Warchi/iStock via Getty Images

A Quick Take On Procore Technologies

Procore Technologies (NYSE:PCOR) went public in May 2021, raising approximately $635 million in gross proceeds in an IPO that priced at $67.00 per share.

The firm provides construction management software to businesses worldwide.

I’m not optimistic on the conditions for an upside catalyst to the stock in the near term, due to the firm’s high operating losses and potential for a soft construction environment ahead.

I’m on Hold for PCOR in the near term.

PCOR Overview

Carpinteria, California-based Procore was founded to develop a comprehensive construction management SaaS platform for the complete lifecycle from pre-construction to ongoing management.

Management is headed by founder and CEO Craig Courtemanche, Jr., who was previously founder and CEO of software consulting firm Webcage.

The company’s primary offerings include:

-

Prequalification

-

Bid management

-

Project management

-

Quality & safety

-

Design coordination

-

BIM

-

Field productivity

-

Financial management

PCOR pursues medium and large customer accounts via direct sales efforts.

In addition, the firm is active in brand building efforts through participation in a large number of construction industry events.

Market & Competition

According to a 2019 market research report by Technavio, the market for construction management software is expected to grow by $725 million from 2020 to 2024.

A report commissioned by the company and prepared by Frost & Sullivan, indicated that the market for the firm’s existing products is $9.4 billion.

Deloitte estimates that 1.5% of the global construction expenditure will be spent on IT products and services, which would equate to about $15 billion.

The main drivers for this expected growth are the continuing urbanization trend in major countries worldwide and the ongoing need to upgrade or add new infrastructure.

Major competitive vendors include:

Management says its combination of software tools plus its growing app marketplace promises to drive greater value for customers.

PCOR’s Recent Financial Performance

-

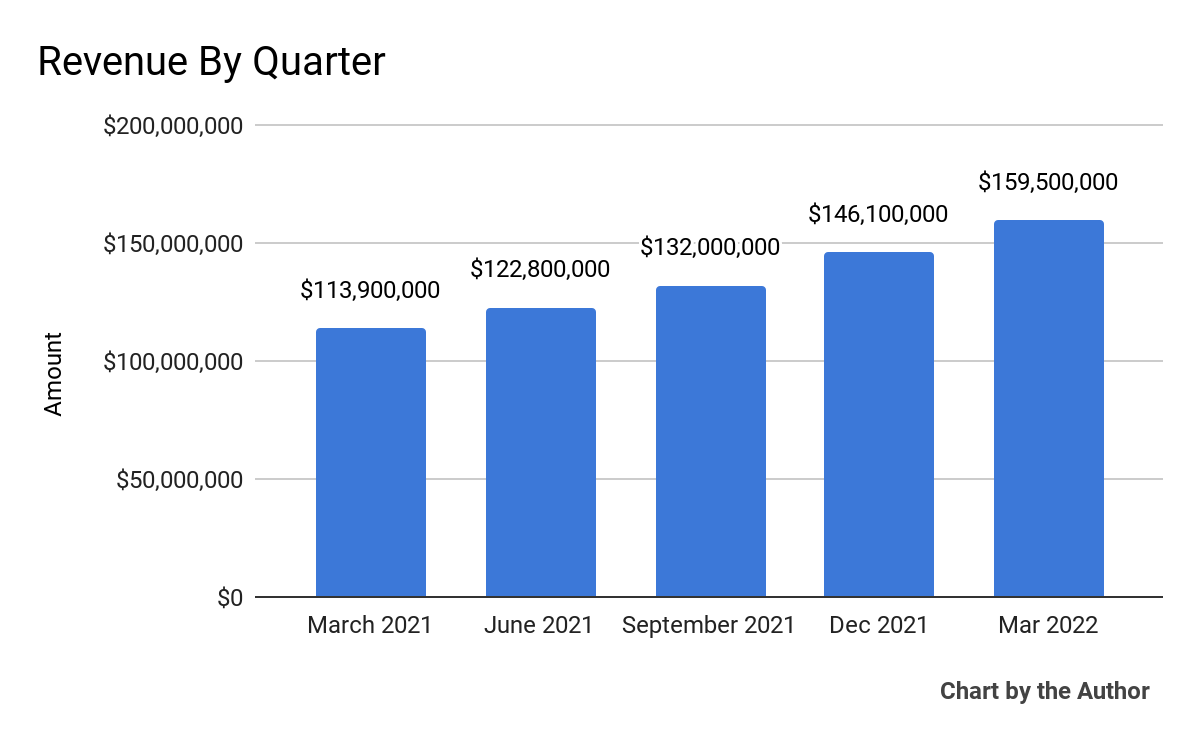

Total revenue by quarter has grown steadily over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

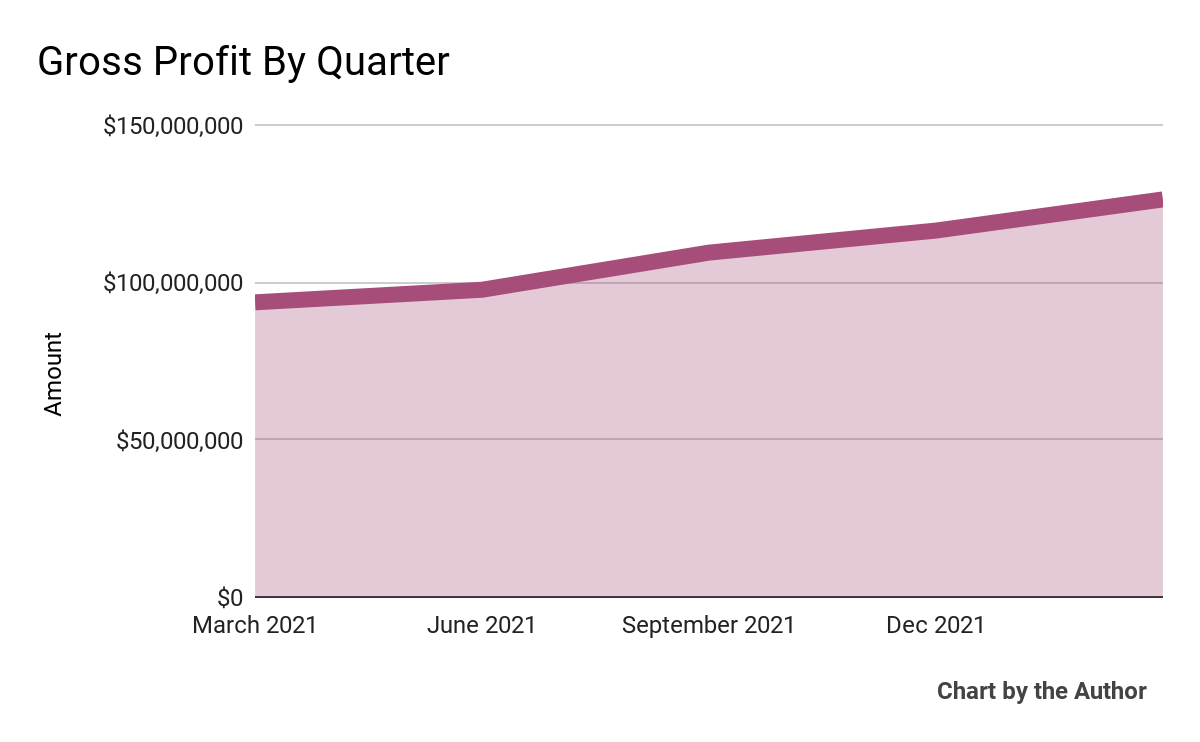

5 Quarter Gross Profit (Seeking Alpha)

-

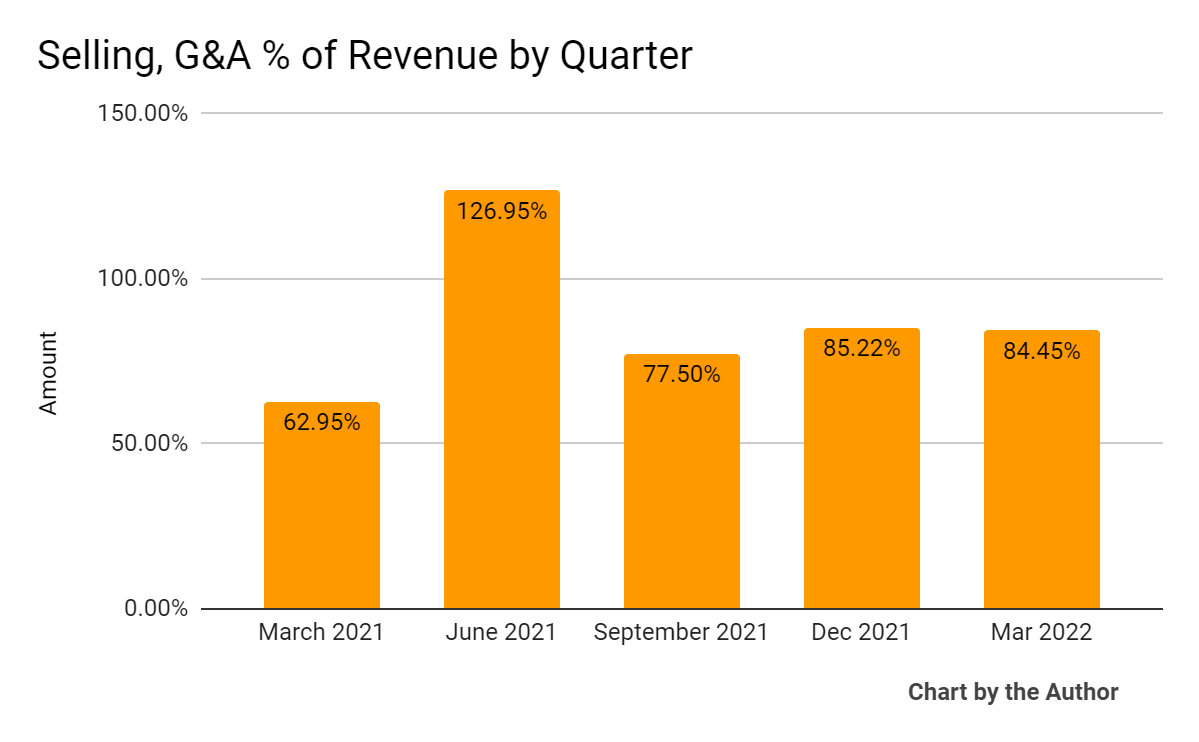

Selling, G&A expenses as a percentage of total revenue by quarter have remained high:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

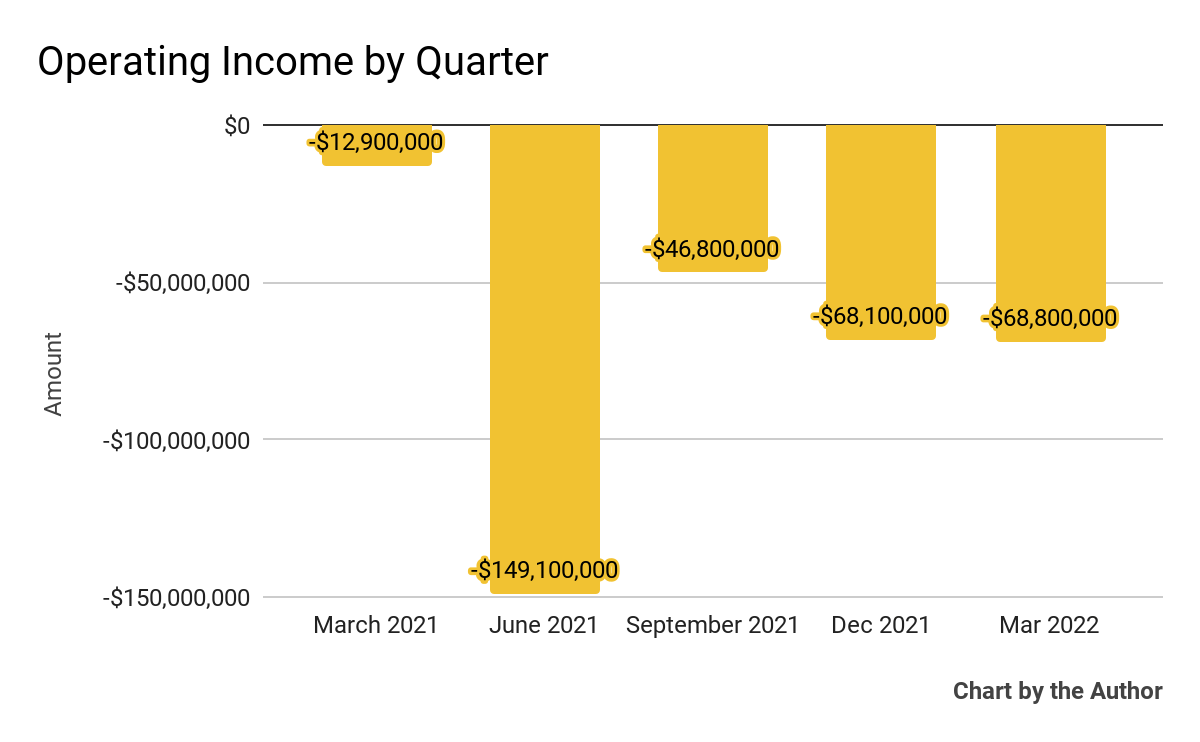

Operating losses by quarter have remained high:

5 Quarter Operating Income (Seeking Alpha)

-

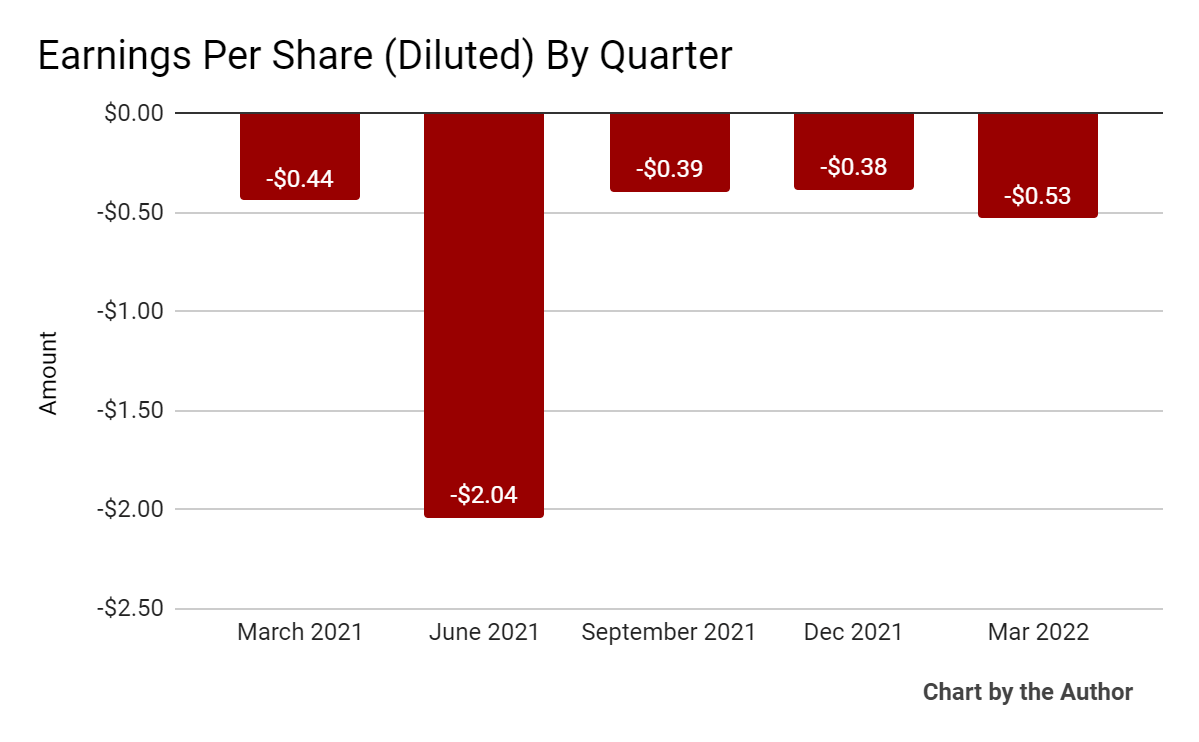

Earnings per share (Diluted) have deteriorated in the most recent quarter:

5 Quarter Earnings Per Share (Seeking Alpha)

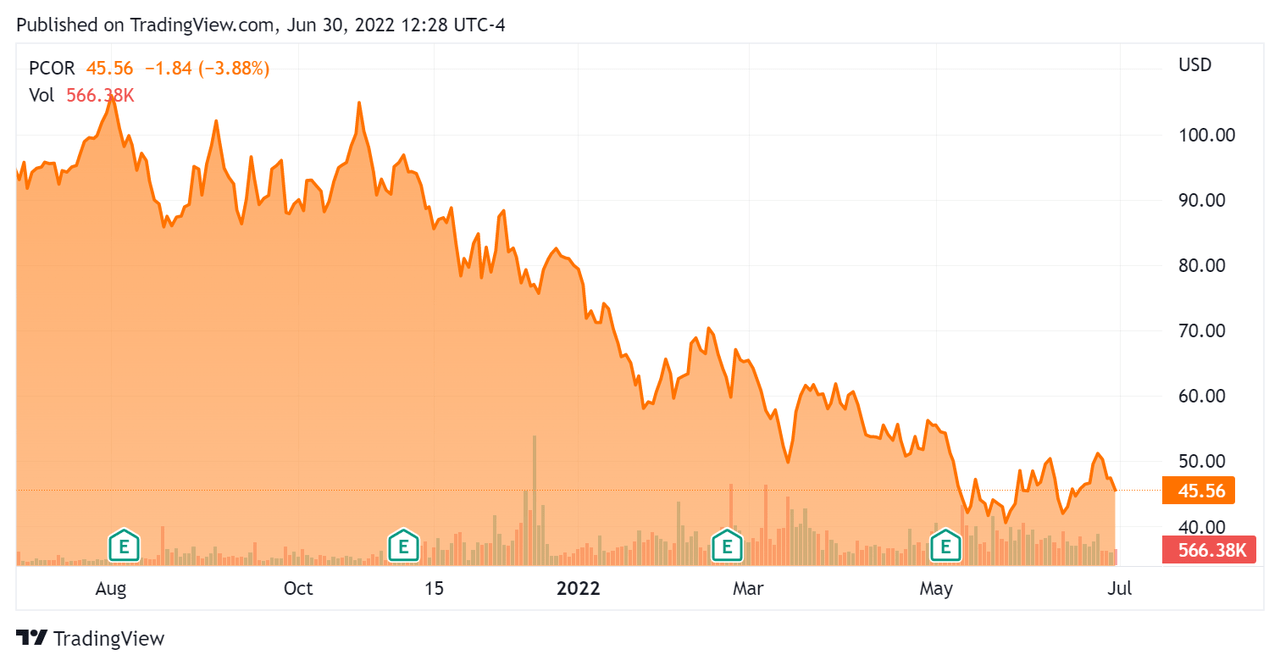

In the past 12 months, PCOR’s stock price has dropped 52.1 percent vs. the U.S. S&P 500 index’s drop of around 11.2 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Procore

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$6,810,000,000 |

|

Enterprise Value |

$5,930,000,000 |

|

Price / Sales [TTM] |

10.02 |

|

Enterprise Value / Sales [TTM] |

10.58 |

|

Operating Cash Flow [TTM] |

$18,720,000 |

|

Revenue Growth Rate [TTM] |

32.83% |

|

CapEx Ratio |

1.07 |

|

Earnings Per Share |

-$3.34 |

(Source – Seeking Alpha)

Commentary On Procore

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the broad nature of its revenue growth in terms of customer types, customer size and locations as well as the company’s pipeline growth.

CEO Courtemanche also stated that construction activity remains ‘robust, and customers tell us that they’ve never seen stronger and healthier project backlogs.’

Notably, the firm is also growing its international business in English-speaking locales.

However, its M&A activity will likely be significantly lower than in 2021 as management focuses on integration of its recent acquisitions.

As to its financial results, revenue increased 40% year-over-year, 34% organically.

The company ended the quarter with over 12,800 customers, a 20% year-over-year growth rate.

Looking ahead, management guided to lower operating margin.

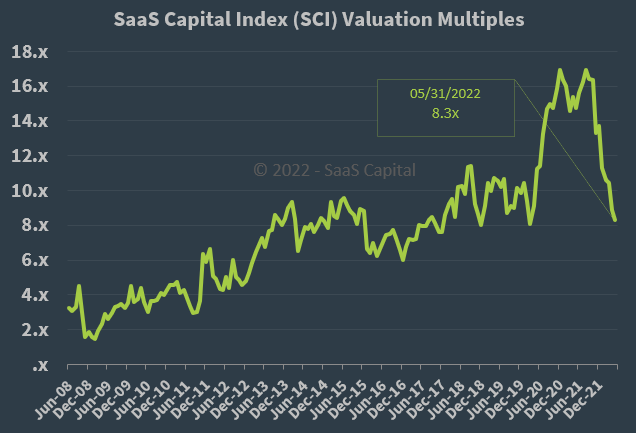

Regarding valuation, the stock is currently being valued on a trailing EV/Revenue multiple of around 10.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x at May 31, 2022, as the chart shows here:

SaaS Capital Index Valuation Multiples (SaaS Capital)

So, PCOR’s 10.6x multiple is still above the average.

The primary risk to the company’s outlook is a rising interest rate environment, which may put a damper on new construction starts and customer spending plans.

Also, while PCOR has certainly produced impressive revenue and gross profit growth, it is generating ever increasing operating losses.

In a rising interest rate environment, companies with this profile have been severely punished by the stock market.

Accordingly, I’m not optimistic on the conditions for an upside catalyst to the stock in the near term, due to the firm’s high operating losses and potential for a soft construction environment ahead.

I’m on Hold for PCOR for the near term.

Be the first to comment