wichayada suwanachun

Thesis

Evercore Inc. (NYSE:EVR) is attractive to us as another top investment bank that can provide good shareholder returns regardless of the economic conditions. We believe management’s commitment to shareholder value, strong historical financial results, and top investment banking reputation are all key factors that make this stock a great investment. Though the stock is under pressure from economic slowdown and monetary tightening, once those headwinds dissipate, we believe that Evercore will once again become a market darling.

Strong Brand, Strong Results

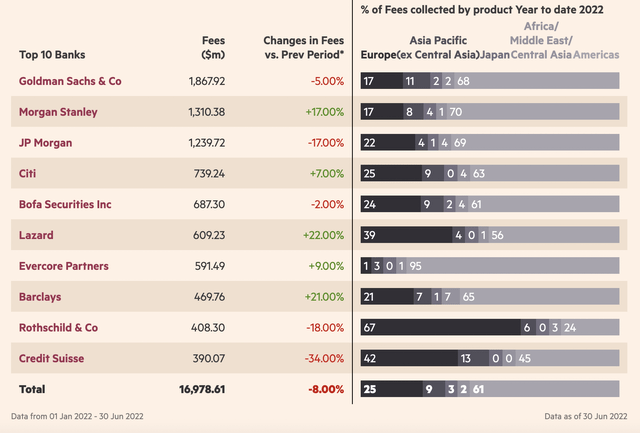

Evercore is a boutique investment bank that specializes in investment banking activities, such as M&A advisory, capital markets advisory, and restructuring. Outside of the bulge bracket banks like Goldman Sachs & Co and JP Morgan, which have considerable non-investment banking related businesses (i.e. Sales and Trading, Commercial Banking, etc.), Evercore is one of the top investment banks by fee volume. In addition, as seen below, year-to-date, Evercore generated most of its revenue from the U.S. markets, which presents a pure play for investors who may only want exposure to the U.S. advisory services market.

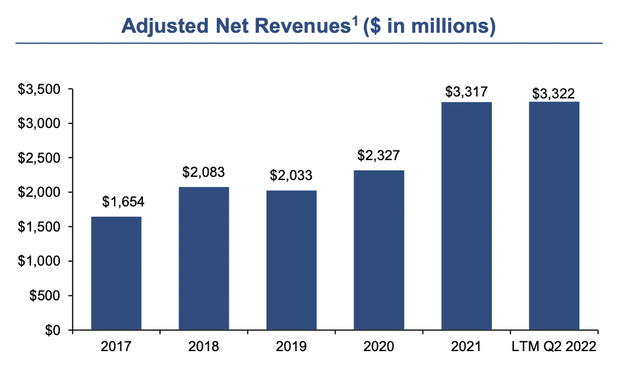

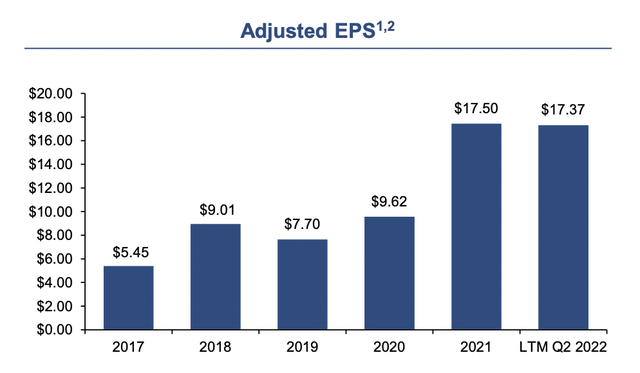

Evercore has been to deliver outstanding financial results for investors for the past few years. In the past 5 years, Evercore has nearly doubled its revenue, and grew its revenue at an impressive 15% CAGR. What is more impressive is that during this time, Evercore has more than tripled its EPS, which represents a near 26% CAGR. This stellar financial performance has been fairly consistent, enduring through the volatile market conditions in the past 5 years.

Evercore Earnings Presentation Evercore Earnings Presentation

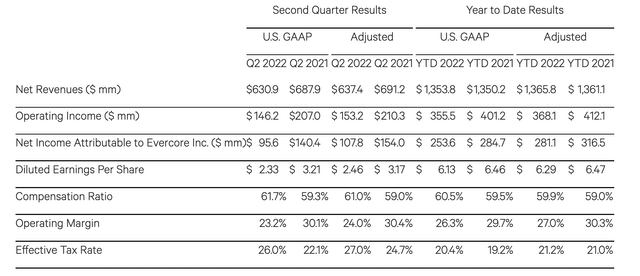

Even though investment banking revenues fell by 38% the first half of this year compared to first half of the previous year, Evercore has actually reported an increase in revenue YoY during the same time frame. As seen below, despite the worse economic conditions in 2022 than in 2021, Evercore has reported a slightly increased in GAAP and adjusted revenue in “Year to Date” results. This stark contrast between the market condition and Evercore’s resilient financial performance further supports the point that Evercore will able to thrive in any environment, as it has done for the past few years.

Evercore Earnings Press Release

Shareholder Friendly Policies

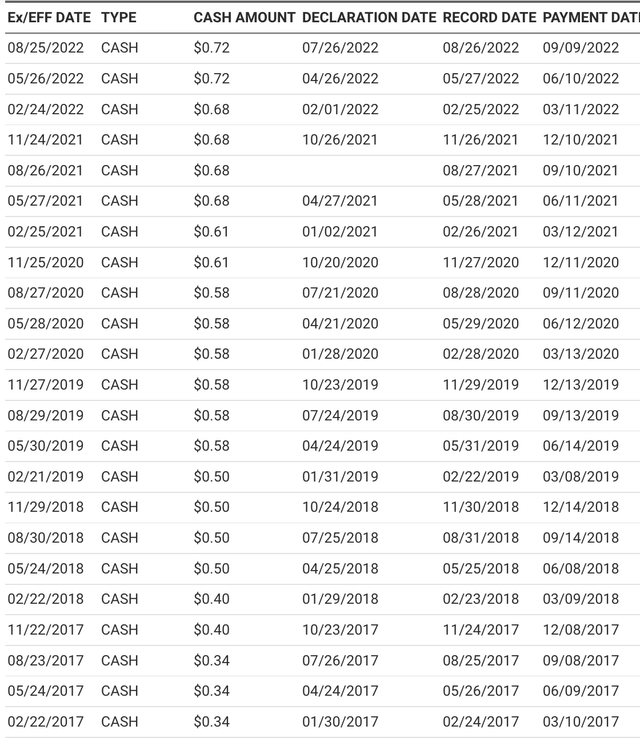

Evercore’s management has been friendly to shareholder value, and has historically implemented generous buyback programs and consistently paid out dividends to shareholders. Earlier this year, Evercore initiated a $1.4 billion share buyback program, which is nearly ~33% of its current market capitalization. Evercore’s huge buyback program demonstrates management’s confidence in the company and its business prospects, while at the same time showing a commitment to increasing shareholder value by returning such a large amount of capital back to its shareholders. In addition to the buyback program, Evercore has been a consistent dividend paying company, and has recently paid out $0.72 per share this quarter, which equates to 2.83% annualized dividend yield. This yield is comfortably higher than the current S&P 500 yield, and Evercore has a track record of consistency when it comes to dividend payments. Compared to the quarterly payout of $0.34 a share in 2017, Evercore has increased its dividends by more than a 100%, and has grown its dividend by a ~16% CAGR, which vastly outpaces the S&P 500 during this time frame.

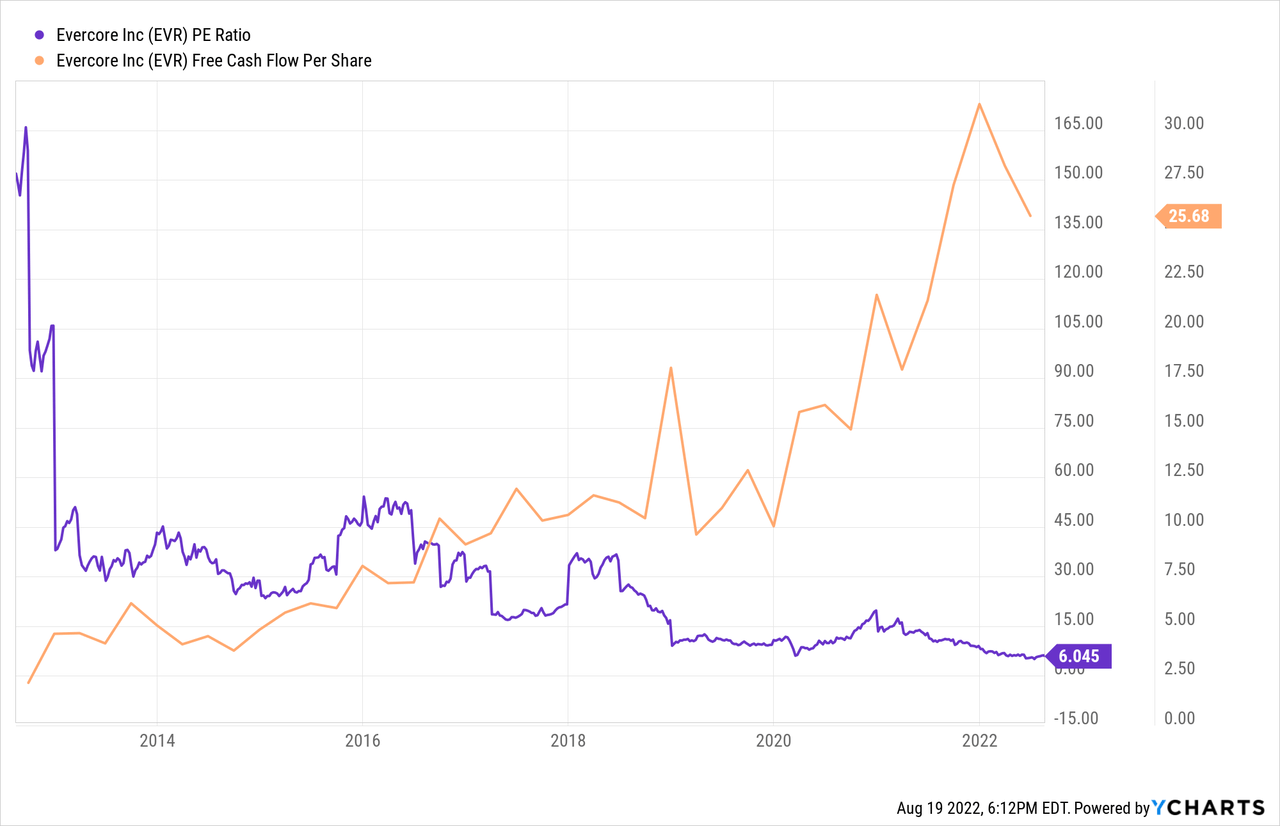

Cheap Valuation

We believe that the trends point to the stock price going higher from here. Using historical data, Evercore stock’s P/E valuation is at historical lows and trades at around 6.0x earnings. Even when going back to the roughly 12.0x to 15.0x P/E multiples based on TTM earnings, we see that the stock price can rise 100% to 150% from its current levels. and In addition, due to the massive buyback program, we see that the FCF per share has been rising rapidly, and now hovers at $25 FCF per share. That means that based on current levels, roughly a quarter of the value of the stock is backed by FCF. That’s quite attractive for value-focused investors, and that should provide some support to the stock price. We believe that as buyback program continues, shareholders are going to see the value of their holdings rise.

Conclusion

Evercore is a top boutique investment bank that deserves the attention of investors who are seeking consistent dividend income and looking for shareholder value growth potential. Evercore has had a track record of success, and there are no indications that the streak of success will end anytime soon. With double-digit revenue and earnings CAGR over the past 5 years, as well as the start of a huge buyback program, we believe that current price levels are perfect entry points for investors to accumulate shares of this beaten down stock.

Be the first to comment