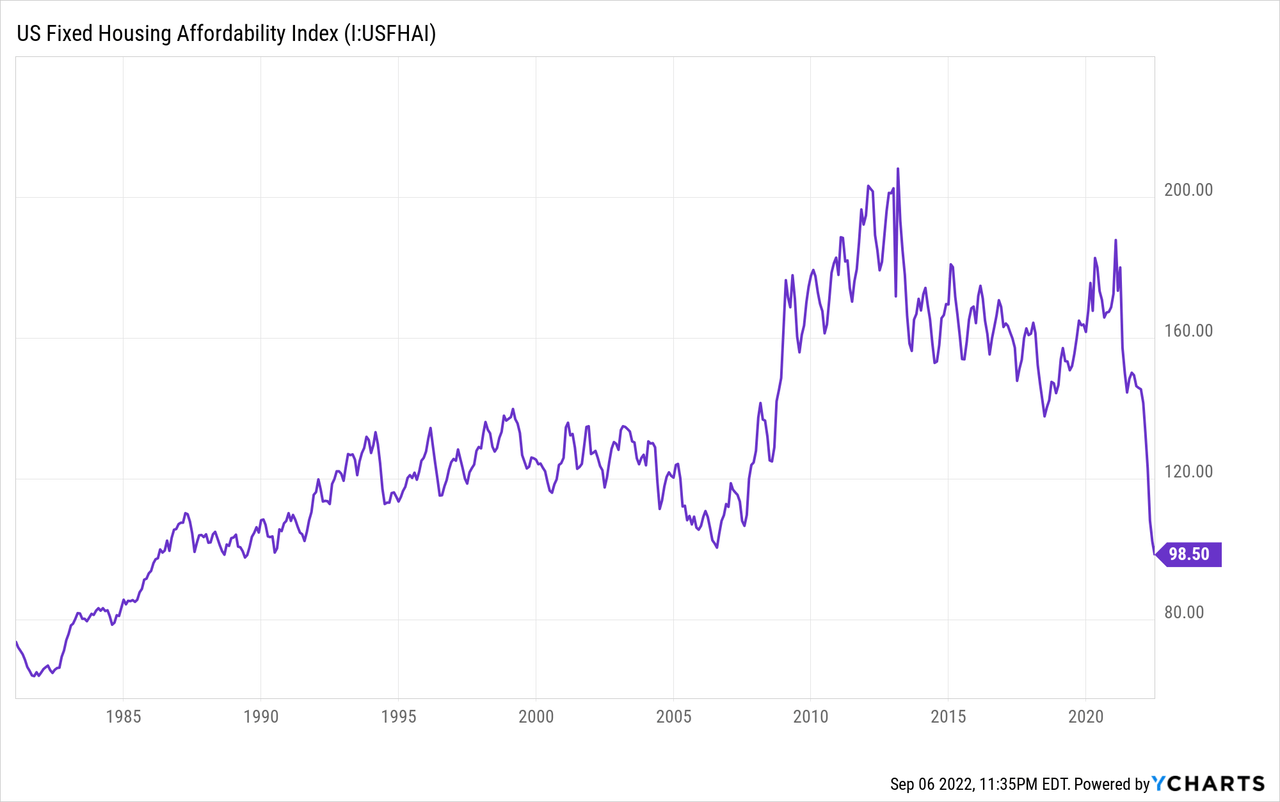

Affordability is the lowest since 2006 and, as I pointed out in my article ITB: Homebuilders Are A Value Trap, data from realestatedecoded.com shows that average home prices in the U.S. are the highest since 1987 when adjusted for inflation and the cost of financing.

The reason why is because mortgage rates have surged higher over the trailing twelve months which is sending a shock through the housing market. The result is 23% fewer mortgage purchase applications than a year ago according to Redfin in addition to a decline in the average sales price of 6% over the last two months. The housing market is slowing and I expect that trend to continue for the next 12-24 months unless mortgage rates decline again.

The Dividend is Well-Rooted But Growth is Withering

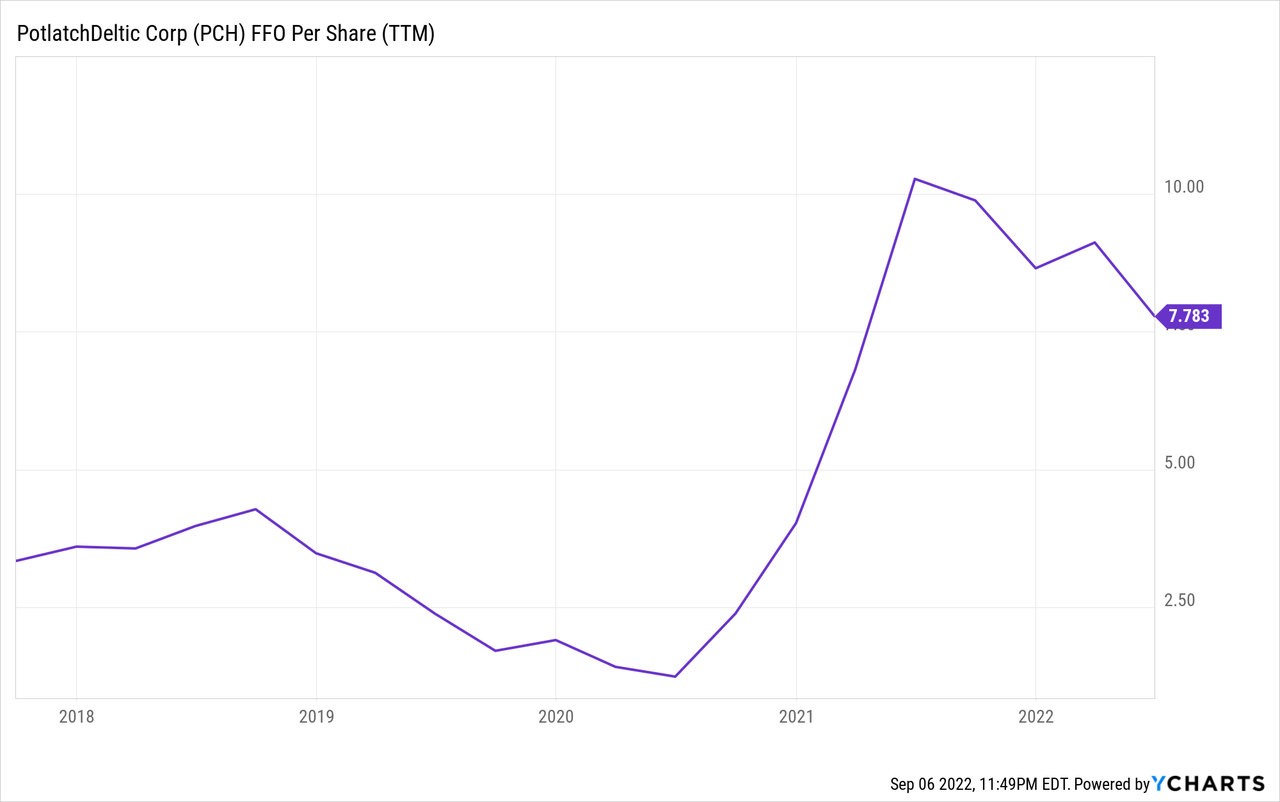

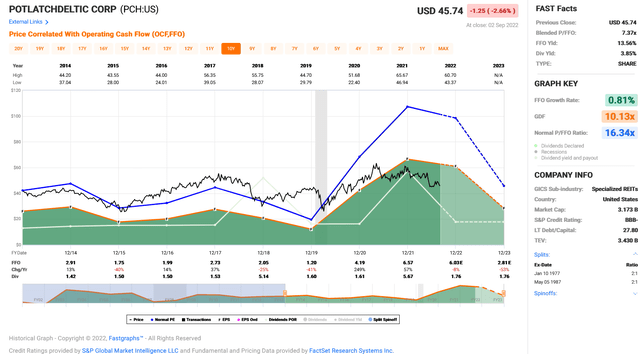

At present, it appears that PCH is performing superbly. Funds from operations per share has risen by 133% over the past five years but the shares are trading 5% lower than they were five years ago. According to FAST Graphs the shares are trading at an FFO yield of 13.56% which is outstanding if future growth is positive.

Analyst forward estimates for 2023 is bleak with earnings per share expected to decline by 61% and FFO expected to decline by 53%. If these estimates prove to be accurate, the shares would stay flat at around $45 per share if they were priced at its 10 year normal P/FFO multiple of 16x. I think that it’s more likely that shares will trade at a discount to its normal multiple, as is typical during cyclical bear markets.

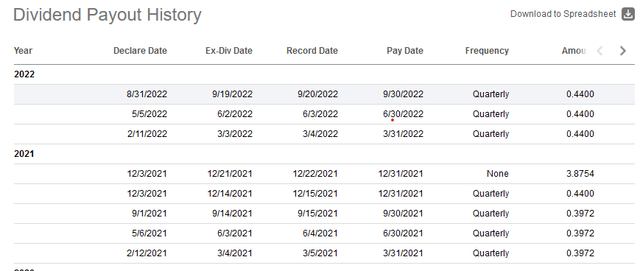

It is promising that the company is looking to deploy capital in line with shareholder interest during this cyclical downturn. The company has announced a $200 million share repurchase program which is equal to 6.3% of market cap. Additionally, the company has been consistent in issuing special dividends when financial performance is strong. The company paid a $4 per share special dividend in 2021 and plan to issue another this December, although management has expressed preference in buying back shares instead. This is what CEO Eric Cremers said during the Q2 2022 earnings conference call:

Given our strong results in the first half of the year we expect to pay another special dividend this year. While the amount depends on our performance for the remainder of the year, we expect the amount will be much lower than the $4 special dividend we paid last year.

Later during the call CFO Jerry Richards added this:

Really it was largely driven by the excess cash we were generating both in the REIT with index log prices, but more so in on our lumber business with cash it was generating. And as it turns out who to talk, but there actually is a cap on how much cash we can hold in the company. So we have to hit the release valve, if you will, and distribute cash in the form of a special dividend last year. So we would prefer to buy shares to be honest with you, especially today with where the stock price is at then paying cash out in the special dividend to be honest… Our regular dividend payout has increased this year versus last year. And really what that does is, it converts what might have been a special dividend in our component of that to the regular dividend this year.

That increase to the regular dividend that Mr. Richards is referring to is a 10.7% increase in the dividend from Q3 2021. PCH receives a top class dividend safety grade of A+ from Seeking Alpha, primarily due to a forward AFFO payout ratio of 28.39% and an FFO interest coverage ratio of 19.48.

Summary

PotlatchDeltic is a well-run company with a dominate market presence in the U.S. The stock is trading at low valuations because the company is coming off of a cyclical high in the lumber market and is still producing strong cash flows. The issue is that the industry has now begun a cyclical decline and company cash flows are very likely to decline for the next year at least.

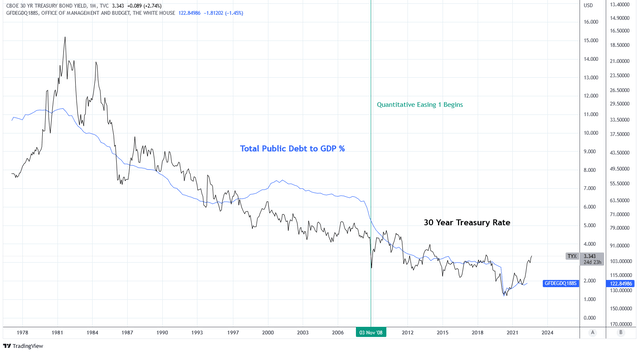

The dividend appears to be safe to me even if forecasts for declines in earnings come true. I do expect that the special dividend will pause after 2022. Still, for me the time to buy a company like PCH is when the cyclical trend is turning up. One indicator that I’m watching to prepare for that turn is 30 year treasury rates. The last chart shows how the 30 year treasury rate has been negatively correlated with the total public debt to GDP ratio since the late 1970s. The relationship became particularly tight after the first quantitative tightening in response to the GFC. Long term I expect this relationship to continue. This means that 30 year mortgage rates will decline again, perhaps to the 2-3% range in the coming few years.

Be the first to comment