gesrey

The ProShares UltraShort Yen ETF (NYSEARCA:YCS) has been one of the best performing funds in 2022 as policy differences between the Fed and the BOJ has led to dramatic declines in the Japanese yen. While the fundamental driver behind YCS performance remains strong, the weak Japanese yen is now drawing policymaker attention. Investors should have one foot out the door, ready to book their winnings from the YCS ETF if/when the BOJ changes policy.

Fund Overview

The ProShares UltraShort Yen ETF seeks to provide investors with -2x exposure to the daily returns of the Japanese yen, relative to the U.S. dollar. The YCS ETF has $52 million in assets.

Strategy

The YCS ETF achieves its investment objective by holding Japanese yen derivative instruments, and rebalancing the exposure daily such that the -2x daily exposure is maintained.

Portfolio Holdings

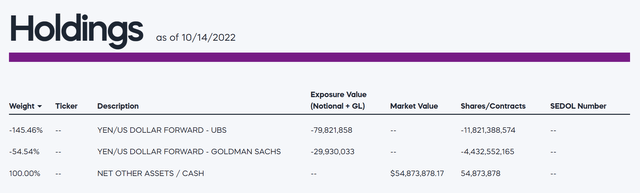

The YCS ETF’s investment portfolio is very straightforward. It holds cash and JPY/USD forward contracts with major investment banks such as UBS and Goldman Sachs (Figure 1). Every night, depending on the daily movements of the JPY/USD relationship, the YCS ETF adjusts its holdings.

Figure 1 – YCS Holdings (ProShares)

Returns

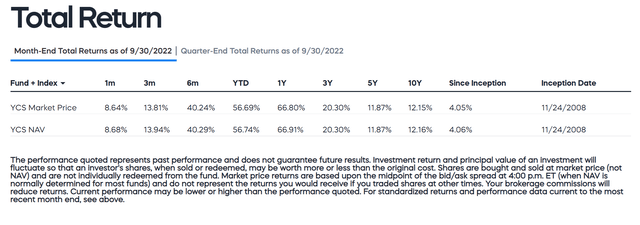

The YCS ETF has delivered strong returns, especially in 2022. The fund delivered 3/5/10 Yr average annual returns of 20.3%/11.9%/12.2% respectively. YTD to September 30, 2022, YCS has returned 56.7%.

Figure 2 – YCS Returns (ProShares)

Distribution & Yield

The YCS ETF does not pay a distribution.

Fees

As a specialty product, the YCS ETF charges a higher expense ratio of 0.95% compared to vanilla equity funds like the SPY.

Differing Central Bank Policies Leading To Phenomenal Returns For YCS

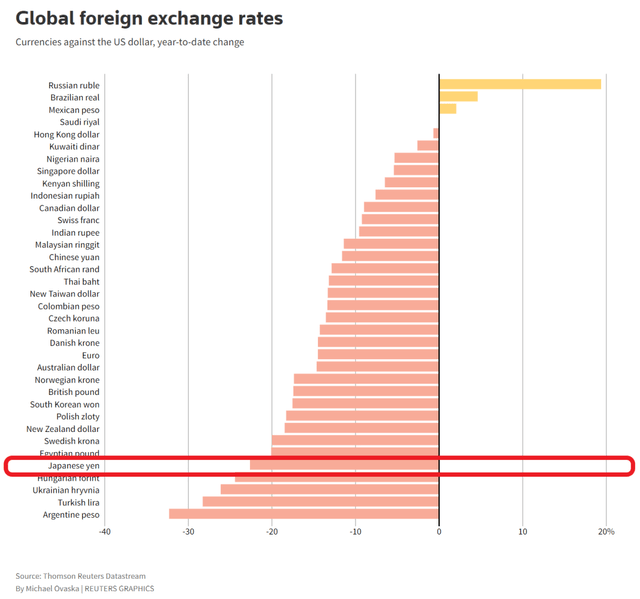

While 2022 has been a year to forget for many investors, with both bonds and stocks suffering a nasty rout, that has not been the case for FX traders. 2022 has been a great year for many currency traders who were long the U.S. dollar against foreign currencies. Figure 3 shows the YTD change in value of global currencies relative to the U.S. dollar, with the Japanese yen highlighted.

Figure 3 – YTD performance of major currencies against USD (Reuters)

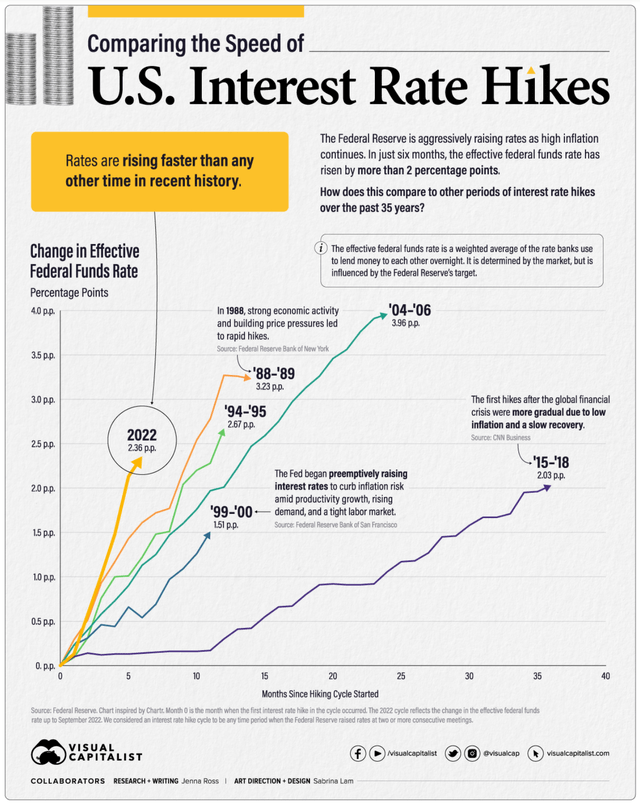

The main reason behind the currency moves YTD has been the actions of the Federal Reserve vis-a-vis that of foreign central banks. The Federal Reserve has embarked on the fastest interest rate hiking cycle ever to tame soaring inflation (Figure 4). Any foreign central bank that hasn’t followed suit saw their currencies routed.

Figure 4 – Federal Reserve has raised interest rates at the fastest pace ever (Visual Capitalist)

The value of the Japanese yen has been hit particularly hard, because the Bank of Japan had been engaging in yield curve control (“YCC”) since 2016.

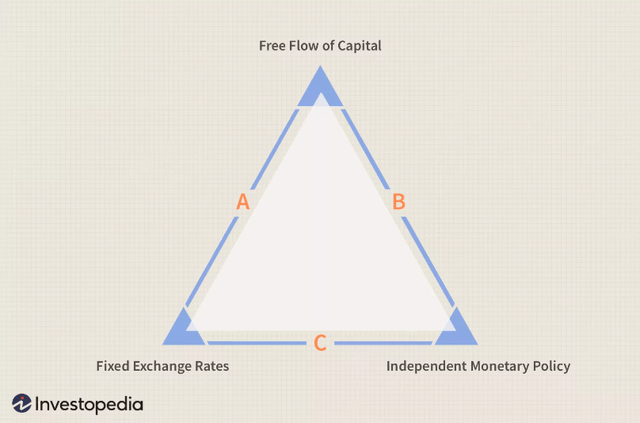

Students of economics should have heard of the Mundell-Fleming trilemma. Essentially, what the Mundell-Fleming model says is that policymakers in an economy can only control 2 of 3 possible things at any given time: autonomous interest rate policy, fixed exchange rates, or free flow of capital (Figure 5).

Figure 5 – Mundell Flemming Trilemma (investopedia)

In the case of Japan, as it allows free flow of capital and the Bank of Japan (“BOJ”) is intent on keeping Japanese interest rates at zero, therefore, the exchange rate of Japanese yen had to fall. And boy did the Japanese yen fall.

USDJPY At Multi-Decade Highs

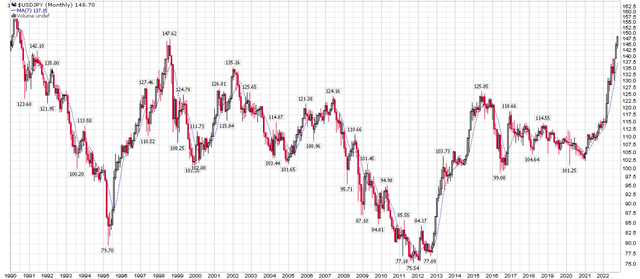

Figure 6 shows the USDJPY cross (author’s note, the Japanese yen is most often quoted as how many yen can be bought with 1 U.S. dollar) over the past 30+ years. At USDJPY 148, the Japanese yen is trading at levels not seen since the Asian Currency Crisis in 1998.

Figure 6 – USDJPY at multi-decade highs (stockcharts.com)

BOJ Beginning To Intervene; Expect 2-Way Volatility To Increase

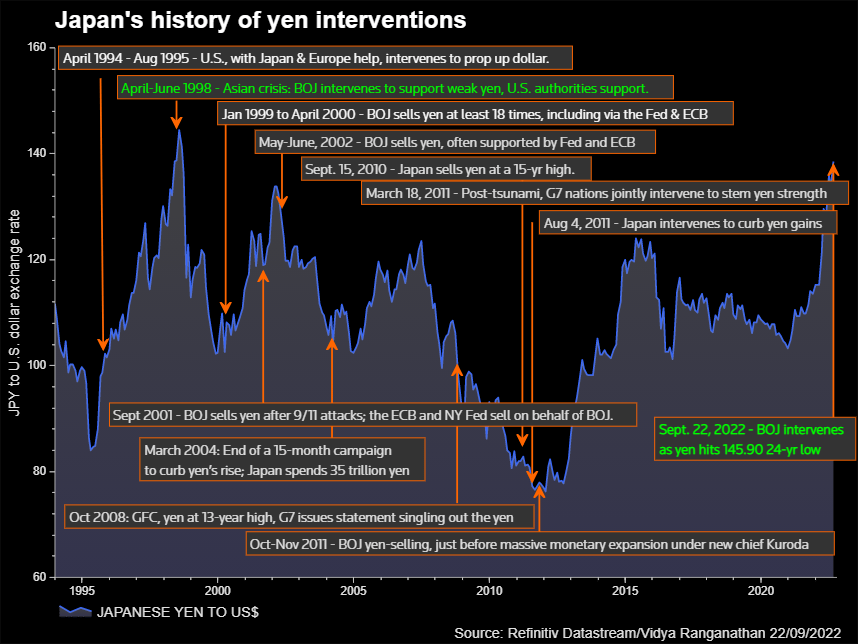

Recently, on September 22, 2022, the BOJ intervened in the FX markets in an attempt to halt the rapid decline of the Japanese yen. This was the first intervention by the BOJ to buy Japanese yen since 1998, highlighting the seriousness of the situation. The USDJPY reached a low of 140.35 from the intraday high of 145.90 (3.8%, a large move by currency standards) as the BOJ sold U.S. dollars and bought Japanese yen (Figure 7).

Figure 7 – BOJ interventions (Reuters)

Unfortunately, the BOJ’s intervention only lasted a day, as the Japanese yen continued to trade weaker shortly afterwards, and is now quoted at over USDJPY 148.

While the fundamental reason behind a weaker Japanese yen – policy differences between the Fed and the BOJ, remains as strong as ever, investors in the YCS ETF need to be mentally prepared for increased 2-way volatility, as the Japanese government and the BOJ is clearly concerned about the Japanese yen’s weakness and will increasingly try to halt its declines.

Ultimately, further weakness in the Japanese yen hinges on the BOJ continuing with its ultra-loose monetary policy and the Federal Reserve continuing to raise interest rates in the U.S.

Risk

The biggest short-term risk is additional interventions by the BOJ, and perhaps even the U.S. Federal Reserve. Note in 1998, the Fed and BOJ coordinated together to support a weak yen. So far, the intervention has been small and unsuccessful. However, as the strong U.S. dollar puts more strain on the international financial system, there is a rising possibility of something ‘breaking’, and a coordinated response from central banks around the world. The recent U.K. sterling and pension crisis is a prime example of pressures building and things ‘breaking’.

In the longer-run, the BOJ’s ultra-loose monetary policy is clearly unsustainable. Already, Japanese inflation has surpassed its 2% inflation target. The current stubborn BOJ policy response increasingly appears to be one man’s (Governor Kuroda) attempt to leave behind a legacy of not ‘buckling to market pressure’ before his term ends in early 2023. If the BOJ changes policy course in the coming months, YCS holders could see a dramatic reversal, as short Japanese yen has been one of the most crowded macro trades recently.

Conclusion

In conclusion, the YCS ETF provides investors with exposure to -2x the daily price returns of the Japanese yen vs. the U.S. dollar. Short Japanese has been one of the best macro trades in 2022, as policy differences between the Fed and the BOJ has led to dramatic returns for the YCS ETF. While the fundamental driver behind YCS performance remains strong, the weak Japanese yen is now drawing policymaker attention. Investors should have one foot out the door, ready to book their winnings at the sign of a BOJ policy change.

Be the first to comment