Editor’s note: Seeking Alpha is proud to welcome Heinsite Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Bob Levey/Getty Images Entertainment

Thesis highlight

I recommend going long on Bowlero (NYSE:BOWL) ($11.67 as of this writing). It is a straightforward firm with incredible unit economics, and it is led by a solid management team with a track record of completing value accretive M&As, which supports BOWL’s long runway of growth.

As BOWL executes its growth initiatives, I predict it to generate 350m EBITDA in FY24, with a 12x forward EBITDA multiple resulting in $17/share of equity value (45% upside).

Company overview

Bowlero is the largest operator of bowling centers in the world, with 317 facilities in North America (~8% share). Its portfolio of bowling centers include:

- Bowlero/Bowlmor Lanes (162 centers) for upscale bowling entertainment

- AMF (146 centers) for classic bowling in an updated format

Since its founding in 1997, the business has grown both organically and via the acquisition of several bowling operators, including AMF and Brunswick. Additionally, BOWL is the owner of the Professional Bowlers Association (PBA), which it purchased in 2019 and which has millions of fans worldwide. BOWL is listed through a SPAC merger with Isos in Dec 2021.

Investments merits

Huge growing TAM

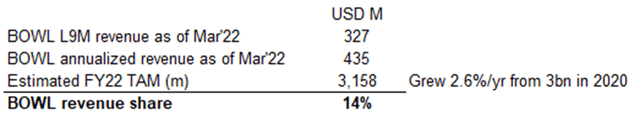

U.S. bowling revenue peaked at $4.4 billion (per SPAC deck) in 2019, up 4.1%/year from 2010, but has since fallen to $3 billion by 2020 owing to the spread of COVID (due to the pandemic). In spite of the downturn, it is expected to grow post-covid at a CAGR of 2.6% to $4 billion in 2027, which I expect to be driven by factors such as consumer shift toward experiences, affordable “American” activity against a more challenging macroeconomic backdrop, post-pandemic reopening benefits, particularly for events/league play, and the transformation of traditional centers into upscale/entertainment venues.

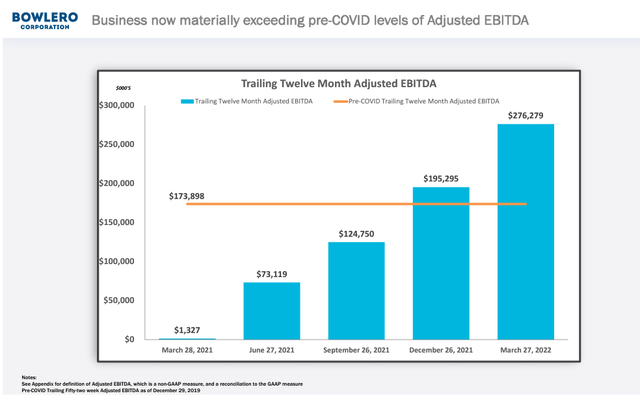

Evidence of recovery post-covid was further shown in comments used during BOWL’s 3Q22 results:

- “Revenue increased 129.8% year over year, 25.8% vs. pre-COVID performance and 12.2% on a same-store basis; Revenue trends accelerated through the week ended April 24, 2022”

- “Business now materially exceeding pre-COVID levels of Adjusted EBITDA”

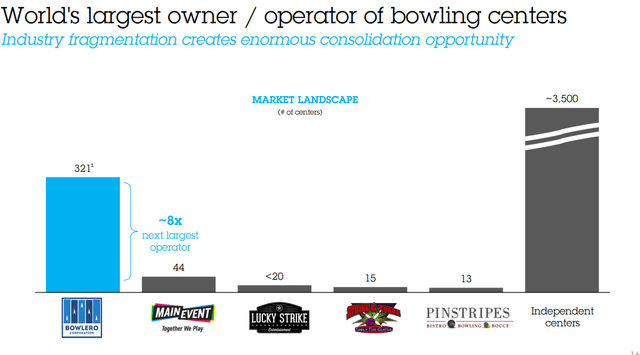

Fragmented industry provides ample opportunities to execute M&A strategy

BOWL’s 8% market share in the US bowling market (>300 locations) is four times bigger than the combined 2% market share of the following four competitors. As for the remaining 90%, they are largely operated by independent operators (~3,500 centers).

Of the ~3,500 centers available, there is a clear path for BOWL to continue acquiring them and apply its own operating model to improve operation excellence and EBITDAR margin. Post-acquisition EBITDAR margin typically improves by 1,000+ bps (as illustrated in the SPAC deck). Given the large number of centers available, it is likely management could hit their long-term target (5% unit growth/year) of ~10 acquisitions per year at $2.5m rev/center, which is expected to represent 2/3 of BOWL new center growth (according to its ABC strategy).

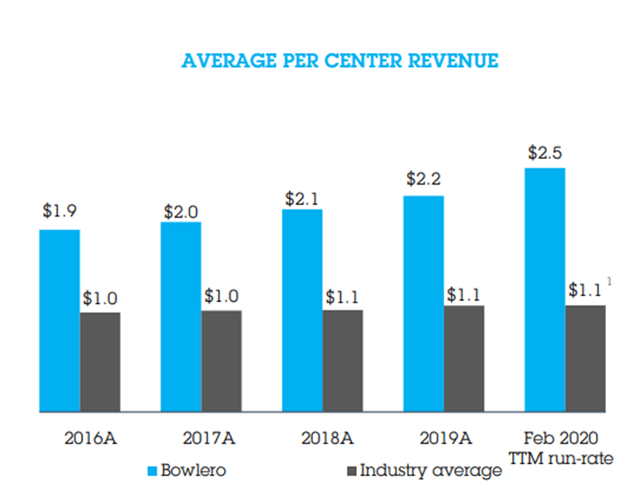

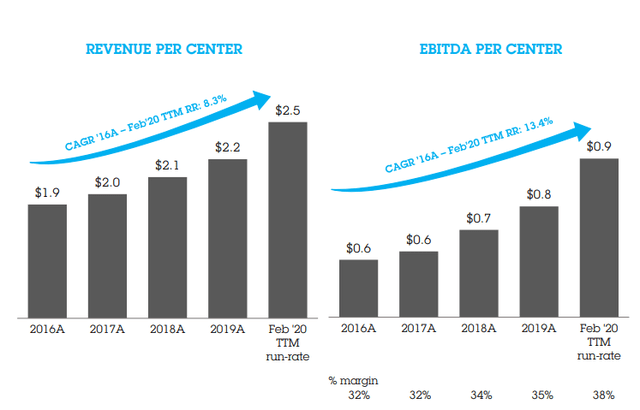

Strong unit economics drives larger revenue share providing huge cashflow generation capacity

While on a unit share basis, BWOL has ~8% share, it has ~ 14% revenue share. This stems from BOWL’s operation excellence, such that its average per center revenue is >2x the industry average, and EBITDA margin has been expanding consistently over the past 5 years. This is critical as it gives BOWL a strong advantage in terms of dry powder to conduct acquisitions and compete aggressively in customer acquisition/maintain top-of-mind-awareness (e.g., marketing, promotions, etc) and working capital (bidding for new leases), all while maintaining a strong FCF margin.

Image created by author using data from BOWL’s filings and own estimates

EBITDA margin on track to continue expanding

The majority (~2/3) of BOWL revenue carries a high incremental margin. The incremental margins for bowling revenue (>50% of revenue mix) are ~90%, with 10% of BOWL’s revenue (amusement) incremental margin being close to 100%. Hence, increased volume revenue—whether measured in visits or playtime—supports margin expansion, especially since BOWL is doubling down on raising brand awareness, growing leagues, and upgrading centers with new entertainment products like gaming and arcades, as well as digital optimizations like food service kiosks.

Recently acquired centers depress overall margins as they are still in the process of being re-structured. In acquired centers, BOWL’s cost-management discipline and efficiency translate to a sizable EBITDA margin potential (in particular, closing the gap between BOWL’s EBITDA margin and the industry’s EBITDAR margin). Through February 2020, the average center EBITDAR for the company’s two major chain acquisitions from the prior decade—266 AMF’s locations in 2013 and Brunswick’s 85 centers in 2014—rose by more than 1,000bps. To give context in terms of valuation, BOWL typically spends 7-8x TTM EBITDA to buy a center, which is equivalent to 3-4x on a future basis.

Management introduced a new operating system known as QMS (Quantitative Management System). By using this technology, BOWL is able to quickly achieve cost synergies post-acquisitions by:

- Gathering all available data asap for a bowling center,

- Benchmarking it against peer sets

- Determining the financial worth of the prospects

- Outlining a potential solution that may be used to boost productivity

Strong management team

The CEO, Tom Shannon, and CFO, Brett Parker, have worked together for more than 20 years. The current management team, made up of a variety of 10+ year industry veterans has developed and is still executing a repeatable, proven operational approach for bowling alley revenue development that is applied to newly constructed and acquired sites. It’s significant that management together owns close to 40% of BOWL stock, which, in my opinion, shows that management has a lot of skin in the game.

Valuation

Price target

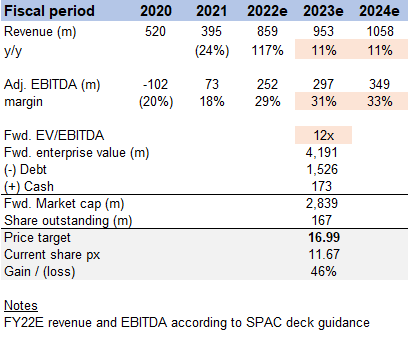

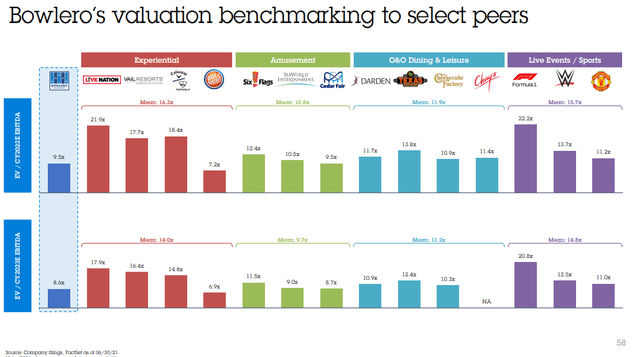

My model suggests a price target of ~$17 or ~45% upside from today’s share price of $11.67. This is on the basis of low-teens revenue growth from FY22 to FY24, exit EBITDA margin of 33% in FY24, and a forward EV/EBITDA multiple of 12x (which is roughly in line with comps and BOWL’s history).

Image created by author using data own estimates

Revenue growth

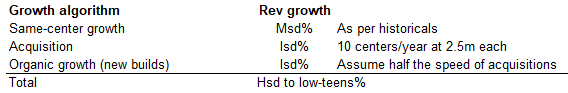

My base case assumes BOWL to grow as per management guidance and historical performance, ~hsd to low-teens growth from FY22E to FY24E.

Image created by author using data from own estimates

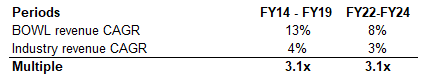

This is similar to how BOWL performed prior to covid, when it grew three times faster than the industry. As the U.S. bowling industry is estimated to grow by lsd% moving forward, applying the same ratio equates to hsd% growth.

Image created by author using data from own estimates

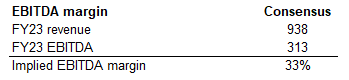

EBITDA margin

I believe EBITDA margins will improve as management implements the strategies outlined above, and my opinion differs from the consensus. Consensus is expecting EBITDA margin to be in line with management’s guided figure in 2H21 of the low-30s. As said in the above thesis, this margin is supported by the high incremental margin and the scale advantage (fixed cost base).

Image created by author using data from Bloomberg consensus

Valuation multiple

The reason for using a 12x multiple is that the FY23 EV/EBITDA multiple across BOWL’s peers ranges from hsd to low-teens, which averages out to be ~12x

Risks

Execution

In my opinion, this is the key risk. A large part of BOWL’s guided growth is from the acquisition of independent operators and closing the margin gap. While management has a strong record of conducting this strategy, any execution mishap would dramatically impact future earnings.

Recession

BOWL’s earnings are tied to consumer spending. Consumers may elect to reduce their discretionary spending as a result of the failing economy, resulting in fewer than anticipated sales and earnings.

Covid-19 resurgence

If COVID-19 or similar situations become more common, bowling may be subject to additional regulations than other outdoor recreational activities. The impact of COVID could be seen again during the Omicron wave, which had a huge impact on profitability in 1Q22.

Competition

BOWL operates in a highly competitive and fragmented industry. Aside from direct competitors, BOWL is competing with a variety of out-of-home entertainment and food choices, such as theaters, athletic events, amusement parks, and restaurants, which all compete for consumer “free-time.” The same analogy is drawn from cinemas vs. all-other-entertainment (be it Netflix, mobile gaming, etc.).

Conclusion

To conclude, I believe BOWL is worth ~45% more than its value today ($11.67 as of writing). Despite the downturn during COVID, BOWL operates in a sizable, expanding market that is projected to increase after the recession at a CAGR of 2.6% to $4 billion in 2027. The shift in consumer preference toward experiences and reasonably priced “American” activities will be one of the elements driving the increase. As BOWL is the biggest player, it has a significant edge in terms of dry powder for conducting M&As, and the fragmented market offers numerous opportunities.

Overall, as BOWL works toward its goals, its EBITDA and revenue should go up, which will help the company realize its true value.

Be the first to comment