OwenPrice

This article was co-produced with Chuck Walston.

The Coca-Cola Company (NYSE:KO) and PepsiCo, Inc. (NASDAQ:PEP) are bucking the market’s trend. Shares of both are up year-to-date, highlighting why investors favor defensive consumer staple stocks during times of economic uncertainty.

KO and PEP control over two-thirds of the global soft drink sales, but sugary drinks are facing secular headwinds, especially in developed nations. Both companies are embracing products to fight this trend, each with its own strategy.

While the general public may view the two as akin to twins, investors dissecting the companies will discover somewhat divergent business models.

What Recent Earnings Tell Us

PepsiCo provided Q3 earnings in the middle of last month, while Coke released the third quarter’s results last week.

Shares of PepsiCo jumped following a beat on the top and bottom lines. EPS of $1.95 topped consensus by $0.11, and revenue of $21.97 billion, up 9% year-over-year, surpassed analysts’ estimates by $1.13 billion. The beat on revenue was in spite of a 3% hit from foreign currency headwinds.

Organic revenue increased 16%; however, that was due to higher pricing, as overall volume declined by 0.8%.

Despite volume declines, the Frito-Lay North America division and the Quaker Food North America division recorded revenue increases of 20% and 15%, respectively.

PepsiCo Beverages North America’s revenue increased 4% on slightly higher volume.

Like the North American businesses, Africa, the Middle East, and South Asia saw a 4% rise in revenue on lower volume in foods and higher volume in drinks.

Revenue in Europe increased 1% despite lower volumes.

Asia-Pacific and China bucked the trend, with revenue up 3% on stronger volume in both food and drinks.

Management forecasts inflationary pressures will result in a high-teens negative headwind for FY 2022. PepsiCo guides for 12% organic revenue growth, an increase from the previous estimate of 10%. The forecast for EPS was raised from $6.63 to $6.73 in FY 2022, up 7.5% over FY21.

Like PEP, Coke also beat analyst’s estimates. EPS of $0.69 was above consensus of $0.64, and Coke’s adjusted net sales increased 10% to $11.05 billion, topping analysts’ $10.52 billion target.

Unit case volume increased by 4%. Coke Zero was a standout, with volumes growing 11% during the quarter.

KO reported net income of $2.83 billion, or 65 cents per share. That’s an increase from 57 cents per share a year earlier.

Management guides for adjusted EPS to increase 6% to 7%, up from the prior range of 5% to 6%. The company also raised its outlook for organic revenue, now projected to grow at a 14% to 15% range, an increase from the prior 12% to 13% forecast.

KO and PEP: Their Similarities, Their Differences

With a product portfolio of more than 500 brands, Coke is the world’s largest nonalcoholic beverage company.

Carbonated soft drink consumption (‘CSD’) products are Coke’s largest product category, and KO’s global share of the nonalcoholic ready-to-drink market is more than two times that of Pepsi’s.

To appreciate how KO dominates the competition, consider this: The company owns six of the top 10 CSD brands in the U.S., and red Coke garners 23.5% of the U.S. market, more than twice that of Pepsi.

Pepsi is more U.S. centric than Coke. PEP generates 55% of net revenues from the United States. In contrast, about two thirds of Coke’s revenues were generated overseas, with Coke garnering 36% of the global beverage market.

However, although only 17% of KO’s unit case volume sales in 2021 were in the U.S., 34% of total revenues were from the States.

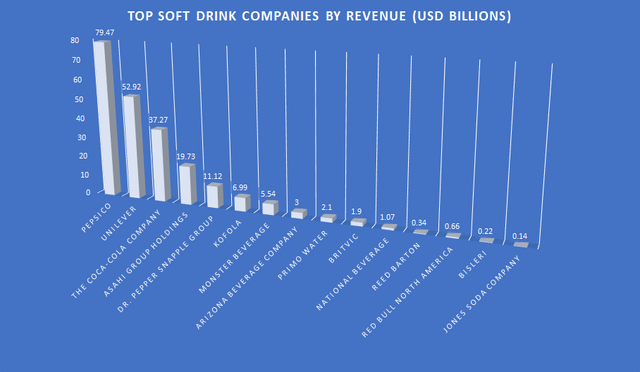

Bizvibe

Herein lies the most obvious distinction between the two companies. Snack foods constitute around 55% of Pepsi’s revenue, and that product line is growing at a more rapid rate than beverages.

Pepsi’s volume share of salty snacks is more than nine times that of its closest rival. Lay’s, with more than $30 billion in sales, is the world’s top selling snack food brand.

There’s another arena in which the two companies differ: Coca-Cola’s gargantuan presence in most markets provides obvious cost advantages. However, the leverage provided by scale combines with an underappreciated aspect of Coke’s business model to reap an additional synergy.

KO does not package and distribute most of its products. Instead, Coke produces the concentrates or syrup used by bottlers. This is a very low-cost position within the product chain.

In essence, KO farms out the more costly operations. The packaging and distribution of the finished products is undertaken by bottlers. This results in Coca-Cola posting gross margins in excess of 60%.

Consequently, KO’s operating margins are in the high-20s, whereas Pepsi’s range is in the mid-teens. Furthermore, PEP’s workforce is roughly 4X as large as Coke’s.

However, Coke spends a low double-digit percentage of revenue for marketing, while Pepsi devotes a mid-single-digit share.

Head-To-Head Comparisons

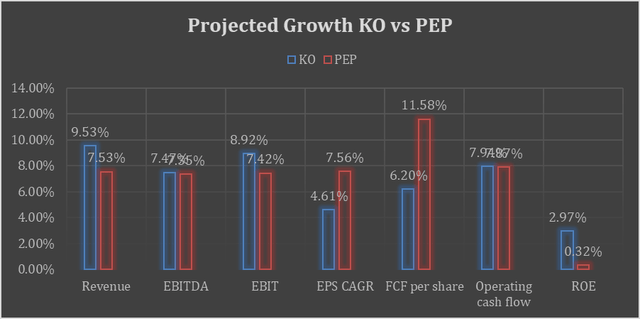

The following chart provides projected growth metrics for KO and PEP. The EPS CAGR is for a 3-to-5-year period. All other data represents analysts’ consensus revenue estimates for two fiscal years forward.

Seeking Alpha Premium

I see no distinct overall advantage.

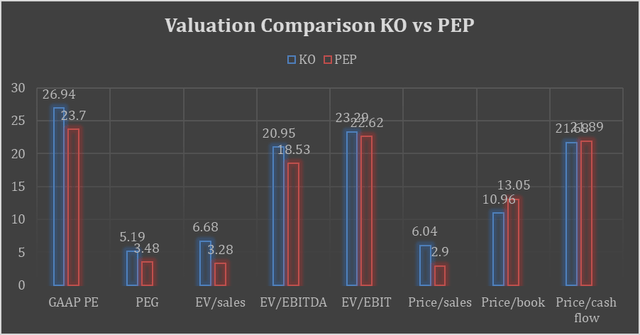

The next chart provides valuation metrics. The data represents analysts’ consensus estimates for the next fiscal year. The single exception is the PEG ratio, which represents the CAGR for the next three to five years.

Seeking Alpha Premium

I would give KO a marginal advantage.

KO currently trades for $59.52 per share. The 12-month average price target of the 18 analysts who follow the company is $66.50, an increase of 11.17%.

PEP currently trades for $180.59. The 12-month average price target of the 11 analysts that follow the company is $184.15, an 1.97% increase.

Dividend Metrics

KO yields 2.94%. The payout ratio is a bit below 70%, and the five-year dividend growth rate is 3.57%.

PEP yields 2.53%. The payout ratio is a bit below 67%, and the five-year dividend growth rate is 7.39%.

Both companies are Dividend Aristocrats, and each has solid investment grade credit.

KO and PEP: Buy, Sell, Or Hold?

Both stocks are characterized as safe investments. However, in terms of share appreciation, Pepsi has nearly matched the S&P 500 over the last decade. Meanwhile, Coca-Cola stock has lagged the market by a wide, double-digit margin the last 10 years.

Aside from the brand strength, scale, and distribution advantages both companies hold, the product lines are also reasonably resistant to e-commerce. Additionally, private label penetration remains low in the CBD space.

About 80% of the world’s population lives in developing and emerging nations, where commercial beverages constitute around 30% of beverages consumed. Sales of Coke and Pepsi products are likely to grow as the middle-class populations of developing countries increase.

Although consumers in the U.S. and Europe are gravitating away from sugary drinks, both companies are adapting by offering a broader array of alternative beverages. Furthermore, Coca-Cola’s partnership with Monster, and Pepsi’s partnerships with Starbucks and Lipton are strategies designed to diversify each company’s brand portfolio.

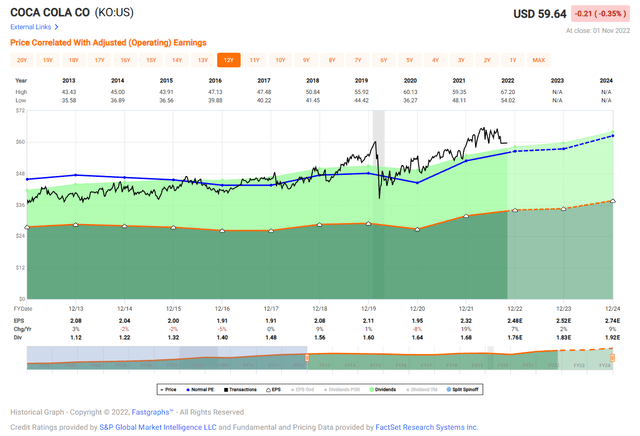

Despite the many strengths evidenced by both Coca-Cola and Pepsi, I do not believe the current share valuation of either stock provides a margin of safety. Consequently, I rate both as HOLDs.

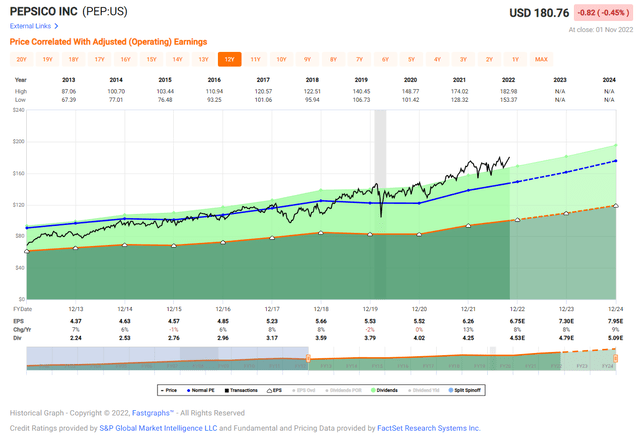

FAST Graphs

FAST Graphs

I would not be surprised to see the shares perform reasonably well over the short run. This is largely due to a prevailing narrative that investments in KO and PEP are ideal for the current macroeconomic environment.

However, as a dividend growth investor, I view the mediocre yields and lackluster dividend growth rates, as negatives. I believe I can identify a number of investments with better overall prospects.

Be the first to comment