Hiroshi Watanabe

iShares Environmental Infrastructure and Industrials ETF (NASDAQ:EFRA) is an exchange-traded fund that invests in companies that provide solutions for energy efficiency and emissions mitigation, pollution reduction, or land and resource optimization. EFRA invests globally. The purpose of EFRA is to provide investors with exposure to an environmental infrastructure thematic. The expense ratio is 0.47%, and the fund was launched only recently on November 1, 2022. Therefore, net assets under management are reported as being only $4 million as of November 4, 2022.

Having reviewed many iShares funds, the funds that survive usually have at the very least up to $100 million in assets, although some smaller ones exist. In order for a fund to have longevity with iShares, it likely needs to approach $100 million in assets. One could assume that EFRA will gain in popularity, especially given the fund’s theme which is certainly not contrarian.

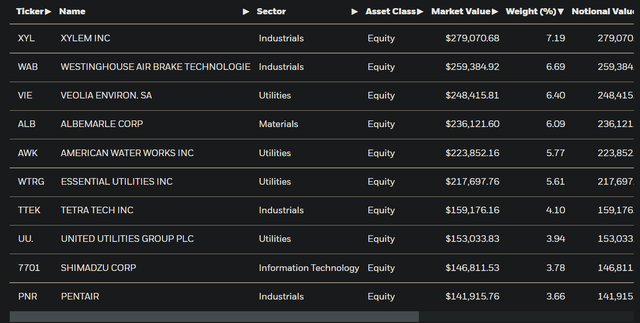

The fund had 45 holdings as of November 3, 2022, including Xylem, Inc. (XYL), a large American water technology provider (7.19% of the fund), Westinghouse Air Brake Technologies, i.e. Wabtec (WAB), an American manufacturer of various industrial products including locomotives, freight cars and passenger transit vehicles (6.69% of the fund), and Veolia Environnement (OTCPK:VEOEY), a French transnational company that operates across water management, waste management and energy services (6.40% of the fund).

The fund is quite concentrated as a result of having fewer than 50 holdings. The fund’s mandate is to invest in accord with its chosen benchmark index; to track the index, which is the FTSE Green Revenues Select Infrastructure and Industrials Index.

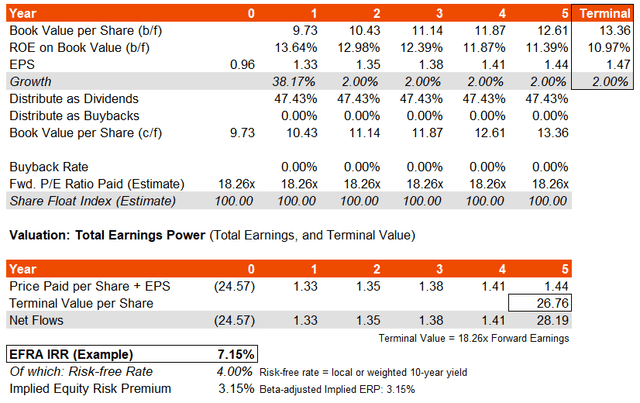

Based on Morningstar data, the fund’s forward price/earnings ratio is 18.26x, with a price/book ratio of 2.49%, and a three- to five-year earnings growth estimate of 10.13% (on average). That implies a forward return on equity of 13.64%, which is not very high. Separately, iShares provide a trailing price/earnings ratio as of the same date (November 3, 2022) of 25.23. Already, to me, this relatively modest earnings growth estimate of 10% (at least relative to analyst consensus forecasts of other sectors) combined with a relatively modest underlying return on equity (from a global perspective) would suggest to me that the fund is possibly overvalued. Or, to put it more politely, EFRA is perhaps trading at a premium given its thematic.

Nevertheless, we will proceed using the above basis. The model below is constructed based on the above data and an assumption of no share buybacks and a constant earnings multiple of 18.26x. In my model, in which average earnings grow at 8-13% over the forecast horizon, the return on equity ticks down to just under 11% in the final year.

In this case, assuming a risk-free rate of 4% (just under the current U.S. 10-year), the underlying equity risk premium is assessed as being roughly 3.15%. That is low, and does imply that EFRA is trading at a premium. A more normal equity risk premium for U.S. equities would be circa 4.2-5.5%, or perhaps as low as 3.2% or so for tech stocks in high demand (and/or for stocks with high earnings growth potential). For context, Professor Damodaran of NYU’s most recent U.S. ERP is 4.59% as of November 1, 2022.

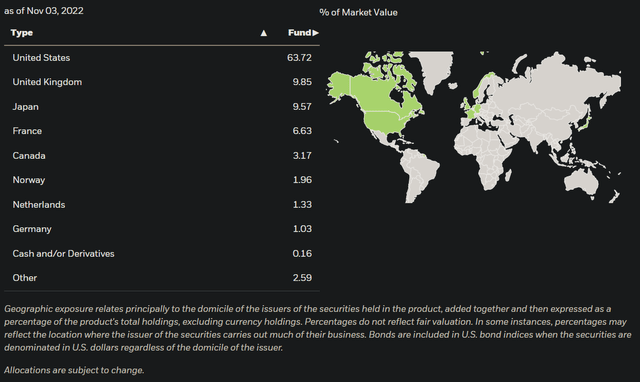

Bear in mind that EFRA also invests beyond the United States, as mentioned earlier, and that means that arguably EFRA is trading at an even greater premium than my model above. That is because countries beyond the U.S.’s highly developed economy and equity market tend to carry positive country risk premiums. As shown below, top country exposures include the United Kingdom (9.85%), Japan (9.57%), and France (6.63%) as well as Canada, Norway, Netherlands, and Germany, in smaller allocations.

So, at the very least, EFRA should probably be priced for an IRR of the sum of 4% plus an equity risk premium of, I would argue, at least 4.6% (minimum) given that the U.S. ERP is closer to 4.6% at present given Damodaran’s work. If we call it 8.5%, but assume long-term earnings growth in the region of 2-3%, arguably the forward earnings multiple might be 15.4-18.2x. That compares with our current 18.26x, and so EFRA is probably priced at the upper bound of what might be considered “fair” (at best). Having said that, on an IRR basis, you could argue that EFRA is trading at a roughly 5-10% premium (i.e., EFRA would need to fall by about as much in order for our forward IRR to increase to a more acceptable level).

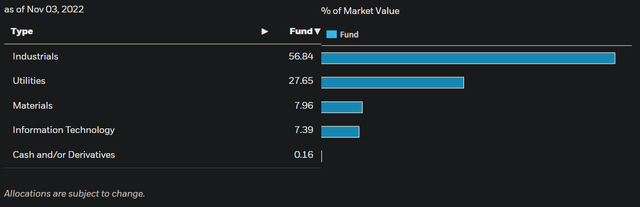

From a simplistic perspective with reference to sector exposures, EFRA’s portfolio is geared toward Industrials (56.84% as of November 3, 2022), and Utilities (27.65%).

The bias here toward industrials makes the fund probably pro-cyclical with the broader economy, while the utilities component gives the fund another tilt toward a defensive, lower-beta approach. On balance, EFRA is likely to produce modest long-term returns, in line with its presently modest return on equity and forward earnings yield (13.64% and 5.45%, respectively). I would be surprised if EFRA were to beat my IRR projection of about 7% per annum over the next few years (including any dividends reinvested). Further, I would assume under-performance, given the heavy 28% utilities allocation which is characteristically defensive.

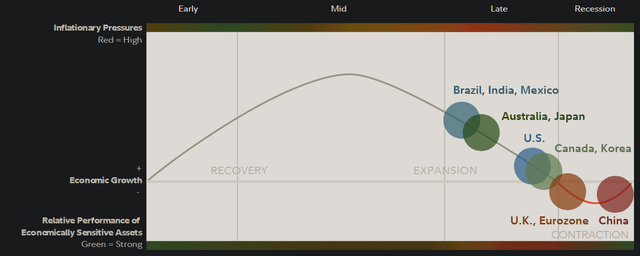

Right now, as of Q4 2022, the world is in a slower-growth phase, heading into a recessionary phase (at least most of the world, including the United States).

This makes industrials-focused funds fairly poorly positioned. While markets might lead the economy by circa 6-12 months, EFRA also has a heavier defensives position that would also likely soften any potential for out-performance on the other side. Therefore, my general impression is that EFRA is probably going to perform in a fairly steady fashion across the business cycle (i.e., tracking broader markets with a sub-1.00x beta) but not ever really out-performing. I would be neutral on EFRA, as I would prefer to invest in valuation and cyclical potential rather than thematics.

Be the first to comment