Warchi

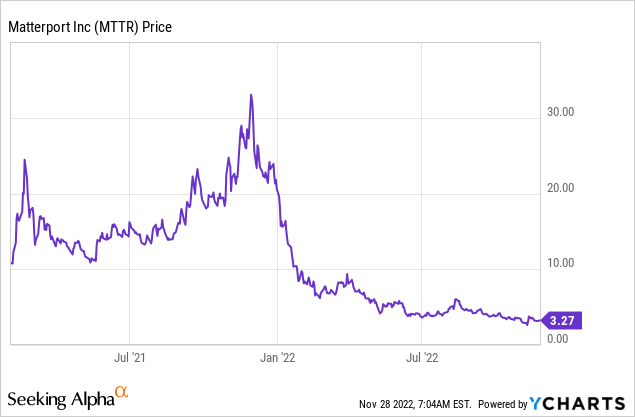

Matterport, Inc. (NASDAQ:MTTR) is a 3D modeling and camera company that focuses on creating digital versions of real buildings. The company went public in February 2021, which wasn’t great timing, as shortly after there was a large transition from “growth stocks” to value stocks in the market, due to high inflation numbers being released in March 2021. Since that point, Matterport’s stock has been butchered by 73%.

However, the company has recently produced “record” revenue for the third quarter of 2022. In addition, Matterpot is poised to benefit from the growth in the “Metaverse.” This is an industry that is forecasted to grow at a 39.8% compounded annual growth rate, and be worth nearly $1 trillion by 2030. Thus in this post, I’m going to break down the company’s financials and valuation, let’s dive in.

Strong Third Quarter Financials

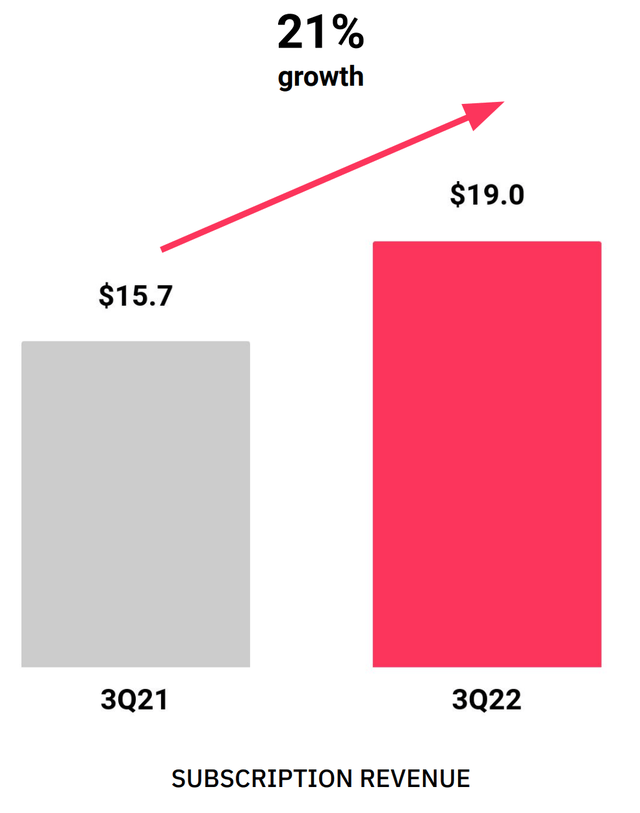

Matterport reported strong results for the third quarter of 2022. Revenue was a record $37.99 million, which increased by 37% year-over-year and beat analyst estimates by $2.05 million. This was driven by solid growth across the company’s 3 main revenue segments: subscriptions, services, and products. Subscription revenue increased by 21% year-over-year to $19 million, with annual recurring revenue expanding to a record $76 million. The company reported 657,000 subscribers, with the majority (594,000) being free subscribers followed by 63,000 paying subscribers. Matterport’s strategy is to gradually convert subscribers from free to paid, and so far that strategy has been working well.

Subscription Revenue (Q3,22 report)

The company reported a net dollar expansion rate of 106% in the third quarter, which was driven by strong upsells for its enterprise customers. Small and medium-sized businesses were less reluctant to increase spending, due to the macroeconomic environment. Personally, I don’t think this is a major issue, as Enterprises are much greater customers overall with larger budgets and more stable contracts.

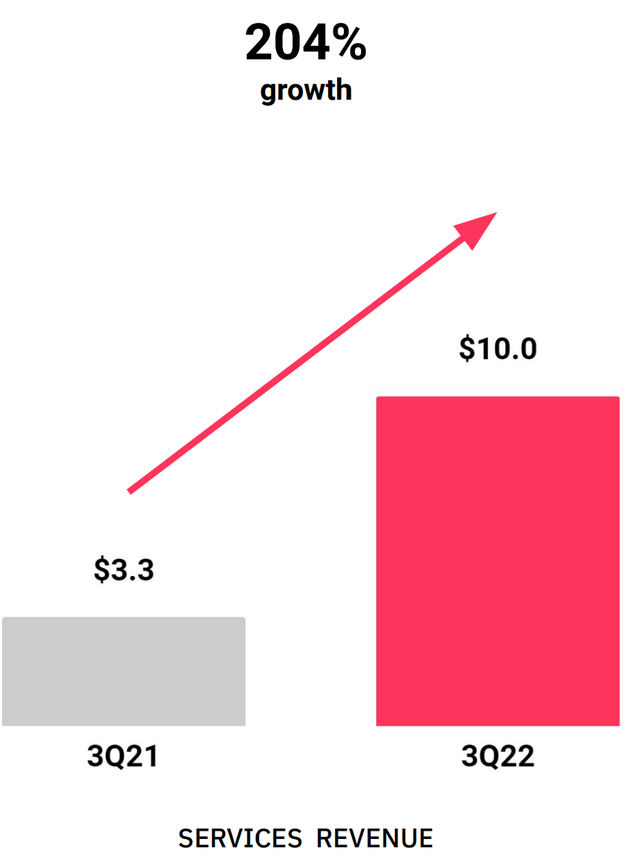

Matterport reported Services revenue of $10 million in Q3 2022, which increased by a rapid 204% year-over-year. This was mainly driven by the acquisition of VHT. VHT Studios is a real estate marketing company that offers professional photography, drone imagery, floor plans, and even virtual tours. The idea of the acquisition is to combine VHT Studio’s existing relationships with agents with Matterport’s Digital 3D Twin technology.

Services Revenue (Q3,22 report)

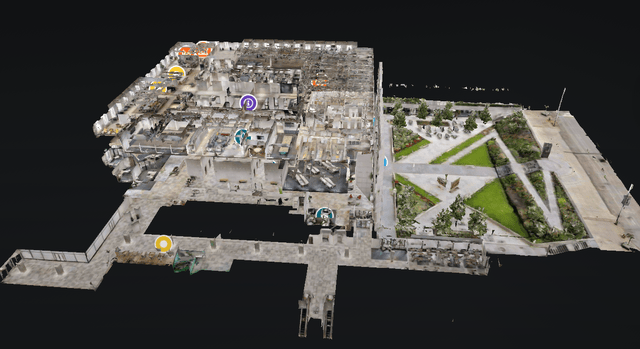

Matterport’s Digital twins are 3D models of real buildings, which range from houses to offices and even factories. Digital Twins have many applications which include the ability to optimize facilities for remote working or manufacturing, in addition to marketing and promotion through interactive real estate. Matterport has grown its spaces under management to 8.7 million which has increased by 40% year-over-year.

Matterport Digital Twin (Official Website)

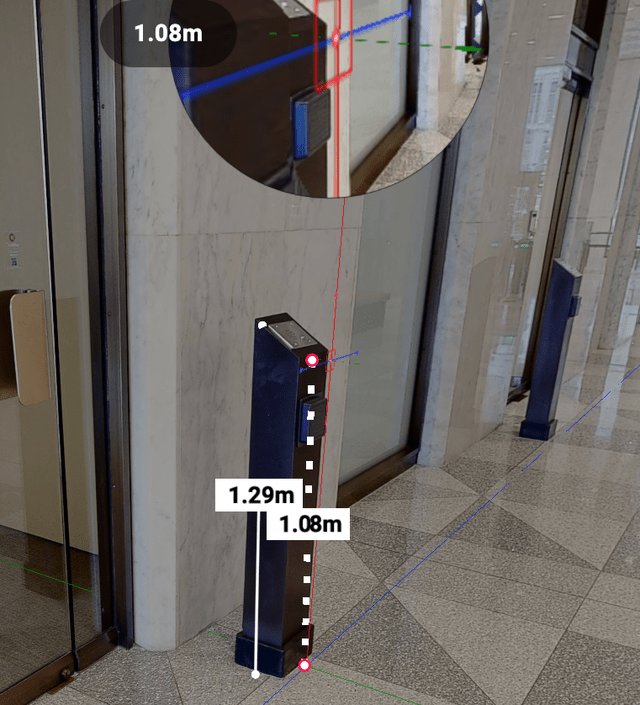

Using Digital Twins, Customers can make data-driven decisions remotely, do virtual inspections, and even collaborate with others virtually without the need for site visits. A question you may ask is what makes Matterport different from just walking around a building with a standard smartphone camera on record: in one word, I would say accuracy. Matterport models have every dimension to scale, this means you can make real measurements, as if you had a tape measure inside the building. For example, I have just measured the length of this column inside a 3D model on Matterport’s website.

Matterport Measurement (created by author with Matterport Model)

As a former Design engineer, I see the benefit of this technology, as it can help with creating drawings for contractors to do building work or ordering replacement items. For example, in the image below you can see the Digital Twin can be embedded with real data on various parts, which helps with maintenance, replacement, and construction.

Digital Twin Maintenance (Matterport Website)

Matterport has recently scored a partnership with Burns & McDonnell, an engineering, construction, and architecture firm with over 10,000 employees. In addition, the company has partnered with TD SYNNEX, a leading IT distributor with over 150,000 resellers in its network.

The company also reported strong product revenue of $8.6 million, which increased by 78% year-over-year. This was driven by the popularity of the newly launched Matterport Pro3 Camera, which uses LiDAR and sensors for 3D capture. The camera costs approximately $6,000 and has already been used to “digitize” huge stadiums and arenas, indoors and outdoors. Matterport was struggling with supply chain constraints for its older Pro2 Camera in the first half of 2022, but has since shipped all of its order backlog for this model and begun shipments of its new Pro3 Camera.

Matterport Pro3 Camera Kit (Q3,22 report)

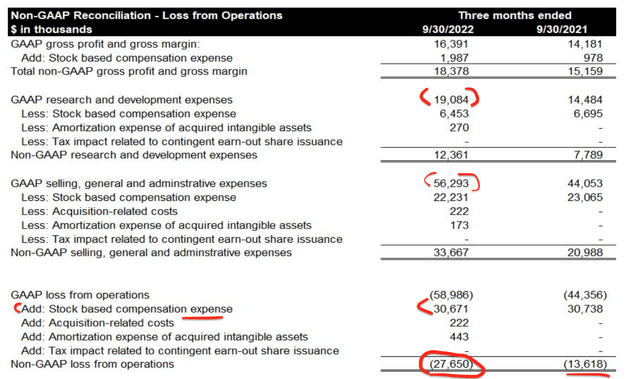

The lack of profitability is an issue for the company. On a Non-GAAP basis, its Loss from Operations has ballooned from negative $13.6 million in Q3,21 to negative $27.7 million by Q3,22. This is despite $30.6 million in stock-based compensation being added back. The $19 million in GAAP R&D expenses are not an issue, as I believe the company should continually invest into product innovation to stay ahead. However, the increase in Selling and General and Administrative expenses from $44 million in Q3,21 to $56.3 million by Q3,22 is not great to see.

Matterport Financials (Q3,22 )

The only consolation for Matterport is a portion of the expenses has been the result of acquisition costs. Its overall operating expenses have also declined by 6% quarter-over-quarter. This reflects management’s new focus on operating efficiency, although the business still has a long way to go.

Matterport reported Q3 earnings per share of negative $0.20, which beat analyst estimates by $0.06. On a Non-GAAP Basis, EPS was negative $0.09, which beat analyst estimates by $0.05.

Matterport has a solid balance sheet with $495 million in cash and short-term investments (after acquisitions costs). In addition, the business has virtually no debt.

Advanced Valuation

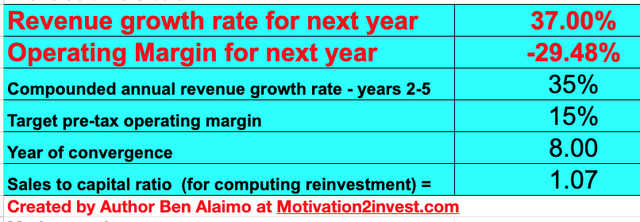

I have plugged the latest financials into my valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 37% revenue growth from next year and 35% revenue growth over the next 2 to 5 years, which is aligned with prior growth rates.

Matterport stock valuation 1 (created by author Ben at Motivation 2 invest)

Valuing Matterport is fairly challenging, as the business is growing steadily but still burning a lot of cash. If management can drive efficiencies like they are predicting, then its operating margin could increase to 15% over the next 8 years.

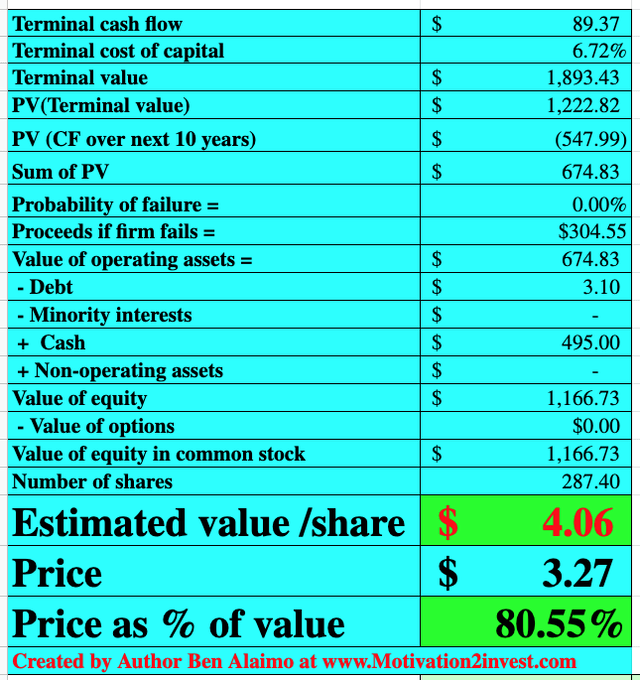

Matterport stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $4.06 per share. The stock is trading at $3.27 per share at the time of writing, and is thus ~20% undervalued.

Risks

Recession/Cash Burn

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. This will likely result in lower spending by businesses, especially for non-essential products. Matterport is also operating at a heavy loss, so unless the company can reduce its expenses drastically as management is forecasting, then it will continue to eat into its cash position. At its 2021 cash burn rate ($44 million a quarter for Q3,21), the company has approximately ~2.8 years’ worth of cash before it will need to raise capital or become profitable. If I use the operating loss figures for 2022 ($58 million for Q3,22), the company has a 2.1-year cash runway left.

Final Thoughts

Matterport is a great technology company that is continually innovating and has a popular product. The company has recently produced record revenue results, but its increasing operating expenses is a worrying sign. Matterport, Inc. stock is undervalued intrinsically, but I will label it as a “hold” until management can drive down expenses.

Be the first to comment