RiverNorthPhotography

On August 8, Tyson Foods, Inc. (NYSE:TSN) released its Q3 2022 results, causing investor disappointment. In fact, the price per share that day plummeted 8.40%, pushing it 20% far from its all-time high. In my opinion, the investor reaction was unwarranted since the results released, while not positive, were not that tragic. What’s more, almost every company in the food processing sector is experiencing difficulties due to continued slowdowns in the supply chain and the general increase in raw materials. In this article, we are going to look in detail at what has spooked investors and what Tyson Foods is worth in light of the considerations made.

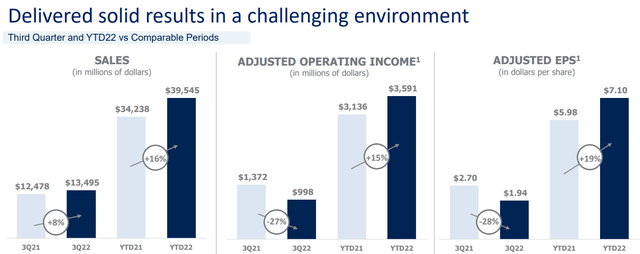

Sales and operating income

The company’s Q3 sales and operating income results were quite positive.

- Sales are up 8% from Q3 2021 and up 16% from YTD 2021

- Operating income is down 27% from Q3 2022 but is up 15% from YTD 2021

- EPS are down 28% from Q3 2021 but are up 19% from YTD 2021. However, this result was aided by the buyback plan adopted by the company this fiscal year: 8.1 million shares were purchased for a total value of $693 million.

Overall, what we see from this Q3 is that it was certainly more onerous in terms of operating costs and cost of goods sold: we can infer this from the rising revenues and declining operating income. After all, the whole macroeconomic environment still has many limitations, and this company is not exempt. On the positive side, however, if we look at YTD, this fiscal year is getting great improvements over the previous one. In any case, what worries investors is not the results we just saw, but the decreasing sales volumes.

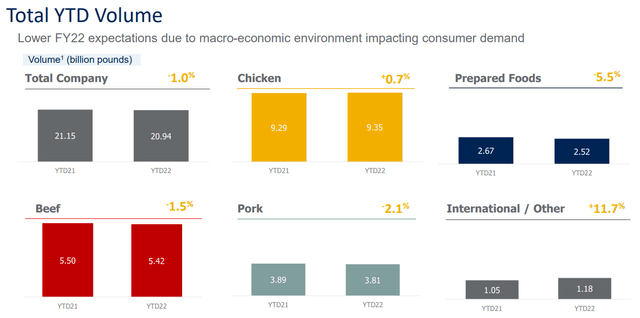

Distressed volumes

Tyson Foods is among the top companies in U.S. for meat sales, and as good as that may be there are doubts that grip shareholders. This industry, though stable, is not growing, so it is hardly desirable that Tyson Foods’ sales volumes can improve so much in the future.

From what we can see, only demand for chicken products is expected to increase, along with international sales. All other segments have declined.

The company has justified this with low consumer demand due to the current macroeconomic scenario, but I personally believe there are other underlying reasons as well. There is no question that vegan products have been popping up in recent years, and as much as Tyson Foods has already tried to enter this market in 2019, the results have not lived up to its brand name. As the demand for vegan products increases, the one to suffer is meat consumption, which has been declining for years in the U.S.

- Beef consumption per capita was 76.4 pounds in 1980, 67.5 pounds in 2000 and 56.1 pounds in 2022.

- Pork consumption per capita was 56.8 pounds in 1980, 50.8 pounds in 2000 and 50.1 pounds in 2022.

- Poultry consumption per capita was 57.2 pounds in 1980, 94.1 pounds in 2000 and 111.7 pounds in 2022.

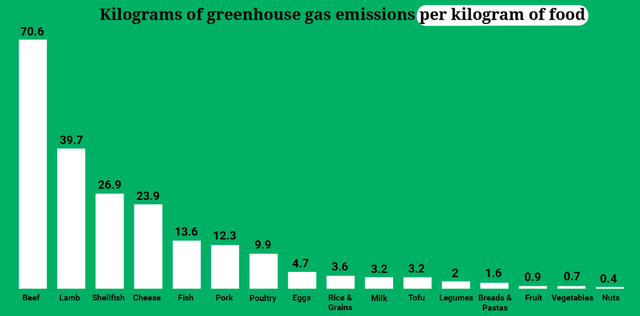

Beef and pork are responsible for about 50% of Tyson Foods’ revenues, and demand for both segments is on a long-term downward trend, especially beef. The company has found considerable growth in the chicken segment in recent years, almost catching up with the beef segment in terms of revenues. How long this segment can grow is hard to say, but it will certainly be less growth than in the past. In any case, whatever meat is raised, I do not think it is realistic that Tyson’s business can expand more and more in the future, as it is very harmful to the environment. If Tyson wants to expand it will have to do so in line with ESG criteria and by finding eco-friendly solutions.

Livestock farming is one of the main causes of pollution in the world and everything will be done to solve this problem. In order for Tyson Foods to increase its sales volumes it should focus more on a more sustainable market such as selling vegan products or selling more overseas but still meeting ESG criteria. In any case, even if Tyson Foods did not become popular by selling veggie burgers, I think it is also important for a company to adapt to the most popular demands in the market. The global plant-based meat market could reach a value of $15.70 billion in 2027, achieving a CAGR of 14.70% from 2022 to 2027.

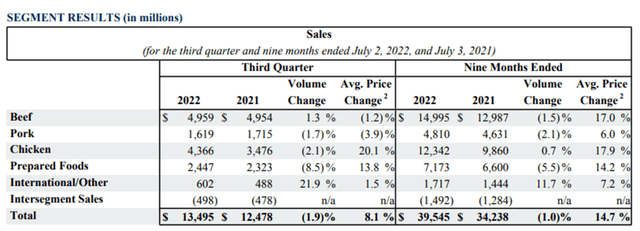

Sharply rising prices

Earlier we saw how YTD 2022 revenues increased compared to YTD 2021 revenues, but how was this possible when we have just seen that growth volumes are down? The answer lies in the market power of this company.

As can be seen from this table, the prices of Tyson Foods’ products increased significantly from the previous year, finding an increase of 14.7%. Such an increase managed to completely cover the 1% volume loss, which is why such high revenues resulted for this fiscal year. This is a very good result in my opinion, as the company has managed to pass on the general increase in production costs to consumers. Only a company with a well-known brand and strong market power can afford such a large price increase. I exclude the possibility that sales volumes have been reduced due to excessive price increases as I believe it stems from far more important macro-trends (reduced demand for meat in the US and environmental impact). In any case, even if the latter statement were true, the end result was positive since it has largely compensated for the slight loss in sales volumes.

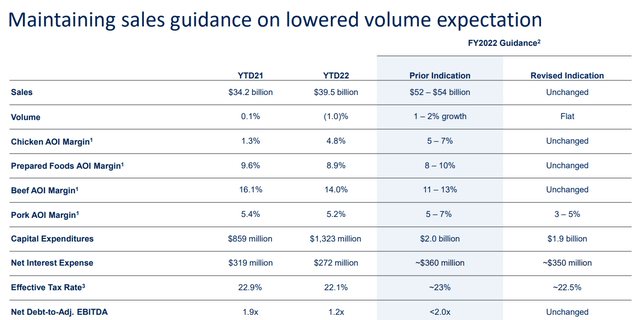

Guidance FY2022

The guidance regarding this fiscal year was another element that somewhat discouraged shareholders as some forecasts were revised downward. Once again, however, I reiterate that these are not such serious results as to justify an 8% sell-off in my opinion.

The main negatives in the FY2022 guidance are the lack of sales volume growth and a lowered revised operating margin. For a company like Tyson Foods where the profit margin is very low, (net income hardly exceeded 5%) even a 2% reduction on operating income as in this case can make the difference between a good year and a bad one.

How much is Tyson Foods worth

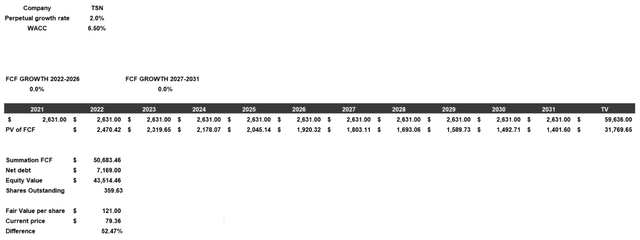

Considering what we have seen so far, what is Tyson Foods worth? To calculate its fair value I have created a discounted cash flow. This model will be constructed as follows:

- The cost of equity will be 7.75% and includes a beta of 0.66, a risk-free rate of 3.50%, country market risk premium of 4.20% and additional risks of 1.50%. This last figure was deliberately included so high, as I fear that Tyson’s growth may slow in the future. The after-tax cost of debt is 3.42%.

- The capital structure considered is 70% equity and 30% debt, with a resulting WACC of 6.50%.

- I did not want to include any growth rate for the next 10 years, only the perpetual growth rate of 2%. With decreasing volumes, I don’t think Tyson can always raise prices to achieve a positive result overall. It did well this year but that may not be the case in the future, after all consumers might buy meat from other brands. At the moment except for international sales there is no segment from which I expect good growth in the future; therefore, I preferred to be conservative and enter zero growth.

According to my assumptions the fair value of this company is $121 per share, much more than the current $79.36. Despite the zero-growth rate, therefore, Tyson Foods is undervalued, and would have been undervalued even if a negative growth rate were included. This is all quite surprising, but at this price I still would not buy this company. As solid and undervalued as it may be, I personally need an even wider margin of safety since this company may have growth problems. The idea of investing in a company with a very low if any growth rate does not particularly appeal to me, even if it is undervalued. Around $70 per share I consider it a reasonable price to start building a position; therefore, it is currently a hold for me. I do not blame those who are already buying at $80 per share; after all, the numbers are on their side. Selling, on the other hand, would make no sense to me.

Conclusion

This Q3 2022 has highlighted some issues related to this company’s volume growth, as well as reduced operating margins in 2022 due to the adverse macroeconomic environment. The company has shown that it can increase revenues even by selling less quantity due to its market power to raise prices, but how long can this last? The inflationary environment has justified the recent price increase, but I don’t think future growth can be based on that alone; sales volumes need to be increased in the long run. Except for demand for chicken meat all other meats have a long-term decreasing demand in the US, which leads Tyson to solve one of the biggest problems since he has been in this industry. Currently what inspires my confidence is that the company is very solid, undervalued and established, which is why I believe it can engineer itself in some way to improve future growth. What is needed, in my opinion, is to diversify revenues geographically to the fastest-growing countries and to include new segments within the business model that are more in line with current trends (vegan products for example).

Be the first to comment