FatCamera/E+ via Getty Images

In the global fight against diabetes, one of the larger players in the space to pay attention to is Insulet Corporation (NASDAQ:PODD). With its hallmark product, the Omnipod System, the company can offer a continuous delivery of insulin that offers all of the same benefits that an insulin pump therapy regime would. Financial performance achieved by the company has generally been robust, particularly when it comes to its revenue. Having said that, shares of the enterprise are looking very expensive at this point in time. Even though shares have declined in recent months, I do think that further downside is likely on the table. So much so that I cannot help but decrease my rating on the company from a ‘hold’ to a ‘buy’.

Shares look expensive

Back in early May of this year, I wrote an earnings preview covering the first quarter of the company’s 2022 fiscal year. In that article, I talked about what analysts were expecting and what investors should look out for. I found myself impressed by the strong growth the company had achieved and I felt as though the long-term trajectory of the company was positive. At the same time, however, shares of the enterprise were looking very pricey, leading me to rate the firm a ‘hold’. Since then, shares have fallen by 7.9%. Although this may seem painful, I actually consider this a win when you consider that the broader market declined by 14.3% over the same window of time.

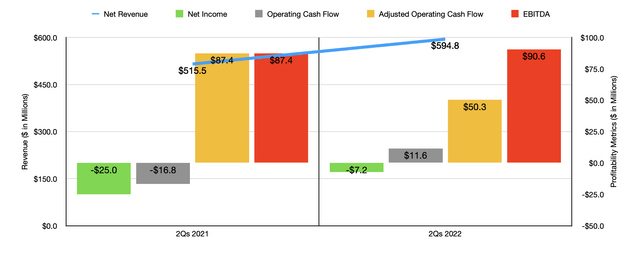

This limited downside was likely driven by continued growth on the company’s top line. In the first half of the 2022 fiscal year, sales of the company came in at $594.8 million. That’s 15.4% higher than the $515.5 million generated the same time only one year earlier. The greatest strength for the company came from its US Omnipod sales, with revenue surging by 26.1% thanks to higher volumes driven by customer base expansion and, to a lesser extent, by an increase due to growth through the pharmacy channel that the company operates. International Omnipod revenue grew a more modest 1.8%, with much of the upside it experienced being negatively impacted to the tune of 8.9% because of foreign currency fluctuations. And drug delivery sales fell by 1.7% year over year.

From a profitability perspective, the picture has also been generally positive. The company went from generating a net loss of $25 million in the first half of 2021 to generating a net loss of $7.2 million the same time this year. Operating cash flow went from a negative $16.8 million to a positive $11.6 million. However, if we adjust for changes in working capital, it actually would have fallen from $87.4 million to $50.3 million. And over that same window of time, we saw EBITDA inch up from $87.4 million to $90.6 million.

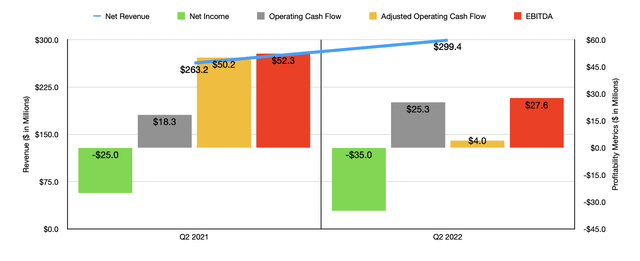

It’s important to note that financial strength for the company was experienced in both quarters of the year. In the second quarter, for instance, revenue came in at $299.4 million. That’s 13.8% higher than the $263.2 million generated one year earlier. On the other hand, profitability metrics were slightly worse. The company’s cost of revenue in the second quarter rose from 30.6% to 36.4%, with the company’s gross profit margin shrinking in response to higher production costs and manufacturing inefficiencies as U S manufacturing continues to ramp up and become a larger portion of the company’s total production. Selling, general, and administrative expenses also increased, shooting up from 44.2% of sales to 58.2%. This, management said, was primarily attributable to $27.3 million of legal costs related to the settlement of a patient infringement lawsuit, as well as other related expenses. Even with this, however, operating cash flow grew from $18.3 million to $25.3 million. On the other hand, if you adjust for changes in working capital, it would have plunged from $50.2 million to $4 million, while EBITDA decreased from $52.3 million to $27.6 million.

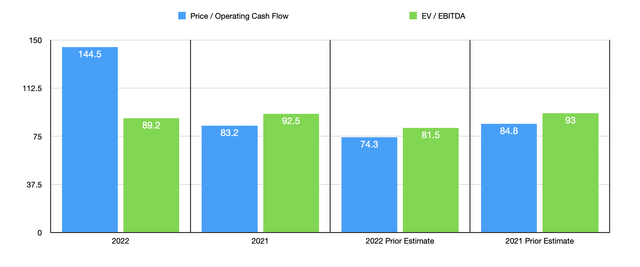

For the entirety of the 2022 fiscal year, management has not provided all that much in the way of guidance. They did say that revenue should now rise by between 14% and 17%. This compares to the prior expected range of between 12% and 16%. They also said that the operating profit margin of the company should contract because of higher expenses. Unfortunately, that did not leave us very much to project out what financials might ultimately be though. If we were to just annualize results experienced for the first half of the year, we would anticipate adjusted operating cash flow of $112.5 million and EBITDA of $190.1 million.

Given these figures, we can calculate that the company is trading at a forward price to adjusted operating cash flow multiple of 144.5. And the EV to EBITDA multiple should come in at 89.2. In comparison, using the data from 2021, these multiples would be 83.2 and 92.5, respectively. I should also note, as shown in the chart above, that this pricing is higher than it was when I last wrote about the firm. This is especially true of the forward pricing for the company. Also, as part of my analysis, I compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 8.8 to a high of 56.1. And using the EV to EBITDA approach, the range was between 7.9 and 55.6. In both cases, our prospect is the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Insulet Corporation | 83.2 | 92.5 |

| Hologic (HOLX) | 8.8 | 7.9 |

| Steris (STE) | 32.9 | 32.7 |

| Sonova Holding AG (OTCPK:SONVY) | 26.5 | 21.0 |

| Abiomed (ABMD) | 56.1 | 55.6 |

| Teleflex (TFX) | 23.9 | 20.1 |

Takeaway

From a pure business perspective, I will say that I am impressed with Insulet. As I detailed in my initial article on the company, the technology is interesting and the long-term outlook for the company will likely be positive. But this doesn’t mean that the company makes sense to buy into right now. With how expensive the stock is at this point in time, I cannot bring myself to rate it anything other than a ‘sell’.

Be the first to comment