Prologis is a great REIT and it finally trades at a great price again. The only bad thing about Prologis has been how hard it is to get a great entry opportunity.

JHVEPhoto/iStock Editorial via Getty Images

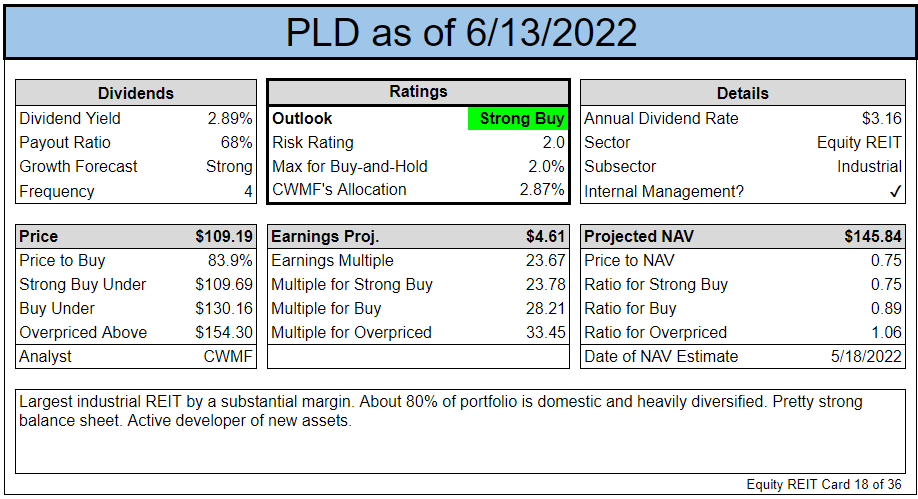

Prologis (NYSE:PLD) is due for an upgrade. The massive industrial REIT has continued to drive dramatic value for shareholders. Shares got a bit expensive during the last 8 months, but they came crashing down. The huge fall was not driven by their operating performance, which has been outstanding.

What Went Wrong

The first issue for PLD is simply that industrial REITs began getting hit on 4/29/2022. Since then, the sector has been slaughtered with PLD taking the worst of it.

The second issue goes beyond the general weakness in the sector. Wall Street was not thrilled with PLD’s attempt to acquire Duke Realty (DRE). Duke’s board promptly declined the renewed interest, saying they would be open to hearing even higher offers.

PLD’s offer seems to be driving concerns about their valuation, but investors are overreacting. Much as shares were too expensive in late April, they are too cheap today.

Shares fell from $173 on 4/28/2022 down to $119.72 on 5/19/2022. That’s over 30% of the share price disappearing in 3 weeks.

Since then, shares recovered moderately followed by dipping even further.

On 6/13/2022, when PLD announced they had reached a deal to acquire DRE, share prices took another hit. It was a down day for the whole market, but PLD got hit worse than most.

Note: There is nothing wrong with DRE. The challenge is only about the price for the transaction.

Don’t Blame Rates

This drop isn’t about interest rates.

On 4/28/2022, the 10-year Treasury was at 2.82%.

On 5/19/2022 the 10-year Treasury is at 2.84%.

Sorry, the adjustment of .02% just isn’t relevant.

Since then, rates have increased rapidly. However, the majority of the drop for PLD occurred during a period when rates were roughly flat. The latest dip came on the announcement that they had reached a deal to acquire DRE.

No Longer On the Back Burner

With so many REITs to cover, we dropped PLD to the back burner as valuations became too high for our taste. Drop a strong industrial REIT by more than 30% and our attention returns. PLD has an excellent balance sheet, and their properties remain in high demand.

They’re achieving excellent spreads on new leases and driving strong growth in same-property NOI (Net Operating Income).

There is not a good reason to dislike PLD today.

Valuation

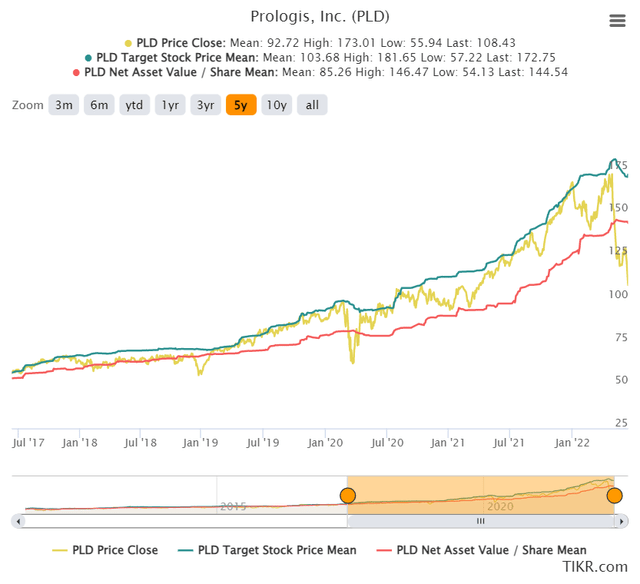

If we track PLD’s share price over several years, it has moved remarkably well with consensus targets. To be fair, part of that is because PLD is so large Wall Street updates targets more frequently remain closer to the actual share price. However, it’s worth noting correlation.

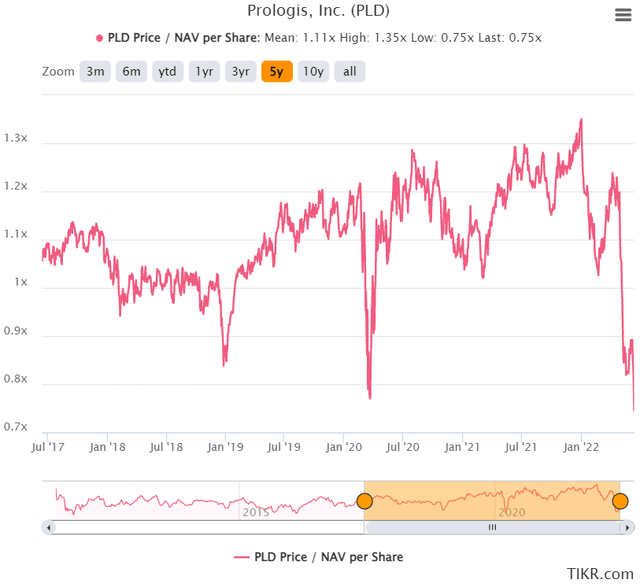

It’s also worth recognizing that PLD has very rarely traded below consensus NAV estimates. So even if you believe consensus NAV estimates might be a bit too high (put me in that camp), the price-to-NAV ratio would still stand out as being too low:

TIKR

While share prices plunged, NAV estimates have been solid. PLD continued to deliver strong guidance for year-over-year growth.

The price-to-NAV ratio today, using consensus estimates, is about equal to the bottom of the pandemic:

TIKR

Such dips have not lasted long. PLD has taken a few big hits to the share price, but it bounced back because it’s a great REIT. It is worth noting that PLD’s share price was materially low at the bottom. In March 2020, the NAV per share estimate was significantly lower. So even though the price-to-NAV was only slightly lower, the actual share price was significantly lower.

I believe that over the last two years the underlying value of PLD has increased materially as they drove a significant increase in the cash flows available for shareholders. Consequently, even in a pandemic scenario I don’t think PLD’s share price would be testing those prior lows again. By comparison to the pandemic (including the financial crisis it created), the current potential for a recession is significantly less scary. The potential recession is negative for share prices but doesn’t produce the same risk to financial markets or to global trade.

Guidance

PLD’s earnings can be a bit strange. PLD is heavily involved in developing industrial real estate and earns additional income. Consequently, part of the income PLD generates is going to be more volatile. That’s okay, we just need to be aware and treat that portion of income as being less valuable.

To get a quick feel for PLD, I prefer to use “Core FFO, excluding net promote income”. The guidance moved from a range of $ 4.45-4.55 to a range of $4.50-4.56. This isn’t perfect as it ignores recurring capitalized expenditures, but we can adjust for that when setting targets.

Fundamentals

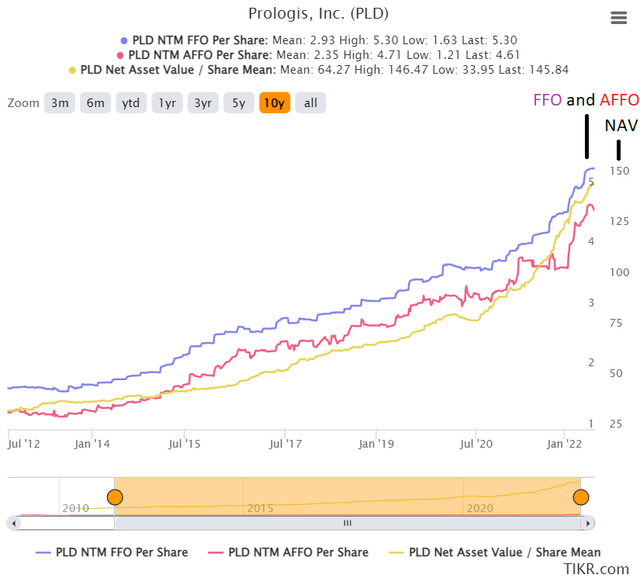

The fundamentals for PLD have been solid. Just look at the trend in estimates for FFO, AFFO, and NAV per share over the last decade:

TIKR

All three lines consistently move up as they move to the right. That’s precisely what we want to see.

We expect industrial REITs to deliver solid growth in AFFO per share because they should be able to deliver strong leasing spreads leading to strong growth in same-property cash net operating income. PLD has outperformed my expectations. Guidance for the year started strong at a range of 6-7%. However, in the Q1 2022 earnings update it was revised higher to a range of 7.25-8%.

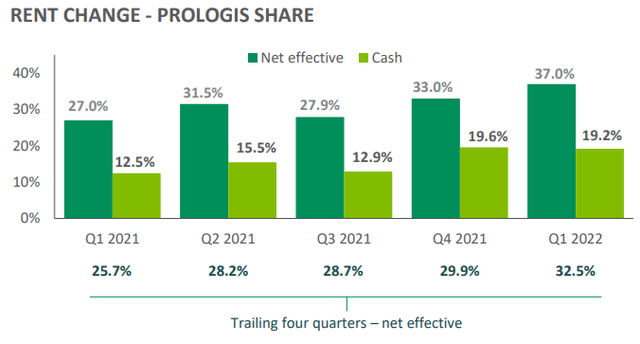

Demand remains very strong with massive cash leasing spreads:

PLD

Those cash leasing spreads ran over 19% in the last two quarters, which reflects extremely strong industrial demand. In prior decades, industrial real estate was heavily exposed to recessions. However, that exposure is much smaller now thanks to the rapid growth of e-commerce.

During a recession, some tenants may decline to pay rent, since they think the landlord would struggle to replace them. The tenant may think they have a strong position for negotiations. However, that isn’t the case for industrial real estate today. Due to the rapid rise in industrial rents, most leases more than a year or two old are already below market rates. That makes it much easier for the landlord to come down hard on any deadbeat tenants.

A Reasonable Expectation

Cash leasing spreads might come in from the 19%+ values recorded recently, but my long-term projections for PLD assume lower spreads anyway. PLD should continue to have high occupancy and be able to generate significant growth in “Core FFO excluding net promote income”. That’s what I want to see from them. Based on the strong underlying fundamentals, I think PLD will earn a much higher share price over the next several years.

I can’t predict precisely when it turns around, but it would be surprising to me if PLD stayed this cheap for long.

Risk Rating

With this plunge in shares, there is a new opportunity to open positions in PLD. With a relatively low risk rating (at 2.0), shares are suitable for most long-term buy-and-hold investors. Prologis also enjoys an A- credit rating on their debt, which would often go with a risk rating of 1.0 or 1.5.

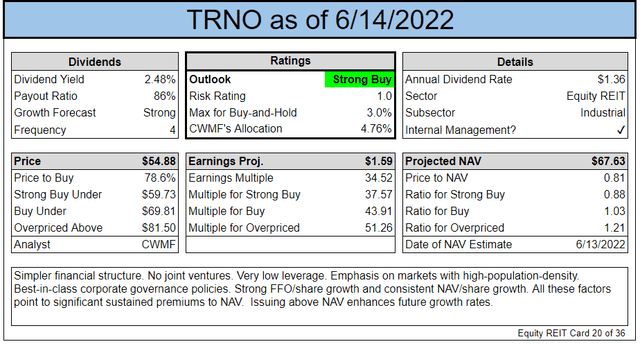

Remember Terreno

Since I’m already writing an article about industrial REITs, I want to highlight Terreno (TRNO) as well. Terreno is a smaller industrial REIT, but they have an outstanding balance sheet and corporate governance. TRNO is driving huge growth in same-property NOI and AFFO per share. Due to a higher AFFO multiple, most investors completely ignore TRNO. However, we believe TRNO deserves a strong buy rating also.

Both TRNO and PLD are poised for explosive growth in AFFO per share because their portfolios are leased well below market rates. Rental rates for industrial real estate increased dramatically over the last few years. As old leases are replaced by new leases, it drives very high levels of growth in cash same-property net operating income. That translates into extremely high growth in AFFO per share.

We’ve been building positions in both of these REITs during this outstanding sale. These are REITs we wanted to own before, but we couldn’t stomach paying the higher prices. With shares plunging, investors can buy great REITs at a bargain price.

Conclusion

PLD is a great industrial REIT. They have a massive global portfolio and a strong credit rating. Their leasing spreads and same-store cash NOI exceeded my expectations as fundamentals have been even stronger than expected. Even recognizing the significant risks for a recession, shares look unusually cheap. Industrial properties historically were exposed to recessionary risks, but landlords have a much stronger hand in negotiations now due to the strong demand for space in their portfolio.

We previously invested in PLD but sold out early to reallocate. The decision to buy REXR was perfect, but the decision to sell PLD was hard as we continued to like the fundamentals. Over the last several months PLD was relegated to the back burner since shares were simply too expensive for our taste.

Now that shares dropped over 30% in 3 weeks, they are firmly back on our radar and deserved an update. Following the even deeper drop in June, they deserve a Strong Buy rating.

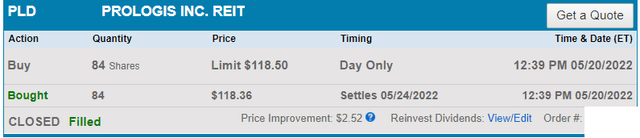

We reopened a position in PLD on 5/20/2022 at $118.36.

Schwab

That was a great entry price, but the market got even cheaper.

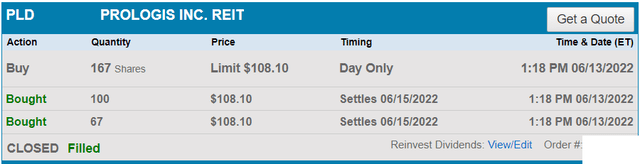

On 6/13/2022 we more than doubled that position at $108.10.

Schwab

Rating

The REIT Forum

The REIT Forum

Be the first to comment