Thinkhubstudio/iStock via Getty Images

From the Portfolio Manager’s Desk

Unprofitable med-tech continues to face systematic headwinds as the market looks to match mispricings in fundamentals to future expectations. However, risk-assets have caught a bid since June and that’s meant high-beta names have clawed back some of the losses incurred in FY22. We’ve made no changes to our thesis on BioSig Technologies, Inc. (NASDAQ:BSGM) from my previous analysis in June. We also covered BioSig in late 2020. We encourage investors to factor a data driven approach in this name until there is some fundamental value to be derived.

Investment Summary

We reiterate a hold rating on BSGM following Q2 earnings as systematic headwinds remain for this name. We note the stock has caught a bid since the June bounce however we argue this is likely beta related rather than some unidentified or uncorrelated premia BSGM is presenting relative to peers. With cash flows still priced well out into the future, BSGM is one to be watched from the sidelines from now for a defensively positioned equity portfolio. Rate hold on a $1 valuation.

Risks to investment thesis

Investing in small-cap equities comes with inherent risks that must be factored in before investment decision. Moreover, investing in commercial stage medical device companies carries its own set of downside risks. Being a neutral stance, there is both upside and downside risks to our investment thesis. In addition, small-cap equities can become disconnected from fundamentals upon news releases or wider market actions and display wide volatility in price swings. These risks pose a threat to this investment thesis and must be considered heavily into one’s investment reasoning when reading this analysis.

Recent upside likely beta related

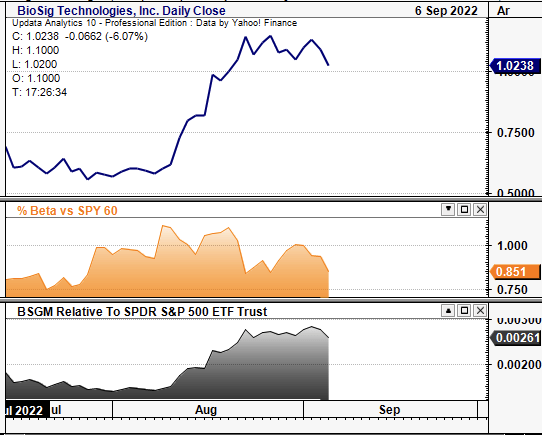

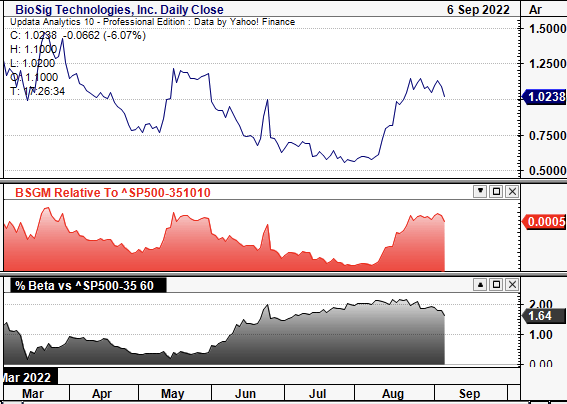

Quantitative analysis of recent stock returns points to the fact the upside is likely due to equity market and sector-beta rather than company-specific risk premia. As seen in Exhibit 1, since the leg upward from the July bounce, BSGM’s equity beta to the S&P/500 also shifted well above 1 and has remained buoyant since. This tells us that investors are buyers of BGSM in seeking strategic equity/health care exposure, versus tactical positioning from active managers/investors.

Exhibit 1. Up-shift in covariance structure accompanying the latest leg in the BGSM share price suggesting recent upside is likely equity beta versus idiosyncratic risk/return

Data: Updata

Further evidence of the above is seen in Exhibit 2. As noted, health care as an investment universe has caught a bid since the June bounce along with positioning in risk-assets. However, we note that BSGM’s correlation to the medical devices and health care index equipment has also shifted up since May. As a result, we question if the recent upside is a function of certain investors having identified in BGSM that the market consensus has overlooked, or, just a function of sector-beta, as mentioned. We are leaning towards the latter.

Exhibit 2. Correlations to med-tech and health care benchmarks also lifting since early May raising questions on where we can attribute the source of recent equity returns from in BGSM

Both charts [above and below] demonstrate a tight dispersion between equity market and sector beta and the BGSM share price since it began to tick up in August

Data: Updata

Pure EP updates still priced in

As has been the case with BSGM, the growth engine centres around PURE EP and updates around the same. However, as has also been the case this year, investors have priced in additional updates quickly and with little amplitude. Most recently on 24 August it reported that it had installed a second evaluation system at the Cleveland Clinic, expanding physician access to the company’s ‘signal’ technology. However, the market’s reaction was mute, as has been the case previously.

In particular, we note the market’s muted reaction to the news BSGM will reduce product evaluations down to 60 days from 180-360 days. However, there’s still no revenue booked for the segment, in preparation for the commercial rollout. We mentioned in June that, “BSGM likely has revenue tailwinds set to be realised in H2 FY22, with a ramp up in sales predicted into the coming years pending a successful launch.” This likely has been overshot and we now look to Q4 to see some form of how the company intends to proceed with its sales strategy looking ahead.

The question then turns to what exactly are we paying for today in BSGM. Shares are priced at more than 7.1x book value, on shareholder equity of $6.8mm and book value per share of $0.15. It’s also priced at 6.6x enterprise value (“EV”) to book value. At this multiple we’d be paying an implied price of $1.00, suggesting the market consensus has the stock fairly discounted at its current market capitalization.

Moreover, and looking at the balance sheet, we’re buying into a capital structure that is weighted towards equity holders, with $596mm in tangible assets and $317mm in patents that it amortizes on a straight-line basis over 20 years. However, we’re not buying into any substantiated return on any of this capital investment, and we are set to pay what looks like fair value for cash flows priced well out into the future. This degree of uncertainty keeps us trigger shy on the name.

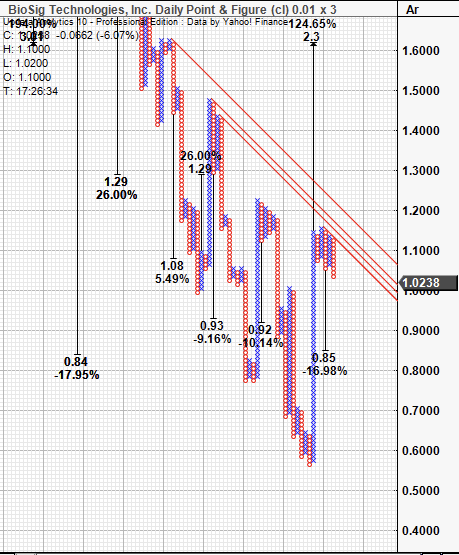

Technical factors

With a lack of fundamental data, we checked the market’s psychology around the stock and noted there remains a downside bias in price action. As seen in Exhibit 3, there are downside targets clustered towards the $0.85-$0.92 region. The stock has set a series of lower highs and is again testing the inner resistance line shown below. From this chart, price action appears to be bearish, and unsupportive of near-term upside.

Exhibit 3. Numerous downside targets to $0.85-$0.92

Data: Updata

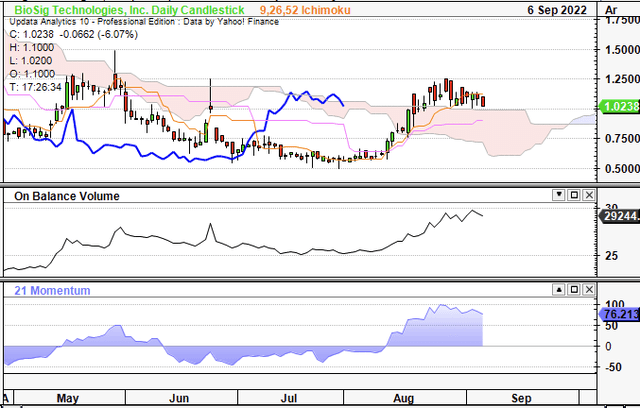

On the cloud chart, shares had punched above the cloud but the lag line has yet to break through, and so we remain neutral based on the culmination of these two technical charts. On balance volume looks to have completed its upswing two whilst momentum indicators have rolled over as well, suggesting the near-term uptrend may have exhausted for now.

Exhibit 4. Testing cloud support but lag line yet to break through and has rolled over, therefore nullifying uptrend

With these points in mind there’s no additional flesh to place on the skeleton in BSGM’s investment debate, nothing to pivot from previous ratings of a hold. We reiterate this on a $1 valuation.

Be the first to comment