Kativ

At some point, big tech was bound to start missing earnings, having grown too large to be immune from a slowing economy.

This earnings season that proved to be the case, with Microsoft (MSFT), Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), Meta (NASDAQ:META) and Amazon (AMZN), all disappointing on earnings and/or guidance.

The results for the stock prices were ferocious and swift. Here were the peak declines right after missing earnings, including after hours.

- MSFT: -8% (the next day)

- GOOG: -9% (the next day)

- AMZN: -23% (after hours)

- META: -27% (after-hours)

All told $360 billion in market cap were wiped out last week, and the number would have been much larger had it not been for a two week bear market rally driven by technicals including yet another “Fed pivot” hopium rally.

When some of the world’s biggest and best blue chips collapse, it naturally causes many investors to wonder if the investment thesis is broken or if it’s a great chance to be “greedy when others are fearful.”

Several DK members have requested updates on these blue chips so today I want to take a look at META and GOOG to provide the best and most up-to-date fundamentals-focused analysis of each company’s prospects.

So let’s take a look at the good, bad, and ugly for META and GOOG to see why META might possibly be broken, while GOOG can still make you rich.

Let’s start with META, the most troubled of the FAANG stocks.

Meta Platforms: A Potentially Wonderful Company At The Mercy Of A Mad King

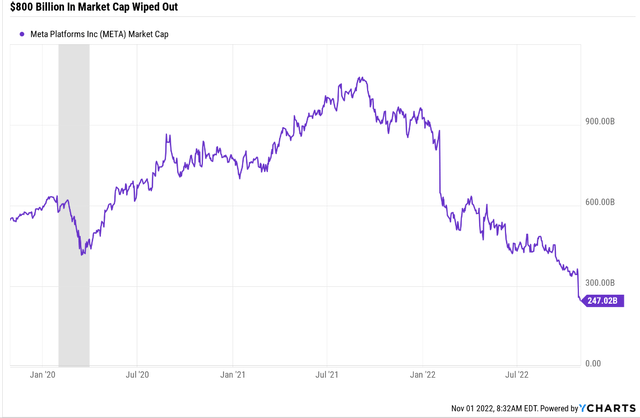

Ycharts

Mark Zuckerberg holds the title as the person responsible, at least in large part, for the second greatest decline in investor wealth in history, an impressive $800 billion.

- META is down 78% off its record highs

The only person to best Mr. Zuckerberg is China’s President Xi, who in a single week wiped out $6 trillion in market cap when he was appointed to a third term.

This was the second 20%-plus single day crash for Meta,

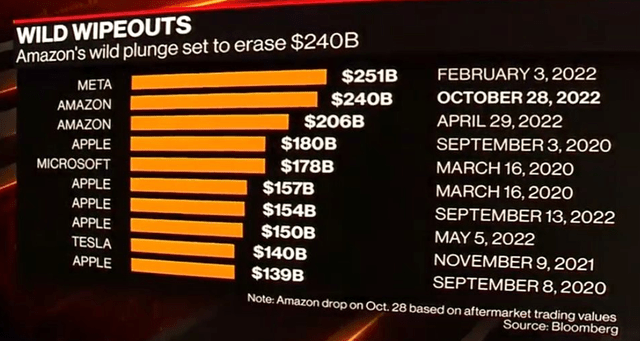

Bloomberg

Back in February, Meta became the first company in history to lose a quarter trillion in value in a single day.

This time the decline was about $60 billion owing to Meta having fallen to a $300 billion market cap.

Why did Wall Street gut Meta so ferociously?

Was it Meta’s struggles to grow its global user base?

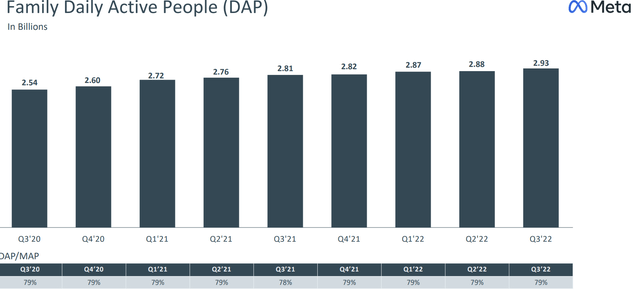

investor presentation

Not really. Total users are growing at a slow pace, but still growing and the percent of monthly users who are using Meta’s platforms daily remains steady at 79%. What about sales?

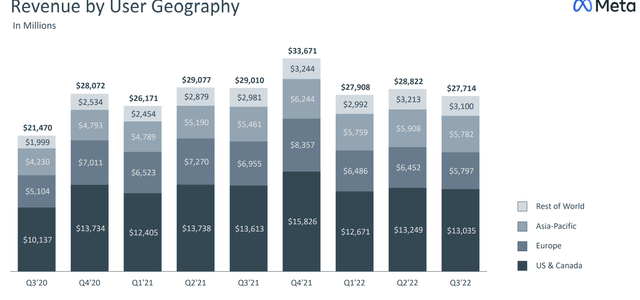

investor presentation

While sales are down from last year, that’s mostly due to the overall pullback in advertising spend and Q3 revenue was stable compared to Q1 and Q2.

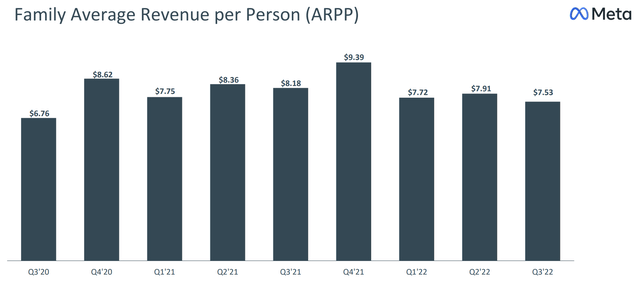

What about revenue per family/user?

investor presentation

That’s been steady for two years now, which isn’t great in terms of sales growth. But again, part of that is from the fact that global advertising is struggling right now.

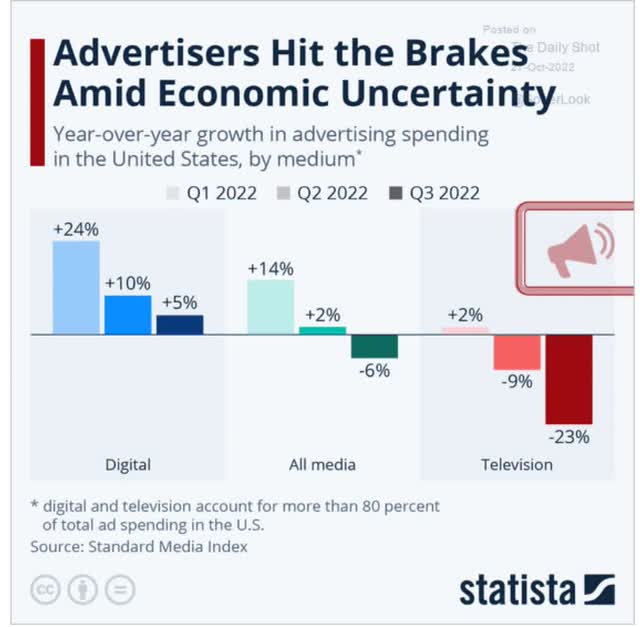

Daily Shot

So what caused the market to freak out over META and send shares down as much as 27% in a matter of hours?

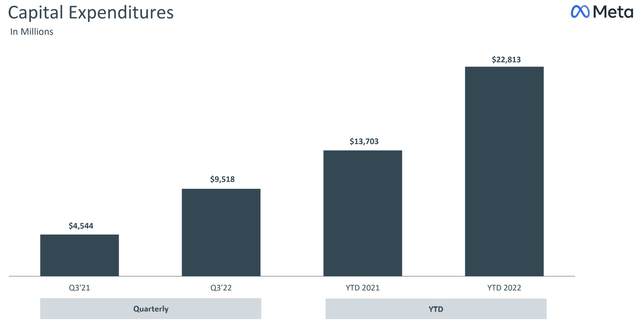

investor presentation

META has a big spending problem, almost doubling its growth spending on Reality Labs, its massive 10-year bet on the Metaverse.

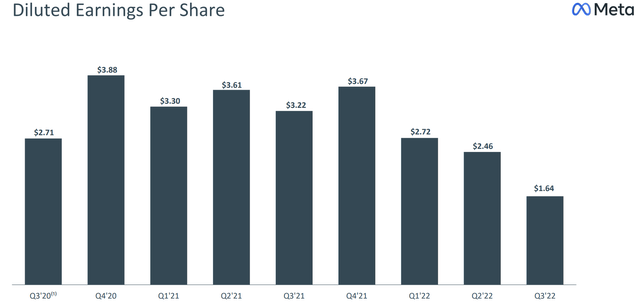

investor presentation

META’s EPS has been hammered by spending at Reality Labs, and is now expected to decline 34% in 2022 and another 15% in 2023.

Why? Partially due to the 2023 recession the bond market now considers a 100% certainty.

But also because of this.

We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year. Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run.” – Mark Zuckerberg, Q3 conference call (emphasis added)

Last year META lost $10 billion on the Metaverse, and this year it’s expected to lose even more. And per its CEO and founder, next year “significantly more” still.

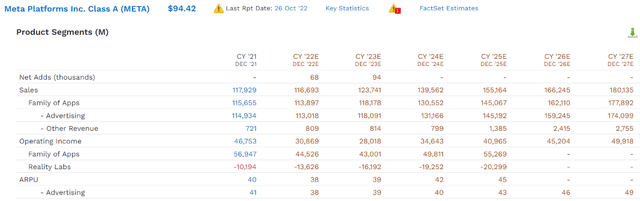

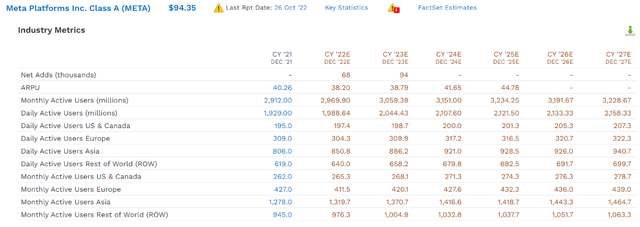

FactSet Research Terminal

Based on Zuckerberg’s comments about “pacing” spending beyond 2023 analysts expect capex to remain elevated by about 2X compared to before Meta changed its name and went all in on the Metaverse.

Mark Zuckerberg: The Mad King Is The Biggest Reason Meta Is A Speculative Blue Chip

Mark Zuckerberg holds 55% of voting power at META, thanks to his class B shares. Until now, that hasn’t been a problem, even though he’s been effectively the “emperor” of Facebook since the beginning.

But now that former COO Sheryl Sandberg, who built the META ad model into a free cash flow minting machine, has left? Well, it appears there’s no one with the credibility in META’s c-suite to stand up to the mad king and his potentially disastrous $100-plus billion boondoggle.

But isn’t Zuckerberg a visionary? A mad genius who turned a simple and what many thought was a stupid idea into a formerly $1.1 trillion company?

Yes, but there’s a fine line between genius and madness and Zuckerberg is potentially on the wrong side of it. Why?

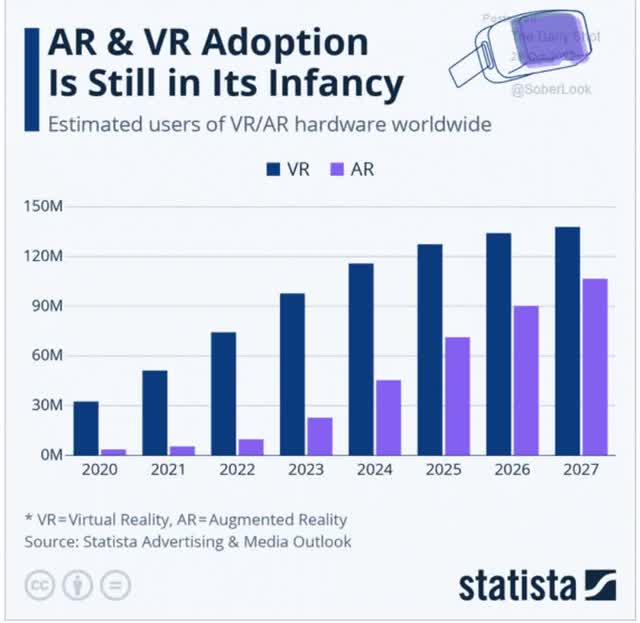

Statista

The potential market for VR in general is about 100 million people today and that’s expected to grow to about 130 million by 2027.

META is struggling to grow its user base beyond its current 3 billion, because it’s largely saturated its addressable market of Internet-0connected people around the world.

Zuckerberg has a grand vision of a Meta, controlled Metaverse, a digital world in which we all wear VR goggles and live second lives online.

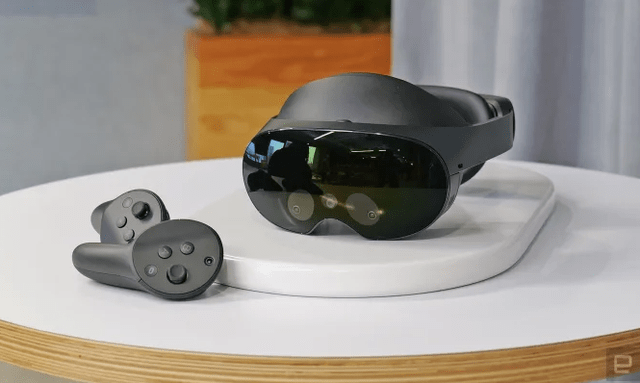

Engadget

Meta’s “significantly higher losses” in Reality Labs next year is due to launching the Quest Pro, a $1,500 VR headset that costs 5X more than the Quest 2 headset.

META’s timing on the Metaverse literally came at the worst possible time.

- the company pivoted to massive spending on new and untested tech that it admits might not make money for 10 years.

- just as the speculative tech bubble burst

- and now is launching a $1500 VR headset that costs more than an iPhone during a recession

- today even Apple is starting to struggle with iPhone sales

- and the Quest Pro is much less useful or desirable than an iPhone

And I’m not the only one skeptical of Meta’s giant pivot into a sci-fi future.

FactSet Research Terminal

Reality Labs revenue was about $721 million in 2021 and growing at 9% annually in recent years.

- not exactly a thrilling level of growth

That grow rate isn’t expected to improve until 2025, and even by 2027, when Metaverse revenue is expected to double, it’s expected to total $2.8 billion, just over 1% of the company’s sales.

All while generating $20.3 billion in operating losses, by 2025.

Reality Labs was founded in 2021, when Meta changed its name and its mission.

- $79.5 billion in cumulative operating losses through 2025

- with no signs of declining annual losses, much less profits

Zuckerberg is either crazy or a genius, and so far all the evidence points to crazy.

- Potentially $180 to $200 billion in Metaverse losses by 2030 if they keep burning $20 billion after 2025

But what if Zuckerberg is a Steve Jobs style genius? Jobs famously said that you often can’t ask customers what they want in a product, because true innovation is so revolutionary they don’t know they want it.

If I had asked people what they wanted, they would have said faster horses.” – Henry Ford

How many people were excited about the iPod when it was introduced in 2001? It was just a better, sleeker, and cooler MP3 player. And yet it transformed Apple into a cash flow machine.

And then gave Steve Jobs the credibility and “reality distortion field” to change the world with the iPhone.

In other words, truly revolutionary change requires a “build it and they will come” mindset. At least that’s how Mark Zuckerberg is spinning his $200 billion bet.

The difference between Zuckerberg and Henry Ford and Steve Jobs is that neither of them risked even a fraction of the money Zuckerberg is planning on.

For what’s objectively a very speculative bet.

For every 10 mad geniuses trying to change the world with their inventions, nine of them fail. And none of them have ever had the resources or power of Mark Zuckerberg, the mad king of Facebook.

It Wasn’t All Bad

Our positive takeaways from Meta’s results were that the network effect remains intact given the firm’s encouraging user count and engagement metrics, which we think position Meta to accelerate revenue growth in late 2023, with the assumption that macro uncertainty eases.

In addition, Reels is creating incremental engagement time per user and has also displayed early signs of high monetization potential. Plus, the firm continues to invest in enhancing its ad measurement capabilities while adding new advertising options for businesses, which we think will further drive a turnaround.” – Morningstar

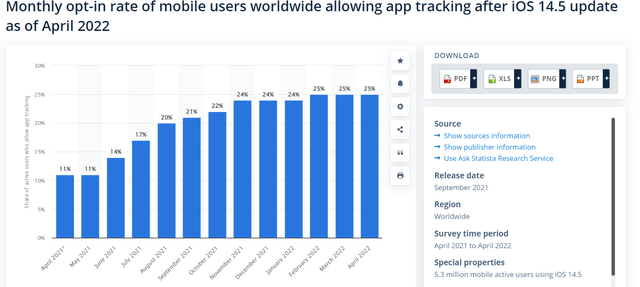

META has been very badly hurt by Apple’s change in private policy, which automatically blocks data tracking unless users specifically opt-in. Just 25% of iOS users have opted in and that number appears to be stable but not improving.

Statista

iPhone has 55% market share in the US, the most lucrative digital ad market in the world. This means that with this single privacy policy change, social media companies saw their user data collapse by 42% and it might never be coming back.

META, GOOG, and AMZN are the three giants of digital advertising, and each one is hurt to a different degree by this privacy policy change.

- META most of all

- GOOG less so because it has alternative data sources (more than 7 services with over 1 billion global users)

- AMZN least of all because its ad-algos are mostly running on its own proprietary data

FactSet Research Terminal

Meta’s user base is expected to grow slowly over time, but the 58 analysts that cover META (more than any other company on Wall Street) don’t believe the Social Media king is dying.

Average revenue per user is also expected to recover once the recession is over, though grow by just a modest 15% by 2025.

And free cash flow, which has been cut in half in the last 12 months, is expected to nearly triple to $43 billion by 2027.

And thanks to a much lower market cap, Meta’s consensus buybacks of $93 billion from 2023 to 2027 could buy back a lot of stock.

- 34% of shares at current valuations

- up to 10% of shares each year

And what about Meta’s growth prospects after it gets past the 2023 recession and this painful pivot to the Metaverse?

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Meta Platforms | 0% | 15.3% | 15.3% | 10.7% | 8.4% | 8.5 | 2.25 |

| Nasdaq | 0.8% | 11.5% | 12.3% | 8.6% | 6.3% | 11.4 | 1.85 |

| Schwab US Dividend Equity ETF | 3.6% | 8.5% | 12.1% | 8.4% | 6.2% | 11.7 | 1.82 |

| Dividend Aristocrats | 2.6% | 8.5% | 11.1% | 7.8% | 5.5% | 13.1 | 1.71 |

| Alphabet | 0.0% | 11.1% | 11.1% | 7.8% | 5.5% | 13.1 | 1.71 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.6 | 1.62 |

(Sources: DK Research Terminal, FactSet, Ycharts, Morningstar)

Analysts remain bullish on META, far more so than Alphabet in fact, expecting META to potentially deliver 15.3% long-term returns while GOOG is expected to match the aristocrats and modestly beat the S&P over time.

And that doesn’t include valuation, and there’s no question that at 4.9X cash adjusted trough 2023 earnings, META is trading at a fire sale price.

Meta Is A Screaming Buy… If You Trust Zuckerberg’s Vision

| Metric | Historical Fair Value Multiples (8-Years) | 2021 | 2022 | 2023 | 2024 | 2025 |

12-Month Forward Fair Value |

| Earnings | 26.84 | $369.59 | $224.38 | $224.38 | $286.92 | $364.22 | |

| Average | $369.59 | $224.38 | $224.38 | $286.92 | $364.22 | $224.38 | |

| Current Price | $94.82 | ||||||

|

Discount To Fair Value |

74.34% | 57.74% | 57.74% | 66.95% | 73.97% | 57.74% | |

| Upside To Fair Value | 289.78% | 136.64% | 136.64% | 202.59% | 284.12% | 136.64% | |

| 2022 EPS | 2023 EPS | 2022 Weighted EPS | 2023 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $8.36 | $8.36 | $1.13 | $7.23 | $8.36 | 26.8 | 11.3 | 4.9 |

IF META does grow at 15% over time, then historically it’s worth about 27X earnings and today it trades at 11.3, and just 4.9X cash-adjusted earnings.

- a bargain by even private equity standards

Its PEG ratio is 0.32, hyper-growth (potentially) at an absurdly wonderful price.

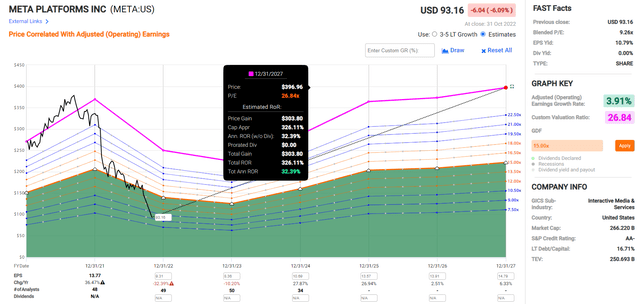

Meta 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If META can grow as expected and return to market-determined fair value consistent with its expected growth rate, then within two years it could nearly triple, delivering 63% annual returns.

- about 6X more than the S&P 500

Meta 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

META has Amazon like return potential over the next five year, IF the turnaround is successful.

- 326% consensus return potential through 2027

- 32% CAGR

- about 7X more than the S&P 500

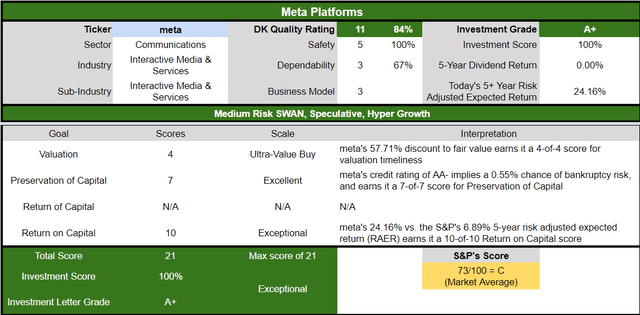

Meta Investment Decision Tool

DK

(Source: Dividend Kings Automated Investment Decision Tool)

(Source: Dividend Kings Automated Investment Decision Tool)

META is as close to a perfect speculative hyper-growth blue-chip opportunity as exists on Wall Street for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 57% discount to fair value vs. 2% S&P = 55% better valuation

- almost 50% better long-term annual return potential

- about 4X higher risk-adjusted expected returns

Alphabet: One Of The World’s Best Growth Blue-Chips Is Doing Just Fine

Bottom line up front, GOOG is a far safer and better run company than Meta.

| Company | Meta Platforms | Alphabet | META Wins | GOOG Wins |

| LT Growth Consensus | 15.3% | 11.1% | 1 | |

| Total Return Potential | 15.3% | 11.1% | 1 | |

| LT Risk-Adjusted Expected Return | 10.7% | 7.7% | 1 | |

| Inflation & Risk-Adjusted Expected Return | 8.4% | 5.5% | 1 | |

| Years To Double | 8.5 | 13.0 | 1 | |

| Historical Total Return | 11.6% | 19.8% | 1 | |

| 12-Month Consensus Total Return Potential | 68% | 40% | 1 | |

| 12-Month Fundamentally Justified Total Return Potential | 137% | 47% | 1 | |

| 5-Year Consensus Return Potential | 29% to 45% | 19% to 21% | 1 | |

| Discount To Fair Value | 57% | 32% | 1 | |

| Cash-Adjusted PE | 4.9 | 9.7 | 1 | |

| DK Rating | Ultra Value Buy | Very Strong Buy | 1 | |

| Dividend King’s Automatic Investment Decision Score | 100% A+ Excellent | 100% A+ Excellent | 1 | 1 |

| Quality Score | 84% | 97% | 1 | |

| Safety Score | 100% | 100% | 1 | 1 |

| Dependability Score | 67% | 94% | 1 | |

| S&P LT Risk Management Global Percentile | 63% Above-Average, Low Risk | 93% Exceptional (Very Low Risk) | 1 | |

| Credit Rating | AA- Stable | AA+ Stable | 1 | |

| 30-Year Bankruptcy Risk | 0.55% | 0.29% | 1 | |

| Return On Capital (12-Months) | 46% | 68% | 1 | |

| Return On Capital Industry Percentile | 60% | 64% | 1 | |

| Return On Capital (13-Year Median) | 95% | 74% | 1 | |

| Return On Capital (5-Year trend) | -16% | -1.0% | 1 | |

| Sum | 14 | 11 |

(Source: DK Zen Research Terminal)

Meta is the better value, BUT only if you are comfortable with its speculative nature and risk profile.

Mad king Mark is running the show and if he wants to run it straight into the ground you have no say in the matter.

META’s AA-stable credit rating is excellent, but GOOG’s AA+ stable rating is slightly better, with just 0.29% 30-year bankruptcy risk according to S&P.

META’s 68th S&P long-term risk management percentile is above-average bordering on good, indicating low risk.

But GOOG’s 93rd percentile risk management is exceptional, indicating a very low risk, and you don’t have to worry about a CEO king who for now looks to have lost his mind.

GOOG’s historical profitability is superior to META’s, and its wide moat has been far more stable in recent years.

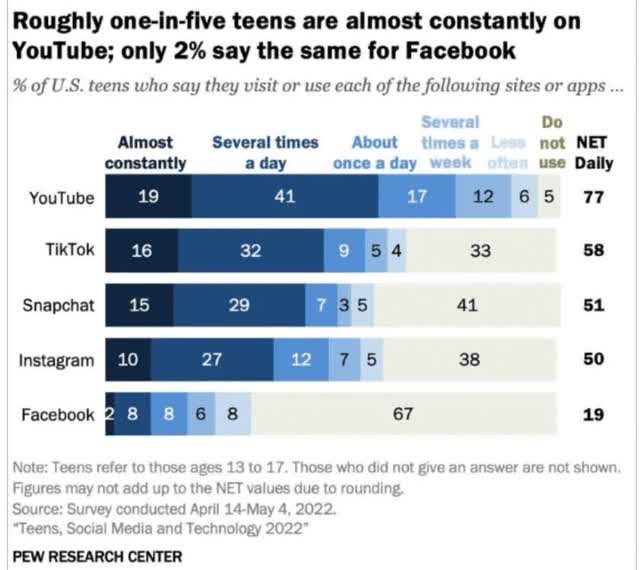

Daily Shot

And YouTube, the crown jewel in GOOG’s social media crown, is far more popular with young people than Facebook or Instagram.

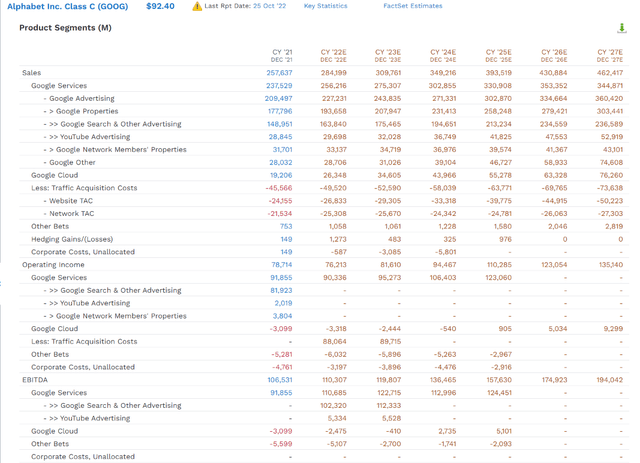

FactSet Research Terminal

And unlike META, which is 100% reliant on advertising, GOOG is a far more diversified company.

- its #4 in Cloud Computing

GOOG’s “other bets” it’s moonshot programs, are expected to have $2.8 billion in sales in 2027, just like Reality Labs. The only difference is that GOOG spends about $3.2 billion annually on other bets, and that part of the GOOG empire could be worth $50 billion.

Or to put it another way, META is spending 4X as much money on Reality Labs as GOOG is on Other Bets, and GOOG plans to cut back on that spending in the next year. META plans to increase its spending by about 20%.

GOOG has so far lost $27 billion on Other Bets, searching for its next world-beater business. META plans to potentially lose $200 billion or 8X as much, on Reality Labs, and for a business model that so far only 100 million people say they are interested in using.

- 100 million global VR users, not META VR users

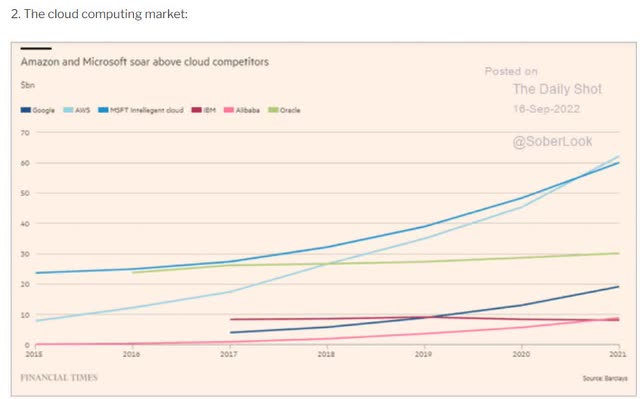

Daily Shot

GOOG Cloud is a fast growing business. It’s not yet profitable but is expected to become profitable in 2025, a year when META is expected to lose over $20 billion on Reality Labs.

By 2027 analysts expect Google Cloud to be generating $76 billion in sales (vs $2.8 billion for Reality Labs) and converting that into $9.3 billion in operating income.

In other words, Google Cloud is a 26% CAGR growing business that’s expected to be minting money far faster than Reality Labs, assuming the Metaverse ever achieves profitability for META.

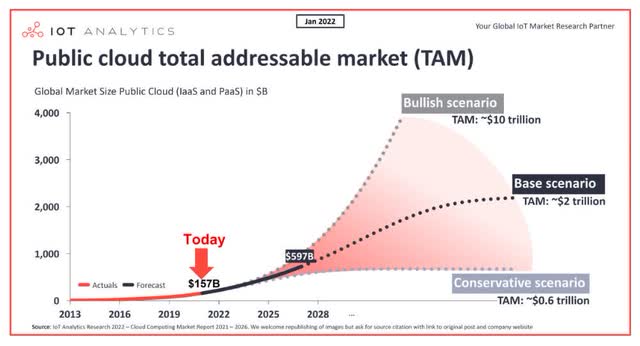

IOT Analytics

And unlike the Metaverse which is expected to have 130 million users (maybe) by 2027, cloud computing is a proven industry, growing at 15% per year and which could become a $2 trillion to $10 trillion industry by 2030.

The global Metaverse revenue opportunity could approach $800 billion in 2024 vs. about $500 billion in 2020, based on our analysis and Newzoo, IDC, PWC, Statista and Two Circles data. The primary market for online game makers and gaming hardware may exceed $400 billion in 2024 while opportunities in live entertainment and social media make up the remainder.” – Bloomberg

Now in fairness to Mr. Zuckerberg and fans of the Metaverse, the Metaverse is already a $500 billion global market. But that’s 80% gaming which META is getting only a small handful off.

- META’s market share in the Metaverse is currently 1.6%

In other words, with Alphabet the big growth driver is a 26% growing business in a bigger and proven model.

GOOG’s ability to generate meaningful cash flow from cloud is not speculative, just look at how AWS and Azure are minting money for AMZN and MSFT.

And speaking of cash flow.

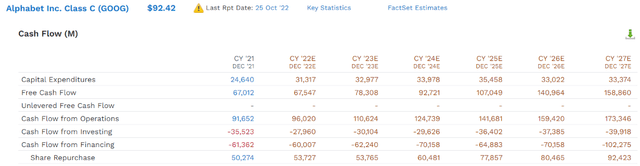

FactSet Research Terminal

While META’s FCF is expected to get cut in half to $16 billion in 2022, GOOG’s is expected to remain stable at $68 billion.

In 2027 META is expected to generate a solid $43 billion in FCF. But GOOG is expected to generate $159 billion, the most in human corporate history.

2027 FCF Consensus Forecasts:

- GOOG: $159 billion

- AAPL: $155 billion

- AMZN: $137 billion

- MSFT: $101 billion

- META: $43 billion

And while META is expected to buy back a very healthy $93 billion in stock in the coming years, GOOG is expected to spend $365 billion between 2023 and 2027.

In fact, in 2027 alone GOOG’s consensus buybacks of $92 billion is as much as analysts expect META to spend over the next four years combined.

Alphabet Valuation: Potentially A Very Strong Buy And Close To An Ultra Value Buy

Alphabet reported disappointing third-quarter results as revenue growth decelerated further, driven by the stronger dollar and economic uncertainty, which is increasing hesitancy in ad spending. Assuming less uncertainty in the macroeconomic environment, plus the monetization of YouTube Shorts, we expect advertising revenue growth to return to double-digit levels in 2023. Unlike advertising, the cloud business maintained impressive growth.” – Morningstar

GOOG’s 9% plunge post-earnings was purely for cyclical reasons, nothing to do with its core business. Advertisers are pulling back due to the slowing economy and coming recession.

Nothing about GOOG’s fundamental core business is broken, unlike META which has chosen to make a $200 billion speculative pivot.

- GOOG is not a turnaround story (20% or less max risk cap rec)

- META is a turnaround story (2.5% or less max risk cap rec)

YouTube Shorts has already reached 1.5 billion monthly active viewers, reducing fears that Tok-Tok is hurting the business. With the strong network effect present on YouTube, the strength of Google search, and the firm’s ad-tech powered measuring capabilities, Google’s ad revenue miss wasn’t significantly due to Apple privacy changes either.” – Morningstar

While META is struggling to compete with Tok-Tok (and losing for now), GOOG’s YouTube is holding its own.

And while META’s user data feed was gutted by Apple’s privacy change, GOOG was barely affected at all.

- GMAIL has almost 2 billion global users

- 4.3 billion people use Google Search

- GOOG has over seven services with over 1 billion users.

This is how GOOG is able to replace that user data that META can’t.

And the more Google Cloud grows, the more data of all kinds it will have to improve its algorithms even faster.

META has no plans for cloud computing, and no way to increase its user data feed, unless everyone buys into its Metaverse vision.

- the most passionate Metaverse advocates hate META with a passion

- they view Zuckerberg’s vision as a “Ready Player One” style dystopia

So with GOOG you have a more diversified and better run business, with far better long-term risk-management according to S&P.

You have a clear path to growth and far less execution risk than what META faces.

And most of all, you don’t have a single person who reigns over the company as a potentially mad god king who no one can stop from running into the ground, which is the largest risk to META today.

Alphabet: A Wonderful Company At A Wonderful Price

| Metric | Historical Fair Value Multiples (all years) | 2021 | 2022 | 2023 | 2024 | 2025 | 12-Month Forward Fair Value |

| Earnings | 25.79 | $144.68 | $122.76 | $138.75 | $163.25 | $196.26 | |

| Average | $144.68 | $122.76 | $138.75 | $163.25 | $196.26 | $136.60 | |

| Current Price | $92.11 | ||||||

|

Discount To Fair Value |

36.34% | 24.97% | 33.61% | 43.58% | 53.07% | 32.57% | |

| Upside To Fair Value | 57.08% | 33.28% | 50.64% | 77.23% | 113.07% | 48.30% | |

| 2022 EPS | 2023 EPS | 2022 Weighted EPS | 2023 Weighted EPS | 12-Month Forward PE | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $4.76 | $5.38 | $0.64 | $4.66 | $5.30 | 25.8 | 17.4 | 9.8 |

GOOG has historically been valued by billions of investors at about 26X earnings, even when it was growing at 4%.

Thus I’m confident that GOOG growing at 11% (those estimates might increase post-recession) is still worth about 26X earnings.

Today GOOG trades at 17.4X earnings, but just 9.8X cash-adjusted earnings.

- a PEG of 0.88

- growth at a reasonable price, and in an AA-rated Ultra-SWAN quality 93rd percentile risk management package

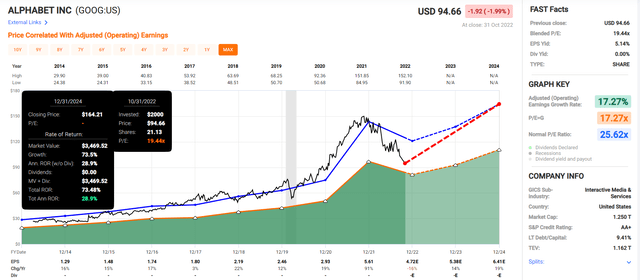

Alphabet 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If GOOG grows as expected and returns to historical fair value, it could deliver 73% returns, or 29% CAGR.

- more than 2X greater than the S&P 500

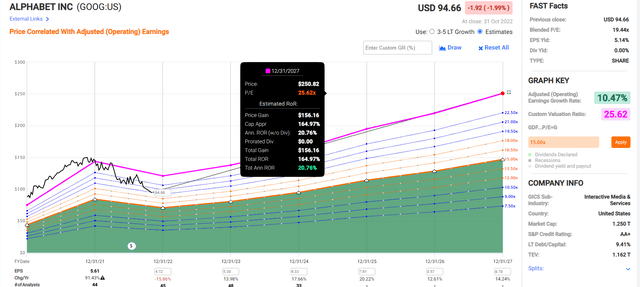

Alphabet 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If GOOG grows as expected through 2027 it could deliver 165% total returns, or 21% CAGR.

- Buffett-like returns from a blue-chip bargain hiding in plain sight

- about 2.5X more than the S&P 500

- 19% to 21% CAGR consensus return potential range

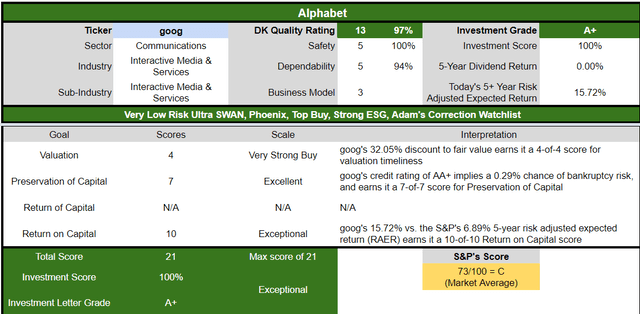

GOOG Corp Investment Decision Tool

DK

(Source: Dividend Kings Automated Investment Decision Tool)

GOOG is as close to a perfect growth blue-chip opportunity as exists on Wall Street for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 32% discount to fair value vs. 2% S&P = 30% better valuation

- 10% better long-term annual return potential (but with far better safety, quality, and risk-management)

- about 2X higher risk-adjusted expected returns

Bottom Line: Both META And Alphabet Are Screaming Bargains But The Mad King Zuckerberg Makes GOOG The Smarter, Safer, And Less Speculative Buy Today

META has become cheap for a good reason, the speculative turnaround plan that CEO/King Zuckerberg has doubled down on.

I’m personally skeptical that Reality Labs will pay off big, and expect that META will pivot and significantly reduce its spending plans on the Metaverse.

That’s why I still own the stock, though just a 1% position (2.5% OR LESS is the max recommended position size).

In contrast, GOOG, while not as undervalued, is also a higher-quality, more diversified, and stronger company in terms of balance sheet and free cash flow generation.

It’s 93rd percentile risk management and AA+ stable credit rating are a testament to it being one of the greatest world-beaters in existence.

And with its big growth plan being Google Cloud, a 26% growing business with a $2 trillion addressable market and clear path to profitability, I consider GOOG the safer, less speculative, and smarter investment today.

Both META and GOOG could make you Buffett-like returns over the next five years, if they grow as expected. But with GOOG I’m a lot more confident that GOOG won’t just meet growth forecasts, but potentially exceed them by a wide margin.

With META? Well, it’s ride or die with mad king Zuckerberg, and his Ford/Jobs like strategy of “if you build it they will come.” I join with all META shareholders in hoping that king Zuckerberg will spend a lot less than $180 billion on testing his theory and bringing his vision to life.

Be the first to comment