Drew Angerer

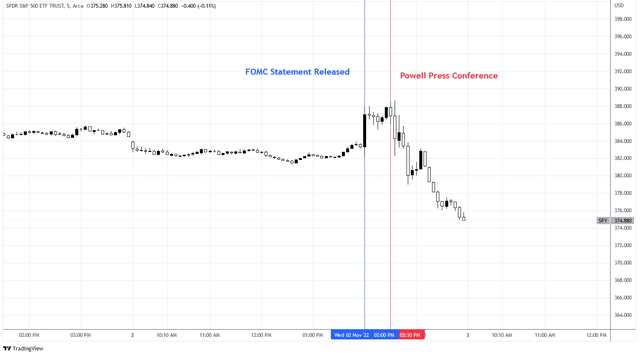

Yesterday was a doozy. It was a wild day for markets with the FOMC Meeting and Press Conference. Equity markets rallied after the release of the FOMC Statement only to be slammed down after Chairman Jerome Powell began his press conference. The Federal Reserve raised the Fed Funds rate by 75 basis points, as was expected. But clearly the market was not prepared for the narrative that followed with the S&P 500 down 2.5% on the day.

S&P 500 on November 1 and 2 (Charts by TradingView (adapted by author))

There were several statements made by the Chairman that sent a clear message to markets: no pivot for you.

Powell is not being evasive. He was clear in the first paragraph of his opening statement of the November FOMC Press Conference (bold added for emphasis):

My colleagues and I are strongly committed to bringing inflation back down to our 2 percent goal. We have both the tools that we need and the resolve it will take to restore price stability on behalf of American families and businesses.

The hawkish tone was a shock to many. In fact, the 75 point basis rate hike was surprising to some. But it came as no surprise to me. I have been writing about the tough position that the Fed is in and the threat to its institutional credibility if it fails. This matter is serious, perhaps the most serious matter affecting the nation at the moment.

FOMC Message: Higher For Longer

During the Q&A section of the FOMC Press Conference, Chairman Powell responded to a question with this statement:

…it is very premature to be thinking about pausing so people when they hear lags they think about about a pause it’s very premature in my view to think about or be talking about pausing our rate hike we have we have a ways to go…

He’s not even talking about talking about pausing.

He went on:

…incoming data between the meetings both the strong labor market report but particularly the CPI report do suggest to me that we may ultimately move to higher levels than we thought at the time of the September meeting…

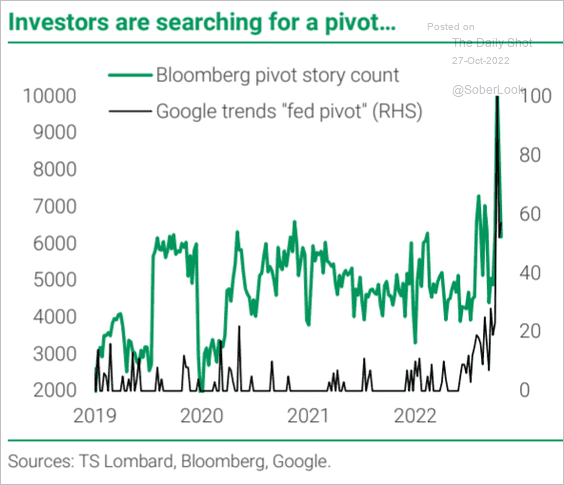

Chairman Powell is talking about terminal rates. While the market is considering pivot, the FOMC is considering higher terminal rates in the long run. He made it clear that the pace of rate hiking is up for debate. And this notion of lower rate hikes has been permeating the financial community lately, especially following the article by Wall Street Reporter Nick Timiraos that suggested a 50 basis point hike may be in store for December.

The Daily Shot (used with permission)

Nonetheless, this is what Powell has said:

The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive.

Translation: higher for longer.

Initially, the market responded favorably to messaging from the FOMC following the announcement of the 75 point basis rate hike. Included in the FOMC meeting statement was (bold added for emphasis):

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

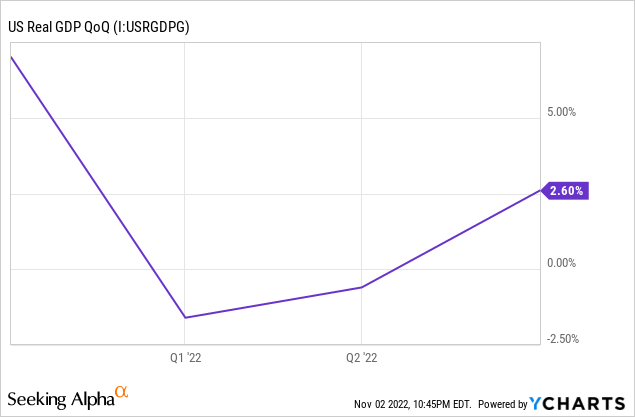

This was interpreted as meaning “data dependent” and much of the economic data is already demonstrating substantial weakness. For example, the Michigan Consumer Sentiment was very low in October at 59.9. Also the first two quarters of U.S. real GDP growth in 2022 was negative, although the third quarter came in strongly positive at 2.6% QoQ.

But perhaps the most telling moment came during the press conference when Chris Rugaber of the Associated Press incorrectly stated that markets were reacting positively and asked for Chairman Powell’s reaction:

…it looks like stock and bond markets are reacting positively to your announcement so far. Is that something you wanted to see? Is that a problem, or how might that affect your future policy to see this positive reaction?

Here is what Powell answered (bold added for emphasis):

You know, we’re not targeting any one or two particular things. You know, our message should be-what I’m trying to do is make sure that our message is clear, which is that we think we have a ways to go. We have some ground to cover with interest rates before we get to-before we get to that level of interest rates that we think is sufficiently restrictive. And putting that in the statement and identifying that as a goal is an important step, and that’s meant to put that question, really, as the important one going forward.

And the last thing I’ll say is that I would want people to understand our commitment to getting this done, and to not making the mistake of not doing enough or the mistake of withdrawing our strong policy and doing that too soon.

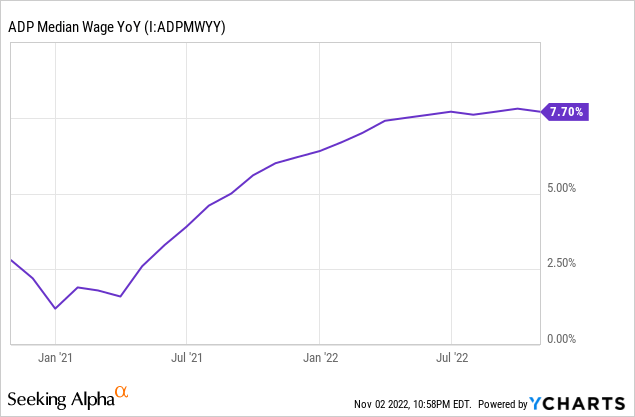

One of the most problematic economic data points setting this path is the trajectory of wage growth. Wage inflation tends to lag broad price inflation and also cements price inflation as wages contribute to the cost of every good and service and are difficult to reverse once raised. The October ADP National Employment Report released on November 2nd found that wages for job-stayers has increased by 7.7% YoY. But wages for job-changers has increased by a staggering 15.2% YoY. This is lower than the YoY rate in September which was 15.7%, but the magnitude of wage growth is going to contribute to persistent price inflation in the near term.

Then, how far are rates going to go?

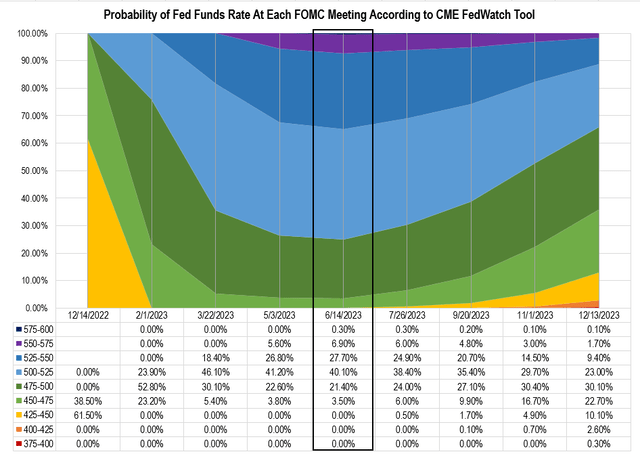

Chairman Powell did not discuss a specific terminal rate that they have in mind. But according to Fed Funds Futures the terminal rate is currently around 5.1%. Data from the CME FedWatch Tool is forecasting peak rates by the June FOMC meeting with a 96.5% probability that the rate will be above 4.75%. The data is displayed in the graph below.

Chart by author (data from CME FedWatch Tool)

Higher Rates, Higher Risk Premium

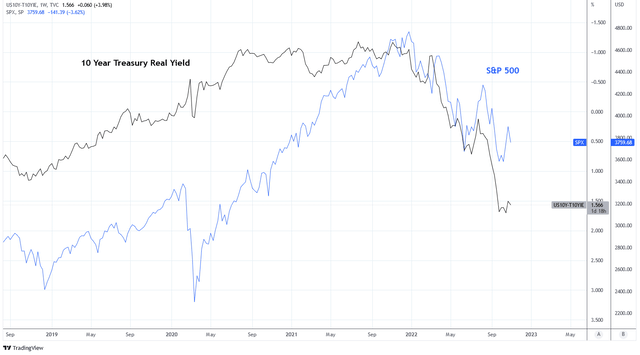

Higher rates and further balance sheet reduction is not accommodative for risk assets and long duration bonds. As rates increase I expect real rates to increase concurrently. The real rate on 10 year Treasuries is currently 1.56%. The last time the 10 year real yield was this high was March 2010.

Charts by TradingView (adapted by author)

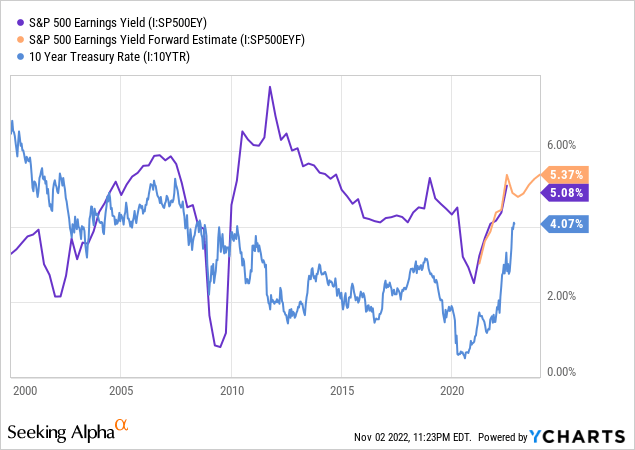

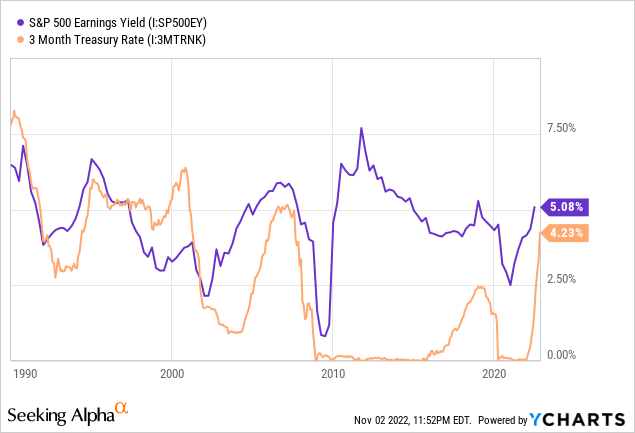

What matters is the spread between risk-free rates and earnings yield, known as risk premium. The current S&P 500 earnings yield is approximately 4.96%. Compared to the 10 year Treasury rate, this is 90 basis points of risk premium. Additionally, earnings estimates for 2023 remain strong although they have been revising lower. Some analysts are expecting S&P 500 earnings of $235.92 per share which is 6.6% higher YoY. This would result in an earnings yield of 6.2% at current prices.

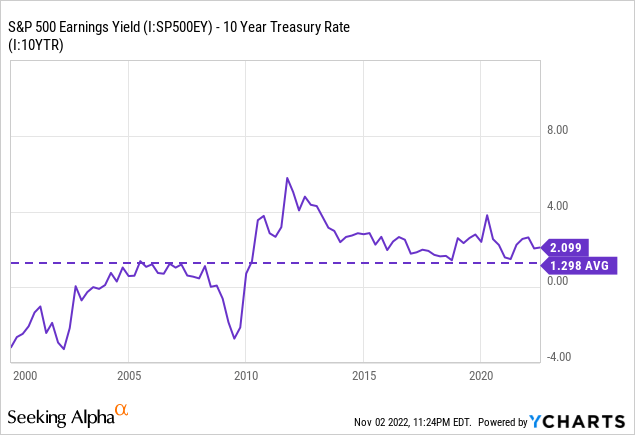

If earnings estimates are true and the terminal Fed Funds Rate is 5% this could put the 10 year Treasury at 4.5%. This would result in a risk premium spread of 0.87-1.7%. The 20 year average risk premium spread is 1.29%. This means that if earnings estimates are correct, the price of the S&P 500 could go nowhere just to simply keep risk premium on trend.

I don’t think that is a likely scenario at this point. For one, I think earnings estimates are too generous. Tighter monetary conditions are not conducive of strong earnings growth. The Fed is trying to slow the economy and cause demand destruction by raising rates. Notice how each episode of rising short term rates has preceded a decline in earnings over the last three decades.

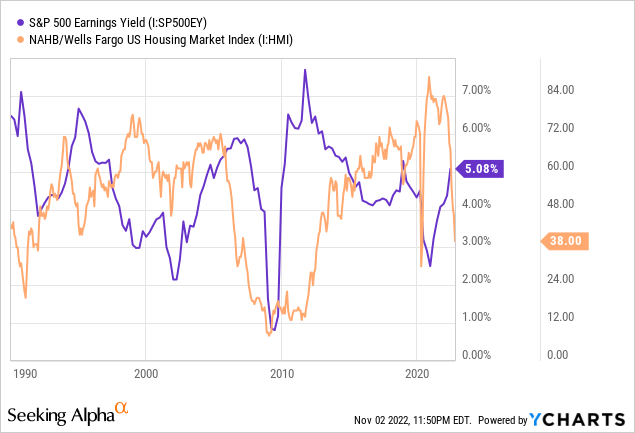

Additionally, rates have reached restrictive levels for home buyers and causing a severe downturn in housing market activity. The NAHB index has fallen sharply which tends to precede declines in earnings.

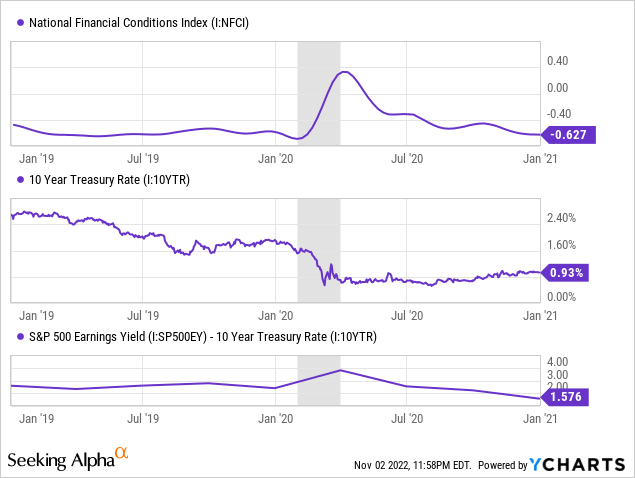

Secondly, risk premium tends to expand during periods of uncertainty and tighter financial conditions. Notice how risk premium expanded in early 2020 as financial conditions tightened even as the rate on the 10 year Treasury fell:

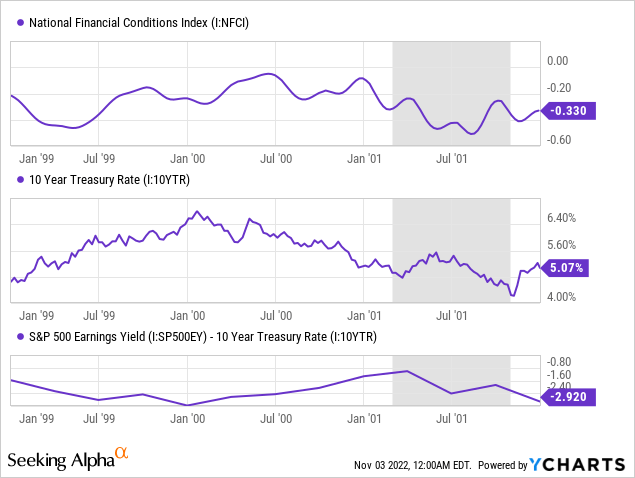

The same thing occurred in 2000 as risk premium expanded while rates declined until financial conditions eased:

Summary

Chairman Powell concluded his introductory remarks at the press conference by saying:

We will stay the course, until the job is done.

Inflation is still nowhere near their 2% target. September PCE was 6.2% YoY while Core PCE was 5.1% YoY. September CPI was 8.2% YoY and Core CPI was 6.6% YoY. The momentum of inflation is slowing but the level is still unacceptable. This is while employment data remains strong. As a result, the Fed is targeted a higher terminal rate at a more distance point in the future. The pace of rate hikes may slow but that is not a pivot.

Equity and bond markets face further volatility in the quarters ahead as the monetary tightening continues. Risk premium and valuations compared to real rates is currently unattractive. Higher rates will exacerbate the issue. Lower earnings would cause havoc. For these reasons my portfolio remains defensive with underweight positions in equities and overweight positions in U.S. Treasury bills and Floating Rate Notes. Powell says he has the resolve. I won’t dare doubt him.

Be the first to comment