Darren415

This article was first released to Systematic Income subscribers and free trials on Dec. 3.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of December.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

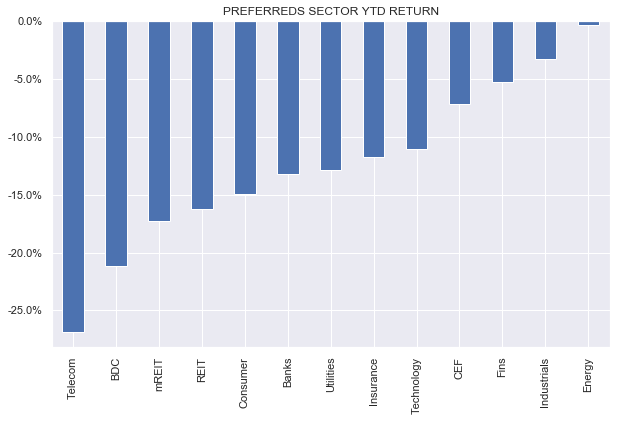

Preferreds had a tough week, under pressure from higher Treasury yields and lower stocks. All sectors finished in the red. Recent underperformance in the Energy sector due to the drop in the energy prices means that all sectors now feature negative year-to-date returns.

Systematic Income

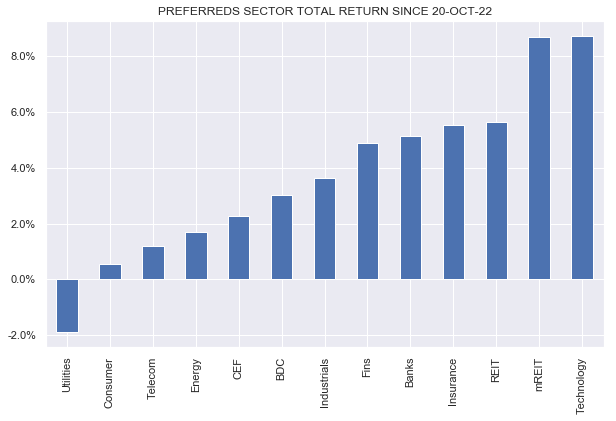

The recent rally in Treasury yields since October has brought a measure of relief to a number of sectors including higher-quality sectors like Banks and Insurance as well as the mREIT sector which has benefited from some stability in mortgage securities.

Systematic Income

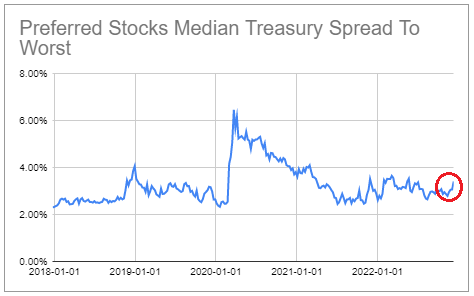

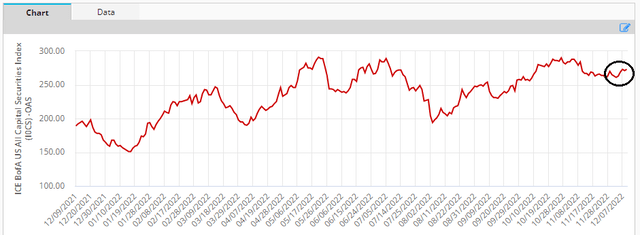

Exchange-trade / retail preferreds have underperformed the recent rally in Treasury yields, which is reflected in the widening of credit spreads in the chart below.

Systematic Income Preferreds Tool

We see something similar, though to a smaller extent, in the broader preferreds space as shown in the chart below.

The current credit spread level in preferreds looks attractive to us, particularly in the context of a combination of moderate duration and credit quality, generating all-in yields of 6.5-7%.

Market Commentary

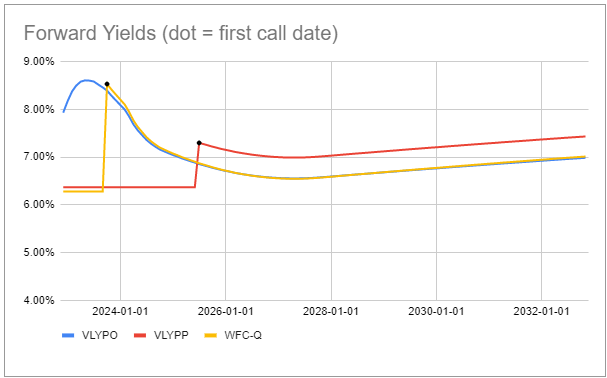

There was a question on the service about the bank preferred Valley National (VLYPO). This is one of a few floating-rate preferreds which we’ve highlighted a number times in the second half of the year as likely to benefit from rising short-term rates.

The stock is up close to 11% over the last 3 months versus a flat bank preferred sector. At a coupon of around 3mL + 3.6% and a stripped price around “par” its yield is around 8.3% or about 2% above the average bank preferred despite a fairly high-quality profile (senior unsecured debt is rated BBB with preferreds a level below that).

Its yield will likely peak around 8.5% and move lower once (and if) the Fed starts to cut, however even at the consensus trough in short-term rates of around 3% in a couple of years the yield will still be above today’s average bank preferred. In a couple of years, it might be worth switching over to VLYPP which will float at a higher yield in 2025 than VLYPO.

The chart below shows two of the Valley National preferred alongside a Wells Fargo preferred which we recently highlighted for reference. For fans of WFC.PQ who don’t want to wait for the first call date when the stock’s coupon should jump significantly or who worry about a redemption on that date, may want to also allocate to VLYPO and enjoy the higher yield today (albeit at a slightly worse credit profile). Interestingly, the forward yields of the two stocks after the WFC.PQ first call date are right on top of each other.

Systematic Income Preferreds Tool

Business development company Saratoga Investment (SAR) priced another baby bond – the 8.125% 2027 bond with a ticker SAY. The company has two existing bonds trading SAJ and SAT. SAJ is currently trading at a 8.2% yield so is slightly more attractive, particularly given the slightly shorter maturity. Current yield curve inversion is making things less intuitive. In the current environment, investors should expect to earn a higher yield on shorter-maturity assets, all else equal, which is just fine and dandy in our view. 8%+ looks pretty attractive for the bond given Saratoga’s stable historical NAV profile and current asset coverage.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Be the first to comment