Shannon Finney/Getty Images Entertainment

Investment Thesis

Bumble Inc. (NASDAQ:BMBL) is a mission-driven, founder-led dating app company that takes a completely new approach to the world of dating. Its female-centric approach is a huge differentiator between itself and the competition, and this has caused a buzz about Bumble – propelling it to more than 40 million users.

But does that make the company a good investment right now? I put it through my framework to find out.

Business Overview

Bumble is an online dating company which operates three apps: Bumble, Badoo, and Fruitz (acquired in February 2022). The Badoo App was first launched in 2006 and pioneered free-to-use dating products, but the main story for this company is with the Bumble App. Launched in 2014, Bumble is a dating app with ~1.8 million paying users where women make the first move. Both apps operate freemium business models, where users can pay for a subscription in order to access premium features such as rematching with a prior expired match, seeing who has swiped to match with them, or having the ability to swipe privately so other users can’t see which way you swiped.

For me, a big attraction to Bumble as an investment is the fact that it’s a true mission driven company, with an aim to “create a world where all relationships are healthy and equitable.” Just take a quick read of the opening paragraphs from Bumble’s 2021 annual report:

Bumble app was founded because we noticed two different, yet related issues in our society: antiquated gender norms, and a lack of kindness and accountability on the internet. We observed that women were often treated unequally in society, especially in romantic relationships. At the same time, social networks created possibilities for connections, but they were focused on connections with people you already know and lacked guardrails to encourage better behavior online.

We created Bumble app to change this. The Bumble brand was built with women at the center—where women make the first move. Our platform is designed to be safe and empowering for women, and, in turn, provides a better environment for everyone. We are leveraging innovative technology solutions to create a more inclusive, safe and accountable way to connect online for all users regardless of gender.

This is a business that knows what it stands for, and it has helped turn Bumble into a leading female-centric global brand. This mission also opens the door to plenty of optionality, as Bumble looks to utilize its brand to empower women in all walks of life: love, friendships, careers and beyond.

As mentioned, the company had two main apps before its recent acquisition of Fruitz – Badoo and Bumble. Whilst Badoo may have a lot more users (approximately 300 million), it actually has substantially fewer paying users, and its growth is trending in the wrong direction.

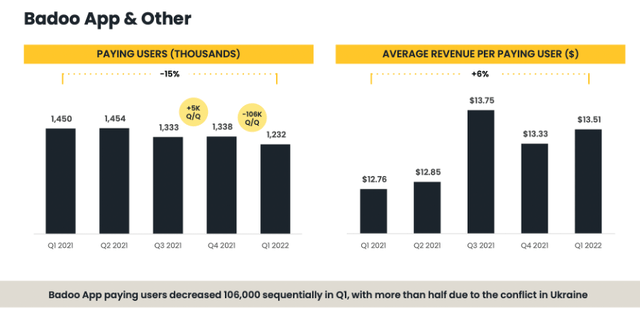

Bumble Q1’22 Investor Presentation

In Q1 alone, it lost 106,000 users QoQ – although more than half of this decline was driven by issues with Russia. Either way, if you’re investing in Bumble, it certainly isn’t because of the Badoo App – just look at how revenue growth for the Bumble App has outpaced Badoo.

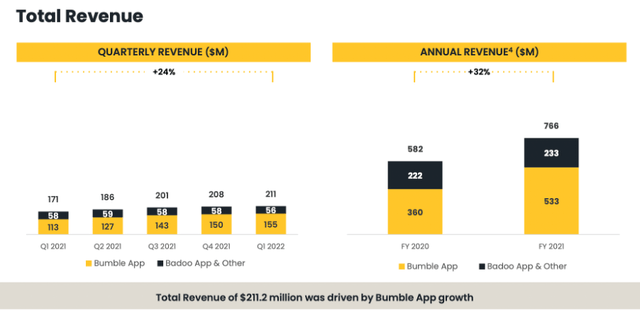

Bumble Q1’22 Investor Presentation

The story here is undeniably all about the Bumble App and the Bumble brand. It is using this brand to expand into new offerings such as Bumble BFF (where users can find a match to make friendship connections) and Bumble Bizz (made for networking).

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

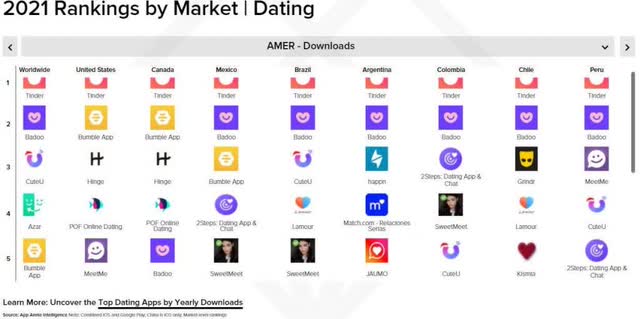

One of the main economic moats that Bumble benefits from is the network effect, which is no surprise for a platform like this. It is the leading female-centric dating app, and has a growing user base – and more people means more potential matches, so if I’m going to sign up for a dating app, I’ll want to go where most people are, which then increases the number of people on that app – and this is a virtuous cycle that has helped Bumble to grow to its current level. As we can see below, Bumble is already one of the most popular dating apps in North America, only behind Match Group’s (NASDAQ:MTCH) biggest app, Tinder. You’ll notice Badoo there as well, but this company is extraordinarily bad at monetizing its users.

The other clear economic moat is the company’s brand, which has helped it to grow so quickly. The brand is synonymous with female-empowered dating, and the company is trying to utilize this brand to grow elsewhere.

Another interesting economic moat is counter-positioning, which is when a business model is so different from competitors that it would harm a competitor if they adopted it. Bumble unapologetically made its app focused on ensuring that women have the best dating experience possible, giving them the power to make the first move. A company such as Tinder might risk losing a substantial number of users if they made this change, and so they wouldn’t want to risk it. The result is a dating app that is top-of-mind for women, and this competitive advantage goes hand-in-hand with the Bumble brand.

Outlook

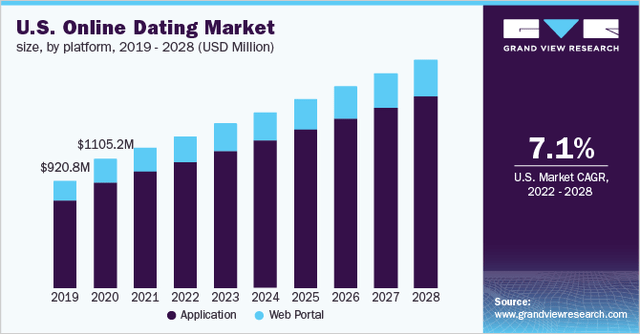

According to Grand View Research, the Global Online Dating Market size in 2021 was $3.97 billion, and is projected to grow at a 6.9% CAGR from 2022 to 2028, eventually reaching a size of $5.78 billion. This growth is meant to be slightly faster in Bumble’s core U.S. market, growing at 7.1%.

Bumble’s revenues in 2021 were $766 million, which translates to ~19% of the current global online dating market (per Grand View Research). Whilst this is already a big portion of the market, its main competitor Match Group had 2021 revenues of $2,983m, representing ~75% of the global market. So 19% might not necessarily imply loads of future growth, but for Bumble it’s all about stealing some market share from Match Group.

Let’s also remember that Bumble is attempting to diversify away from the online dating market – if it can do this successfully, then its total addressable market will increase substantially.

Management

I always aim to find founder-led businesses where inside ownership is high, and I’m happy to have this in Bumble and its Founder & CEO Whitney Wolfe Herd. She became the youngest self-made female billionaire after Bumble went public in February 2021 (although after the share price drop, this is no longer the case). She actually co-founded Tinder, the Match Group-owned dating app that transformed the world of dating, prior to a well-publicized fallout after Wolfe Herd sued Tinder for sexual harassment in 2014.

I want to invest in companies where leadership has skin-in-the-game, and we get this here with Bumble & Wolfe Herd, as she owns 13.6% of all shares in Bumble.

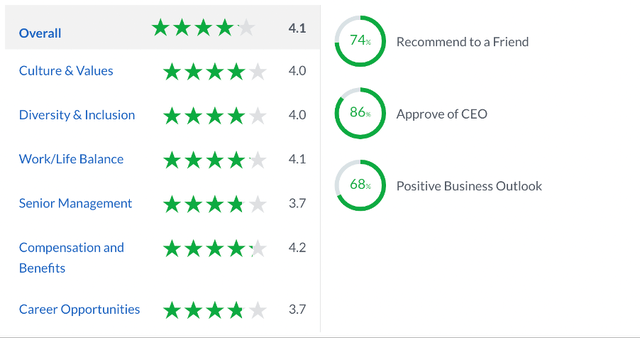

Bumble 2022 Proxy Statement / Excel

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Bumble gets some pretty good scores from the 457 reviews left by employees. Any score over 4.0 is impressive, and Bumble obtains this in quite a few categories – with particularly high scores in compensation and benefits. These scores are all strong, but it’s worth highlighting that the overall company ranking at the start of 2021 was 4.6, whereas it has since dropped down to 4.1. Scores do remain high, but it looks like the past 12 months have seen some internal struggles with Bumble, and this is just something to watch out for.

Financials

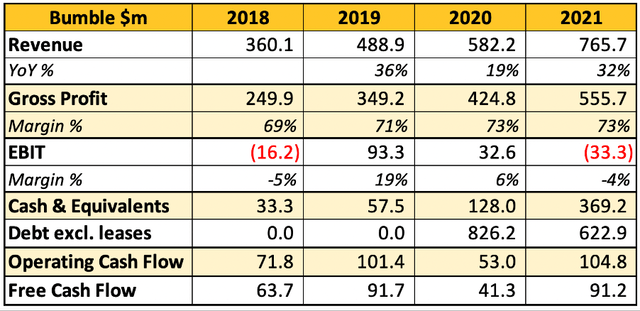

There are some things to like & others to dislike when we take a look at Bumble’s financial trends. Revenue growth was hit in 2020 due to the pandemic, but started to recover as the world reopened in 2021. All in all, revenue growth over the past three years has achieved a pretty good CAGR of 28.6%. The company also generates strong gross profit margins above 70%, and achieved positive EBIT in 2019 and 2020, with IPO-associated stock-based compensation costs moving EBIT back into the red in 2021.

I’m not a big fan of the company’s balance sheet, as they have substantially more debt than cash. This means that they are less financially nimble, and might struggle to weather difficult times, or might not have the capital to take advantage of opportunities. Yet I don’t think the business itself is at risk, since both operating and free cash flows are positive, and have been for quite some time.

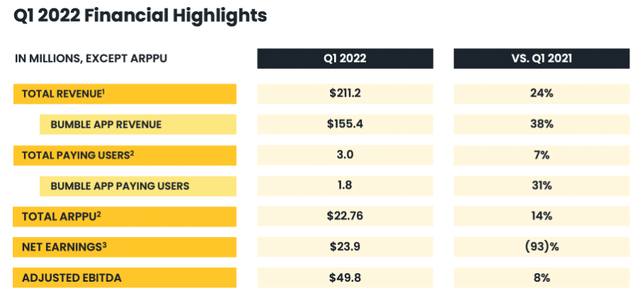

Bumble Q1’22 Investor Presentation

Revenue growth in Q1 was strong, with the Bumble App continuing to drive revenue growth forward (with 38% YoY growth). It’s also worth highlighting the increase in ARPPU (or average revenue per paying user) by 14%. This is important, as it means users are spending even more on Bumble’s apps.

Valuation

As with all high growth companies, valuation is tough. I believe that my approach will give me an idea about whether Bumble is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

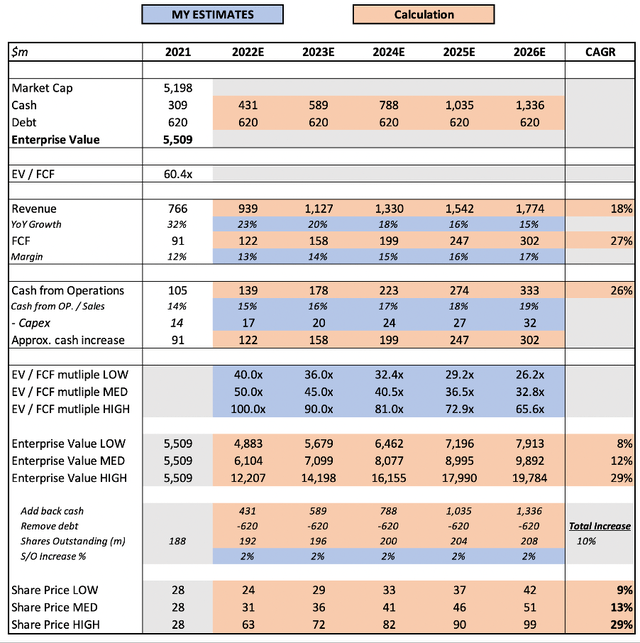

I have assumed revenue growth for 2022 in line with the midpoint of Bumble’s most recent guidance, with an assumption for a slowdown in revenue growth (since Bumble already has a high market share, and the market is growing at only ~7%). I do think this is a conservative assumption, as the Bumble App becoming a greater percentage of overall revenue could boost growth, and similarly Bumble’s avenues outside of dating could also result in additional top-line growth.

I’ve assumed a FCF margin expansion as Bumble continues to grow and benefit from scale – it’s worth highlighting that Match Group, the best well-established proxy, saw FCF margins of 27.9% in 2021.

Match Group is also currently trading at an EV / FCF multiple of ~18x, which is the lowest multiple it has traded at since coming public. On average, the company has had an EV / FCF multiple of just over 50x. As such, I have assumed an ending EV / FCF multiple for Bumble in my mid-range scenario of 32.8x.

Put all that together, and I can see Bumble’s shares achieving a 13% CAGR through to 2026 in my mid-range scenario.

Risks

I think the biggest risk for Bumble is the fact that they are up against a behemoth in Match Group, who own 75% of the market. This is a company that could put all its force into aggressively competing with Bumble, and it has a lot more power. It also has substantially more apps than Bumble – for example, Match Group’s app Hinge has recently soared in popularity.

The second risk for Bumble is their potential inability to leave the dating space. I really like the idea behind their additional apps, and I do think that the move will provide the company with some exciting new avenues to explore, but I would personally like to see some more results & uptakes in the new offerings. It is still early days, but this is something I will be watching closely.

Finally there is a risk of a recession to Bumble. People will always want to use dating apps, but will they always want to pay, or can they survive on the free version of the app? Only time will tell, but this is another short-to-medium term risk.

Summary

All in all, Bumble is a mission-driven company that is trying to empower women across all forms of life. It has so many of the things I look for in a high-quality investment, but it’s shares are still not at an attractive enough level for me to rate this as a buy, given some of the concerns I have.

If the shares fall further OR revenue growth accelerates OR I see evidence of the expansion outside of the dating world succeeding, I will switch my rating – but for now, Bumble shares are a hold for me – and that is what I will continue to do myself, as I still think this company has a lot going for it.

Be the first to comment