April30

Summary

I still recommend purchasing Proterra (NASDAQ:PTRA). My opinion on PTRA has not changed since I first wrote about it; rather, this piece serves as a continuation of the thesis in light of the company’s 3Q22 earnings report. My assessment is that investors can still expect a positive IRR from the current valuation.

Earnings overview

In light of persistent supply chain difficulties, especially in its Transit division, management has reiterated revenue expectations of $300–325 million, or 24%–34% growth. As vacations and plant shutdowns for the end-of-year inventory count are factored into the forecast, I believe it is likely that sequential sales will be flat or slightly lower than in the third quarter. This is something to note as it might cause further short-term stock volatility. Something positive to note is that since the first phase of the Powered 1 facility is nearly finished, the business has reduced its capex guidance to $70 million.

I am confident that demand for battery-electric commercial vehicles will continue to rise beyond FY22, this is especially due to the large awards of public spending, such as the estimated $800 million yearly award under the Bipartisan Infrastructure Act through 2026. In addition, there were a total funding requests of over $4 billion submitted to the EPA for the inaugural year of the Clean School Bus Program, which I dare say it is good news as there were 2,350 electric school buses that received nearly all of the funds. Furthermore, the deadline for spending these funds is April 2023, which means there will be demand and PTRA is well positioned to capture it.

In addition, starting in 2023, the Inflation Reduction Act is projected to provide even greater amounts of funding for commercial vehicle electrification, such as a per-vehicle credit of up to 30% of a new Class 4–8 electric commercial vehicle. In my opinion, this would further increase adoption for electric commercial vehicle as the initial “CAPEX” is further lowered. This is perfect for PTRA as they benefit from the boom of EV adoption.

Updates on supply chain

I believe we are still in the midst of addressing this huge supply chain mess, which I think would continue to weigh on the stock until further good news are released by the company. I do take comfort that management has factored in the negative impact while reaffirming the FY22 revenue guidance – which means we are unlikely to see a “guidance miss”.

Transit sees positive improvements

In spite of not adding a complete second shift, transit deliveries rose by 8 units, which I see as a result of the company’s successful efforts to optimize its manufacturing processes. During the quarter, PTRA also supplied five pre-owned buses, suggesting there is growth potential in this segment of the market as well.

Though ongoing supply chain headwinds affected volumes, especially owing to wiring harness shortages, overall, I view this as a positive because revenue climbed by 12% to a record $56 million in 3Q22. With federal funding, such as the $829 million from the Bipartisan Infrastructure Act designated for zero-emission transit buses and related charging or refueling infrastructure purchases, I am optimistic about PTRA’s potential to drive transit production over the next few years. Further, the FTA has made over $550 million available from its buses and bus facilities program for the purchase of electric transit buses.

Battery systems delivery up year on year but down sequentially for the first time

The number of battery systems shipped in the third quarter of 2022 was around 292 units, representing a year-over-year increase of 275% but a sequential decrease of 16% for the first time since the first quarter of 2021. That said, I believe the overall performance was alright, the overall number of batteries produced, 94MWh, grew 51% year over year and 20% sequentially, which I think may be indicative of a shift in mix toward larger and heavier batteries and a more profitable future.

Furthermore, management has observed strong underlying demand, with deliveries to nine different OEMs across a wide range of vehicles, with electric school bus demand growing rapidly.

Investment in LFP

In order to ensure a steady supply of lithium iron phosphate [LFP] cells built in the United States, management has proposed considering a strategic equity investment in a battery cell manufacturer. I believe Proterra’s localization of LFP cell supply will help position the company as a favored supplier as OEMs move their supply chains onshore, given that more than 90% of iron-based batteries are now made in China.

In addition, management believes that diversifying the company’s cell chemistries beyond its present cylindrical NMC technology would create additional sales prospects as the company becomes a competitive alternative for clients seeking a less dense, less expensive battery.

Valuation update

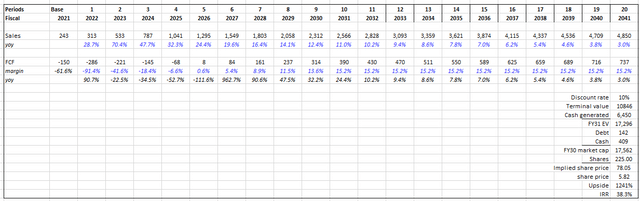

I believe the current market price still presents a decent entry point for investors to enjoy very attractive IRR over the long-term.

Key updates to model:

- Sales: reduced growth rate in FY22 and FY23 to reflect new consensus estimates

Conclusion

PTRA is a thriving business with exciting plans for the future of electric buses and transportation. Investors still have a fantastic chance to profit from a massive mispricing at the current valuation.

Be the first to comment