Galeanu Mihai/iStock via Getty Images

Voya Financial, Inc. (NYSE:VOYA), a US-based provider of retirement income solutions, asset management, employee benefits, and life insurance products, recently announced the acquisition of Allianz Global Investors’ (“AGI”) U.S. equity and fixed income investment teams, client service, and sales professionals, as well as ~$120bn of assets under management. The transaction appears strategically and financially favorable, as VOYA opportunistically adds investment management capabilities and distribution scale on accretive terms without sacrificing capital flexibility.

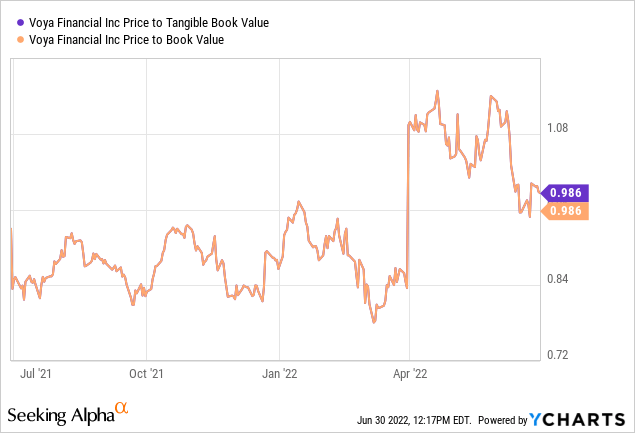

In the near term, the deal should also help VOYA balance out EPS headwinds from any equity market weakness, providing a nice tailwind to its 12-17% EPS growth target. Having also taken steps to de-risk the P&L and improve its return profile through M&A, VOYA’s <1x tangible book value multiple is undemanding, in my view, and has ample room to re-rate higher over time.

Puts and Takes from the AGI Deal Announcement

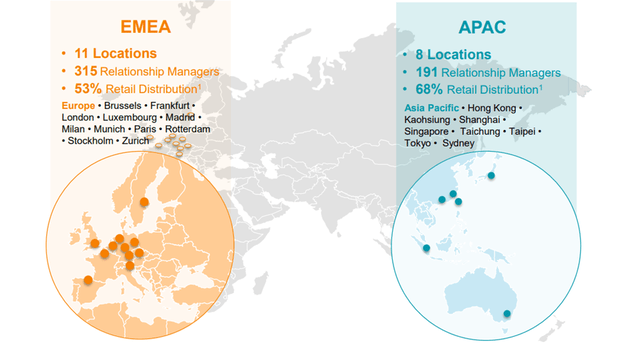

Per VOYA’s press release, the definitive agreement with AGI will see it integrate ~$120bn of AGI US assets in exchange for a ~24% Allianz stake in the combined asset management entity – in line with the <24% disclosed in the prior May memorandum of understanding (“MOU”). The deal also establishes a distribution partnership with Allianz SE (OTCPK:ALIZF), which will see it distribute VOYA investment management products across its international base.

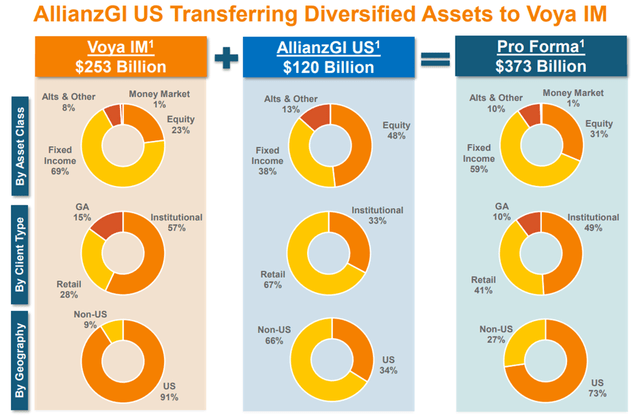

Per VOYA, the combined assets under management (“AUM”) will amount to ~$373bn on a pro forma basis as of Q1 2022, with the transaction set to significantly diversify the AUM of the investment management division. In particular, the deal will drive non-U.S. contribution to ~27% (up from ~9% prior), with retail expanding to ~41% of AUM (up from the current ~28%). By asset class, VOYA’s fixed income concentration will reduce to ~59% of AUM (vs. the current ~69%), with equities moving up to ~31% (from the current ~23%), alternatives at ~10% (up from ~8% currently), and the remaining ~1% in money markets. Assuming no unforeseen regulatory hurdles, the deal should go through by the planned July 2022 close.

A Net Positive Financial Impact

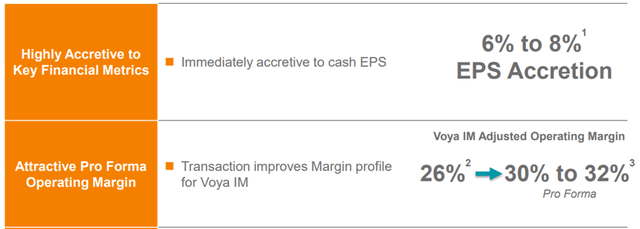

VOYA has guided to a baseline 6-8% “cash” EPS accretion in 2023, although the operating EPS benefit is likely to be modestly lower (all else equal) given the GAAP impact from intangible amortization. The accretion target makes sense, in my view – AGI’s margins are higher, so VOYA’s investment margin profile will see an immediate uplift to >30%. Plus, the earnings accretion is incremental to the 12-17% annual EPS growth range target provided at last year’s investor day, so upward revisions seem inevitable – recall that at VOYA’s 2021 Investor Day, management had guided to ~27% investment management margins in 2022, improving ~1%pt per year to ~29% in 2024. Finally, the transaction could also yield upside to VOYA’s 90-100% free cash flow conversion target range, given the investment management business typically sustains higher than average FCF conversions.

One of the key reasons for AGI’s superior margin profile is its higher fee rate across an AUM base skewed more toward equity and retail assets (vs. VOYA’s fixed income tilt). While the margin differential is somewhat closer than many had expected following the MoU released last month, VOYA still has levers for margin improvement. Per management, VOYA could pull 4-6%pts of immediate margin improvement, bringing the overall margin profile to 30-32% (up from ~26%). Much of the delta will come from operational efficiency, as VOYA can spread the overhead from acquired AGI assets/teams over a larger base. As VOYA will also effectively pay for the acquired AUM using equity in the combined entity, it will maintain its excess capital position and, by extension, capital deployment optionality. Given negotiations that occurred during Q2 2022, though, expect a temporary pause in share buybacks before an acceleration in the back half of the year.

Covering the Strategic Bases

The acquired AGI assets are a great fit on paper – it diversifies the VOYA base more towards equities, retail and non-U.S. exposure. The acquired teams have a great track record as well, generating >$20bn of net inflows last year (equivalent to organic growth of >20%) and even breaking even on fund flows YTD. Additionally, the new structure adds capital flexibility since no capital outlay is required and allows VOYA to leverage Allianz’s global distribution (500 relationship managers across Europe/Asia Pacific) via a long-term partnership. The most important part of the deal, though, is capping downside risks – VOYA has not only negotiated protections from legacy AGI litigation issues (i.e., the >$6bn in penalties from the DOJ/SEC settlement for its “Structured Alpha” funds) but also has agreements in place to mitigate revenue and AUM attrition post-deal through early 2023.

Taking Another Positive Step Forward with Accretive AGI Deal

With the addition of AGI’s ~$120bn AUM on accretive financial terms, VOYA has once again shown its uncanny opportunism in adding investment management capabilities and international distribution via M&A. The move follows VOYA’s prior steps to de-risk its portfolio and enhance its financial profile, more than justifying its <1x tangible book valuation multiple. As the company further builds out a less interest rate sensitive business and leverages its excess capital position, expect the valuation to continue to re-rate higher. Keep your eyes peeled for incremental updates to the double-digit EPS target for this year (in conjunction with the upcoming Q2 earnings), as well as updates on the buyback path given the enhanced Investment Management FCF conversion profile post-AGI deal close.

Be the first to comment