koya79/iStock via Getty Images

Introduction

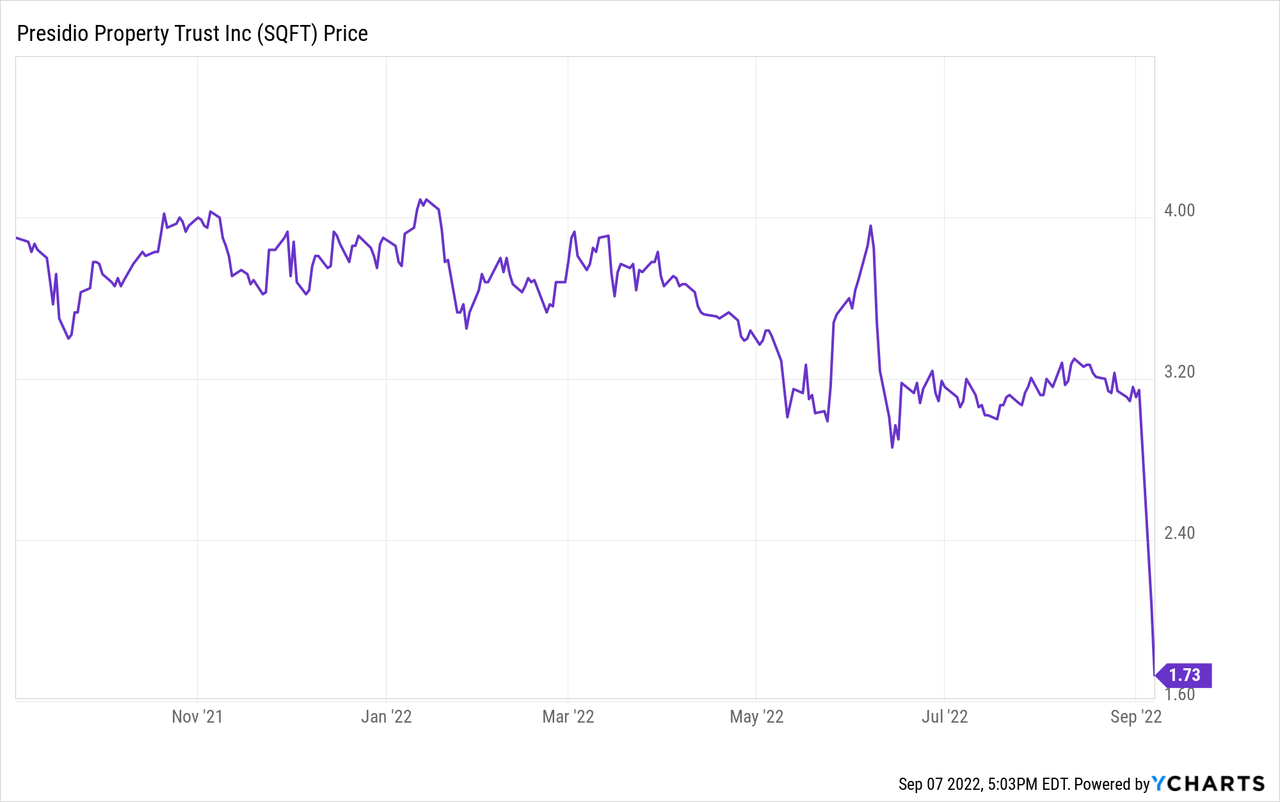

The share price of the common shares of Presidio Property Trust (NASDAQ:SQFT) has collapsed in the past two trading days after the REIT cut the distribution on its common units. This wasn’t a surprise as I have been warning for this to happen for over a year now as the quarterly distributions were a multiple of the FFO the REIT was generating. As the REIT now (finally) made the difficult but right decision to cut the distributions, the share price is in freefall. Unfortunately the preferred shares are hit as well although the distribution cut on the common shares makes them safer.

So what happened?

On Friday Sept. 2, just a few minutes after the closing bell, Presidio Property announced it was cutting the quarterly dividend from $0.106 per share to $0.02 per share. Meanwhile, it also mentioned its switch to a “variable” dividend policy to bring the payout in line with the FFO the REIT actually generates.

Let’s not talk about the weak, almost cowardly move, to put such news out on a Friday evening ahead of a three day weekend. I’m not sure what Presidio tried to accomplish with that timing but if the management thought the markets would “forget” about the announcement during the three days the market was closed, it was wrong. Instead of dealing with problems head on and putting a plan on the table to discuss the path forward for the REIT, I’m not too happy with the decision to try to “bury” the distribution cut.

In any case, what’s done is done. And the market was obviously pretty upset as the fat dividends were the only reason why a certain subset of shareholders was holding the name. Now the yield has been cut to just around 4.5% (and this is after the 44% drop), and a lot of dividend-focused investors are bailing.

This cut should not come as a surprise (but apparently it did). Just over one year ago, I already warned the dividend was absolutely unsustainable, and as the situation didn’t improve, I repeated this warning in April of this year. I very rarely tag a stock as a “strong sell,” but SQFT was one of those rare occasions. The stock was trading at $3.52 when the previous article was published, and is now down about 50% at $1.76 as of the time of writing this update.

The distribution cut was absolutely necessary, but it also makes the preferred shares safer

What’s done is done. The distribution has been cut, but this doesn’t mean Presidio is out of the woods yet as even the $0.02 quarterly distribution is barely manageable. To explain my point, let’s have a look at the Q2 results, which were published a few weeks ago.

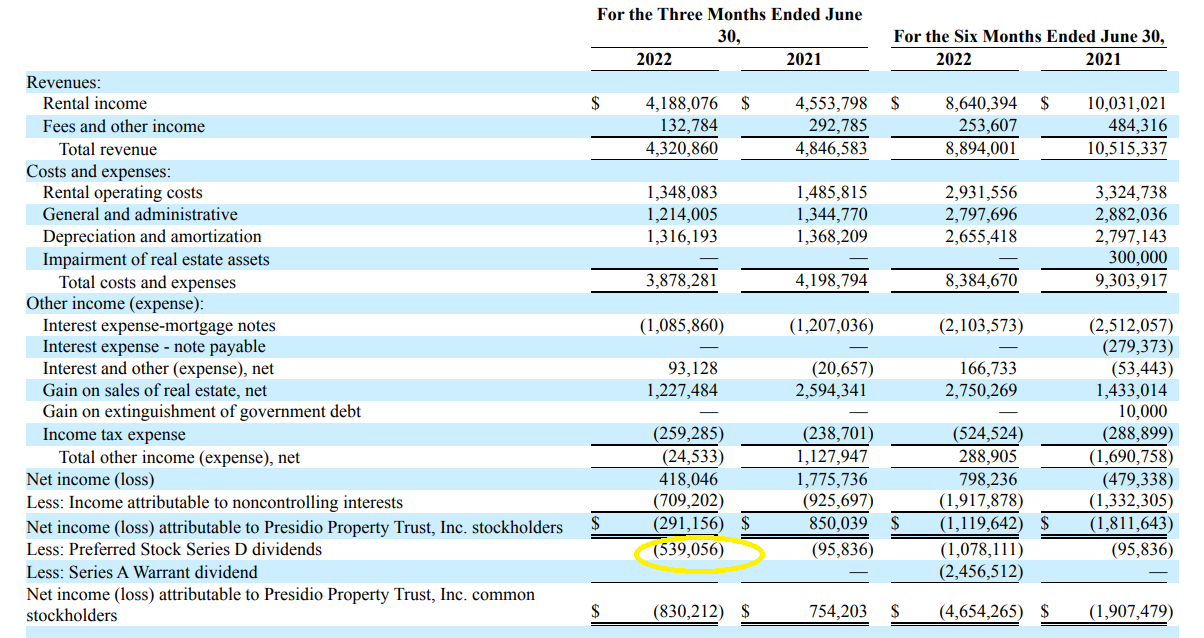

Although the FFO is a more important metric for a REIT than the net income, the income statement does provide a useful breakdown of the expenses, including the total cost of the preferred dividend.

Presidio Property Trust Investor Relations

As you can see in the income statement above, the net loss attributable to the common shareholders of Presidio Property Trust was approximately $830,000, including the payment of almost $540,000 in preferred dividends.

The preferred shares of Presidio are trading with (NASDAQ:SQFTP) as ticker symbol and offer a 9.375% yield payable in 12 monthly preferred share dividends of $0.1953125. This is a cumulative issue, and can be called by the REIT from June 2026 on.

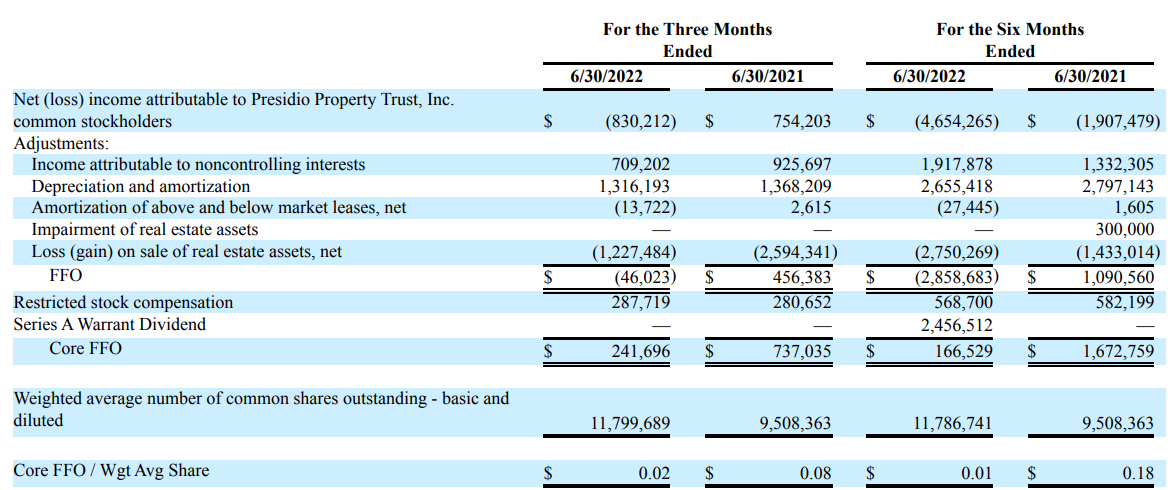

The FFO calculation below shows the core FFO came in at just over $240,000 which works out to be roughly 2 cents per share.

Presidio Property Trust Investor Relations

That’s important for the preferred shareholders as this means the preferred dividends are still fully covered considering the starting point of the FFO calculation is the net loss attributable to the common shareholders. This means the adjusted FFO before taking the preferred dividends into account was approximately $780,000 and about 69% was needed to cover the preferred dividends. Not only was the distribution cut to two cents per quarter absolutely necessary, it also was the most benign cut the REIT could make as its payout ratio is still 100%.

While I’m happy with the distribution cut, I think the REIT should have done more because based on the current performance, not a single cent of the core FFO gets retained on the balance sheet to use for future expansion plans and/or debt reduction plans.

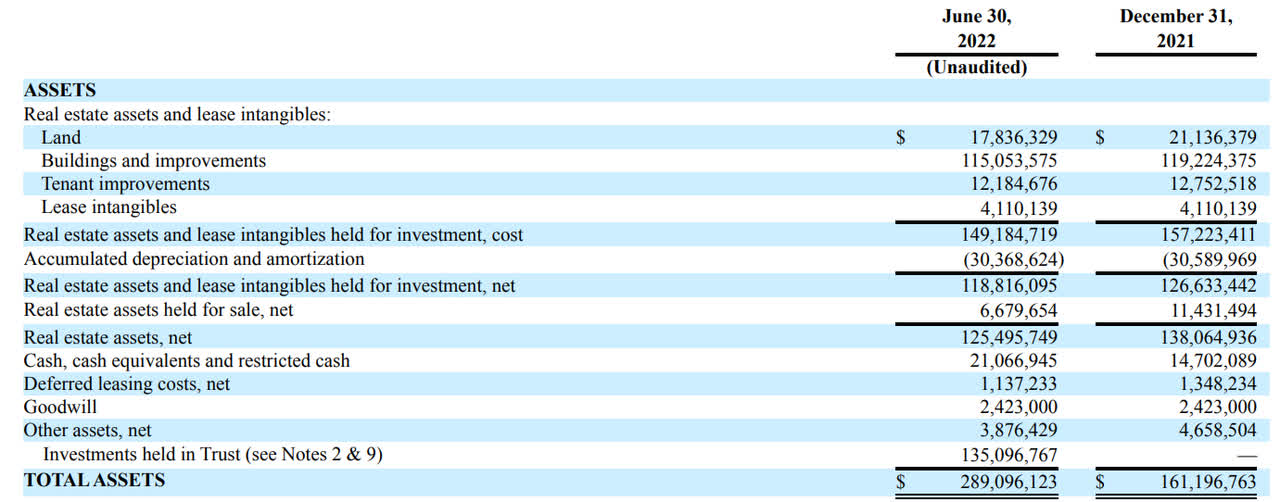

Looking at the asset side of the balance sheet, Presidio has increased its total amount of assets to just under $290M, thanks to the SPAC idea. Earlier this year, the REIT acted as sponsor of a SPAC focusing on “acquire businesses in the real estate industry.” The SPAC, Murphy Canyon (MURF) is still looking for an asset.

Presidio Property Trust Investor Relations

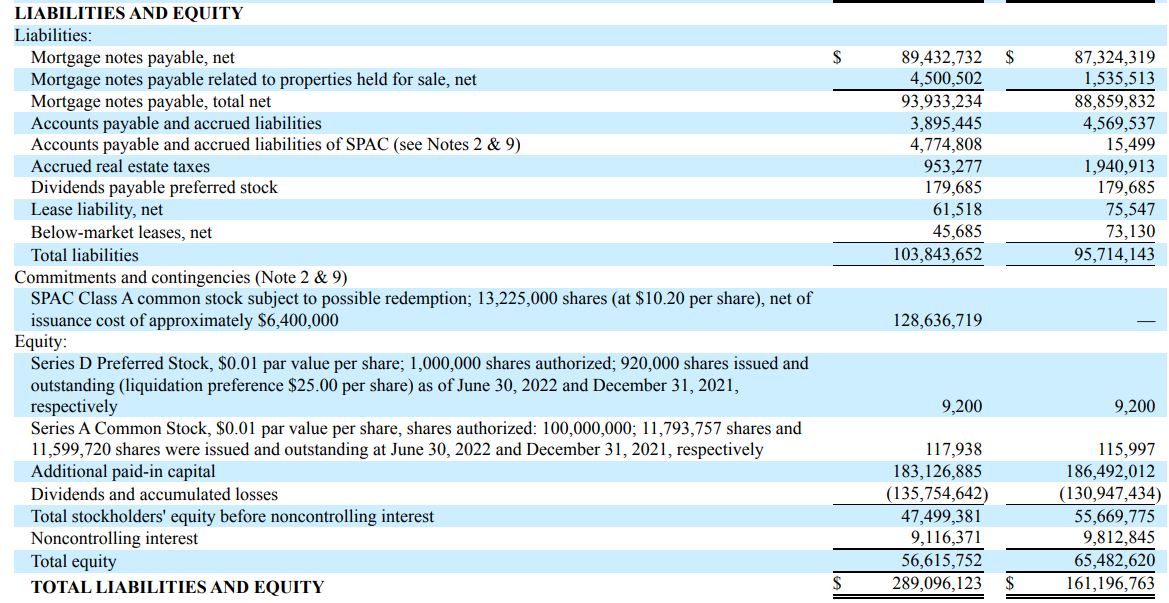

The investment in the SPAC is the wild card for Presidio. If it turns out well, the company could make money of it, but considering the lack of experience and track record in the SPAC business, I’m not assigning any additional value to this asset. As you can see on the image below, there are also about $128M in liabilities related to the SPAC, so for now, I think it’s best to look at the balance sheet as if the SPAC wasn’t there.

Presidio Property Trust Investor Relations

We see the REIT has about $94M in mortgages while the asset side contains just over $21M in cash resulting in a net debt of approximately $73M. The total assets on the balance sheet are estimated at $125.5M including in excess of $30M in accumulated depreciation. So from an LTV ratio, the balance sheet doesn’t look too bad. The LTV ratio is approximately 58%. Not low, but quite doable.

That being said, the equity portion of the balance sheet consists of just $47.5M in equity attributable to the equity holders of Presidio. The preferred shareholders rank senior to the common shareholders and we know about 920,000 preferred shares have been issued, which means the total amount of preferred equity on the balance sheet is approximately $23M, representing just under half of the total equity value on the balance sheet.

This also means the net equity value attributable to the common unitholders was approximately $24.5M or $2.07/share. Presidio has listed a few assets for sale, including the Grand Pacific Center in North Dakota which has a book value of $5.35M and a mortgage to the tune of $3.56. Should this property be sold, Presidio will free up about 1.9M in cash while the 4.02% mortgage will result in a $140,000 interest saving per year. Of course, the downside is that Presidio will no longer collect rent from its tenants which means this sale will help to gather more insight in how realistic the book value is calculated. And of course, the sale of the model homes (which used to be a very interesting niche Presidio was specialized in) also will provide more insight.

Investment thesis

Despite the risks related to the model homes, I have increased my position in the preferred shares of Presidio. The lower distribution on the common shares should reduce the cash drain and based on the FFO results in Q1 and Q2, the preferred dividends are still fully covered.

This doesn’t mean the preferred shares are a slam-dunk investment as they remain rather speculative. The preferred dividend coverage ratio was just over 140% which is pretty low, while the preferred equity coverage ratio was 206%.

Presidio has in excess of $20M in cash on the balance sheet, and I think that’s where they key lies to unlock value. If it deploys the capital in assets with a 6% net rental yield, the $1M+ in net rental income could double the core FFO and further improve the coverage ratio. And in a worst-case scenario, Presidio could use $20M to repay some of the more expensive mortgages, saving over $800,000 per year in interest expenses which would increase the core FFO by 60-80% per quarter.

I added to my long position in the preferred shares on the drop fully understanding that while the dividend cut on the common shares is good news for the preferred shareholders, this doesn’t make the preferred shares a slam-dunk. The distribution cut on the common units should not have come as a surprise and it’s a pity the REIT has spent millions on distributions it couldn’t afford. And although the common units are now trading at a discount of approximately 20% to the book value per share, I still have no intention to initiate a long position in the common units.

Be the first to comment