Andrei Berezovskii/iStock Editorial via Getty Images

Investment Thesis

From being an unprofitable company in 2017, AMD (NASDAQ:AMD) managed to achieve an incredible $3.39 billion profit in 2021 while also managing to outperform its competitor Intel (NASDAQ:INTC) in terms of return on investment. AMD’s growing influence in the semiconductor industry has been well seen by the market, perhaps even too much since its market cap has reached an unreasonable value. The fact that AMD has improved a lot in recent years does not justify investing at any price, otherwise the risk is to overpay this company. On the other hand, we have its competitor Intel, a leading company in the semiconductor industry for decades and capable of generating profits of $19.8 billion in 2021. Although the overall comparison between the two companies looks merciless from a profitability perspective, Intel’s shares have not seen the same increase in demand as AMD’s as growth rates are believed to be very different. AMD is seen as the company that will grow unabated, Intel as a boring and struggling company. The reality of the facts, however, is quite different, and with the appointment of Pat Gelsinger last year, Intel is laying the groundwork for a glorious future just like the past. Hundreds of billions of dollars will be invested in the next decade, and it will be much more complex for AMD to grow within this industry. I personally believe that AMD has had its moment of glory that may last for a few more years, but once Intel’s investments start generating cash flow, the market will realize the mistake of pricing it at $38 per share. Finally, comparing the multiples of the two companies and comparing their respective discounted cash flow, Intel’s current price per share is highly undervalued, while for AMD, we are far from a buy price.

Profitability Comparison

In recent years, specifically from 2021 onward, consumer and investor preferences have turned more toward AMD than Intel, consequently leading to a weakening for the latter. On the consumer side, Intel’s market share has shrunk in every segment in favor of AMD; on the investor side, AMD’s market capitalization has nearly caught up with Intel’s ($126 billion vs. $152 billion).

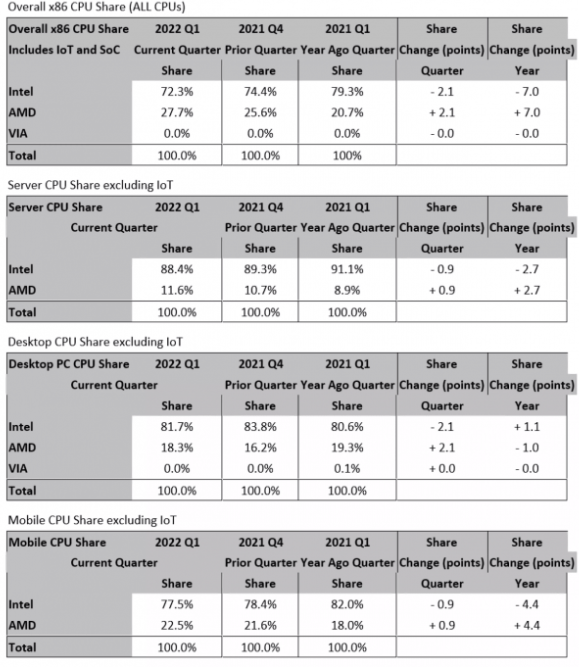

Market Share in Q1 2022 (www.extremetech.com)

This image shows the improvement AMD achieved in the year 2021 at the expense of Intel. What can be seen is that the year-on-year improvement was remarkable (as much as 7% in the first segment), but Intel’s dominance remains evident. I believe this last statement is crucial to this analysis, because I think investors are forgetting too easily that Intel has been leading the industry since forever and AMD is only recently performing well. AMD’s numbers have improved a lot in the last 3 years, but they are nowhere near Intel’s. In the graphs I am about to show, you will be able to see visually the overwhelming power of Intel.

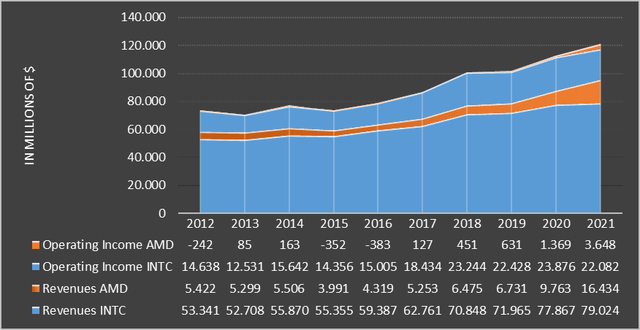

Intel and AMD profitability (TIKR Terminal )

AMD’s orange area is barely visible even though its revenue growth rate since 2016 has been 24.95% CAGR. This is because Intel’s revenues have always had steady growth, and its operating income remains more than 6 times that of AMD.

Intel and AMD profitability (TIKR Terminal )

On the other hand, from this other image, we can see that Intel’s net income is even greater than AMD’s revenues, and even regarding free cash flow Intel’s supremacy remains evident.

Through these two graphs, I think I have given an idea of the income disparity between AMD and Intel, but I would like to make a point. Even though there is such a large divergence in profits, the two companies are perfectly comparable since they have a very similar market cap ($126 billion AMD vs. $152 billion Intel) and operate in the same industry. In light of this, the first doubts are beginning to emerge about AMD’s current valuation when compared to Intel’s. At this point, AMD supporters might object by saying that the growth rates of the two companies are totally different and that a premium must be paid to be an AMD shareholder: personally, I would not pay this company that much anyway, and I will explain why in the next paragraphs.

To conclude this section on profitability, I will highlight profitability indicators expressed in percentage values so as to take the numerical disparity between Intel and AMD out of context.

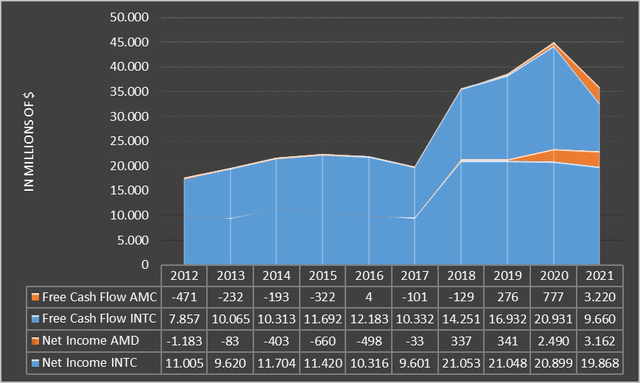

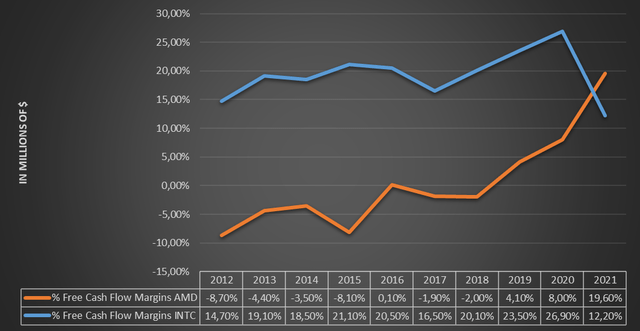

Intel and AMD profitability (TIKR Terminal)

What is visible through these two graphs is that Intel has always been more consistent than AMD (also true for the years prior to 2012), but in 2021, there was a reversal of the trend for the first time. Lisa Su’s extraordinary work led AMD to achieve a higher ROIC and free cash flow margin, but how was this possible? I think the answer lies mainly in the inefficiency of Intel’s management, which has not done an adequate job of curbing competitors’ growth.

Intel Management’s Faults

Although Intel is still the world leader in its field and a very profitable company, there is no doubt that competition from AMD is beginning to cause concern. The reasons for the loss of some of the market share experienced in recent years is the result of multiple components, but I believe it is attributable in large part to the choices made by the last 2 CEOs, Brian Krzanich and Bob Swan.

Brian Krzanich (2013-2018) has been the architect of greater diversification of Intel products, but this has caused some weaknesses in Intel’s operations. Because of his decisions, Intel struggled to produce 10-nanometer chips unlike TSMC and Samsung, leading to a slowdown and loss of market share in computer chips to AMD’s own. During his tenure, his political exposure led him to receive several threats, which is why at the time increased expenses for his and his colleagues’ security. In addition to this, he was the subject of discussion for some misconduct, such as insider trading and a consensual relationship with a subordinate, which is why he resigned in 2018. Brian Krzanich was never the leader Intel was looking for.

Bob Swan (2019-2021) has been Intel’s CFO since 2016 and was later appointed interim CEO from June 2018 after his predecessor resigned. Bob Swan became full-time CEO in January 2019, but his reluctance to serve in this role was well known. His career as CEO can be understood as a temporary buffer that the company used to think about who was the right person for that job. Krzanich’s sudden resignation had not given the company enough time to find an appropriate new CEO. Even under Bob Swan’s leadership, Intel once again presented problems with delays in the launch of its CPUs, in this case 7-nanometer CPUs.

What is clear from the last two CEOs is that Intel lacked a real leader who could lead the company to maintain its dominance over its competitors, and AMD was very clever in exploiting a moment of historical weakness for Intel. As of today, however, the tune has changed, and with the appointment of Pat Gelsinger in 2021, I think AMD will have a much harder time to increase its market share.

The New Corporate Vision According To Pat Gelsinger

Pat Gelsinger is one of the best CEOs around in his field and already knows the environment since he has already worked 30 years for Intel. I personally consider his ambition and expertise the trigger for a new beginning, and his words were very promising right from the start:

I am thrilled to rejoin and lead Intel forward at this important time for the company, our industry and our nation. Having begun my career at Intel and learned at the feet of Grove, Noyce and Moore, it’s my privilege and honor to return in this leadership capacity. I have tremendous regard for the company’s rich history and powerful technologies that have created the world’s digital infrastructure. I believe Intel has significant potential to continue to reshape the future of technology and look forward to working with the incredibly talented global Intel team to accelerate innovation and create value for our customers and shareholders.

Gelsinger’s plan is to double Intel’s revenues in the long run, but to do so the company will have to sacrifice its profits in the short run. Intel’s goal to date is not to improve its profit margins but to invest as much as possible to achieve strong growth in the future, which is why the company is willing to worsen profitability margins in the short term. AMD does not plan to adopt a similar strategy, so it is likely that it can continue to grab additional market share at the expense of Intel in the short to medium term. However, I believe that this scenario may be only temporary, and once Intel’s investments start generating cash flow for AMD, it will probably be difficult to maintain even its current market share.

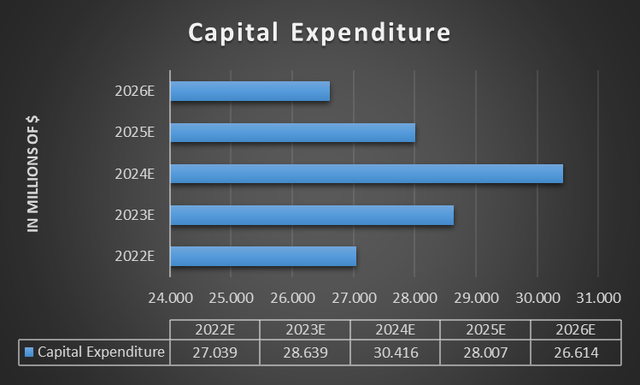

Intel’s capex in 2021 was $18.7 billion but is expected to rise sharply as a result of the new investments that will be made under Gelsinger’s leadership.

Intel capex estimates (TIKR Terminal )

Having AMD with a capex of only $301 million (2021), again the disparity in resources available for the two companies to invest is evident. It has to be said, however, that even in the past Intel has invested much more than AMD but without getting better results; therefore, these investments that will be made may still not result in an increase in market share. Personally, I am positive about this and believe that under Gelsinger’s leadership, Intel’s investments will be more focused and profitable enough to widen the gap between Intel and AMD.

Intel’s New Investments And Their Importance

Pat Gelsinger has decided to invest heavily in the future and sacrifice almost all the free cash flow the company will generate in the coming years to increase Intel’s leadership in the world. Since the company will invest hundreds of billions of dollars, its investments will not only affect the company itself, but the economy of all Western developed countries. Through these investments, Intel will provide tens of thousands of jobs in America and Europe, as well as improve supply chain resilience.

Moreover, Intel represents the only Western hope for reducing dependence on Asian chips. As President Biden stated about the semiconductor industry, “China’s doing everything it can to take over the global market,” so huge investments are needed to change the trend, and only Intel has the economic capacity to do so. In 2020, dependence on Asian chips was 80%, but Gelsinger wants to reduce this to 50% by 2030. Intel’s new investments, therefore, will not only impact the company, but the entire supply chain.

But what are these investments? There are 2 main segments:

- The first concerns investments in the U.S. and in particular the largest private sector investment in Ohio‘s history, two new chip production plants costing $20 billion. Construction of these plants will begin this year, but they will be productive only from 2025 onward. The company, however, expects the investment to even reach $100 billion in the next 10 years as the 1,000-acre land acquired has a total capacity of as many as 8 plants. These investments in US according to Gelsinger will help meet the unprecedented demand for chips and thus avoid a subsequent chip shortage like the one we are facing now. However, the investments in US include not only the construction of new plants but also the improvement of previous ones such as the Rio Rancho site in New Mexico, which will have $3.5 billion worth of improvements.

- The second segment concerns large investments in Europe, particularly in Germany. Intel’s goal is to create a global strategy and ensure that other countries can also benefit from semiconductor technology innovation. Here is what Gelsinger expressed in this regard: “Our planned investments are a major step both for Intel and for Europe. The EU Chips Act will empower private companies and governments to work together to drastically advance Europe’s position in the semiconductor sector. This broad initiative will boost Europe’s R&D innovation and bring leading-edge manufacturing to the region for the benefit of our customers and partners around the world. We are committed to playing an essential role in shaping Europe’s digital future for decades to come.” The total investment in Europe is around €80 billion over the next 10 years, and the first €17 billion will be allocated to create a mega plant in Germany, another €12 billion in Ireland and €4.5 billion in Italy. Investments will also include other nations such as France, Poland and Spain. At the end of these investments, Intel’s global network will be impressive, and I don’t see how AMD will be able to fight against such a giant.

How Much Are Intel And AMD worth?

Intel and AMD will be evaluated through three methods: method of multiples, RSI analysis, and discounted cash flow.

Method of multiples and RSI

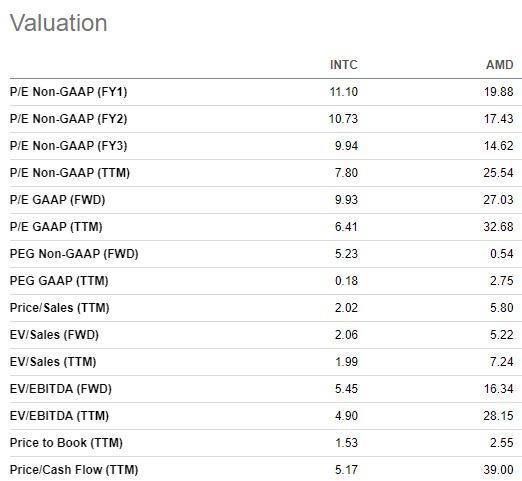

Intel and AMD multiples (Seeking Alpha )

According to this data obtained right here on Seeking Alpha, the comparison of multiples between the two companies looks totally in Intel’s favor. After all, this is to be expected: Intel’s profits are greater than AMD’s revenues, and the two companies have similar market cap. While it may be true that AMD’s growth in the next few years will be higher and therefore deserves higher multiples, I believe that a GAAP P/E (TTM) of 32.68x and a Price/Cash Flow of 39x are still too high. The risk of investing in AMD at this price is to overpay for this company’s future growth, which by the way will be seriously eroded once Intel’s new plants will generate cash flow. Considering Price/Sales (TTM), a ratio that does not consider any kind of cost and investment, AMD is still overvalued, not only compared to Intel, but compared to its historical values as well.

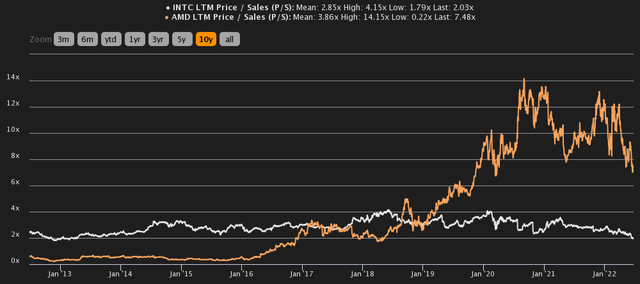

Intel and AMD P/S (TIKR Terminal )

Intel, on the other hand, is undervalued relative to AMD and its historical values. What is shown by the analysis of multiples is that the market is over-punishing Intel for its recent investments that will reduce profit margins and is considering that AMD can grow at the same rate as in recent years, which I think is unlikely. For those who want to invest for the long term, Intel is currently priced at very low multiples not seen in years. Finally, I would like to make one last comparison from a technical point of view.

AMD Technical Chart (Investing.com)

It is evident that from the bottom in March 2020 to the peak in late 2021 AMD has been affected by heavy speculation. Despite since the all-time high there has been a 50% drop, its multiples continue to be high and in the past, it has already shown that it has suffered plunges far greater than 50%. Currently, considering a likely recession scenario, there is no reason to believe that this slump will stop, or at least, that AMD will perform better than Intel, a more solid and reliable company. In the current macroeconomic scenario, investors are shifting their capital from riskier to less risky assets, and AMD is definitely part of the riskier ones. Technically, on the other hand, the monthly RSI of 48.5 suggests that the descent may continue. On the other hand, however, Intel once again emerges as a better bargain.

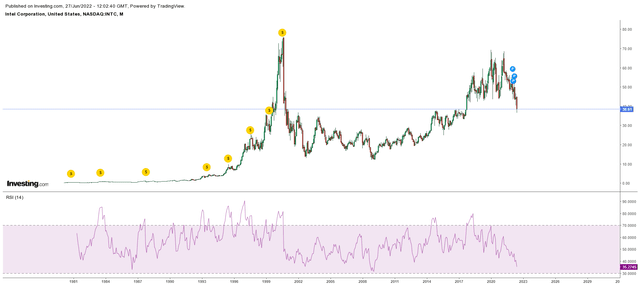

INTC Technical Chart (Investing.com)

Since 2009, the long-term trend has been rising and is experiencing a strong retracement. Intel’s monthly RSI is 35.2, very close to an oversold zone. The last time Intel had such a low RSI was after one of the worst financial crises in history; therefore, I believe the market is currently underestimating Intel’s potential.

Discounted Cash Flow

Through this methodology, I will calculate an intrinsic value for both companies in order to understand at what price to buy them to make a good profit.

AMD

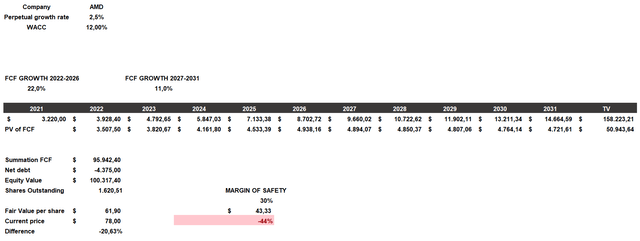

AMD’s model will be constructed as follows:

- WACC equal to cost of equity (12%) since the company is debt-free. The cost of equity was calculated using a beta of 1.86, a country market risk premium of 4.20%, a risk-free rate of 3.50%, and additional risk adjustments of 0.50%.

- The free cash flow growth rate in the first 5 years is 22% and then decreases to 11%. The reason I have included a decreasing growth rate is because I believe Intel from 2026 onward will totally change the market once the new plants are fully operational. Overall, however, this is still a significant growth for AMD, which would go from a free cash flow of $3.2 billion in 2021 to $14.6 billion in 2031. More growth than I have included, I consider pure speculation.

- The outstanding shares and net debt belong to TIKR Terminal.

Discounted cash flow (Sources already cited )

According to my assumptions, despite high growth rates, AMD is overvalued. Its fair value is $61.90, while it is currently trading at $78. Also considering a margin of safety, AMD’s ideal buy price should be just over $40. Personally, I would not even buy it at $40 knowing that Intel is trading at $38.

My assumptions may be too conservative, but this is my opinion for this company. Financial analysis is often influenced by subjective components, and everyone might draw a different fair value from it.

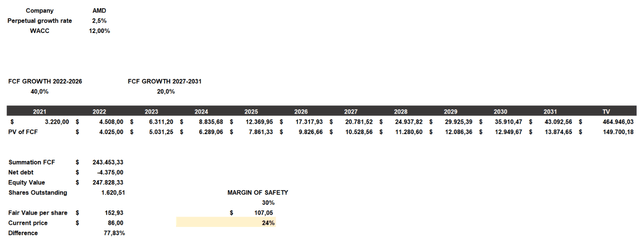

Discounted cash flow (Sources already cited )

Considering a growth rate of 40% for the first 5 years and 20% for the following 5 years AMD’s fair value is a whopping $152.93. Searching online there are many analysts who believe it is worth around $150, but how realistic is it that AMD will have a free cash flow of $43 billion in 2031? Until a few years ago, the company was even struggling to have positive free cash flow. Entering a lower WACC would also increase the fair value, but since this is a very volatile stock, the result obtained could be misleading. Overall, the latter scenario created is not impossible but, in my opinion, highly improbable.

Intel

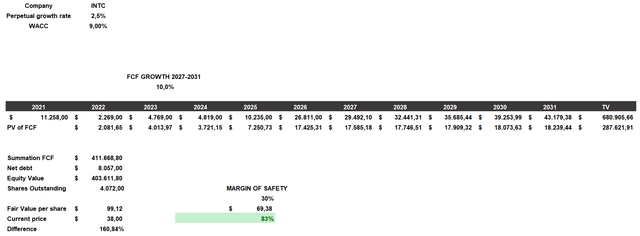

Intel’s model will be constructed as follows:

- The cost of equity will be 9.50% and considers a beta of 0.60, a country market risk premium of 4.20%, a risk-free rate of 3.50% and additional risk adjustments of 3.50%. I preferred the latter value to be so high in order to discount, within the fair value, any problems related to the new investments made. The cost of debt will be 5.28% and considers a selected long-term debt of 6% and a tax rate of 12%. The assumed financial structure consists of 90% equity and 10% debt. The resulting WACC is 9%.

- Net debt and outstanding shares belong to TIKR Terminal.

- Free cash flow values from 2022 to 2026 belong to TIKR Terminal analysts’ estimates. Intel’s free cash flow in 2020 was almost $21 billion, but as explained earlier, since Gelsinger became the CEO (2021), the company’s capex has been increased significantly, and thus a very low free cash flow is expected for the next few years. From 2026, however, much of the plants built will be functional and will bring in a huge amount of free cash flow. From that year on, the considered free cash flow growth will be 10%.

Discounted cash flow (Sources already cited )

According to my assumptions, Intel is highly undervalued and has a fair value of $99.12. Considering a 30% margin of safety, Intel is a buy without any doubt. From this scenario, there is no doubt that Intel is worth an investment in the long run. Although AMD has improved a lot in recent years, its current valuation is much less attractive than Intel’s. Finally, it is interesting to notice that in the scenario where AMD is worth $152, the free cash flow in 2031 is roughly the same as Intel’s. In other words, this implies that believing in the scenario where AMD is worth $152 is equivalent of saying that in 10 years AMD will be able to completely fill the gap currently in Intel’s advantage. I think even the biggest AMD supporter has a hard time believing in such a scenario.

Dividends And buybacks

As a last cue in this analysis, I would like to highlight another important aspect that might go by the wayside: dividend issuance and buyback programs. The corporate policies of AMD and Intel in this differ widely and I will now show why.

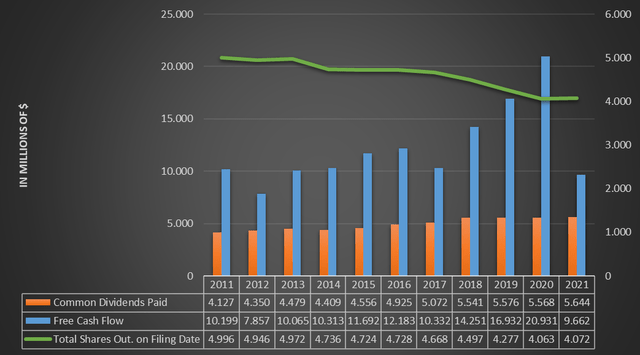

Intel

Intel dividends and buybacks (TIKR Terminal )

Over the past 10 years, Intel has rewarded its shareholders both by issuing a substantial dividend and through buyback programs. This favorable situation for shareholders may change, however, as the company vision has changed from the past due to the new CEO. Here are Intel’s words on the matter: “We are not obligated to make repurchases under our stock repurchase program. The amount, timing, and execution of our repurchases fluctuate based on factors that include prioritizing cash for other purposes, such as investing in our business, including operational spending, capital spending, and acquisitions, and returning cash to our stockholders as dividend payments. We expect our future stock repurchases to be significantly below our levels from the last few years”. What is evident from these statements is that Intel will probably cease or reduce its buyback practices and use that money to invest it in its operations. Since the company’s capex will increase substantially, this choice was quite predictable. There was no warning in the annual report about a dividend cut, but I would venture to predict that it will happen in the coming months since the cash from the dividend could be used in the massive future investments.

AMD

AMD total shares outstanding (TIKR Terminal )

Based on what this chart shows, an investor in AMD in 2011 would have suffered tremendous dilution by staying invested to date. The shares outstanding increased dramatically but you can see how this trend reversed just last year. What happened? In May 2021, the company’s board of directors decided to carry out a buyback program of up to $4 billion since 2021 was a very profitable year for the company. However, a $4 billion buyback program was later deemed insufficient by the board, so in the latest quarterly report, it was announced the intention to add another $8 billion to the previous $4 billion. As of today, another $8.3 billion remains to purchase common stock in the open market. In this way, the company has solved the dilution problem, but overall, I think it has raised other problems. The reasons why I do not think such a large buyback program is reasonable are mainly two:

The first is that I do not consider the price at which the shares were purchased to be reasonable.

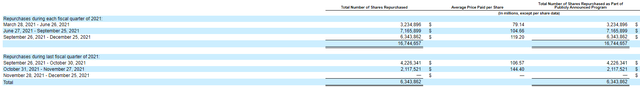

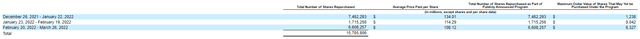

AMD buyback program (Annual report 2021) AMD buyback program (Q1 2022)

It is striking to buy back shares right in November 2021 at $144.40 per share, basically at the peak of the speculative bubble. The buyback should be made when the stock is undervalued, not the other way around, otherwise the result is just a big loss.

The second reason why I do not understand the AMD board’s choice concerns the allocation of the cash flow obtained in 2021. Last year was the first year where AMD performed far better than Intel, and I think they should have used the excess capital to invest it in their operating business instead of buying back common stock at an unreasonable price just to artificially increase the demand for their shares. I personally consider buyback an option for established companies with a dominant market share, but this is not the case for AMD.

Through this last comparison in my opinion, it is possible to summarize the difference in the corporate vision of the two companies:

- Intel invests billions of dollars to achieve long-term sustainable growth, even at the cost of reducing current operating margins and remuneration to its shareholders. This is a very rational behavior for a company that is trying to prosper over the long term.

- AMD as soon as it has had a good year invests billions of dollars to increase in the present the demand for its shares through a buyback at an unreasonable price. In the long run, however, those who prosper will be those who allocated their money better and those who sacrificed the present to invest in the future.

Be the first to comment