Joe Raedle

Q3 Earnings – Headline Expectations Appear To Be Subdued

General merchandise retailer Target (NYSE:TGT) is poised to publish its Q3 results on the 16th of November, followed by a conference call at 8 AM EST.

The Q3 Revenue consensus number currently stands at $26.4bn (implied growth of just ~3% YoY), whilst the EPS stands at $2.18 (implied decline of 28% YoY). Both metrics suggest there is nothing to get overly excited about, and over the last three months, the majority of sell-side analysts who cover TGT have downgraded EPS estimates for Q3 (23 downgrades and just 1 upgrade). It also doesn’t help that Q3 this year, will be overlapping a tough base period, where comparable sales last year were up by ~13% (vs Q2 when it was up by ~9%)

In addition to that, considering TGT’s recent track record during earnings season, investors may ostensibly be feeling a little wary, as the company has failed to meet EPS expectations for two straight quarters now (In Q1 the bottom-line miss was ~28%, and in Q2 it was even worse at 46%).

Yet, There Is Potential For Upside Surprises

Regardless, if one is willing to look beyond the headlines, I think you could see a few green shoots which may be taken well by the markets.

There’s an outside chance that the revenue number comes in better than expected, as Q3, in both 2020 and 2021, couldn’t quite benefit from ample back-to-school, or back-to-college momentum. This is the first year in a while, where the company would likely have received a sustained boost from those tailwinds, particularly as they’ve built up a good portfolio of budget-friendly ‘own brands’ goods, which would have appealed to a wide array of students, and academicians, in the current climate.

Then in the hardlines sub-segment (which also faces tough comps of mid-teens growth last year), whilst one would expect some weakness to linger in categories such as electronics, I think something like the toys category could generate positive surprises, as it tends to do very well as we get close to the holiday season

Target’s inventory management challenges received plenty of negative attention in June this year, but some of the initiatives they’ve taken since should set the company up nicely. They’ve been aggressively curtailing their inventory position for much of H2, and I’d expect the days in inventory to trend closer to the long-term average of 62 days. Over the last two quarters, it has come in at 71 and 68 days.

It isn’t just a case of curtailing inventory; TGT has also done well to reorient its inventory strategy to suit the current environment; high-risk discretionary items have received limited impetus in their recent inventory-building initiatives, whilst the inventory focus has shifted to more stable avenues such as food and beverages, daily essentials, etc. Even warehouse-related costs could be well-controlled as TGT mentioned that their distribution center utilization levels will likely only stay at 85% even during the seasonal period (not as close to 100%, as we saw in June). Whilst TGT could continue to take a $200m hit in Q3 as well (on account of inventory re-sizing initiatives), it’s fair to say that the worst is over.

Another area where we could potentially see a positive surprise is the supply chain and transportation-related cost base. Previously, the company had stated that they expect to incur incremental freight and transportation costs of $1bn in H2, but I suspect this could be scaled down. Given TGT’s enhanced focus on the early receipt of goods, they would have likely been able to benefit from lower spot container rates, particularly in the latter half of Q3.

Freightwaves

On account of all these factors, I think TGT is well-set to deliver some upside surprises with the expected Q3 operating margin which is expected to come in at 5-6% (in Q2 it was only 1.2%); Q4 margins could be even higher and likely closer to the 6.5%-6.8% mark.

Closing Thoughts

It’s worth noting that the majority of Wall Street Analysts who cover TGT’s stock have a favorable rating on it; for further clarity, note that 22 out of 32 analysts have either a ‘BUY’ or ‘OUTPERFORM’ rating, with the rest comprising of only ‘HOLD’ ratings.

I’d like to think that an important tenet of the ‘BUY’ case would likely be dictated by how favorable forward valuations look, once we get 2022 out of the way. Based on the January 24 EPS of $11.9, Target’s stock trades at a FWD P/E multiple of 14.5x, which is a 35% discount over its long-term average.

YCharts

Given the low base effect of 2022 (January 2023 year-end), it wouldn’t be entirely appropriate to only consider the earnings growth delivered for the January 2024 year-end. Rather if one looks at a 2-year CAGR which also considers the January 2025 EPS, TGT comes across as a business poised to deliver earnings growth of 29%. For a business priced at 14.5x (it is priced even lower at 13x P/E, if you’re basing it on January 2025 numbers), you’re getting earnings growth that is almost twice as good, implying a low forward PEG ratio of just 0.5x!

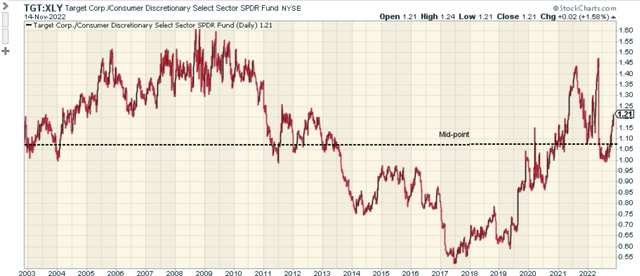

Whilst the valuation picture looks tantalizing, investors may also do well to devote some attention to the technicals.

Relative to other stocks from the retail sector, I don’t believe TGT offers the best risk-reward; this is exemplified by a relative strength ratio (TGT over the retail ETF- XRT) that is well above the mid-point of its long-term range.

Stockcharts

On Target’s weekly chart there are two key patterns playing out, and the unappealing risk-reward picture is reiterated here as well. Firstly, we have a descending broadening wedge pattern that has been playing out since H2-21. Within that wedge, we then have a bearish flag pattern playing out. In both cases, the price is currently closer to the upper end of both boundaries which doesn’t make the current price point the most appropriate price zone. I’m not suggesting that the price can’t break out of both these patterns if Q3 results prove to be better than expected; I just feel the margin of safety is not that great at this point.

Investing

Be the first to comment