Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 10.

The Fed has hiked rates sharply this year and has promised to keep going until inflation is on a clear downward trajectory. And because it will likely take time for inflation to come down, Fed governors have been clear that they expect to keep the policy rate elevated over the medium term. Allocating to floating rates securities has been the obvious trade this year. The less obvious trade has been to allocate to securities that have a fixed coupon now but that will switch to a floating one in the near term. These securities will see a rise in their yield and should also outperform, as has been the pattern this year. In this article, we highlight a number of these securities.

Higher For Longer

The messaging from the Fed has been very clear – rates are moving higher and likely staying high as well for the medium term. Mary Daly of the San Francisco Fed said she aims to keep hiking and doesn’t expect a rate cut in 2023. Raphael Bostic of the Atlanta Fed said he wants to see the policy rate rise to 4-4.5% and stay there for a while. Neel Kashkari and Christopher Waller said they are not expecting a pause until inflation moderates.

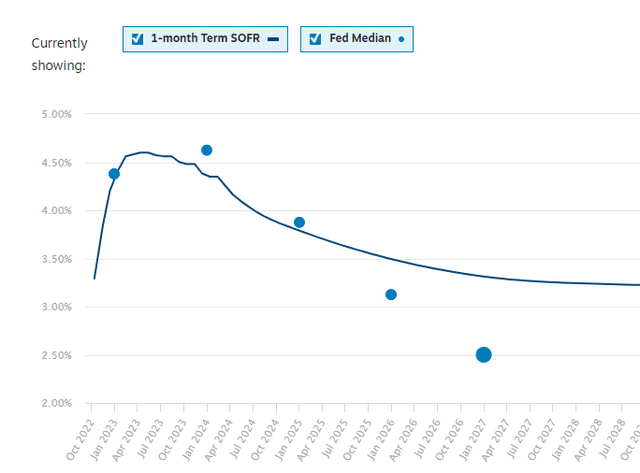

The chart below shows both the expectations of the Fed (i.e. Fed median dot plot) as well as market expectations (i.e. 1M Term SOFR). Both metrics are around 4.5-4.7% at the end of the year – more than 1% higher than where the policy rate is today. By the end of 2024 there is some agreement for the rate to come down to roughly where it is now. There is some disagreement about the longer-term level with the Fed seeing a steeper drop while market expectations bottom out around 3.25% or marginally below current levels. The takeaway here is that rates are expected to move higher and remain around today’s level of higher for about two years. In short, an easing by the Fed is unlikely to be on the cards any time soon.

Market Dynamics

The obvious benefit of holding floating-rate securities in a rising market environment is that the dividends the security throws off increase over time along with short-term rates.

There are two less obvious benefits of securities that will soon convert to floating-rates. One is that the initial floating-rate coupon will be significantly above the previous fixed-rate one. This may sound obvious but it doesn’t have to be true. The reason it is true today for the vast majority of preferreds is that when their spreads over Libor / SOFR were set, short-term rates were well below current ones. Spreads are set at issuance so that the floating-rate coupon is equal to the fixed rate coupon. For example, a security with an initial fixed coupon of 6% would have been issued with a floating-rate coupon of Libor + 4% when Libor was 2%. However, because Libor is 3.75% today (and rising), that coupon will be 7.75% if the stock resets to a floating-rate today.

The other less obvious benefit of securities that will soon convert to floating rates is that the market tends to take time to catch on to this fact. This allows these securities to outperform leading up to the coupon switch to a floating-rate.

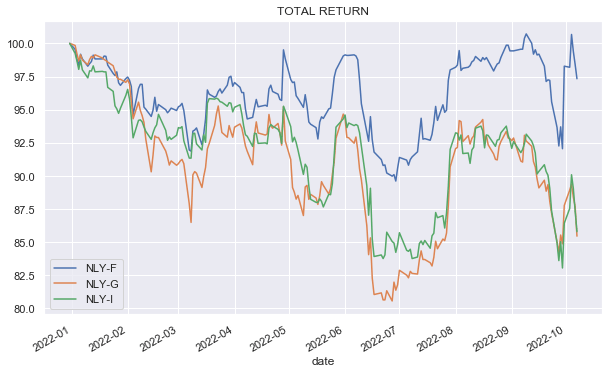

For example, the chart below shows the relative performance of Annaly Capital (NLY) preferreds and shows how NLY.PF, which just converted to a floating-rate, has steadily gained ground over the other series.

Systematic Income

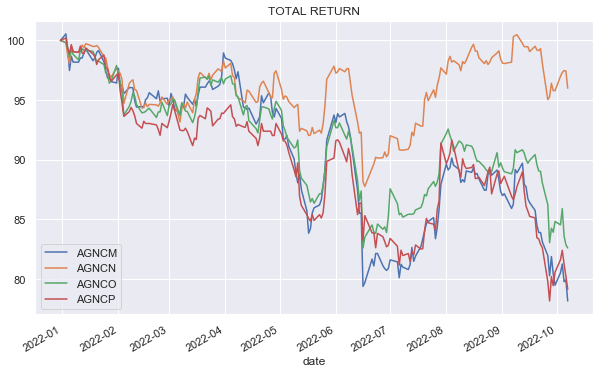

We can see the same dynamic for AGNC Investment’s AGNCN which will convert shortly to a floating-rate.

Systematic Income

Some Ideas

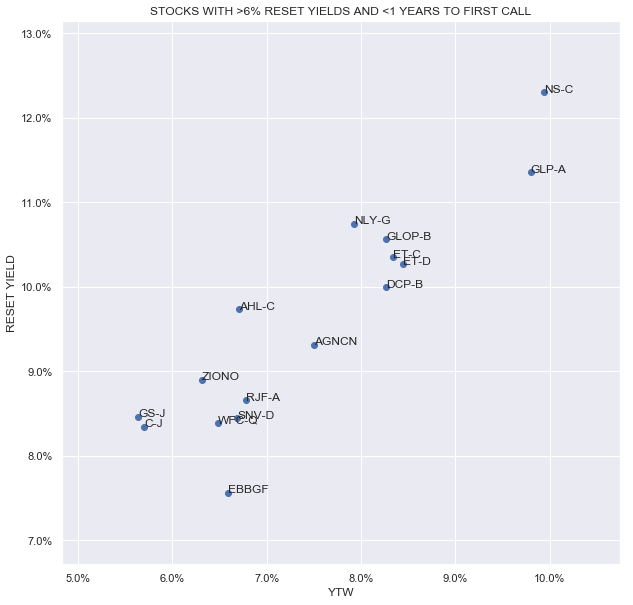

The chart below screens for preferreds with an above 6% reset yield and less than 1 year to the first call date (i.e. the date when the coupon converts to a floating-rate, unless redeemed). The reset yield is the expected yield of the stock at its current price based on Libor/SOFR forward rates.

Systematic Income

Some of the stocks worth highlighting are the following.

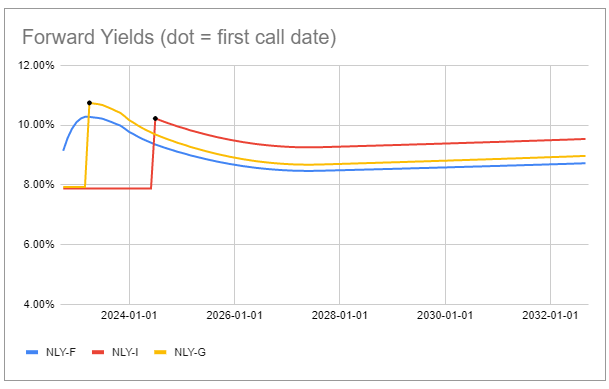

The NLY 6.5% Series G (NLY.PG) will switch to a floating-rate in Mar-2023 with a coupon of 3M Libor + 4.172%. At its $20.49 stripped price, the market does not expect a redemption, but if it happens, it would obviously be a great outcome for investors. The forward yield chart below shows that the yield of NLY.PG is expected to jump sharply out to 10.75% and it will remain above the yield of NLY.PF. NLY.PI is also worth a look, however, its floating-rate switch is in June of 2024. The average stripped yield of the agency-focused mREIT subsector is 8.7% and 8.3% if you strip out the basket case that is IVR. NLY.PG stripped yield until the coupon reset is 7.93%.

Systematic Income Preferreds Tool

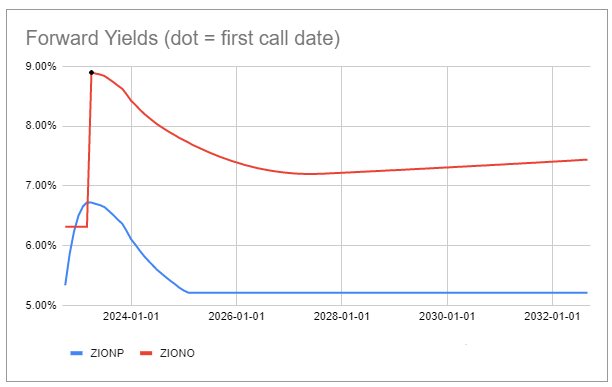

Zions Bancorporation Series G (ZIONO) has a respectable stripped yield of 6.3% now and should see a big bump in yield to 8.9% in Mar-2023 when its coupon resets to 3M Libor + 4.24%. This is very attractive for a split investment-grade preferred – the average yield of the Bank preferreds sector is 6.36%. The stock is trading very near “par” so a redemption is not out of the question. ZIONO stripped yield until the coupon reset is 6.32%

Systematic Income Preferreds Tool

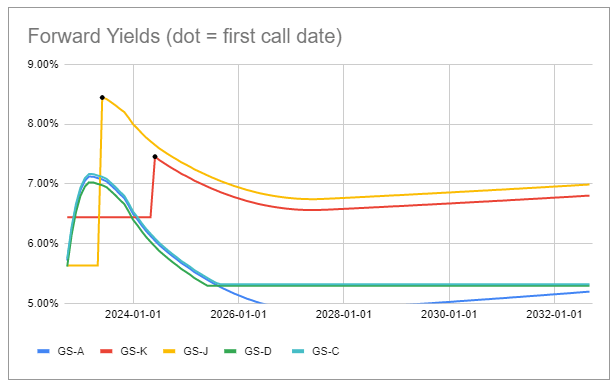

Finally, we like the Goldman Sachs Series J (GS.PJ) which is rated a notch below investment-grade and will convert to a floating-rate in May-2023 unless redeemed. It trades at a $24.40 stripped price so a redemption will be a small tailwind if it happens. As shown in the chart below, GS.PJ yield is expected to rise to around 8.4% at the peak and remain the highest yield across the GS suite which should support its price. Its yield will also remain above that of the Banks preferreds sector over time unless Libor falls short of today’s forward rates. GS.PJ stripped yield until the coupon reset is 5.64%.

Systematic Income Preferreds Tool

Takeaways

Soon-to-float securities are attractive on a number of fronts. First, they typically look the most attractive on yield basis within their suites, i.e. relative to other preferreds of the same issuer after the coupon reset. Second, the projected yields of these securities, by the time they float, is very attractive in their broader sector for their quality. And third, securities that have recently floated, outperformed leading up to the switch to a floating coupon as the market slowly caught on to their increasing attractiveness.

The main risk for securities that convert to floating-rate coupons in the near term is that short-term rates somehow collapse. If this happens, fixed-rate preferreds will outperform while floating-rate and Fix/Float preferreds will underperform as we saw happen in 2020 when rates fell sharply.

For this to happen, we would need to see a sharp reversal in inflation as well as a sharp and deep recession. This is not impossible but it’s not our base case. However, investors should be prepared for this eventuality and, in our view, should hold some higher-quality fixed-rate preferreds that should outperform in this scenario. Ultimately, short-term rates are unlikely to remain above 4.5% forever so locking in some fixed-coupon preferred exposure makes a lot of sense as well, particularly, for low turnover income investors who don’t like to see volatility in their portfolio income levels.

Be the first to comment